Bitcoin (BTC) Hits All-Time High – Cautiously Bullish as Price Enters Resistance Belt

Quick overview

- Bitcoin (BTC) has surpassed previous price targets, currently trading around $116,000 and setting a new all-time high.

- The asset is approaching a critical resistance zone between $114,770 and $117,883, which may trigger profit-taking and short-term corrections.

- Institutional interest and developments like Bitcoin Spot ETFs and Lightning Network expansion are bolstering Bitcoin's market position.

- While the long-term trend remains bullish, caution is advised as BTC faces potential volatility near key resistance levels.

Bitcoin (BTC) continues its impressive bullish momentum, firmly following through on our previous forecast from June 24, where we anticipated a bullish continuation toward $109,280 and $111,569.

Not only did BTC decisively smash both those targets, but it also went on to set a new all-time high, currently trading in the $116,000 zone. While this achievement underscores Bitcoin’s remarkable resilience and market confidence, it also signals that the asset is now approaching a critical technical juncture that demands a more measured, cautiously bullish outlook moving forward.

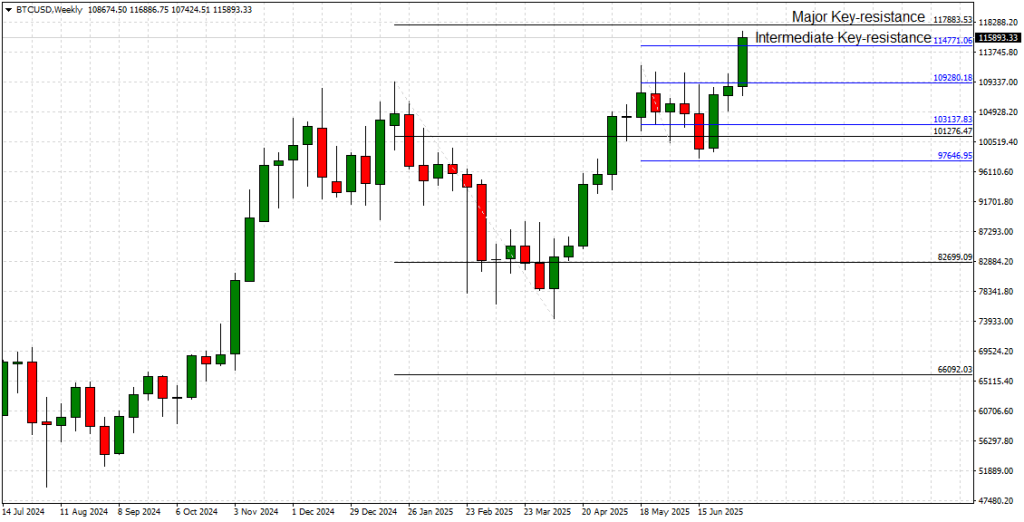

Technical Outlook: BTC/USD Weekly Chart Review

The weekly chart clearly illustrates how Bitcoin surged past the $109,280 and $111,569 resistance levels with solid, consecutive bullish candles. Price action now faces a formidable resistance belt, defined by two closely stacked key levels:

-

Intermediate Key-Resistance: $114,770

-

Major Key-Resistance: $117,883

This zone could act as a significant cap for the current rally, potentially triggering profit-taking and short-term technical corrections as traders react to the overextended conditions.

Key technical insights:

-

The bullish structure remains intact as long as price action holds above the $114,771 key=level, now a recycled inflection point.

-

A spectacular breakout above $117,883 could unleash a new vertical leg toward uncharted territory, targeting the psychological $125,000–$130,000 region.

-

Failure to convincingly breach the $117,883 major resistance could lead to a healthy retracement, possibly toward the $109,280–$103,137 demand zone, providing new long entry opportunities for late bulls.

Given these conditions, while the long-term trend remains bullish, immediate caution is warranted as Bitcoin approaches this overhead barrier.

Technology & Ecosystem Update

From a fundamentals and ecosystem perspective, Bitcoin continues to strengthen its position as the dominant crypto asset, benefiting from several recent and ongoing developments:

Bitcoin Spot ETFs Surpassing $50 Billion in AUM

Institutional interest remains a primary driver behind Bitcoin’s latest rally, with US-based Bitcoin spot ETFs collectively crossing the $50 billion Assets Under Management (AUM) mark as of early July 2025. This influx of regulated capital has significantly bolstered Bitcoin’s liquidity and demand profile, contributing to the asset’s new all-time highs.

Lightning Network Expansion

The Lightning Network, Bitcoin’s primary Layer 2 scaling solution for instant, low-fee transactions, has surpassed $400 million in total value locked (TVL). New integrations by major exchanges, wallets, and payment processors have expanded its utility for both retail and business payments, strengthening Bitcoin’s use case as a practical currency for peer-to-peer settlements.

Ordinal Inscriptions Revival

Bitcoin’s native NFT-like feature, Ordinal Inscriptions, has seen a resurgence, with recent protocol updates reducing fees and improving storage efficiency. The Ordinals market has generated renewed activity on the Bitcoin blockchain, adding fresh network usage and miner fee incentives, which support long-term network security and sustainability.

Conclusion: Cautiously Bullish with Short-term Caution

Bitcoin’s performance since late June has been exemplary, meeting and surpassing our price targets while validating the long-term bullish thesis. However, as BTC enters the resistance belt between $114,770 and $117,883, the probability of short-term consolidation or a technical pullback increases.

While the macro trend remains upward, prudent traders and investors may consider taking partial profits or tightening stop-loss levels as price approaches $117,883. A confirmed breakout above this ceiling would shift the bias firmly back to ultra-bullish, targeting $125,000 and beyond.

For now, we remain cautiously bullish, optimistic about the long-term trajectory while recognizing the potential for temporary volatility and corrective moves at these technically significant levels.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account