Ethereum Surges to 16-Month High Through Record ETF Inflows

Ethereum has seized enormous momentum this week, trading at about $3,600 with gains reaching 7.7% in the preceding 24 hours. ETH/USD has

Quick overview

- Ethereum has gained significant momentum this week, trading at approximately $3,600 with a 7.7% increase in the last 24 hours and a 23% rise over the past week.

- Institutional interest in Ethereum has surged, with a record $727 million inflow into US Ethereum spot ETFs, marking the highest level since January 2025.

- Technical analysis indicates strong bullish momentum for Ethereum, having broken through the $3,400 resistance level and reaching all-time highs in transactions and staked ETH.

- Despite positive trends, potential risks include a significant drop in fee revenue and uncertainties regarding the sustainability of current institutional inflows.

Ethereum ETH/USD has seized enormous momentum this week, trading at about $3,600 with gains reaching 7.7% in the preceding 24 hours. The cryptocurrency has gone up 23% in the past week, which is a lot more than Bitcoin’s 13% rise. This makes it one of the best performers in the current market cycle.

The rise comes at a time when institutional interest is at an all-time high. On Wednesday, US Ethereum spot ETFs saw their biggest single-day inflow ever, with $727 million coming in. This broke the previous record of $428 million established in December. This flood of institutional capital has raised Ethereum’s price to its highest level since January 2025, which is a very important turning point for the second-largest cryptocurrency.

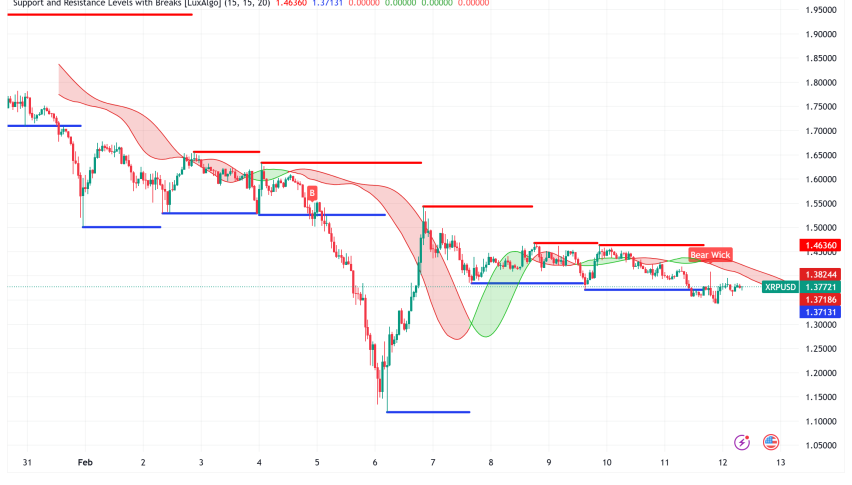

ETH/USD Technical Analysis Points to Continued Momentum

From a technical point of view, Ethereum’s recent price movement shows that there is significant bullish momentum and several support levels have been set. The cryptocurrency has successfully broken through the $3,400 resistance mark that had kept it from going up earlier this year. The number of transactions and daily active wallets on Ethereum has reached all-time highs of almost 19 million and 2.5 million, respectively.

The staking measures give more technical credence to the bullish argument. Staked ETH has hit a new all-time high of more over 36 million tokens, which is about 29% of the total supply. This takes a lot of ETH off the market, which lowers selling pressure and gives holders a return.

Three Pillars Supporting Ethereum’s Institutional Narrative

- Reserve Status of the asset: Because Ethereum is the most popular stablecoin, it has become the backbone of the digital dollar economy. Ethereum has become the main settlement layer for digital financial infrastructure because it issues more than 54% of all stablecoins. Since 2020, the use of stablecoins has grown 60 times, reaching over $200 billion. This has made Ethereum’s function as digital collateral more stronger.

- The Sovereign Digital Economy Fidelity’s most recent report calls Ethereum a sovereign digital economy instead of just a blockchain platform. In this system, ETH serves as base money that connects decentralized users, and the network supports more than $19 billion in DeFi loans. From this point of view, ETH might take a piece of the $500 trillion global store-of-value industry.

- Digital Oil Example: Key players in Ethereum say that ETH is a useful, yield-bearing commodity that drives the on-chain economy. Ethereum is different from Bitcoin’s “digital gold” story because it mixes value storage with usefulness. It burns ETH as fuel for transactions while keeping it scarce by limiting issuance to 1.51% each year.

Ethereum Price Prediction: $4,000 Target in Sight

Ethereum is ready to keep going up based on the present momentum and technical indicators. The cryptocurrency is still trading a long way below its all-time high of $4,855 in November 2021, which means it has a lot of opportunity to expand compared to Bitcoin, which is already in price discovery mode.

There are a number of reasons why $4,000 is a good short-term goal:

- ETF Momentum: Institutional inflows are at an all-time high and show no signs of slowing down. There have been positive flows for 11 of the last 12 trading days.

- Staking Yield: BlackRock’s request to add staking incentives to its Ethereum ETF could open up more institutional demand.

- Technical Breakout: Getting past the $3,400 resistance level makes it possible to reach the psychological $4,000 barrier.

- Relative Underperformance: ETH’s 23% weekly gain is still lower than its historical performance compared to Bitcoin in past cycles.

Risks and Considerations

Even while things look good, there are a few things that should make you cautious. The recent drop in fee revenue from $82 million at the peak in 2021 to just $3 million today shows that Ethereum is shifting its strategy toward Layer 2 scalability. This could temporarily stop ETH holders from getting direct value.

Also, the comparison between SharpLink Gaming (SBET) and MicroStrategy’s Bitcoin approach shows that there may be structural variations in how corporate treasury strategies may change in the future. While more institutions are starting to use it, it’s still unclear how long present levels of input will last.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM