- Home /

- Forex Brokers /

- Earn

Earn Review

Earn is regarded as a low-risk trading platform and is widely recognized as a reliable forex broker. It offers direct market access to major exchanges while providing the benefits of CFD trading. The broker boasts an impressive trust score.

Overview

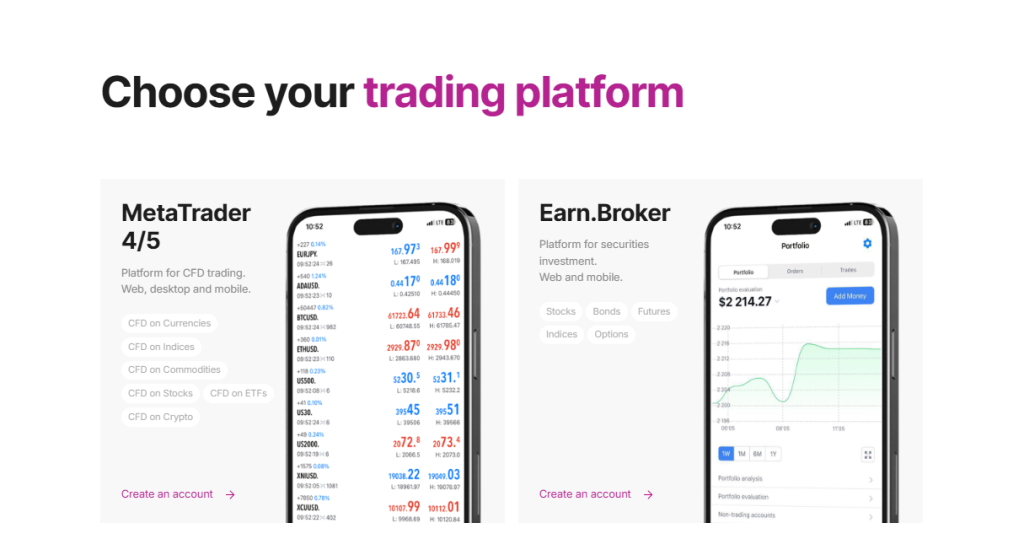

Earn is a Cyprus-based broker regulated by 🇨🇾CySEC, providing investors with CFDs, stocks, ETFs, bonds, and cryptocurrencies. Traders can access advanced tools, AI-driven analytics, and copy trading on MetaTrader 4/5 or the proprietary Earn.Broker platform via desktop, web, or mobile, making it suitable for beginners and professionals alike.

Frequently Asked Questions

What financial instruments can I trade on Earn?

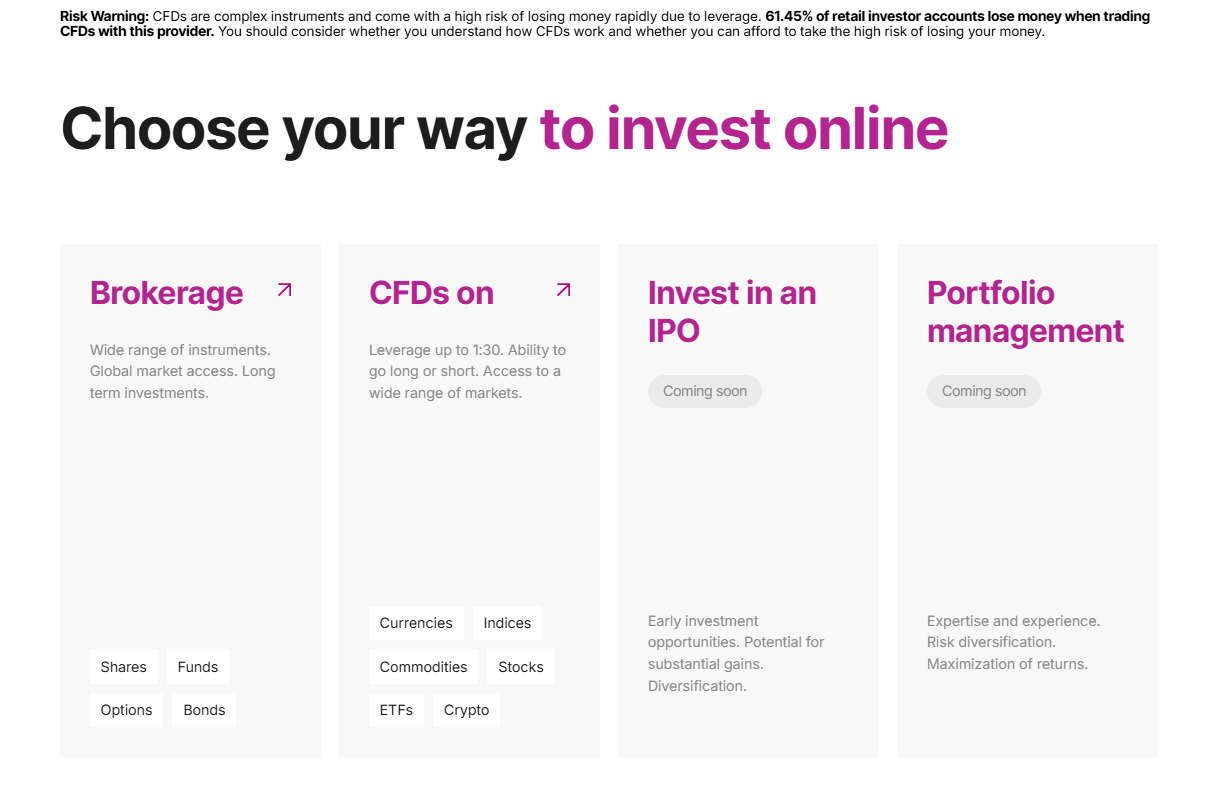

Earn provides a broad selection of instruments, including CFDs on currencies, indices, commodities, stocks, ETFs, and cryptocurrencies. In addition, traders can access stocks, bonds, futures, and options through the Earn.Broker platform, covering most investment strategies.

Which platforms are available for trading on Earn?

Earn supports MetaTrader 4/5 and its proprietary Earn.Broker platform. Both platforms are available on desktop, web, and mobile devices, enabling seamless trading whether at home or on the go.

Our Insights

Earn delivers a technologically advanced and regulated trading environment suitable for both beginners and professionals. With diverse instruments, secure client protection, and accessible platforms, traders can confidently navigate financial markets. Nevertheless, CFD leverage demands careful risk management to avoid substantial losses.

Safety and Security

Earn emphasizes client safety by adhering to strict regulations under 🇨🇾CySEC and MiFID. The broker secures funds through segregated accounts in reputable international banks, provides negative balance protection, and maintains investor protection schemes. Over a decade of experience reinforces its commitment to transparency and regulatory compliance.

| Feature | Details | Protection Measures | Regulation |

| Fund Safety | Segregated accounts in top-tier banks | Negative balance protection | CySEC MiFID |

| Investor Protection | Covers client deposits | Safeguards against financial risks | EU regulatory standards |

| Experience | 10+ years in the industry | Transparent operations | N/A |

| Security Tools | Data protection compliance | Secure platforms | N/A |

Frequently Asked Questions

Is Earn regulated?

Yes, Earn is fully regulated by 🇨🇾CySEC under license #158/11. It operates in line with MiFID directives, ensuring compliance with European Union financial standards and providing clients with a legally protected trading environment.

How does Earn protect my funds?

Earn holds client funds in segregated accounts at reputable international banks, preventing misuse of deposits. Additionally, negative balance protection and investor protection schemes are implemented to safeguard traders from potential financial risks.

Our Insights

Earn provides a highly secure trading environment, emphasizing fund protection and regulatory compliance. With segregated accounts, negative balance protection, and EU-standard investor safeguards, clients can trade with confidence. Nevertheless, traders should remain aware of inherent CFD risks despite these robust protections.

Minimum Deposit and Account Types

Earn offers account types designed to suit beginners and professional traders alike. With access to Forex, stocks, commodities, and cryptocurrencies, the broker provides MT5 Sharp ECN, MT4 NDD, and MT4 Standard accounts. Each type offers flexible leverage, advanced tools, and fast execution to match diverse trading styles.

| Account Type | Platform | Key Features | Fees |

| MT5 Sharp ECN | MetaTrader 5 | Market Execution tight spreads | Commission-based |

| MT4 NDD | MetaTrader 4 | Market Execution wide instrument range | Commission-based |

| MT4 Standard | MetaTrader 4 | Broad Forex CFD access | No extra commission |

Frequently Asked Questions

What is the minimum deposit to open an account with Earn?

Earn does not specify a fixed minimum deposit. Traders can start by selecting an account type that fits their trading preferences and capital, ensuring accessibility for all levels of experience.

Which account type should I choose on Earn?

Beginners benefit from the MT4 Standard account, which provides essential tools without extra spread markups. Experienced traders may prefer MT5 Sharp ECN or MT4 NDD for tighter spreads and advanced features suitable for professional trading.

Our Insights

Earn delivers versatile account options to accommodate both new and seasoned traders. With MT5 Sharp ECN, MT4 NDD, and MT4 Standard accounts, the platform balances accessibility, professional tools, and flexible trading conditions. Traders can select the setup that aligns with their strategy and risk appetite.

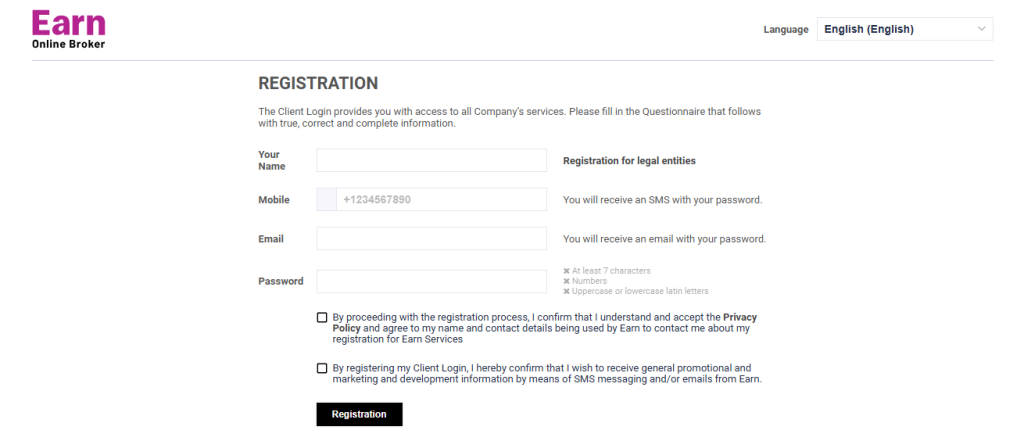

How to Open an Earn Account

Opening an Earn trading account is quick and fully online. You can register, verify your identity, and fund your wallet to start trading on MT4, MT5, or the Earn.Broker platform via web or mobile.

1. Step 1: Visit the Earn registration page

Go to the official Earn website and click Sign Up or Open Account to begin your application.

2. Step 2: Complete the online form

Enter your personal information, phone number, email, and create a secure password. Then complete the short trading experience questionnaire.

3. Step 3: Confirm your email

Open the verification email from Earn and click the activation link to access your secure client dashboard.

4. Step 4: Submit KYC documents

Upload a valid government ID and proof of residence to verify your identity and unlock full trading access.

5. Step 5: Fund your account and choose a platform

Select a deposit method, fund your wallet, and choose between MT4, MT5, or Earn.Broker to start trading. You may also begin with a demo account if preferred.

The process takes only a few minutes, although KYC approval times may vary.

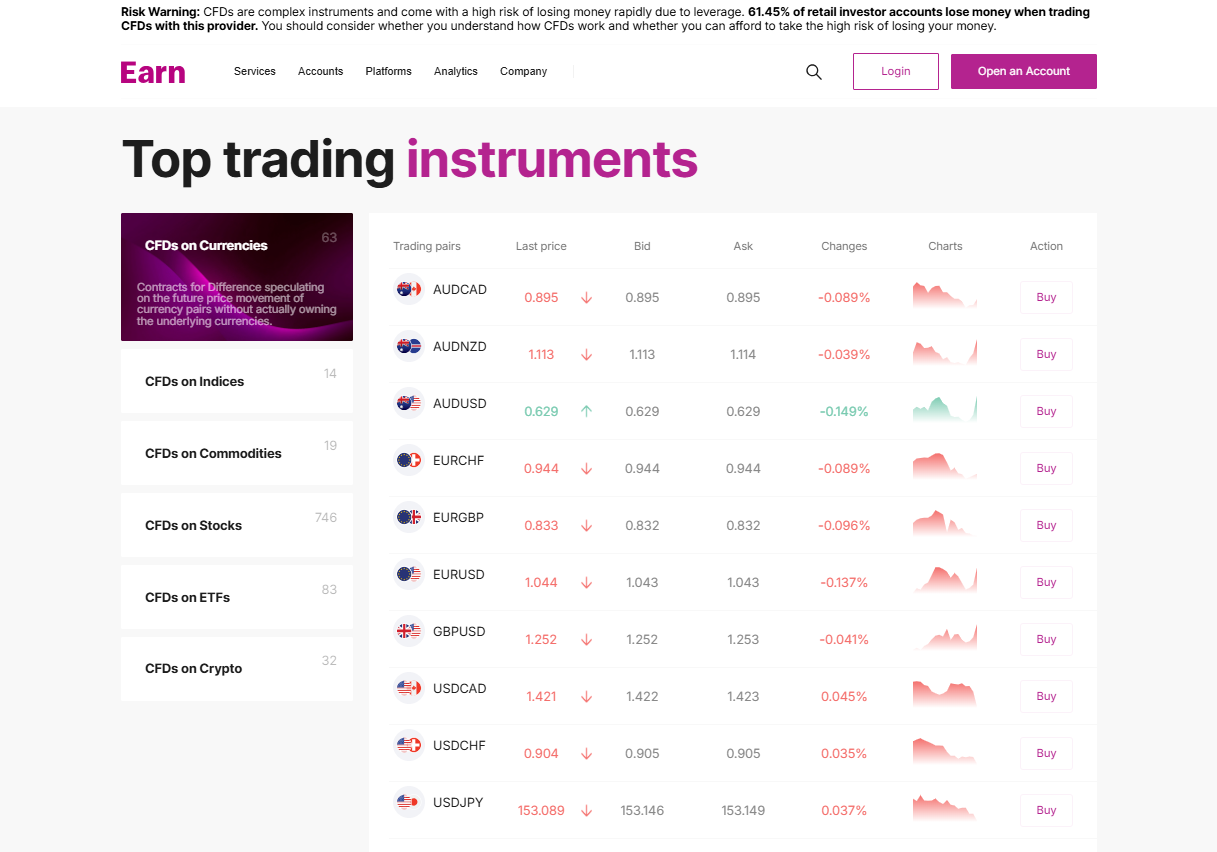

Markets Available for Trade

Earn delivers access to a broad multi-asset environment with more than 950 CFDs across currencies, commodities, indices, stocks, ETFs, and cryptocurrencies. The platform focuses on tight raw spreads from 0.0 pips and rapid execution, giving traders flexible opportunities to diversify and react to global price movements.

| Feature | Asset Types | Spreads | Execution |

| Earn Markets | Forex Stocks Indices Commodities ETFs Crypto | From 0.0 pips | Fast order execution |

Frequently Asked Questions

What markets can traders access on Earn?

Earn grants access to CFDs on currencies, commodities, stocks, indices, ETFs, and cryptocurrencies. Traders can diversify easily by exploring multiple global sectors through a single account, while benefiting from competitive pricing and fast execution for active strategies.

How competitive are Earn spreads?

Earn provides raw floating spreads that start from 0.0 pips on major symbols, making it suitable for cost-conscious traders. These tight spreads reduce trading costs and can enhance profitability, especially for frequent traders who rely on precision and high liquidity.

Our Insights

Earn stands out with extensive CFD coverage, tight spreads, and speedy execution. It enables diversified trading and supports flexible strategies across global markets, making it a strong option for traders seeking choice, efficiency, and competitive conditions within a single multi-asset platform.

Fees, Spreads, and Commissions

Earn delivers cost-effective trading with spreads from 0.0 pips, competitive commissions, flexible leverage, and negative balance protection. Traders can choose between MetaTrader 4 and MetaTrader 5, fund accounts in USD or EUR, and start trading from a minimum deposit of 100, making this setup both accessible and cost-focused.

| Feature | Spreads | Commissions | Leverage |

| Earn Pricing | From 0.0 pips | From 0.007 percent | Up to 1:100 |

Frequently Asked Questions

What are the lowest spreads at Earn?

Earn provides raw spreads from 0.0 pips on selected instruments, giving traders access to tight pricing conditions. These low spreads can reduce overall trading costs, especially for high-frequency traders, scalpers, and day traders who rely on narrow bid and ask differences.

What commissions apply to Earn?

Earn charges 0.007 percent half-turn on MT5 and 0.014 percent round-turn on MT4 for Forex, metals, indices, and commodities. For CFDs on stocks, ETFs, and cryptocurrencies, MT5 commissions are 0.25 percent half-turn, while MT4 round-turn rates reach 0.5 percent.

Our Insights

Earn delivers a cost-efficient structure with tight spreads, fair commissions, strong protection features, and accessible funding requirements. It offers flexibility through dual platforms and leverage options, making it a compelling choice for traders who want affordable, transparent pricing with room to adjust their strategies.

Deposits and Withdrawals

Earn provides secure deposit and withdrawal options with clear limits, transparent fees, and quick processing times. Traders can fund accounts using cards or bank transfers and withdraw from a minimum of 5, with most transactions processed smoothly and without unnecessary complications, which creates a streamlined banking experience.

| Feature | Details |

| Deposit Methods | Cards and Bank Transfers |

| Deposit Fee | 3.5 percent on card deposits |

| Withdrawal Processing Time | 1 to 7 days |

| Withdrawal Fees | Mostly free SEPA 1 EUR International Wire 5 USD |

| Minimum Withdrawal | 5 EUR |

| Daily Withdrawal Limit | 1,000 USD or EUR |

| Supported Currencies | USD and EUR |

Frequently Asked Questions

What deposit options does Earn support?

Earn allows deposits through credit and debit cards such as Visa and MasterCard, which have a 3.5 percent transfer fee. The platform also supports EUR and USD bank transfers, offering users flexibility when adding funds to their accounts for trading.

How long do withdrawals take at Earn?

Withdrawals are processed within 1 to 7 days, depending on the method and card issuer. SEPA transfers usually take between 1 and 2 business days, while international transfers may take slightly longer based on banking procedures and location.

Our Insights

Earn delivers a reliable and secure funding system with fast processing, clear limits, and simple options for global traders. Despite card fees and some bank-transfer charges, the platform remains convenient and transparent, making it a strong choice for users who value smooth financial transactions.

Customer Reviews

🥇 Excellent Platform for Beginners!

I’ve been trading for a few months now, and Earn has been the perfect platform to start with. The interface is easy to navigate, and I appreciate the educational resources. The low spreads and fast withdrawals are a huge bonus. – Joy

🥈 Fast and Reliable Service.

Earn provides great liquidity and fast execution. I’ve traded on several platforms, but Earn stands out due to its transparency and low fees. Withdrawals are quick, and I haven’t had any issues with my funds. A great experience overall! – Mike

🥉 Great for Experienced Traders.

As an experienced trader, I value tight spreads and flexible leverage options. Earn has delivered both. The variety of instruments available, including crypto and commodities, gives me plenty of opportunities to diversify my portfolio. Excellent platform! – Peter

Pros and Cons

| ✓ Pros | ✕ Cons |

| Spreads starting from 0.0 pips | High risk associated with leverage |

| Extensive selection of tradable assets | Withdrawal times may vary |

| Fast trade execution | Fees for specific payment methods |

| Negative balance protection | Limited customer support availability |

| Simple deposit/withdrawal process | Inactivity fees after withdrawals |

In Conclusion

Earn is a trustworthy and well-regulated broker that caters to traders of all experience levels. Established in 2011 and regulated by CySEC, it provides competitive spreads, advanced trading tools, and quick execution speeds.

Although some fee details could be more transparent, the platform’s extensive educational resources, customer support, and powerful tools make it a solid option for those looking to trade CFDs, stocks, indices, commodities, or cryptocurrencies.

References:

Faq

Earn is regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 158/11, and it operates in compliance with MiFID regulations within the EU.

Earn offers MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its own proprietary Earn.Broker platform for trading.

Earn offers leverage of up to 1:30 for CFD trading.

Yes, Earn is beginner-friendly, providing educational tools like webinars and courses to help new traders gain a better understanding of the market.

Earn offers a variety of account types, including MT4 Standard, MT4 NDD, MT5 Sharp ECN, Demo accounts, and managed accounts.