Litecoin (LTC) Breaks Lower as Geopolitical Risks Mount — Bearish Momentum Targets $57.71

Quick overview

- Litecoin (LTC) is experiencing a bearish trend after failing to reclaim the $100.68 resistance level.

- Escalating geopolitical tensions, particularly between Israel and Iran, are contributing to a risk-off sentiment in the crypto market.

- The next key support level for Litecoin is at $57.71, with potential downside pressure if the $72.12 support fails.

- No significant updates on Litecoin's technology or roadmap have been reported, maintaining the current bearish outlook.

Litecoin (LTC) continues to slide lower, extending its corrective phase after a decisive failure to reclaim the $100.68 inflection point.

The technical rejection at this key resistance level, first highlighted in our May 25th forecast, has since materialized into sustained downside pressure, as the broader crypto market struggles under the weight of escalating geopolitical risks.

The market’s fragile risk sentiment was dealt another blow this week amid renewed tensions in the Middle East, with hostilities between Israel and Iran sharply intensifying. This geopolitical flashpoint has introduced fresh volatility across global financial markets, prompting traders to aggressively unwind risk-on positions, including speculative assets like Litecoin.

With LTC now firmly on the backfoot, the technical landscape remains decisively bearish, setting the stage for a continued descent towards the next major key-support zone at $57.71.

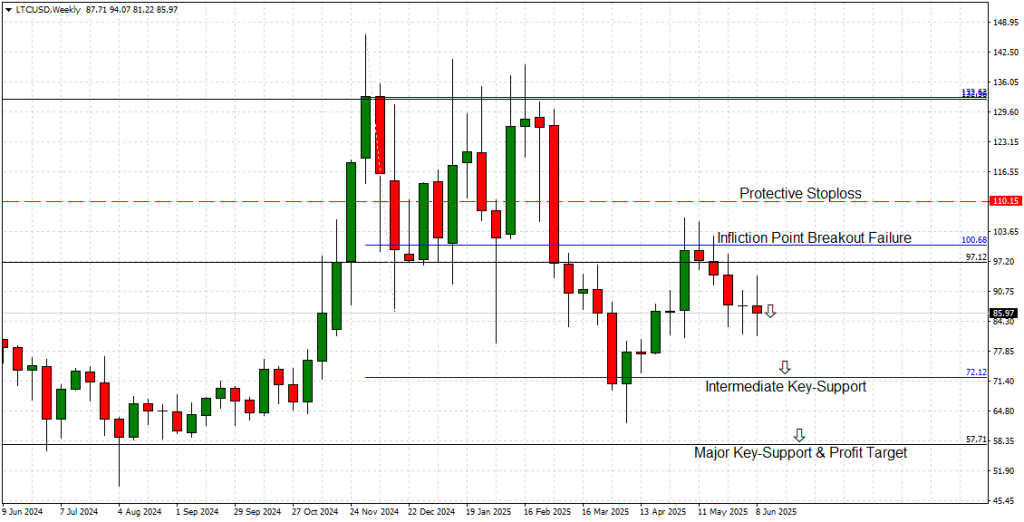

Litecoin Weekly Chart — Key Levels in Play

As illustrated in the uploaded weekly chart, Litecoin has failed on multiple attempts to secure a sustained breakout above the $100.68 inflection point — a level which previously acted as both a critical support and resistance area. This inability to clear overhead supply has now confirmed a classic breakout failure pattern, triggering bearish momentum that is steadily grinding the market lower.

-

Protective Stoploss: $110.15 (remains intact)

-

Inflection Point & Resistance: $100.68

-

Intermediate Key-Support: $72.12

-

Major Key-Support & Profit Target: $57.71

The pair has since slipped below the $97.12 intermediate level, with bearish candles forming lower highs and lower closes on the weekly timeframe. The market is currently hovering around $85.97, with sellers maintaining firm control and additional downside pressure expected should the $72.12 intermediate key-support give way.

Price action structure suggests the path of least resistance remains to the downside, and a sustained break below $72.12 would expose Litecoin to a swift decline towards our primary profit target at $57.71.

Geopolitical Tensions Amplify Bearish Risks

The escalating conflict between Israel and Iran has emerged as the dominant macro catalyst weighing on crypto markets this week. Heightened concerns over regional stability, potential military escalations, and disruption to global oil supplies have prompted a sharp deterioration in risk appetite, with capital fleeing speculative sectors in favor of defensive assets like the US dollar and gold.

Litecoin, like other high-beta crypto assets, remains particularly vulnerable to this risk-off environment. The geopolitical uncertainty has triggered increased liquidation of leveraged positions, compounding downside volatility and amplifying technical weakness.

Unless the situation stabilizes, Litecoin’s bearish trajectory is expected to persist, with market participants likely to remain risk-averse in the face of heightened geopolitical threats.

Technology & Vision — No Major Updates

Since our previous forecast on May 25th, there have been no significant updates or developments regarding Litecoin’s underlying technology, network upgrades, or strategic roadmap. The project continues to focus on its core value proposition of providing fast, low-fee peer-to-peer payments, supported by periodic privacy enhancements such as MimbleWimble via Extension Blocks (MWEB).

While Litecoin’s fundamental framework remains stable, no new innovations or milestones have been announced that could materially alter the prevailing bearish technical outlook or attract fresh investor interest in the near term.

Conclusion

Litecoin’s failure to reclaim the $100.68 resistance has reaffirmed the bearish breakout failure pattern identified in late May, with the market now steadily tracking lower towards the next key-support at $57.71.

With geopolitical tensions between Israel and Iran fueling a broader risk-off shift in financial markets, Litecoin remains at elevated downside risk, particularly if the intermediate support at $72.12 collapses in the sessions ahead.

Barring a significant geopolitical de-escalation or unexpected bullish catalyst within the crypto sector, the technical and macroeconomic landscape continues to favor a bearish outlook for Litecoin over the near to medium term.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM