XRP Price Prediction: CME Launch Fuels Institutional Buzz with 2 Futures Sizes

CME launches XRP futures with two contract sizes and CFTC oversight, boosting ETF speculation and institutional demand for Ripple’s token.

Quick overview

The Chicago Mercantile Exchange (CME) has officially launched XRP futures, making it the first U.S.-regulated platform to offer futures contracts tied to Ripple’s native asset. Sanctioned by the Commodity Futures Trading Commission (CFTC), this development marks a milestone for institutional access and market legitimacy.

CME offers two XRP futures contracts:

- Standard: 50,000 XRP

- Micro: 2,500 XRP

Both are cash-settled in USD and benchmarked against the CME CF XRP-USD Reference Rate. As institutions look for compliant exposure to crypto, these will deepen market participation and maturity.

XRP ETF Speculation Heats Up Amid Legal Gray Area

CME’s move has rekindled hopes for a US listed XRP ETF. “CME traded XRP futures are live. US listed XRP ETFs are next,” said Nate Geraci, President of ETF Store, on X.

But Ripple’s ongoing legal battle with the SEC adds uncertainty. In a recent ruling, Judge Analisa Torres upheld a $125 million fine and maintained the ban on institutional XRP sales. Legal clarity on XRP’s status as a security is key to ETF approval. Ripple will submit a revised settlement proposal later this year which could change the landscape.

Global Expansion Accelerates as Price Faces Headwinds

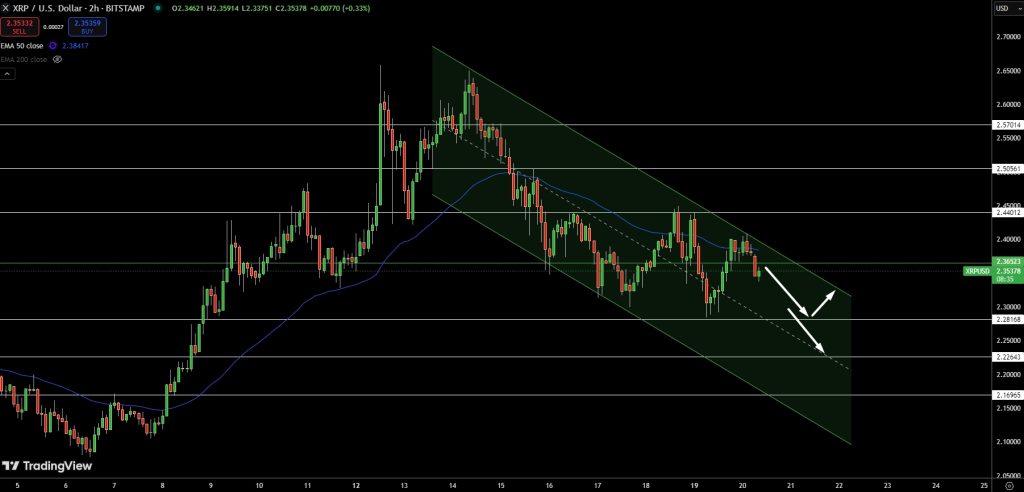

XRP/USD is at $2.35, down from earlier highs, and stuck in a descending channel on the 2 hour chart. Price recently rejected the 50-EMA ($2.38) and the upper channel line, forming a bearish engulfing candle—more downside to come.

Support is building at $2.32, then $2.28 and $2.22, the latter being the lower channel line. A breakout above $2.38 could trigger a short squeeze to $2.44 or $2.50 but until then, sellers are in control.

- Bearish structure: lower highs/lows

- Rejection at EMA confirms resistance

- A breakout above $2.38 could flip sentiment short term

For new traders, think of the descending channel like a slide—unless XRP breaks above that top line, expect more slides.

Ripple Expands

Despite price fluctuations, Ripple is growing globally. It just got a DFSA license in Dubai and added Zand Bank and Mamo to its client list. According to MEA Managing Director Reece Merrick, the license will be key to scaling cross border payment innovation in the region.

Meanwhile on-chain data shows over $350 million in XRP moved between Ripple and exchanges—strategic accumulation during market uncertainty.

Bottom Line

With regulated futures, ETFs and global expansion, XRP is on the radar for institutions. Short term is bearish, long term looks good if regulatory clarity comes in H2 2025.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account