Bitcoin Ready to Test $100K as Institutional Inflows Accelerate and On-Chain Activity Peaks

Bitcoin is currently trading above $94,000, down 1.6% in the past 24 hours but showing strong signals for continued upward momentum after a

Quick overview

- Bitcoin is currently trading above $94,000, down 1.6% in the last 24 hours but showing signs of upward momentum after a recent rally from $84,000.

- MicroStrategy continues its aggressive Bitcoin accumulation strategy, recently acquiring 15,355 BTC, bringing its total holdings to 553,555 BTC.

- Bitcoin spot ETFs have recorded significant institutional investment, with $1.81 billion in net inflows last week, highlighting strong demand for Bitcoin exposure.

- Analysts predict Bitcoin could test the $100,000 level soon, supported by high institutional inflows and positive on-chain activity, despite potential short-term volatility.

Bitcoin BTC/USD is currently trading above $94,000, down 1.6% in the past 24 hours but showing strong signals for continued upward momentum after a recent rally from $84,000. With institutional money flowing in at record rates and on-chain metrics reaching six-month highs, analysts are increasingly confident about Bitcoin’s path to breaking the elusive $100,000 barrier in the near term.

MicroStrategy Continues Aggressive BTC Accumulation Strategy

Following the business’s Q1 results call, MicroStrategy co-founder Michael Saylor has indicated that he is about to buy Bitcoin, therefore marking what would be the fourth straight week of purchases by the BTC treasury company. On April 28, the company acquired 15,355 BTC, worth at more than $1.4 billion, therefore augmenting its overall holdings to an amazing 553,555 BTC.

MicroStrategy has stayed consistent in its Bitcoin accumulation approach even though analyst predictions for Q1 2025 are lacking. Reporting roughly $111 million in sales (down 3.6% from Q1 2024). The company unveiled ambitious ambitions to raise $21 billion through an equity offering to finance the purchase of even more BTC and revealed that it has thus far bought 61,497 BTC in 2025.

MicroStrategy is currently up almost 39% on its investment, according to data from SaylorTracker, meaning over $15 billion in unrealized gains. With MicroStrategy’s average daily rate of Bitcoin accumulation of roughly 2,087 BTC far above the combined daily mined supply of roughly 450 BTC, some analysts have suggested that the aggressive accumulation strategy is essentially generating a “synthetic halving” by outpacing the daily miner output.

Spot Bitcoin ETFs Drive Record Institutional Investment

Recording $1.81 billion in net inflows last week alone, the third-largest weekly inflow in 2025, Bitcoin spot ETFs have maintained their remarkable run into May. This follows an even more amazing third week of April with net inflows of $3.06 billion, amply illustrating institutional demand for Bitcoin exposure.

Attracting approximately $2.48 billion in net inflows, BlackRock’s IBIT continues to be the major actor. Especially on Friday, May 2nd, IBIT accounted for all deposits totaling $674.91 million, therefore displaying its unmatched market supremacy. With investments ranging from $10 million to $41 million, other ETFs having net flows include Grayscale’s BTC, VanEck’s HODL, and Invesco’s BTCO.

With their entire net assets valued at $113.15 billion and their $40.24 billion cumulative total net inflow, the US Bitcoin Spot ETFs now show following this optimistic trading week 5.87% of Bitcoin’s market capitalization.

BTC’s On-Chain Metrics Point to Strong Market Fundamentals

The increase in on-chain activity is among the most positive signals for Bitcoin aficionados. With 925,914 BTC addresses active inside a single day, fresh statistics show that Bitcoin recently recorded its largest number of active addresses in the past six months. This quite high degree of blockchain involvement coincides with Bitcoin’s recovery of the $95,000 price range.

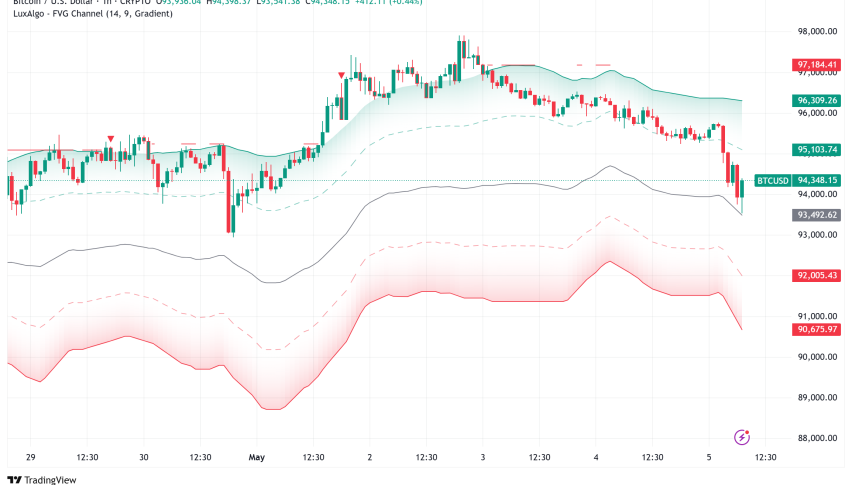

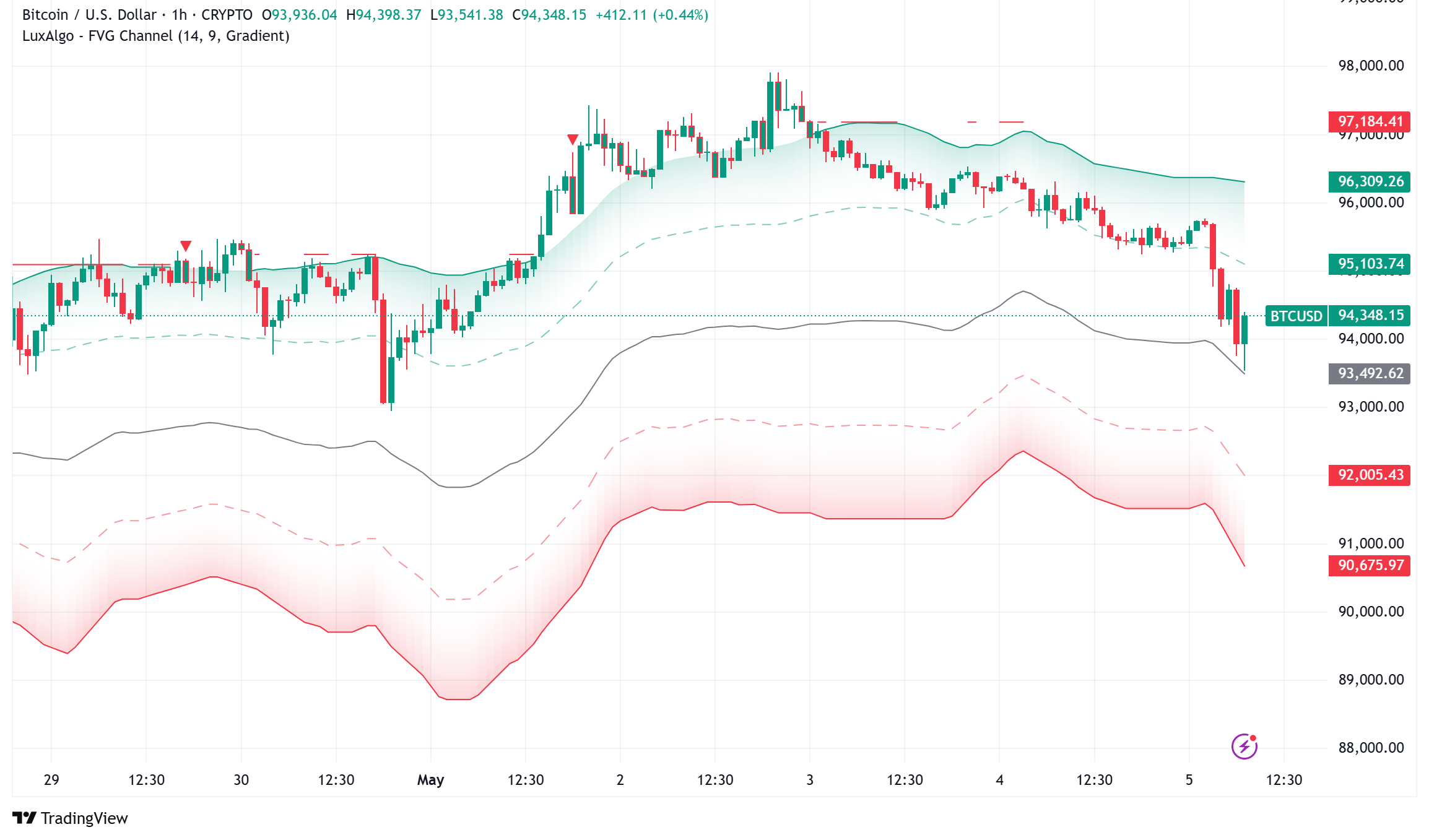

Technical analysts have noted that the present price structure of Bitcoin exhibits amazing resemblance to mid-April trends. Bitcoin consolidated close to $86,000, broke out, produced a fair value gap (FVG), retested the gap, and then rallied almost $10,000 back then. With Bitcoin compressing below $95,000, breaking through resistance, and producing a new FVG between $94,200 and $95,000, a similar trend seems to be developing presently.

Federal Reserve Decision Looms as Critical Catalyst

As a possible trigger for Bitcoin’s next significant movement, market players are attentively monitoring the forthcoming Federal Reserve interest rate decision this week. Ahead of the May 7 meeting, the mix of recession predictions and pressure from President Donald Trump against hawkish signals from Fed officials has generated a volatile environment.

Notwithstanding this uncertainty, the most recent FedWatch Tool data from CME Group shows very low probability of a May 7 rate cut. Many observers believe the crypto market may keep correcting in the days before the Fed meeting, with a possible turnaround around Tuesday followed by an upward path.

Bitcoin Price Prediction: Path to $100K and Beyond

Bitcoin is positioned to test the psychologically significant $100,000 level in the near future given the convergence of high institutional inflows, peak on-chain activity, and positive technical patterns. Should buyers defend the fair value gap between $94,200 and $95,000, the path to $100,000 appears to be essentially unbroken.

Looking ahead, historical cycle study indicates that, following trends seen in past market cycles, Bitcoin could hit its cycle peak about October 11, 2025. Based on the fact that it has been exactly 903 days from the lowest point of Bitcoin in 2022, this estimate is based on the past two cycles whereby Bitcoin reached new all-time highs over 161 days after this same period.

Though short-term volatility is likely, especially surrounding the Federal Reserve’s announcement, Bitcoin’s basic demand picture is still strong. With major institutional players like MicroStrategy still building and ETF inflows keeping strong momentum, the general view of Bitcoin in the next months seems quite positive, with possible targets well beyond the $100,000 level should these favorable conditions last.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account