Ethereum Price Prediction: $296M ETF Inflows Signal Rally Toward $2,645 Resistance

Ethereum is back in the spotlight with institutional flows surging for a 7th week in a row. According to CoinShares, Ethereum...

Quick overview

- Ethereum has seen a surge in institutional investment, with $296.4 million inflows last week, totaling $1.5 billion over the past seven weeks.

- BlackRock's iShares Ethereum Trust (ETHA) accounted for most of the inflows, marking 15 consecutive days of investment.

- A shift in sentiment towards public blockchains and potential regulatory clarity around stablecoins is boosting Ethereum's perceived value.

- Currently trading at $2,562, Ethereum faces resistance between $2,566 and $2,645, with the next 48 hours critical for bullish momentum.

Ethereum is back in the spotlight with institutional flows surging for a 7th week in a row. According to CoinShares, Ethereum investment products brought in $296.4 million last week alone, taking the 7-week total to $1.5 billion. That’s the strongest streak since the November 2023 US elections.

Most of this week’s inflow came from BlackRock’s iShares Ethereum Trust (ETHA) which saw $281.3 million. ETHA has now had inflows for 15 consecutive trading days – a sign of strong and sustained institutional demand. CoinShares’ Head of Research, James Butterfill, called this a “watershed moment” for Ethereum-based products.

Key ETF Stats:

- Weekly ETH inflows: $296.4M

- ETHA 15-day streak: $281.3M

- 7-week total inflows: $1.5B

Butterfill noted that investor narratives are changing fast and macro trends and regulatory clarity are driving the rally.

Public Blockchain Sentiment Shifts

Part of Ethereum’s momentum is coming from a broader shift in sentiment towards public blockchains. Bernstein analysts said in a recent report that Ethereum is being seen as core infrastructure – especially with growing US bipartisan support for stablecoin regulation.

With companies like Visa, Stripe and Mastercard deepening stablecoin integration, Ethereum – the blockchain that underpins most stablecoins – is becoming more strategic. The GENIUS Act is currently in the Senate and would formalize stablecoin oversight, potentially accelerating mainstream adoption.

- Stablecoin growth = Ethereum demand

- GENIUS Act may spark more institutional ETH flows

- Public blockchain value is now both functional and financial

Bernstein summed it up: “If stablecoins are useful, Ethereum has inherent value.”

ETH Price Analysis: Rebound Faces Resistance

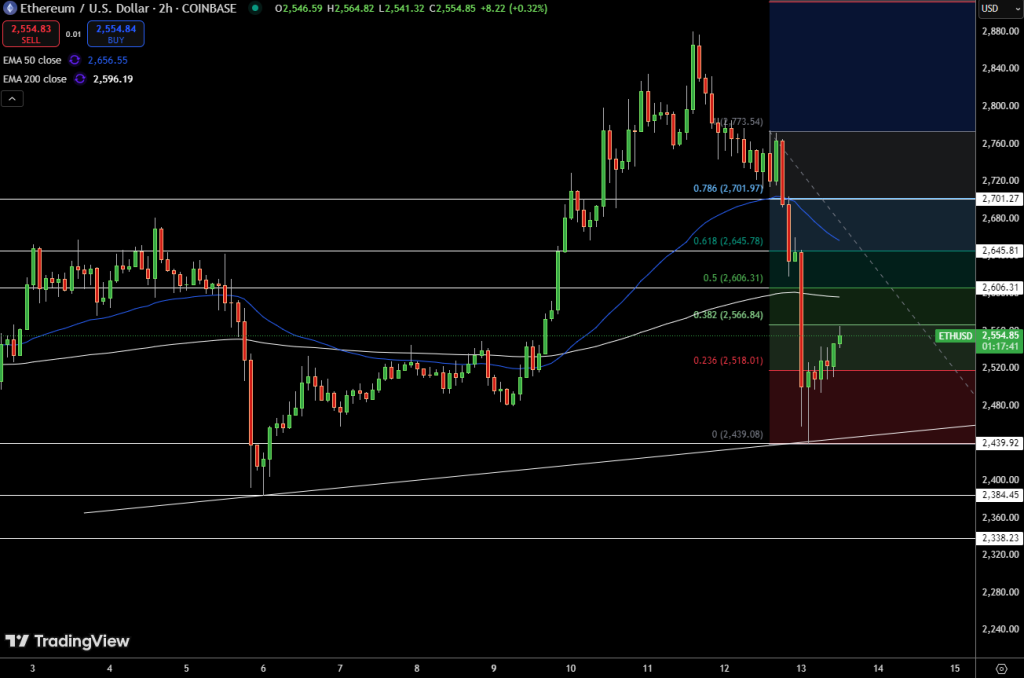

ETH/USD is trading at $2,562 after bouncing from a steep drop to $2,439 earlier in the week. The bounce found support at a rising trendline and reclaimed the $2,550 level. But now Ethereum is facing a dense resistance zone between $2,566 and $2,645.

Technical highlights:

- 200 EMA resistance: $2,596

- 50 EMA resistance: $2,656

- Fib 0.5 and 0.618 retracements: $2,606 and $2,645A bullish engulfing candle above $2,566 could push ETH to $2,606 and $2,645. Failing to get above those levels could send ETH back to $2,518 or $2,480.

Trade:

- Entry: Above $2,566 on volume

- Stop: Below $2,518

- Targets: $2,606 and $2,645

- Risk: Moderate

Ethereum has momentum – but the next 48 hours will tell if the bulls are in charge.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account