Bitcoin Forecast: Bounces Back HARD! New Bullish Targets in Sight

Quick overview

- Bitcoin (BTC) has shown resilience after a volatile week, bouncing back from a key support level of $101,276.

- The easing of geopolitical tensions has reignited risk appetite in financial markets, contributing to Bitcoin's price recovery.

- Short-term targets for Bitcoin are set at $109,280 and $111,569, with bullish momentum expected to continue if key levels are maintained.

- Institutional interest in Bitcoin remains strong, supported by new regulated funds and ongoing developments in its scaling technology.

After a volatile week driven by geopolitical unrest, Bitcoin (BTC) is showing impressive resilience.

Price action recently retraced to retest the major key inflection point at $101,276, a level previously identified as a pivotal support zone for the ongoing bullish cycle. As geopolitical tensions ease — particularly fears over significant Iranian retaliation against U.S. forces — risk appetite has resurfaced across financial markets, fueling a sharp bounce in Bitcoin’s price.

At the time of writing, BTC/USD is trading around $105,166, reclaiming ground and positioning itself for a renewed upside push.

Short-term Outlook

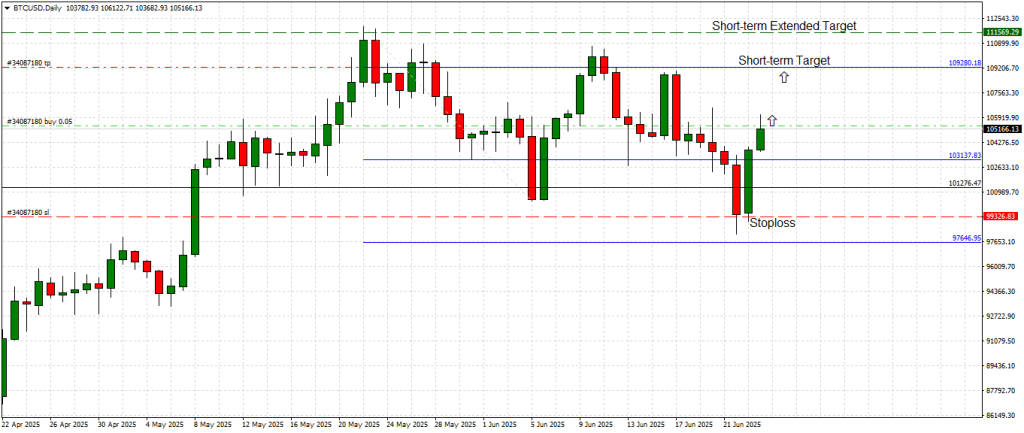

As illustrated on the Daily chart, Bitcoin’s short-term correction found strong support at our key level of $101,276, confirming its importance as a market pivot. The rejection at this level triggered a bullish rebound, with price now approaching the first short-term resistance and target zone at $109,280.

Should momentum persist, an extended short-term target is set near the all-time high around $111,569, marked by the green dashed line on the chart.

Key technical highlights:

-

Stop-loss level ideally placed below the recent support at $99,350 to manage downside risk.

-

Short-term momentum remains bullish above $103,137 (interim minor support).

-

Break and hold above $109,280 likely to trigger another wave of buying pressure.

Long-term Perspective

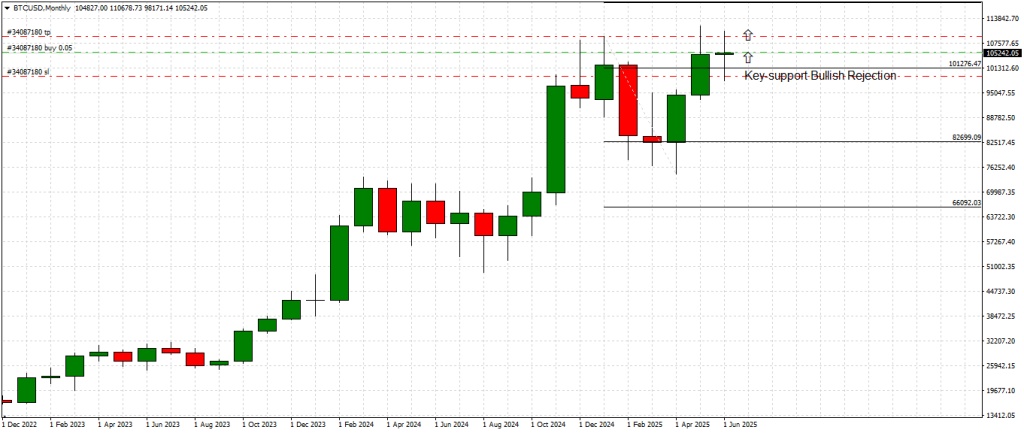

The Monthly chart confirms the long-term bullish bias remains intact. Bitcoin has decisively rejected a break below $101,276, which has proven to be a robust inflection point, aligning with the structural uptrend established since late 2024.

The previous high near $111,570 remains a critical upside target, with a breakout above this level expected to initiate a fresh all-time high run. Price structure remains constructive, with higher highs and higher lows intact on the broader timeframe.

Key Levels to Watch

| Level | Zone Type |

|---|---|

| $99,350 | Stop-loss |

| $101,276 | Major Key Support |

| $103,137 | Minor Support |

| $109,280 | Short-term Target |

| $111,569 | Extended Target / ATH retest |

Fundamental & Macro Overview

The key driver behind this recovery rally is the easing of geopolitical fears. The widely anticipated Iranian retaliation in the Middle East turned out to be far less impactful than feared, exposing the regime’s limited operational reach. This, coupled with a lack of effective counter-response and the market’s anticipation of stabilizing regional risks, has reactivated ‘risk-on’ sentiment globally.

Bitcoin, often seen as a speculative high-beta asset during times of improving risk appetite, is naturally benefitting from this renewed market optimism.

In addition, dovish comments from Federal Reserve officials hinting at potential rate cuts in Q4 2025 have further supported appetite for crypto assets.

Bitcoin Technology & Vision Update

While no major protocol upgrades were announced this week, Bitcoin’s scaling and Layer-2 development ecosystem continues to gain traction. The Lightning Network has surpassed 7,000 BTC capacity, indicating sustained growth in transaction efficiency and micro-payment infrastructure.

Institutional interest also remains robust, with the launch of several new regulated Bitcoin funds in both Asia and Europe, underscoring growing mainstream adoption.

Bitcoin’s vision as “sound money for a decentralized future” is increasingly validated amid mounting concerns over traditional monetary policies and currency devaluation risks.

Conclusion

Bitcoin’s price action remains bullish on both the short and long-term perspectives. The critical hold at $101,276 amid geopolitical turmoil has reaffirmed market conviction, setting the stage for an advance towards $109,280 and potentially $111,569 in the coming sessions.

As always, prudent risk management is advised — with a stop-loss placed below $99,236 to protect against sudden downside volatility.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM