Chainlink (LINK) Bullish Reversal: Key-Support Flip Signals Further Upside Potential

Quick overview

- Chainlink (LINK) has shown a bullish reversal after testing key support levels, with a current trading price around $13.38.

- The breakout above $12.81 signals a market structure shift, with a profit target set at $14.99.

- Recent technological advancements, including the launch of Chainlink CCIP v1.1, enhance its position as a leading decentralized oracle network.

- As long as LINK remains above $12.81, the bullish scenario is intact, with potential upside targets of $16.95 and $19.35.

Chainlink (LINK) continues to follow our projections with impressive technical precision. In our May 25 forecast, we identified clear signs of bearish vulnerability, warning that a rejection at $16.95 would likely accelerate a corrective move toward $12.81 and potentially deeper into the $11.52 support region.

That scenario unfolded almost perfectly, with LINK retracing down to test both levels in sequence. Now, however, the narrative has shifted, and the technical landscape hints at a bullish reversal taking shape — bolstered by key support flips, rising price momentum, and stabilizing macro market sentiment.

Technical Outlook

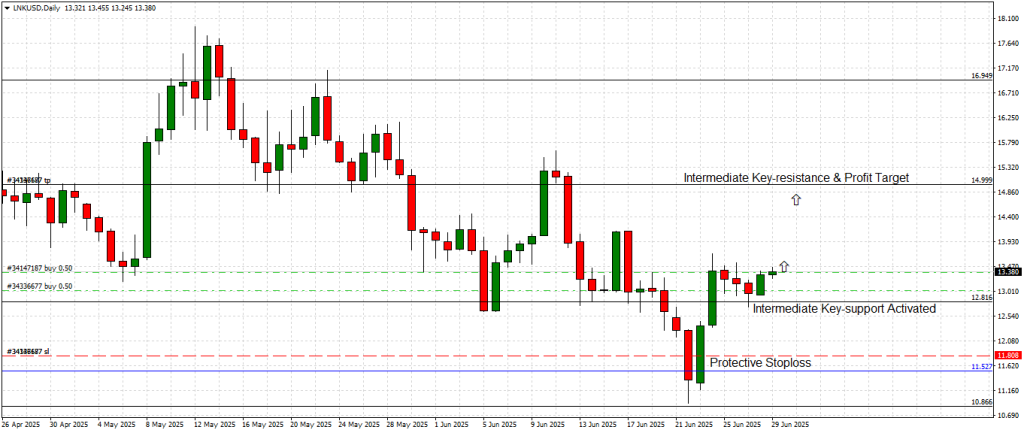

The daily chart (see attached) illustrates a clear structural rebound:

-

After bottoming near $11.52, LINK rebounded sharply.

-

The recent breakout above $12.81, a critical intermediate resistance-turned-support, signals a market structure shift.

-

A successful retest of this level from above confirms it as new support, adding conviction to the bullish thesis.

As of this writing, LINK is trading around $13.38, with short-term momentum pointing toward a test of the Intermediate Key-Resistance at $14.99, which serves as our official profit target for this bullish wave.

On a break above $14.99, the next significant upside level is $16.95, the major resistance level that triggered the last bearish rejection. Clearing this would open the path for a more sustained rally, especially given the improved macro environment and altcoin sector strength.

Higher Timeframe Confirmation

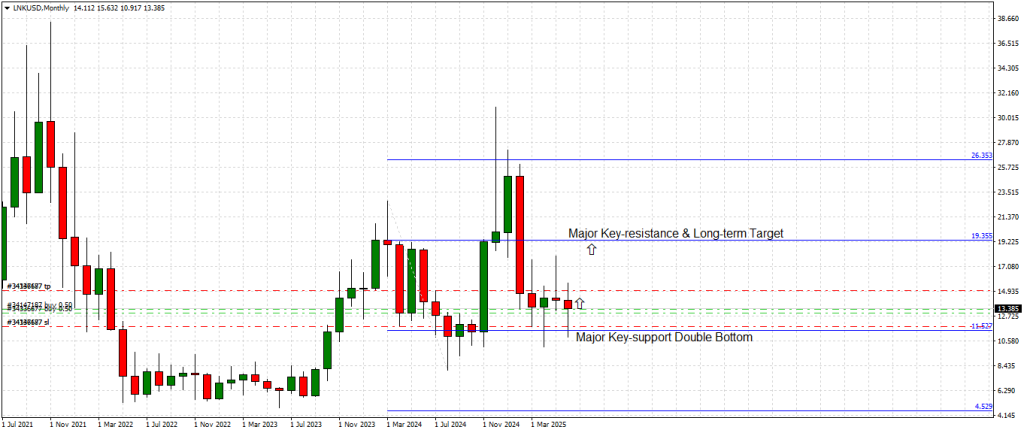

The Monthly chart provides a compelling complementary view:

-

LINK has printed a double bottom structure around $11.52, a historically reliable bullish reversal pattern.

-

A clear re-test and hold above $12.81 adds further confirmation.

-

The next major resistance level resides at $19.35, a long-term horizontal level and prior market pivot point.

-

Beyond this, a secondary upside target is marked at $26.35, though this would likely require broader market tailwinds to reach in the medium term.

As long as LINK holds above $12.81, the bullish scenario remains active, with price expected to gravitate toward the $14.99 target.

Chainlink Technology Update (June 2025)

From a fundamentals perspective, Chainlink continues to solidify its position as the leading decentralized oracle network. Recent updates include:

-

Launch of Chainlink CCIP (Cross-Chain Interoperability Protocol) v1.1, now integrating with several layer-2 scaling solutions, enabling secure cross-chain token transfers and messaging.

-

Expanded staking pools for LINK holders, improving network decentralization and incentivizing node operator participation.

-

Increased enterprise adoption, with recent integrations announced with TradFi institutions leveraging Chainlink’s Proof of Reserve services for on-chain asset auditing.

These enhancements not only strengthen Chainlink’s core infrastructure but also bolster long-term investor confidence, creating a supportive backdrop for the ongoing technical rebound.

Conclusion & Strategy

Chainlink’s price action has executed a textbook bottoming process at key support levels outlined in our prior forecast. With $12.81 flipped to support, bullish momentum is building, setting the stage for a move toward the $14.99 profit target.

Trading Outlook:

-

Entry Zone: Minor pullbacks into $13.00 – $13.20

-

Profit Target: $14.99

-

Protective Stop: Below $11.80

A clean break above $14.99 is likely to trigger the next phase of this recovery cycle, with upside potential expanding toward $16.95 and eventually $19.35 on higher timeframes.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM