Ethereum Long-Term Bullish Outlook As Key Support Sparks Reversal Prospects

Quick overview

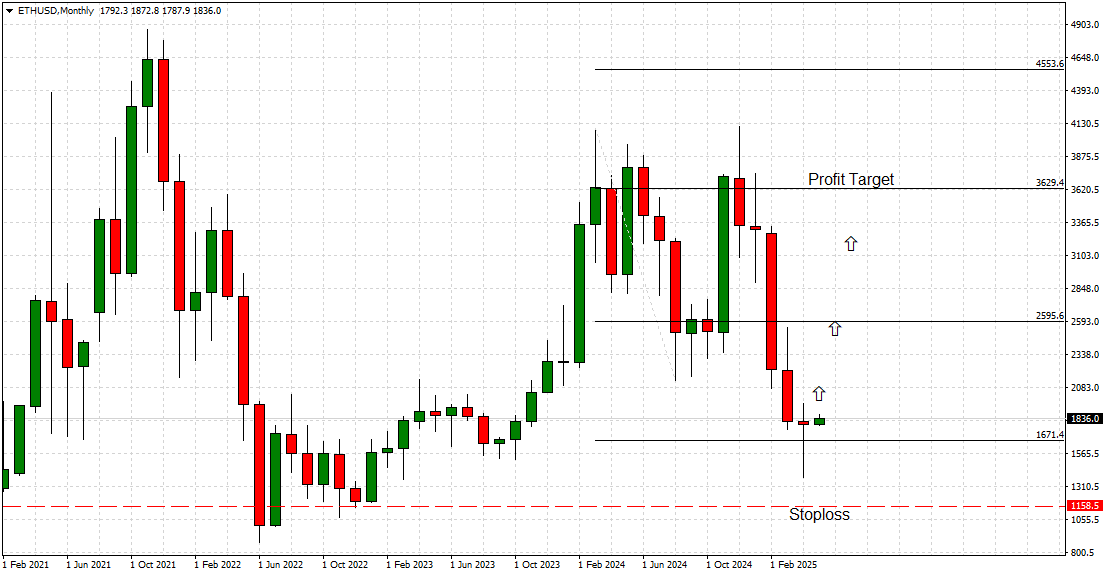

- Ethereum (ETH) shows signs of bottoming out with strong support at $1671, indicating potential for a bullish reversal.

- Recent price action includes a small green candle after a bearish phase, suggesting early accumulation by smart money.

- Immediate upside targets are set at $2595 and $3629, with a recommended stop-loss below $1158 for risk management.

- The network's transition to Proof of Stake has enhanced its scalability and security, reinforcing long-term investor confidence.

Ethereum (ETH) has recently exhibited strong signs of bottoming out, with one of the market’s most significant long-term support levels at $1671 stepping in decisively.

The price action surrounding this zone, as seen in the latest monthly chart, reveals early bullish activity — with a small green candle emerging after an extended bearish phase. This technical reaction, coupled with confirming signals from the Cross-Price Matrix (CPM) pivot system, now points toward a potential upside reversal that could reshape Ethereum’s medium to long-term outlook.

Technical Analysis: Major Support Activated

The uploaded monthly chart highlights Ethereum’s volatile journey since its historic highs, followed by a prolonged downtrend that tested traders’ resolve. The recent touch of the $1671 support level has proven critical. Not only did the market respect this line, but a notable rebound candle formed — signaling early accumulation by smart money.

According to the CPM pivot system, this area represents a long-term pivot zone where probabilities for a sustained upward correction sharply increase. Immediate upside targets now emerge at $2595, a prior key resistance zone from early 2024 price action. Should momentum carry forward beyond this checkpoint, the next major bullish milestone is at $3629, aligning with late 2024 highs.

The recommended stop-loss sits below $1158, offering adequate breathing space while preserving risk management discipline in case of unexpected volatility.

Ethereum Technology & Vision: The Road Ahead

Ethereum remains the undisputed heavyweight in the smart contract and decentralized finance (DeFi) space. Following its successful transition to Proof of Stake (PoS) via the Ethereum 2.0 upgrade, the network has substantially reduced its carbon footprint while enhancing scalability, security, and transaction finality.

The network’s vision extends beyond finance, aiming to become the global settlement layer for everything from art, gaming, supply chains, and even national digital currencies (CBDCs). This fundamental strength underpins long-term investor confidence, making any substantial dip into major support zones an opportunity for strategic positioning.

Conclusion: Bottoming Process in Motion, Bullish Breakout Prospects Rise

Ethereum’s current technical structure suggests that the market has likely carved out its long-term bottom at $1671. The alignment of price action with the CPM pivot system’s upside reversal signal bolsters this bullish outlook. Traders and investors should closely watch the $2595 resistance level for early breakout confirmation, with eyes set on a longer-term target at $3629.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account