Tickmill Minimum Deposit Review

The minimum deposit amount required to register a Tickmill live trading account is 100 USD. Tickmill makes three live trading accounts available with a 100 USD minimum deposit – the Raw, TradingView Raw, and Classic Accounts.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Minimum Deposit and Account Types

Tickmill offers a range of account types to match every trading style, whether you’re a beginner, a scalper, or a high-frequency day trader. Each account delivers transparent pricing, flexible leverage, and access to powerful platforms like MT4, MT5, and TradingView.

Frequently Asked Questions

Which Tickmill account is best for beginners?

The Classic Account is ideal for new traders. It offers commission-free trading, simplified cost structures, and access to the MT4 and MT5 platforms with a low minimum deposit starting from just $100.

What’s the difference between Raw and TradingView Raw accounts?

Both accounts offer 0.0 pip spreads, but TradingView Raw comes with a slightly higher commission of $3.5 per lot per side. It is tailored for users who prefer the TradingView and Tickmill Trader platforms with enhanced charting tools.

Our Insights

Tickmill’s account structure is designed to accommodate a wide spectrum of traders. Whether you prioritize zero commissions, ultra-tight spreads, or innovative charting, Tickmill provides a dependable account type for every goal and strategy.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

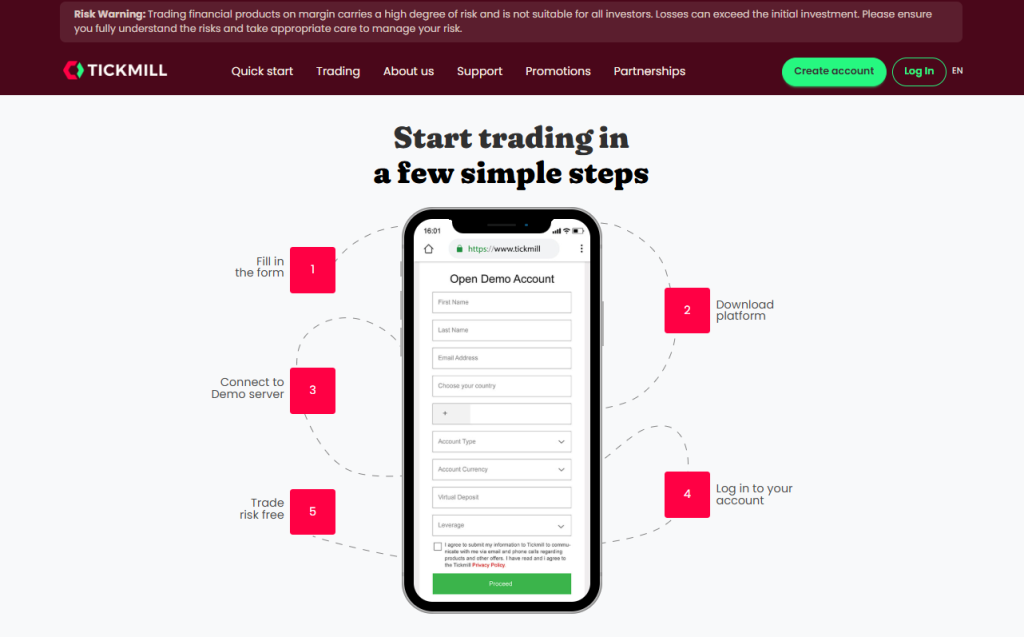

How to Open a Tickmill Account

1. Step 1: Account Creation

To start, click the green “Create Account” button located at the top right of the Tickmill homepage.

2. Step 2: Registration

Fill out the registration form, providing details such as your country of residence and client type.

3. Step 3: Confirmation

After submitting the form, you will receive a confirmation email to verify your account creation.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Islamic Account

Tickmill offers swap-free Islamic accounts for Muslim traders who seek halal trading conditions without compromising on features. These accounts remove overnight interest while maintaining the same spreads, leverage, and execution quality as standard account types.

| Account Types | Open an Account | Swap-Free Option | Platforms | Fees Charged |

| Classic Account | Yes | Yes | MT4 MT5 | Handling fees (after 40+ days for select pairs) |

| Raw Account | Yes | Yes | MT4 MT5 | Handling fees (after grace period) |

| Trading Instruments | Yes | Forex Stocks Crypto Indices Commodities Bonds | MT4 MT5 | Varies by asset and days held |

Frequently Asked Questions

What is a Tickmill Islamic (Swap-Free) Account?

A Tickmill Islamic Account is a Sharia-compliant trading account that charges no interest (swap) on overnight positions. It supports both Classic and Raw account types, with identical spreads, leverage, and execution speeds as regular accounts.

Are there any extra fees on Islamic accounts?

While no swap is charged, Tickmill applies a fixed handling fee on specific instruments after a grace period. These fees are transparent, charged per lot, and only begin after a few nights of holding a position open.

Our Insights

Tickmill provides an authentic Islamic trading solution that respects religious values while offering access to professional trading tools. With no swaps, competitive spreads, and efficient execution, it’s a trustworthy option for Muslim traders globally.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Demo Account

Tickmill’s free demo account offers a realistic, risk-free gateway into the world of Forex and CFD trading. With access to real-time pricing, advanced platforms, and 180+ instruments, it’s the ideal training ground for beginner and experienced traders alike.

| Account | Demo |

| Platform | MT4 MT5 |

| Virtual Deposit | Customisable |

| Instruments Available | 180+ CFDs across 6 asset classes |

| Max Demo Accounts per User | 7 per email |

| Open an Account |

Frequently Asked Questions

What can I trade with a Tickmill demo account?

You can trade over 180 instruments, including Forex, Commodities, Stocks, Indices, Bonds, and Cryptocurrencies. The demo environment mirrors live conditions, allowing you to test strategies in real market scenarios without financial risk.

Does the demo account expire or have limitations?

Each user can open up to 7 demo accounts per registered email. While there’s no immediate expiration, extended inactivity may result in account deactivation. It’s best used consistently for skill-building and platform exploration.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Deposits and Withdrawals

Tickmill empowers traders with a range of instant and secure deposit and withdrawal options. With no hidden fees, fast processing times, and support for multiple currencies, fund management becomes seamless, helping you focus more on trading and less on logistics.

| Method | Min. Deposit | Processing Time (Deposit) | Commission |

| Bank Transfer | 100 USD | Within 1 Working Day | None |

| Crypto Payments | 100 USD | Instant (24/7) | None |

| Visa / Mastercard | 100 USD | Instant* | None |

| Skrill / Neteller | 100 USD | Instant* | None |

| FasaPay | 100 USD | Instant* | None |

| UnionPay | ¥700 / 100 USD | Instant* | None |

Frequently Asked Questions

Does Tickmill charge any deposit or withdrawal fees?

No, Tickmill does not charge deposit or withdrawal fees. Deposits over $5,000 via bank wire may qualify for reimbursement of transfer costs up to $100 when documentation is provided to support the claim.

How long do deposits and withdrawals take to process?

Most deposits are processed instantly, while withdrawals are completed within one working day. Bank transfers may take up to 24 hours, while e-wallets and cards typically reflect much faster.

Our Insights

Tickmill’s fee-free deposits and withdrawals, along with fast and reliable processing, provide traders with financial flexibility. Whether using crypto, cards, e-wallets, or bank transfers, clients benefit from a smooth and trustworthy payment experience.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Getting Started Essentials – A Quick Q&A

5 Frequently Asked Questions about the Tickmill minimum deposit, withdrawal process, and sign-up perks.

Q: What’s the minimum deposit to open a Tickmill account? – Carlos, Brazil

A: Tickmill requires a minimum deposit of 100 USD (or equivalent in other supported currencies). This low entry threshold makes it easy for traders to start exploring Tickmill’s professional trading environment.

Q: How quickly can I withdraw funds from Tickmill? – Aisha, UAE

A: Tickmill processes withdrawal requests within one business day. The total time depends on the payment method: e-wallets are usually instant to 24 hours, while bank transfers may take 3–7 business days.

Q: Does Tickmill charge fees for deposits or withdrawals? – Mark, Canada

A: Tickmill does not charge internal fees on deposits or withdrawals. However, third-party charges such as bank or intermediary fees may apply depending on your payment provider.

Q: Can I withdraw profits to a different method than my deposit method? – Priya, India

A: For security and compliance, withdrawals up to the deposited amount must go back to the same method used for funding. Profits exceeding that amount can be withdrawn through an alternative method in your name.

Q: What perks come with signing up at Tickmill? – John, UK

A: Tickmill offers competitive spreads, zero hidden fees, free demo accounts, negative balance protection, and access to advanced platforms like MetaTrader 4 and MetaTrader 5, making it attractive for both beginners and professionals.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Strong regulation | Limited platform options |

| Full MetaTrader suite | Less competitive pricing on Classic account |

| Low minimum deposit | Commission fees on Raw Accounts |

| Competitive spreads | Limited educational resources |

You might also like:

In Conclusion

Tickmill provides a secure, transparent, and user-friendly trading experience with low deposit requirements, fast withdrawals, and zero deposit fees. Its advanced tools and compliance with regulations make it a solid choice for traders who value reliability, cost efficiency, and a professional trading environment.

Faq

Yes, Tickmill accepts a variety of e-wallets, including Skrill and Neteller, making deposits easy and efficient.

No. Tickmill does not provide deposit insurance other than statutory requirements. To safeguard the safety of customer assets, they keep separate client accounts and follow tight financial standards.

No. Once you have made your initial deposit, you cannot modify the base currency of that account. However, you can establish extra accounts in various base currencies if necessary.

No. Tickmill doesn’t have a dedicated deposit calculator. However, they do provide risk management tools and instructional materials. Depending on your risk tolerance and trading objectives, these can help you choose the right deposit amount.