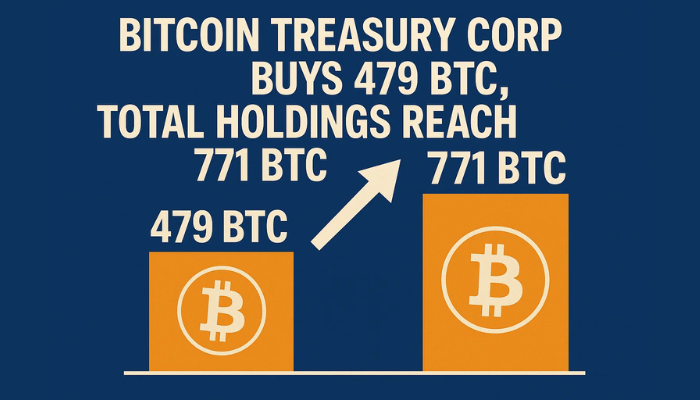

Bitcoin Treasury Corp Buys 479 BTC, Total Holdings Reach 771 BTC

Toronto-based Bitcoin Treasury Corporation (TSXV: BTCT) has completed the first phase of its aggressive Bitcoin accumulation strategy...

Quick overview

- Toronto-based Bitcoin Treasury Corporation has completed its first phase of Bitcoin accumulation by purchasing 478.57 BTC for C$70 million, increasing its total holdings to 771.37 BTC.

- The company's strategy aims to increase its Bitcoin per share (BPS), currently at 0.0000634, linking shareholder value directly to Bitcoin ownership.

- BTCT raised C$125 million through the issuance of 426,650 common shares at C$10 each, allowing retail investors to participate in its Bitcoin-focused corporate strategy.

- With a significant cash reserve and free trading shares, BTCT aspires to become Canada's equivalent of MicroStrategy by leveraging Bitcoin as a strategic reserve asset.

Toronto-based Bitcoin Treasury Corporation (TSXV: BTCT) has completed the first phase of its aggressive Bitcoin accumulation strategy by buying 478.57 BTC for C$70 million. This brings the company’s total Bitcoin holdings to 771.37 BTC and cements its position on Bitcoin as a core corporate treasury asset.

BTCT’s strategy is to steadily increase its Bitcoin per share (BPS) which is currently 0.0000634 fully diluted. This includes convertible debentures but excludes warrants, so you can see the company’s shareholder value tied directly to Bitcoin ownership.

Capital Raise Boosts BTCT’s Market Presence

The timing of this Bitcoin purchase coincides with BTCT resuming trading on the TSX Venture Exchange on Monday, June 30, 2025. The stock was halted during the capital raise and regulatory approval process.

The financing raised C$125 million (approximately US$92 million) by issuing 426,650 common shares at C$10 each. This allows retail investors to buy BTCT shares through various Canadian registered plans including RRSP, TFSA, RESP and FHSA so everyday investors can participate in a pure-play Bitcoin corporate vehicle.

Key financing details:

- 426,650 common shares issued at C$10 each

- Total capital raised: C$125 million (~US$92 million)

- Shares eligible for RRSP, TFSA, RESP and other plans

- Four-month-and-one-day hold on early buyer shares, ending Oct 27, 2025

BTCT’s Vision: Canada’s MicroStrategy?

With over 10 million shares now free trading and a big cash reserve for more Bitcoin purchases, BTCT is joining a small group of publicly traded companies that treat Bitcoin as a strategic reserve asset. The company wants to show how Bitcoin can underpin modern corporate treasuries and drive long-term shareholder value.

If BTCT can scale its lending program and capital deployment, it could become Canada’s MicroStrategy – using capital market strength to generate outsized returns from Bitcoin’s price movements. Investors will get their first chance to act on this vision this week when BTCT starts trading again.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM