Gold Sparks on Israel waging war with Iran

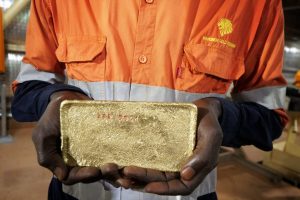

The bullion asset demand increased in London trade on Wednesday following a report that Israel was preparing to attack Iran's nuclear sites

Quick overview

- Bullion asset demand rose in London following reports of Israel's potential military action against Iran's nuclear sites.

- The decline of the dollar and concerns about the global economy helped gold prices recover some losses from the previous week.

- Gold futures increased by 0.6 percent to $3,303.62/oz, while spot gold rose 0.4 percent to $3,302.02 an ounce.

- Rising tensions in the Middle East are driving up gold and silver prices as investors seek safe havens.

The bullion asset demand increased in London trade on Wednesday following a report that Israel was preparing to attack Iran’s nuclear sites.

The dollar’s decline also contributed to the increase. Ongoing worries about the world’s largest economy helped Gold remain reasonably well-priced due to fiscal health and trade negotiation uncertainty, which helped bullion recover some of its losses from the previous week.

While gold futures for June increased 0.6 percent to $3,303.62/oz by publication, spot gold increased 0.4 percent to $3,302.02 an ounce.

Gold increased following CNN’s report that Israel was preparing for a possible military strike on Iran’s nuclear facilities, citing US officials with knowledge of recent intelligence.

Although Israeli leaders had not yet decided whether to launch the attack, military actions indicated that preparations were in progress.

In addition to going against Washington’s wish for diplomatic relations with Tehran, any possible attack on Iran’s nuclear facilities is likely to cause a serious decline in Middle Eastern geopolitics.

An Israeli strike is also likely to provoke vehement retaliation from Iran, given that the two nations launched a series of strikes against one another last year. Rising oil prices and more inflows into safe havens like gold and the Japanese yen were caused by the possibility of more instability in the Middle East.

Other precious metals were holding onto gains from this week’s dollar weakness. Silver futures increased 0.2 percent to $33.255/oz, while platinum futures dropped 1 percent to $1,050.50/oz

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM