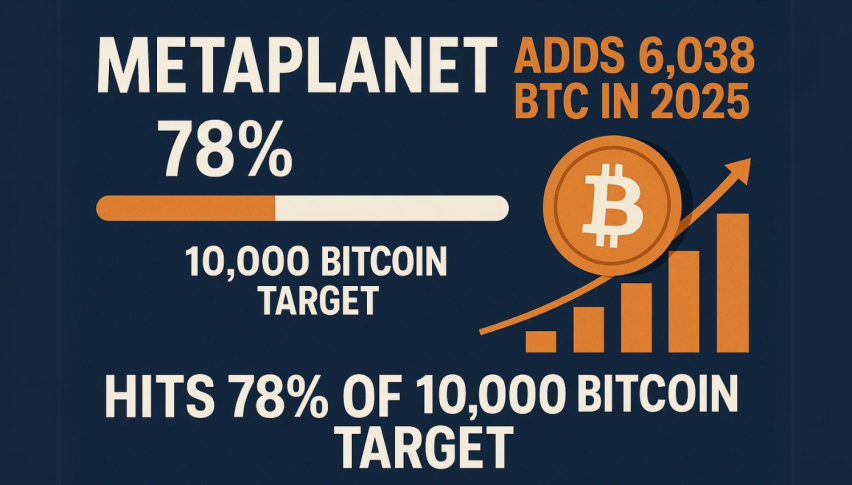

Metaplanet Adds 6,038 BTC in 2025, Hits 78% of 10,000 Bitcoin Target

Japanese tech firm Metaplanet has ramped up its Bitcoin holdings dramatically in 2025, acquiring 6,038 BTC this year alone.

Quick overview

- Metaplanet has significantly increased its Bitcoin holdings in 2025, acquiring 6,038 BTC to reach a total of 7,800 BTC.

- The firm's latest purchase of 1,004 BTC highlights its commitment to a Bitcoin-first treasury strategy, with an average acquisition cost of approximately $91,343 per BTC.

- Metaplanet's stock surged by 15% following a record Q1 revenue of ¥877 million ($6 million), reflecting growing investor enthusiasm.

- The company is expanding its Bitcoin exposure at a rate 3.8 times faster than MicroStrategy, positioning itself as a major player in the institutional Bitcoin market.

Japanese tech firm Metaplanet has ramped up its Bitcoin holdings dramatically in 2025, acquiring 6,038 BTC this year alone. This pushes its total to 7,800 BTC—an impressive 78% of its publicly stated goal of 10,000 BTC. Often dubbed “Japan’s MicroStrategy,” Metaplanet is rapidly positioning itself as a major institutional Bitcoin holder.

The latest purchase of 1,004 BTC, worth approximately $104 million, underscores its commitment to a Bitcoin-first treasury strategy. The average acquisition cost sits at ¥712.5 million ($91,343) per BTC. Remarkably, the firm has quadrupled its holdings since the start of the year, now ranking as the 11th largest Bitcoin holder globally—surpassing even El Salvador.

To fuel its Bitcoin accumulation, Metaplanet utilized a moving-strike warrant program, issuing equity without a fixed discount. This creative financing approach has allowed the company to expand aggressively without diluting shareholder value at a predictable rate.

Stock Soars Amid Record Revenue

Investor enthusiasm is soaring alongside Metaplanet’s Bitcoin stack. Following its announcement of ¥877 million ($6 million) in Q1 revenue—a company record—the firm’s stock surged by 15% on the Tokyo Stock Exchange, hitting 712 JPY. This marks a monthly gain of over 100%.

This surge is largely attributed to:

-

Growing institutional interest in Bitcoin

-

Metaplanet’s transparent acquisition strategy

-

Strong Q1 financials amid broader crypto market momentum

Bitcoin’s current price hovering around $103,500 adds to the bullish sentiment, with traders watching closely for a decisive breakout above $105,000.

Outpacing MicroStrategy’s Bitcoin Model

What’s catching Wall Street’s attention isn’t just the volume of Bitcoin Metaplanet holds—but its velocity. According to Blockstream CEO Adam Back, the Japanese firm is expanding its Bitcoin exposure 3.8 times faster than U.S.-based MicroStrategy, when measured by market net asset value (mNAV) coverage.

Key figures driving the comparison:

-

BTC Yield in 2025: 189.1%

-

Market Sentiment: Positive despite U.S. credit rating downgrade by Moody’s

-

Crypto Impact: S&P 500 faces pressure; Bitcoin seen as a hedge

This strategic edge and rapid scaling make Metaplanet’s stock increasingly attractive to crypto-savvy investors. As global markets remain uncertain, firms like Metaplanet continue to bet on Bitcoin—not just as an asset, but as a core business model.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM