Trump Administration Eyes Direct Stake in Intel Amid Semiconductor Strategic Push

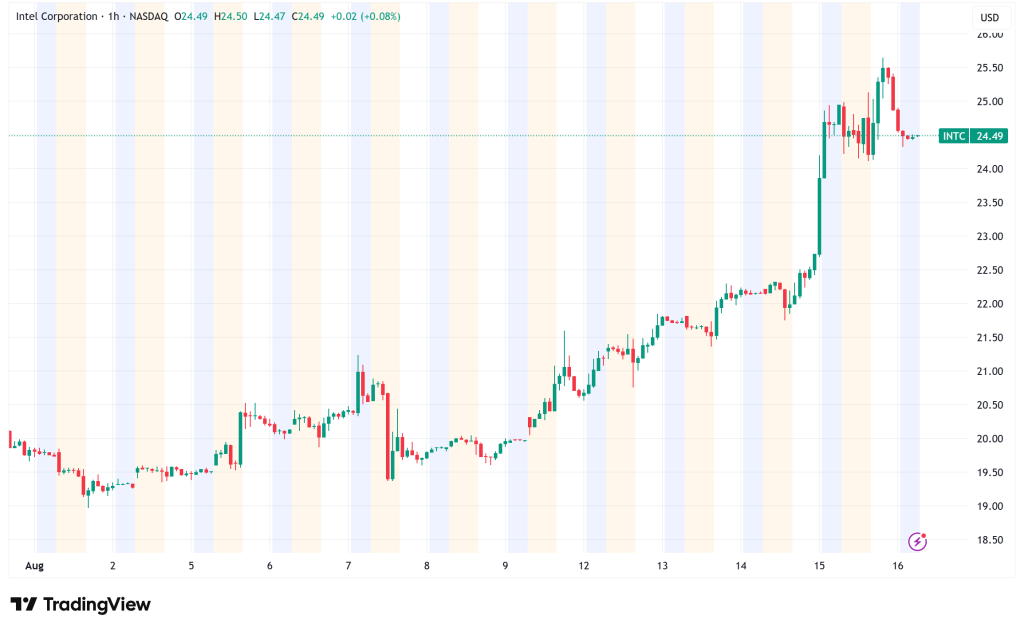

Intel Corporation's stock jumped almost 9% in late trading after news broke that the Trump administration is seriously thinking about buying

Quick overview

- Intel's stock surged nearly 9% after reports of potential government investment from the Trump administration.

- This marks a significant shift in U.S. industrial policy, moving from grants and subsidies to possible direct ownership in key tech firms.

- Intel is facing severe challenges, including a 60% stock drop in 2024 and competition from companies like AMD and NVIDIA.

- Experts suggest that government involvement may be necessary for Intel to remain competitive in the global semiconductor market.

Intel Corporation’s stock jumped almost 9% in late trading after news broke that the Trump administration is seriously thinking about buying a stake in the struggling chipmaker. This would be a big change in U.S. industrial policy and could change the way the government and private tech companies work together.

The unusual action comes only days after President Donald Trump and Intel CEO Lip-Bu Tan met at the White House on August 11. Reports say they talked about how important the firm is to the US’s technical independence. The possible government involvement is a big change from how the federal government usually helps, which is through grants and subsidies instead than direct ownership holdings.

Trump and Intel: From Criticism to Collaboration

The reconciliation between Trump and Intel is a big change from the president’s scathing criticism just a few weeks ago. On August 7, Trump used Truth Social to say that Tan was “highly conflicted” because of his past involvement in Chinese semiconductor companies and called for his immediate resignation. But after their meeting at the White House, Trump called the talk “very interesting” and praised Tan’s “amazing story,” which showed a big change in tone.

This change in position shows that the administration is more aware of how important Intel is to American semiconductor production as a whole. Intel is the only major chip firm in the U.S. that makes advanced semiconductors on a large scale. This has made the corporation a key part of national security talks as competition with China in technology grows.

Strategic Imperatives Drive Trump Administration’s Policy Shift

The possible government interest fits with the Trump administration’s growing tendency to get involved in vital businesses. The federal government can also take a “golden share” in the Nippon Steel-U.S. Steel transaction, and the Department of Defense has put $400 million into MP Materials, a business that mines rare earths.

People who know about the talks said that the administration might use money from the CHIPS Act to help pay for the equity purchase. China, Taiwan, and South Korea have all made big investments in their own chip-manufacturing capacities, making the semiconductor industry a key battleground for global technical supremacy.

Intel’s Challenges Mount

Intel is going through its hardest time in decades, and the government might step in at the right time. In 2024, the company’s stock lost 60% of its value, which was the worst performance in its history. Intel is still behind competitors like AMD and NVIDIA, even if its stock is up 23% so far this year. This is especially true in the fast-growing market for artificial intelligence chips.

Intel’s foundry unit, which makes chips for other firms, has had a hard time getting big customers and competing with industry titans like Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung. Intel has been having trouble getting the money it needs and figuring out how much demand there will be for its planned $20 billion mega-facility in Ohio, which was first announced in 2022.

Former Intel executives have publicly questioned whether the business can stay the leader in semiconductors in the U.S. without major changes. Four former Intel directors have said that the company’s foundry operations should be turned into a separate business that is funded by consumers and the U.S. government. Craig Barrett, the company’s former CEO, said that Intel needed about $40 billion more in investment to be able to compete with TSMC.

Corporate Governance Challenges

Investors are more unsure now that Intel has changed its leadership. After the board fired Pat Gelsinger in late 2024, current CEO Lip-Bu Tan took control and put in place a more cautious, demand-driven approach to growth. But Congress and the Trump administration have looked into Tan’s past, which includes investments in Chinese semiconductor businesses.

The business has also had problems with security within, as former Intel engineer Varun Gupta was recently fined $34,472 and put on two years of probation for stealing around 4,000 private papers before joining Microsoft in 2020. The lawsuit brought up persistent worries about protecting intellectual property in the very competitive semiconductor industry.

Intel (INTC) Stock: Market and Policy Implications

If the government investment goes through, it would be one of the biggest federal actions in a major Internet business since the 2008 financial crisis. The approach might give Intel the financial stability it needs to compete in global markets while keeping American control over important semiconductor manufacturing capabilities.

Some experts in the field say that Intel may need direct government help to be competitive with foreign companies that get a lot of government money. But there are still doubts about how any possible merger would work and what it would mean for Intel’s corporate governance and strategic decision-making.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM