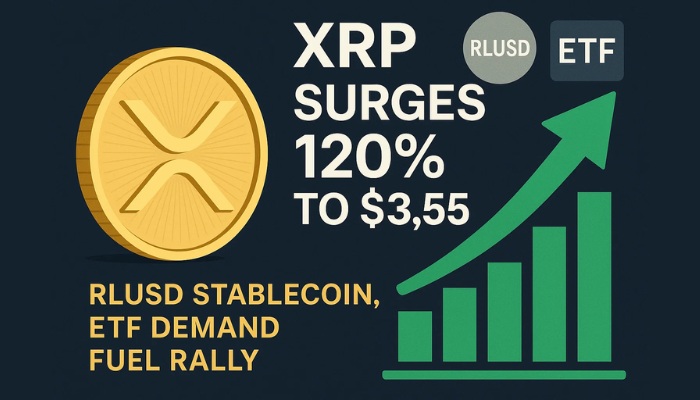

XRP Surges 120% to $3.55 as RLUSD Stablecoin, ETF Demand Fuel Rally

Ripple’s XRP token went up on Monday, July 21 to $3.55—a 120% increase from its April low of $1.61. The rally started on June 22...

Quick overview

- Ripple's XRP token surged 120% to $3.55, driven by the GENIUS Act's regulatory support for Ripple Labs.

- The RLUSD stablecoin has gained significant market traction with a market cap exceeding $520 million.

- Investor interest in XRP is reflected in the Teucrium 2x XRP ETF, which is nearing $500 million in assets under management.

- Technical indicators suggest a bullish trend for XRP, with a target price of $5.20 if it maintains above $3.00.

Ripple’s XRP token went up on Monday, July 21 to $3.55—a 120% increase from its April low of $1.61. The rally started on June 22 and accelerated after former President Donald Trump signed the GENIUS Act into law. This law benefits Ripple Labs whose RLUSD stablecoin meets all the regulatory criteria outlined in the new law.

RLUSD was introduced in December 2024 and has quickly gained traction in the market. Its market cap is now over $520 million and closing in on PayPal’s PYUSD. Analysts point to RLUSD’s transparency and secure custodianship by Bank of New York Mellon as the reasons for its growing trust.

The GENIUS Act seems to be a turning point for XRP, validating Ripple’s regulatory strategy and expanding use cases in its ecosystem.

ETF Demand and Wall Street Interest

Investor appetite for XRP is also visible in the ETF market. The Teucrium 2x XRP ETF which was launched three months ago is still attracting institutional capital with AUM nearing $500 million. This is a sign of increasing Wall Street interest in altcoin exposure.

The demand for XRP ETFs is setting the stage for potential inflows into spot XRP ETFs if they get approved by the US SEC. Meanwhile the futures market is showing bullish conviction with XRP open interest hitting a record $10.8 billion from below $500 million earlier this year.

XRP Investment Trends:

- AUM in 2x XRP ETF: Approaching $500 million

- RLUSD market cap: Over $520 million

- XRP futures open interest: $10.8 billion

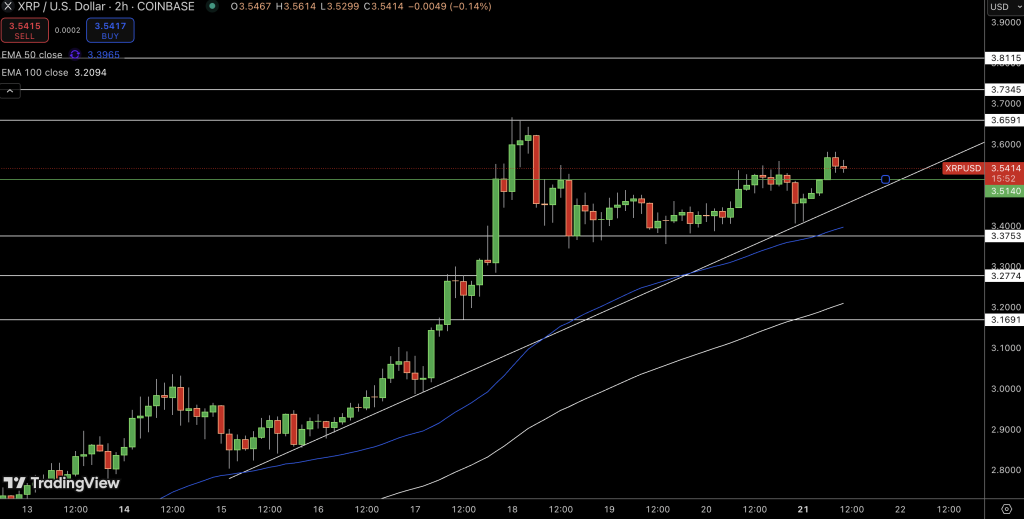

XRP/USD Technical Indicators Point Up

On the technical front XRP is trading above its 50-day and 200-day EMAs and is in a strong bullish trend. The daily chart is forming a cup-and-handle pattern which is a continuation signal for traders.

- Cup base: $1.61

- Cup rim: $3.40

- Target: $5.20 (52% above current levels)XRP must hold above $3.00 to stay bullish. Below that and the trend is broken.

Key Points:

- XRP up 120% to $3.55 from $1.61

- RLUSD $520M

- ETF AUM $500M; futures $10.8B

- $5.20 target

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account