WTI Crude Oil (USOIL) Forecast: Can Bulls Hold as OPEC+ Hints Output Bump?

WTI crude oil prices have been dipping for a second day, thanks to whispers that OPEC+ could boost supply.

Quick overview

- WTI crude oil prices are declining as OPEC+ considers a potential output increase of 411,000 barrels per day.

- The market is cautious ahead of an OPEC+ meeting on May 28, with geopolitical tensions and trade talks adding to uncertainty.

- Iran has raised its light crude prices for June, reflecting ongoing market dynamics.

- Technical indicators show WTI struggling near $61.12, with key support and resistance levels identified.

WTI crude oil prices have been dipping for a second day, thanks to whispers that OPEC+ could boost supply. The market’s been holding its breath ahead of a meeting later this week, where sources hint the group might lock in a production hike of about 411,000 barrels per day for July. And because Monday was the U.S. Memorial Day holiday, the WTI contract didn’t even settle.

“Crude oil edged lower as the market contemplated the outlook for rising OPEC supply,” said Daniel Hynes, a senior commodity strategist at ANZ. Meanwhile, Russian Prime Minister Alexander Novak pointed out on Monday that OPEC+ hadn’t actually agreed on the output bump yet. The group plans to sort it out in an online meeting on May 28.

Some OPEC+ countries that had promised voluntary output cuts are reportedly meeting a day early, on May 31, to finalize plans. Meanwhile, Iran is raising its light crude price for Asian buyers by $1.80 a barrel over the Oman/Dubai average for June, up from May’s $1.65.

-

OPEC+ may increase output by 411,000 bpd.

-

WTI crude is hovering near $61.12 with bearish signals.

-

Iran ups light crude prices for June.

Trade Talks, Iran Tensions Add to the Mix

Geopolitical jitters are also in play. President Trump extended trade talks with the European Union to July 9, calming fears of immediate tariffs that could dent fuel demand.

Over in Iran, President Masoud Pezeshkian said the country could manage even if nuclear talks with the U.S. fall through—meaning continued sanctions, which might keep Iranian oil supplies tighter.

Put it all together—potential OPEC+ output hikes, trade uncertainty, and global tensions—and it’s no surprise WTI prices are treading carefully.

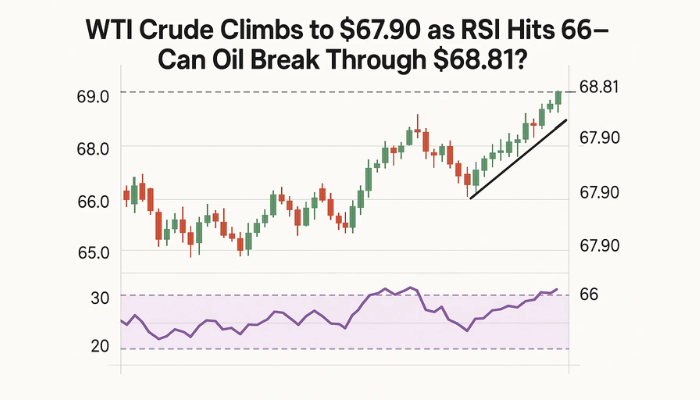

WTI Crude Oil Price Forecast: Testing Support

On the technical front, WTI crude oil is struggling near $61.12. The 50-period EMA at $61.44 is putting a lid on gains, and the price has a downward tilt. Candlesticks are showing a lot of indecision, with no big bullish moves.

MACD indicators are flashing red flags with a bearish crossover and a growing red histogram. The price is also testing a rising trendline near $60.09. If that breaks, expect a drop toward $59.10 or even $58.14. But if buyers step in and push the price above $61.46—ideally with a solid bullish candlestick pattern—there’s a shot at a rebound.

-

Support: $60.09, $59.10, $58.14.

-

Resistance: $61.46, EMA at $61.44.

-

MACD signals growing selling pressure.

For now, it’s best to stay flexible. Wait for a clear move before jumping in.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account