SEC Dismisses Case Against MetaMask, Boosting Ethereum’s Outlook

In a move that could have significant implications for the broader crypto market

Quick overview

- The SEC has dismissed its investigation into MetaMask, boosting confidence among Ethereum investors.

- This decision suggests that MetaMask's wallet and staking services are not classified as securities, benefiting the broader DeFi ecosystem.

- Ethereum's price has risen following the news, indicating a more favorable regulatory environment and potential for increased institutional adoption.

- Analysts predict that sustained positive sentiment could lead Ethereum to reach new resistance levels in the coming months.

In a move that could have significant implications for the broader crypto market, the U.S. Securities and Exchange Commission (SEC) has officially dismissed its investigation into MetaMask, one of the leading Ethereum-based wallets.

This decision has sparked renewed confidence among Ethereum investors, contributing to an optimistic market sentiment.

MetaMask, operated by ConsenSys, has been under regulatory scrutiny over concerns that its wallet and staking services might fall under securities laws. However, the SEC’s dismissal indicates that, for now, these services are not considered securities. This outcome not only benefits MetaMask but also sends a positive signal to other decentralized finance (DeFi) projects and service providers operating on the Ethereum blockchain.

Following the news, Ethereum’s price experienced a noticeable boost. Investors interpreted the SEC’s decision as a sign of a more favorable regulatory environment, at least in the short term. Market participants believe this could pave the way for increased institutional adoption and further development of Ethereum’s DeFi ecosystem without immediate fear of legal obstacles.

In parallel, Ethereum continues to see substantial on-chain activity, particularly in decentralized exchanges (DEXs), staking platforms, and Layer 2 scaling solutions. This level of activity suggests growing utility and demand for the Ethereum network. As regulatory clarity improves, it may encourage more conservative financial institutions to explore opportunities within the Ethereum ecosystem, adding further momentum to its growth trajectory.

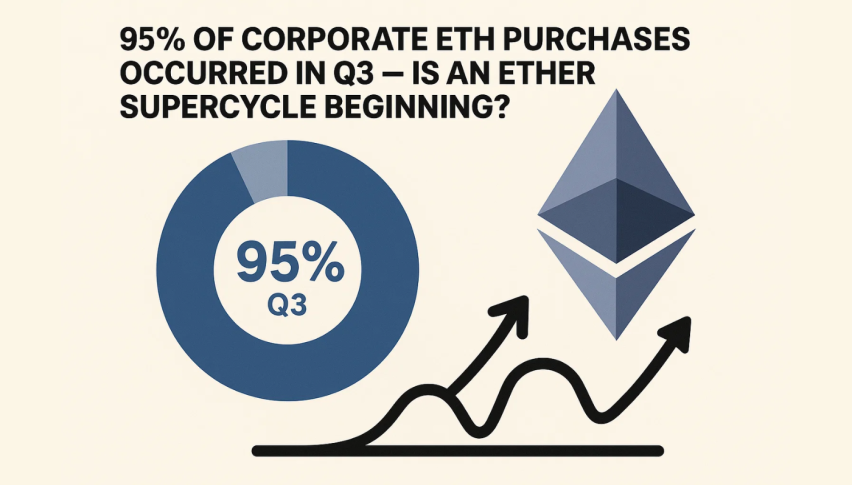

Meanwhile, analysts are keeping a close watch on Ethereum’s price action. Some predict that if positive sentiment persists and institutional interest grows, Ethereum could approach new resistance levels in the coming months. The combination of regulatory relief, robust on-chain metrics, and market enthusiasm is setting the stage for potential long-term gains.

Overall, the SEC’s dismissal of the MetaMask case marks a significant milestone for Ethereum. It reduces some of the regulatory uncertainty that has weighed on the market and opens doors for broader participation in Ethereum-based services. Financial brokers and investors alike are viewing this as a bullish signal that could shape the next phase of Ethereum’s market performance.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account