Oil set to Open $5 Higher after U.S Bombed Iran

Oil is expected to increase by $3 to $5 per barrel when trading resumes Sunday evening following the US attack on Iran over the weekend.

Quick overview

- Oil prices are expected to rise by $3 to $5 per barrel following the US attack on Iran.

- Further price increases may occur if Iran retaliates and disrupts oil supply significantly.

- Analysts predict that geopolitical risks will lead to a higher premium in oil markets.

- The direction of oil prices will depend on whether supply disruptions happen or if the conflict de-escalates.

Oil is expected to increase by $3 to $5 per barrel when trading resumes Sunday evening following the US attack on Iran over the weekend.

Gains are anticipated to accelerate if Iran retaliates severely and significantly disrupts the oil supply. Trump claimed to have “obliterated” Iran’s primary nuclear sites with strikes overnight, joining Israel in escalating conflict in the Middle East as Tehran pledged self-defense.

Jorge Leon, the head of geopolitical analysis at Rystad and a former OPEC official, stated, “An oil price jump is expected.” Even if there is no immediate reprisal, markets will probably factor in a larger premium for geopolitical risk.

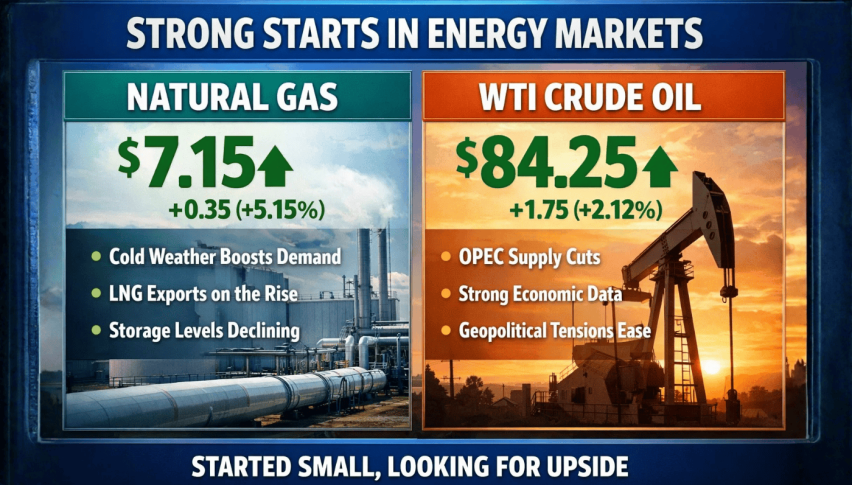

Ole Hvalbye, an analyst at SEB, wrote in a note that the global oil benchmark, Brent crude, could increase by $3 to $5 per barrel when markets open.

WTI has gained about 10 percent, and Brent has increased 11 percent since the conflict started on June 13, when Israel targeted Iran’s nuclear sites and Iranian missiles struck buildings in Tel Aviv. OPEC members’ spare production capacity and stable supply conditions have limited gains.

When supply disruptions have not occurred, risk premiums have generally decreased, according to Giovanni Staunovo, an analyst at UBS. “Whether supply disruptions occur, which would probably lead to higher prices, or if the conflict de-escalates, which would result in a fading risk premium, will determine the direction of oil prices from here,” he stated

. A senior Iranian lawmaker, who made the statement on June 19, warned that Iran could close the Strait of Hormuz as a form of retaliation against its adversaries. However, another lawmaker noted that this would only be possible if Tehran’s vital interests were at stake.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account