XM Minimum Deposit Review

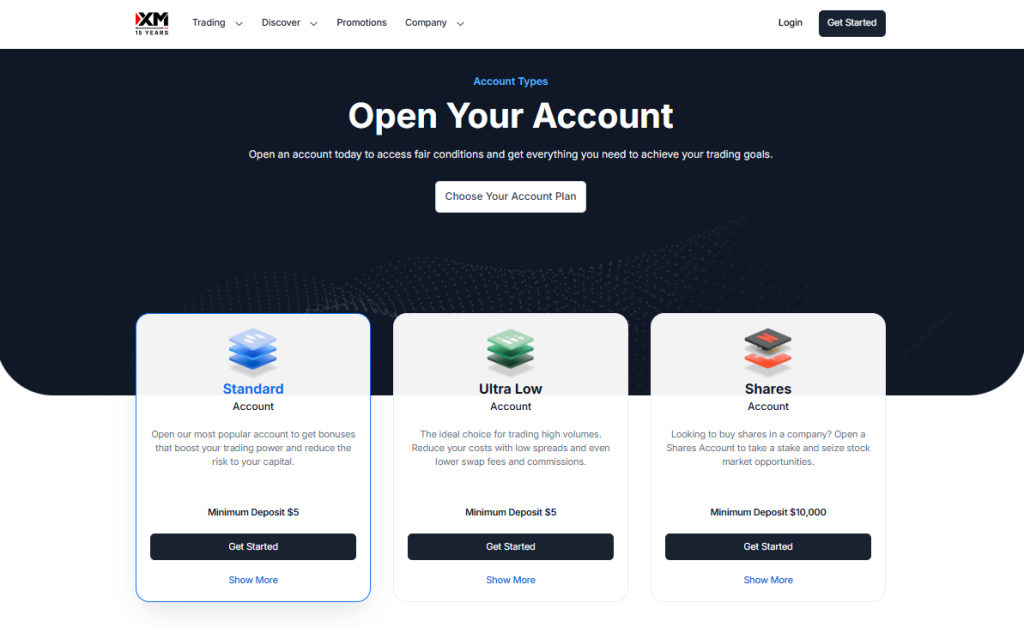

The Minimum Deposit amount required to register an XM live trading account ranges from 5 USD to 10’000 USD. XM makes three live trading accounts available: the Standard, Ultra Low, and Shares Accounts.

★★★★★ | Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). |

Minimum Deposit and Account Types

XM offers a range of account types designed to suit traders at all levels – from beginners to professionals. It sets low minimum deposits, provides competitive trading conditions, and includes built-in risk protection, making it easy for traders to start trading and grow with confidence in global markets.

| Account Type | Best For | Minimum Deposit | Key Benefits |

| Standard | Beginners and casual traders | 5 USD | Trading bonuses, low entry point, reduced capital risk |

| Ultra Low | Active and volume traders | 5 USD | Lower spreads, reduced swap fees, minimal commissions |

| Shares | Stock market investors | 10,000 USD | Direct access to real shares, ideal for long-term stock investing |

| Demo Account | Practice/training | Free | Virtual funds, no risk, real market simulation |

Frequently Asked Questions

What XM account is best for beginners?

The Standard Account is ideal for beginners. It requires only a $5 deposit, offers trading bonuses, and helps manage risk. With user-friendly features, it’s a great way to start trading without needing large upfront capital.

Can I try XM without risking real money?

Yes, XM provides a Demo Account with virtual funds in a simulated market environment. It’s perfect for testing strategies and learning platform features before switching to a real account when you’re confident and ready to trade live.

Our Insights

XM Group offers accounts for all trader levels – from Standard for beginners to Ultra Low for high-volume users – with competitive spreads and negative balance protection. The Shares Account provides direct stock trading with 1:1 leverage and no commissions, ensuring a secure and accessible experience for every trader.

★★★★★ | Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). |

How to Open an Account with XM

Opening an account with XM is simple. Follow these steps to get started:

- Step 1: Go to the XM website and click “Open a Real Account.”

- Step 2: Select the account type that suits your trading preferences.

- Step 3: Fill out the online account application form.

- Step 4: Choose between MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

- Step 5: Specify your desired account leverage.

- Step 6: Complete the identity verification process.

- Step 7: Deposit funds via bank wire, credit card, or e-wallet.

Once your account is verified and funded, you can start trading on your chosen platform.

★★★★★ | Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). |

Transparent Pricing, Powerful Value

XM stands out with low-cost, commission-free trading across its account types. Offering spreads from as low as 0.8 pips, negative balance protection, and swap-free options, it delivers flexible and accessible pricing for traders at every level.

| Account Type | Minimum Deposit | Spreads (EURUSD) | Commissions | Swap-Free Option | Best For |

| Standard | 5 USD | From 1.6 pips | None | Available | Beginners and general traders |

| Ultra Low | 5 USD | From 0.8 pips | None | Available | High-volume traders |

| Shares | 10,000 USD | Market conditions | None | Available | Stock market investors |

Frequently Asked Questions

What is the minimum deposit required to start trading with XM?

XM makes trading accessible with just a $5 minimum deposit for both the Standard and Ultra Low Accounts. For stock-focused traders, the Shares Account requires a $10,000 deposit but offers equally competitive conditions.

Are spreads and commissions competitive at XM?

Yes. The Standard Account starts at 1.6 pips for EURUSD, while the Ultra Low Account offers even tighter spreads starting at 0.8 pips. All accounts are commission-free, maximizing value without hidden costs.

Our Insights

With its low minimum deposits, tight spreads, and zero commissions, XM offers exceptional trading value. Whether you’re a casual trader or managing high volumes, XM provides cost-efficient conditions that support both profitability and risk management.

★★★★★ | Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). |

Getting Started Essentials – A Quick Q&A

5 Frequently Asked Questions about the XM minimum deposit, withdrawal process, and sign-up perks.

Q: What’s the minimum deposit to open an XM account? – Carlos, Brazil

A: XM offers a low entry barrier with a minimum deposit of just 5 USD on most account types, making it highly accessible for beginner traders looking to start trading with minimal investment.

Q: How quickly can I withdraw funds from XM? – Aisha, UAE

A: XM processes withdrawals within 24 hours on business days. E-wallets usually receive funds within the same day, while bank transfers and cards may take 2–5 business days, depending on your payment provider.

Q: Does XM charge fees for deposits or withdrawals? – Mark, Canada

A: XM does not charge internal fees on deposits or withdrawals. It even covers all transfer fees for deposits above 200 USD. However, third-party charges from banks or payment processors may apply.

Q: Can I withdraw profits to a different method than my deposit method? – Priya, India

A: For security and compliance, withdrawals up to the deposited amount must return to the original funding method. Additional profits can be withdrawn via another method under your name.

Q: What perks come with signing up at XM? – John, UK

A: XM provides attractive perks such as ultra-low spreads, zero hidden charges, negative balance protection, free educational resources, and bonuses where available, making it an excellent choice for both beginners and experienced traders.

★★★★★ | Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). |

Pros and Cons

| ✓ Pros | ✕ Cons |

| XM has an extremely low 5 USD minimum deposit | XM charges currency conversion fees |

| There are several bonuses offered | There are strict bonus terms and conditions |

| Traders can access fee-free deposit methods | There are limited payment methods for deposits |

You might also like:

In Conclusion

XM stands out with its low $5 minimum deposit, rapid withdrawals, and zero hidden fees, offering a beginner-friendly yet professional trading environment. Combined with strong security measures and trading bonuses, XM remains a top choice for traders seeking affordability, reliability, and quality tools.

Faq

No, XM doesn’t currently accept PayPal as a deposit method. However, they provide additional payment options, including credit/debit cards, bank transfers, and e-wallets.

XM does not charge any deposit or withdrawal fees internally. However, your bank or payment provider might charge a fee for their services.

No, XM only allows deposits from accounts or cards with the same name as the trading account holder.

XM has no set restriction on the number of deposits daily. However, they might require additional verification for substantial or regular deposits.