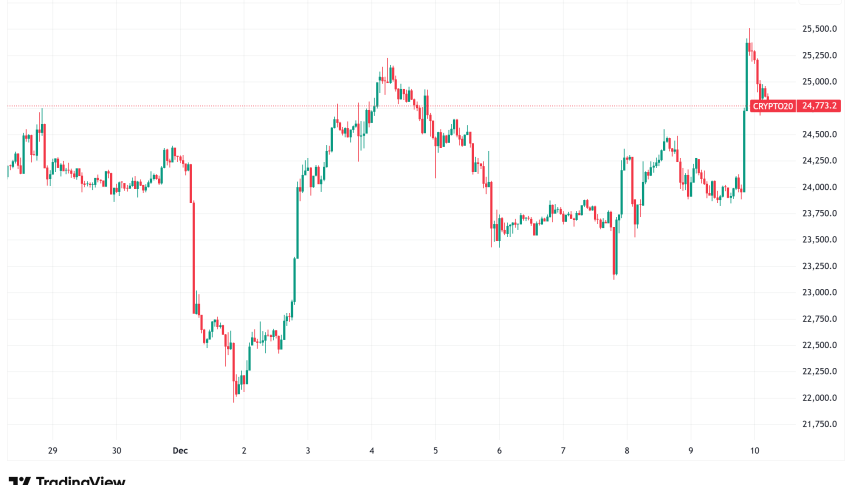

Bitcoin Consolidates Above $119K, $57B Options Activity Signals Major Price Moves Ahead

At the time of writing, Bitcoin (BTC) is trading above $119,000. It has dropped 2% in the last 24 hours as markets settle down before key

Quick overview

- Bitcoin is currently trading above $119,000, having dropped 2% in the last 24 hours as markets await key macroeconomic data.

- Despite recent fluctuations, Bitcoin remains in a strong bull cycle, with significant institutional activity and a total open interest in options nearing $57 billion.

- Long-term price forecasts suggest Bitcoin could reach $340,000, surpassing previous cycle gains, while short-term predictions remain optimistic at $150,000 by year-end.

- The upcoming Consumer Price Index announcement is crucial, as it could influence market sentiment and the performance of risk assets like Bitcoin.

At the time of writing, Bitcoin BTC/USD is trading above $119,000. It has dropped 2% in the last 24 hours as markets settle down before important macroeconomic data comes out. Even if it has dropped recently, the world’s largest cryptocurrency is still in a good position in its current bull cycle. Institutional flows and derivatives activity imply that big changes could be coming soon.

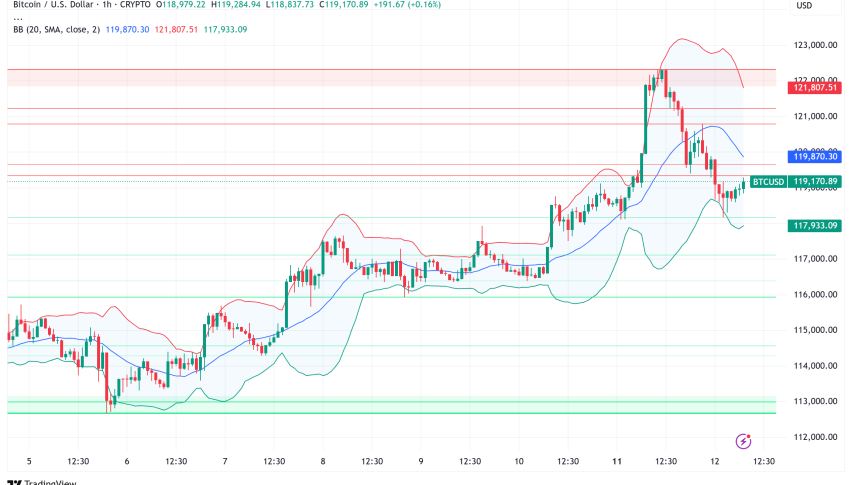

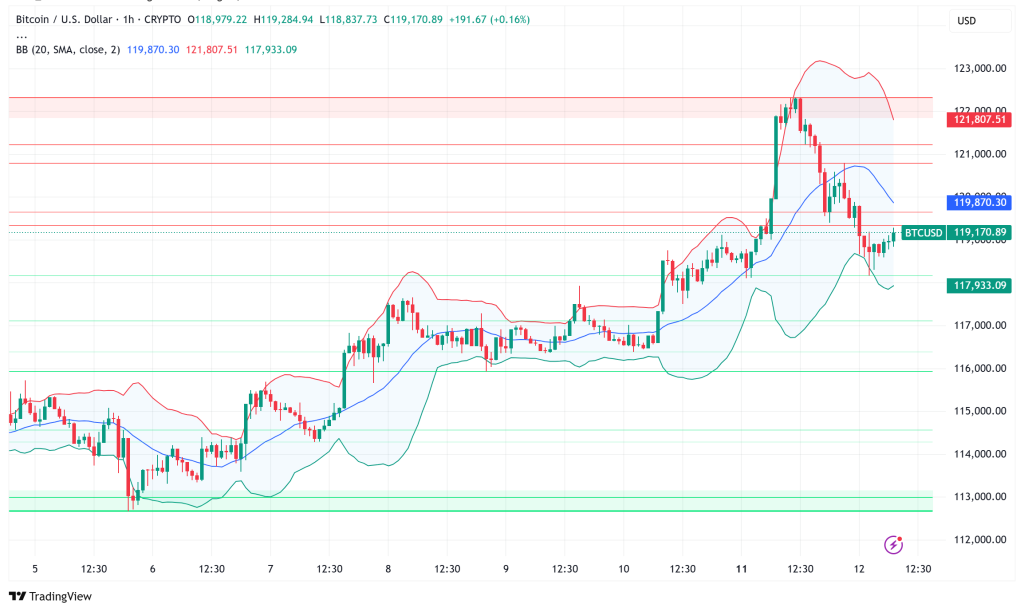

BTC/USD Technical Analysis Points to Critical Resistance Levels

After Bitcoin’s spectacular gain over the weekend, when it climbed beyond $122,000, the current price movement shows that the market is consolidating. Technical indications show that BTC is staying above important support levels. The cryptocurrency has gone up almost 700% since its bear market low of $15,600 in 2022.

Data from the options market shows that institutional traders are positioning themselves strategically, with a lot of demand for short-dated Bitcoin puts in the $115,000–$118,000 region. This defensive stance shows that people in the market are protecting themselves from possible losses while still being open to rewards. The total open interest in Bitcoin options is at $43 billion, close to the $49 billion top reached in July 2025.

Since mid-July, the link between Bitcoin and traditional equities markets has gotten stronger. QCP Capital says that the performance of cryptocurrencies is becoming more and more linked to the mood of risk assets in general. As the markets wait for Tuesday’s Consumer Price Index (CPI) announcement, this correlation might be very important. Most people predict headline inflation to rise by 10 basis points to 2.8%.

Ambitious Price Targets Challenge Historical Precedents

Long-term price forecasts make Bitcoin’s current cycle look very promising. Jason Pizzino, a macro trader, says that Bitcoin would need to hit $340,000 to beat its prior cycle gains of 2,089%. He calls this goal “very big ask” but says it is not impossible.

If Bitcoin reached this price, it would be the first time in its 16-year history that it beat the returns of the preceding cycle. The market valuation would be $6.7 trillion. This would make Bitcoin the second most valuable asset in the world by market cap, behind gold, which is worth about $23 trillion.

Paul Howard of Wincent is still bullish about more modest short-term aims, keeping his $150,000 Bitcoin projection by the end of the year. He points to past trends in the post-halving cycle as evidence that the price will keep going higher.

Institutional Activity Reinforces Market Resilience

Institutional involvement is still a key factor in Bitcoin’s pricing structure. According to CoinShares data, digital asset investment products saw $571 million in net inflows last week. Both Bitcoin and Ethereum benefited from more institutional investment.

The market has shown that it can handle large amounts of sales from long-term holders without major price drops, which means that it has a mature structure that can handle a lot of transactions.

Bitcoin’s five-year performance data show that it is the best macro asset, with a compound annual growth rate (CAGR) of 58.2%. This is a lot better than traditional assets. The next best thing, QQQ, only got 16.28%, followed by the S&P 500 at 13.68% and gold at 10.49%.

Bitcoin Price Prediction: Volatility Expected Amid Macro Uncertainty

The immediate market outlook depends a lot on Tuesday’s CPI announcement, and traders are getting ready for a number of different outcomes. If inflation comes in lower, it could make people more likely to think that the Federal Reserve would drop rates in September. This could help riskier assets like Bitcoin. On the other hand, inflation that is stronger than predicted might put a stop to the current rise in cryptocurrencies.

The total open interest for Bitcoin and Ethereum options is $57 billion ($43 billion for BTC and $13.9 billion for ETH). This shows that the markets are ready for a lot of price changes. Ethereum futures trading has hit $13.9 billion, the most it’s been since 2025 and close to the all-time high of $14.6 billion recorded in March 2024.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account