Ethereum (ETH) Breakout Standoff: Will the Bulls Conquer the Next Frontier?

Quick overview

- Ethereum (ETH) is currently consolidating beneath the critical $2,595 resistance level, which is pivotal for its bullish outlook.

- A confirmed breakout above $2,595 could lead to a significant price target of $3,629, marking a key transition in Ethereum's bullish cycle.

- Recent market sentiment shows increased transaction volume and ETH staking participation, supporting the bullish narrative.

- The Ethereum developer community is making progress with the Pectra Upgrade, enhancing network efficiency and decentralization.

Ethereum (ETH) continues to command attention as the broader crypto market navigates a delicate recovery phase.

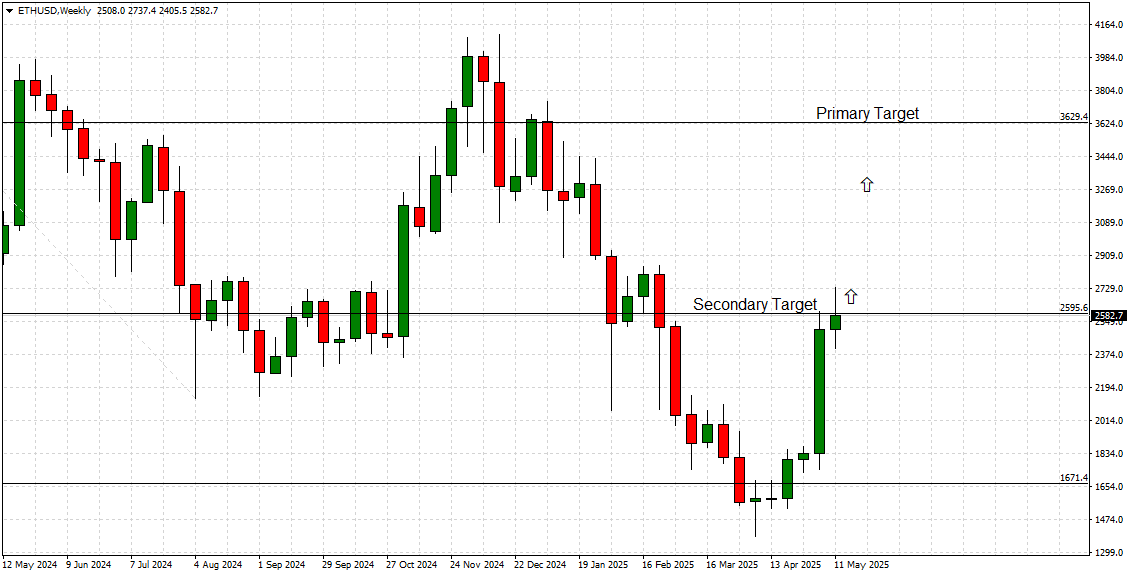

Our previous long-term bullish outlook from May 4th, 2025 highlighted the critical role of the $1,671 support level in catalyzing a price reversal, with our short-term target pinpointed at $2,595. Fast forward to mid-May, Ethereum has impressively fulfilled that projection, reaching the $2,595 resistance threshold — a significant inflection point that now poses a classic make-or-break scenario for the bulls.

As of today’s trading action, Ethereum is consolidating just beneath this crucial level, with visible signs of momentum attempting to drill through. The outcome at this price junction will largely define whether Ethereum transitions into the next leg of its bullish cycle, or faces a temporary pullback before regrouping.

Breakout Levels & Key Resistance Zones

The immediate focus lies squarely on the $2,595 resistance zone, which, historically, has acted as a pivot level for Ethereum’s price structure. A confirmed breakout — defined by a sustained weekly close above this level with accompanying volume expansion — would validate the transition to the second stage of the current bullish cycle.

Should this occur, the path will be open toward the next major upside target at $3,629. This price point represents a confluence of historical supply and a structural ceiling formed during the mid-2024 retracement. Reclaiming this territory would not only mark a technical triumph, but also re-establish Ethereum’s position as a leading market mover in the digital asset space.

Key Breakout Levels:

-

Immediate Resistance: $2,595

-

Primary Bullish Target: $3,629

-

Major Key Support: $1,671

Until a breakout materializes, Ethereum may keep flirting around with the key-level of $2,595 as market participants weigh macro factors and sector-specific catalysts.

Price Action Momentum and Market Sentiment

The weekly candlestick pattern paints a bullishly tilted picture. Ethereum has posted a sustained recovery from its late March lows near $1,550, closing six consecutive bullish candles — a rare momentum streak not seen since early 2024.

Notably, the latest bullish engulfing pattern suggests accumulation strength just beneath the $2,595 barrier, a bullish tell-tale of potential breakout intentions.

However, overhead pressure remains tangible. Should price action fail to secure a firm break, a temporary pullback toward $2,400–$2,200 cannot be ruled out, likely forming a higher-low structure in line with healthy bull market mechanics.

From a sentiment perspective, on-chain activity has reflected rising transaction volume and ETH staking participation, further supporting the bullish narrative.

Ethereum’s Technology & Vision: What’s New?

On the innovation front, Ethereum’s developer community continues to make strides toward network efficiency and decentralization. The Ethereum Foundation just released a mid-quarter progress update on the upcoming Pectra Upgrade — a significant protocol improvement targeting validator efficiency and reducing staking-related centralization risks.

Additionally, Ethereum’s Layer-2 ecosystem continues its rapid expansion, with protocols like ZKSync Era and Base achieving record transaction throughput in early May. These advancements address scalability and transaction cost challenges, cementing Ethereum’s leadership in blockchain infrastructure.

Outlook Summary

Ethereum’s current technical and fundamental posture remains bullish, albeit delicately poised at the $2,595 resistance. A clean breakout above this level would set the stage for a measured advance toward $3,629, confirming the resumption of Ethereum’s broader uptrend.

The recent upswing in staking participation and structural protocol improvements underpins Ethereum’s robust long-term narrative. While short-term volatility around $2,595 is likely, the prevailing momentum and market structure favor the bulls.

Traders and investors should monitor price action closely at this pivotal juncture, with special attention on volume and candlestick formations to validate breakout attempts.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account