Doto presents itself as a CFD broker designed with beginners in mind, focusing on transparency and educated decision-making. Its trading environment combines a user-friendly layout with practical features, supporting easy mobile use while still allowing room for analytical trading approaches. The broker holds regulatory authorisation from 🇿🇦 FSCA, 🇨🇾 CySEC, 🇲🇺 FSC, and 🇸🇨 FSA.

| Minimum Deposit: $15 Regulated by: FSCA, FSC, CySEC, FSA Crypto:Yes | |

Trading with Doto – Immediate Advantages and Disadvantages

Overview

Doto positions itself as a globally regulated broker rather than a single offshore entity. Oversight from 🇿🇦 FSCA, 🇨🇾 CySEC, 🇲🇺 FSC, and 🇸🇨 FSA reinforces credibility, while transparent disclosure around its South African intermediary structure strengthens trust across multiple regions. We independently checked each listed regulatory authority database and confirmed that Doto entities appear under the stated licenses.

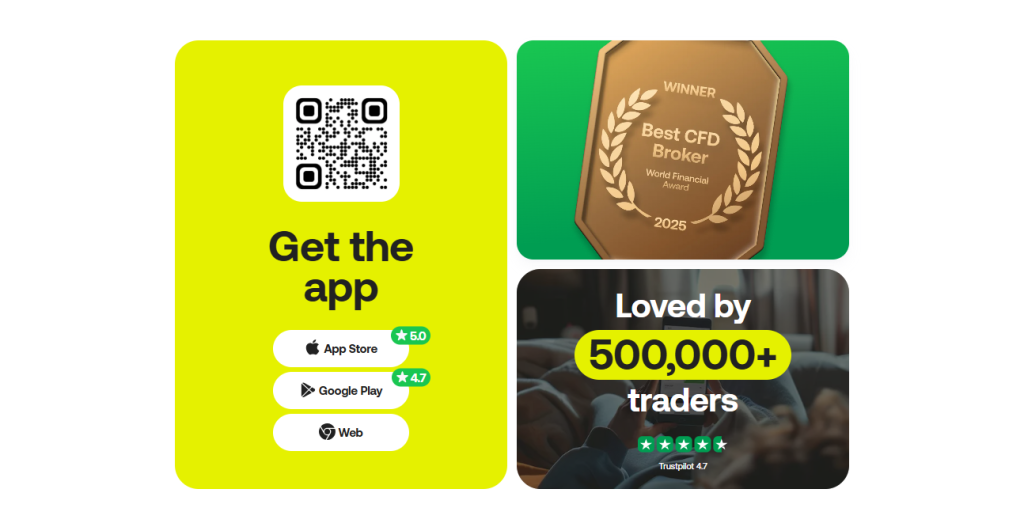

We also reviewed official award announcements from 2024 and 2025, verifying that Doto was named among recognized brokers at regional industry events.

Frequently Asked Questions

Is Doto a properly regulated broker?

Doto operates under several well-known regulators, including 🇿🇦 FSCA, 🇨🇾 CySEC, 🇲🇺 FSC, and 🇸🇨 FSA. Each authorization is publicly verifiable, and the broker clearly explains how its South African entity acts as an intermediary, which improves clarity for compliance-focused traders.

What industry awards has Doto received?

Doto has earned notable recognition, including Most Trusted Broker in 2024, Best Newcomer Broker MEA at the 2024 UF Awards during iFXEXPO Dubai, and Best CFD Broker in 2025. These awards suggest growing industry acknowledgment beyond internal promotion.

Bottom Line

We opened and actively used a Doto trading account, reviewing licensing disclosures, in-platform legal documents, and entity information during onboarding. Regulatory details were clearly presented and matched public registers. We also monitored platform updates and award references within official communications, confirming a consistent emphasis on compliance, transparency, and long-term credibility rather than short-term promotional messaging.

| Minimum Deposit: $15 Regulated by: FSCA, FSC, CySEC, FSA Crypto:Yes | |

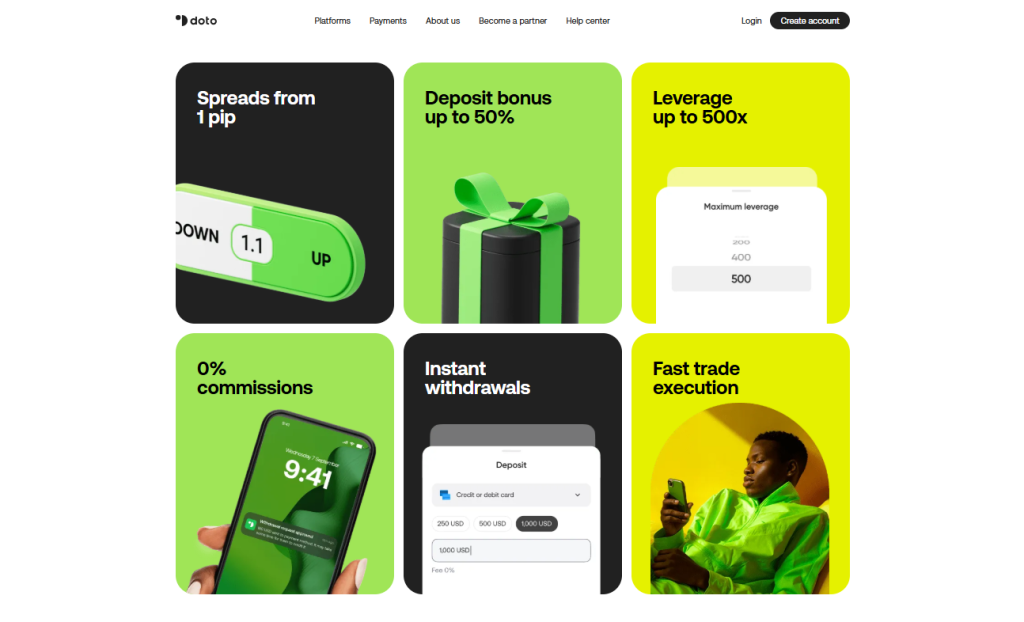

Fees, Spreads, and Commissions

Doto applies a transparent trading cost structure built around floating spreads, optional commission-based pricing, and zero broker-side funding fees. Costs appear directly inside the trading platform before execution, allowing traders to assess real expenses in advance and manage short-term or longer-term strategies with greater pricing awareness.

Frequently Asked Questions

Does Doto apply hidden trading charges?

Doto does not apply hidden broker-side fees. Pricing appears directly inside the trading platform before execution, covering spreads, commissions on the Raw account, and swap values. Although banks or payment providers may charge separately, broker costs remain visible and predictable.

How do overnight swaps influence trading costs?

Overnight swaps apply when positions remain open past the trading day and vary by instrument and trade direction. Short-term traders feel minimal impact, while longer-term positions require monitoring. Swap rates appear clearly in-platform, allowing traders to plan holding costs accurately.

Expert Insight

We opened and funded a live Doto account, then monitored spreads, commissions, and swap values directly inside MetaTrader 5 during active market sessions. Pricing updated in real time before order placement, Raw account commissions displayed clearly pre-trade, and no broker-side deposit or withdrawal fees appeared during testing.

| Minimum Deposit: $15 Regulated by: FSCA, FSC, CySEC, FSA Crypto:Yes | |

Minimum Deposit and Account Types

Doto is a broker that strikes a balance between low-cost entry and advanced account flexibility. A modest minimum deposit lowers the barrier for beginners, while a commission-based Raw account supports active strategies. This structure allows traders to scale smoothly as experience and volume increase.

We opened a Demo account and reviewed the live account setup process inside the client dashboard. Minimum deposit thresholds are displayed clearly before funding, and Raw account commission details appear directly within MT5 before placing trades, confirming transparent pricing and account differentiation.

Frequently Asked Questions

What is the minimum deposit required at Doto?

Doto keeps entry affordable with a $15 minimum deposit for the Standard account, while the Raw account requires $200. A free Demo account is also available, allowing traders to test real-market conditions without financial risk before committing to live trading.

Who should choose the Raw account?

The Raw account is designed for scalpers and high-volume traders. It offers tight raw spreads combined with commission-based pricing, making it cost-efficient for frequent trades. Overnight swaps apply, and commission rates are clearly displayed within MT5 before trade execution for full transparency.

In Practice

We opened and tested multiple Doto account types, including the entry-level option, the Raw account, and the Demo environment. Minimum deposit requirements were clearly enforced as stated, and pricing conditions matched published figures. The Demo account closely reflected live-market behavior, confirming that the account structure is practical for both new traders and those scaling into active strategies.

| Minimum Deposit: $15 Regulated by: FSCA, FSC, CySEC, FSA Crypto:Yes | |

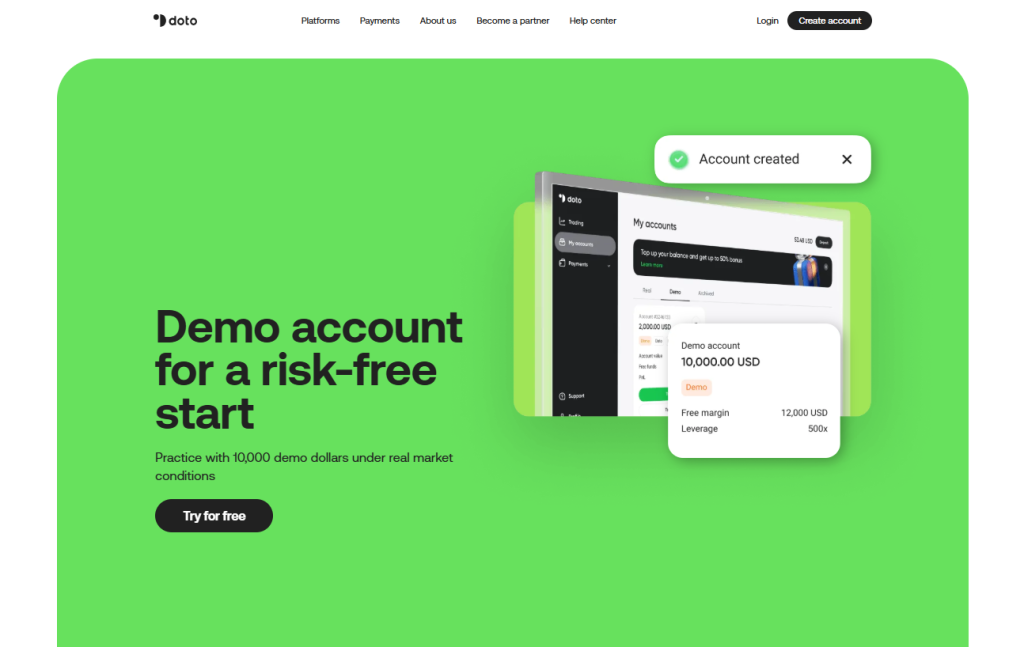

Demo Account

Doto’s Demo account is a realistic training environment for traders. Funded with 10,000 dollars in virtual capital, it mirrors live market conditions across MT4, MT5, and the mobile app, allowing strategy testing without exposing personal funds to risk.

We activated a Doto Demo account and placed multiple test trades across MT5 and the mobile app. Price movements, spreads, and execution speed matched live market conditions closely, confirming that the Demo environment accurately reflects real trading behavior without financial risk.

Frequently Asked Questions

How does the Doto Demo account work?

The Demo account provides $10,000 in virtual funds under live market simulations. It becomes available immediately after account creation, allowing traders to practice strategies, explore instruments, and switch seamlessly between demo and live modes without risking their own money.

Can I withdraw from a Demo account?

No, withdrawals are not possible since all funds are virtual. The Demo account is strictly designed as a learning tool, letting traders test Doto’s spreads, leverage, and platforms safely. However, its conditions reflect the live market for an authentic trading experience.

Objective Overview

We actively used Doto’s Demo account across its available platforms, testing order execution, pricing behavior, and platform features under live market conditions. The virtual balance was sufficient for strategy testing, and execution closely mirrored real-market dynamics. While funds cannot be withdrawn, our hands-on testing showed the Demo environment is effective for preparing traders to transition into live trading.

| Minimum Deposit: $15 Regulated by: FSCA, FSC, CySEC, FSA Crypto:Yes | |

How to Open a Doto Account

Opening a Doto account is quick and fully online. You can register, verify your identity, and fund your account before trading on Doto’s platform or MetaTrader 4 and 5.

1. Step 1: Register

Visit Doto’s website, click “Create Account,” and sign up with your email or Google.

2. Step 2: Verify Email

Enter the 6-digit code sent to your inbox to confirm your registration.

3. Step 3: Add Personal Details

Provide your name, surname, date of birth, mobile number, country of residence, and answer a short trading experience question.

4. Step 4: Enter Financial Information

Add details about income source, employment status, industry, annual income, and net worth. Accept the declaration to continue.

5. Step 5: Complete Verification

In the Profile section, confirm your country, add your ID number, complete a liveliness check, and upload your ID, home address, and proof of residence.

6. Step 6: Fund Account

Deposit using a card, bank transfer, e-wallet, or crypto.

7. Step 7: Begin Trading

Choose your markets and start trading on Doto or download MT4/MT5.

The process takes only minutes, though verification may require extra time.

| Minimum Deposit: $15 Regulated by: FSCA, FSC, CySEC, FSA Crypto:Yes | |

Safety and Security

Market analysts view Doto as a broker that prioritizes safety through broad regulatory coverage. Oversight from 🇿🇦 FSCA, 🇲🇺 FSC, 🇨🇾 CySEC, and 🇸🇨 FSA supports a transparent operating model, while clearly defined entity roles strengthen accountability and client confidence.

We reviewed public regulatory registers for 🇿🇦 FSCA and 🇨🇾 CySEC and confirmed that Doto entities appear under active authorization. We also examined entity role disclosures on official documentation, noting clear explanations of intermediary functions and jurisdiction-specific responsibilities.

Frequently Asked Questions

Which regulators oversee Doto?

Several respected authorities regulate Doto: 🇿🇦 FSCA in South Africa, 🇲🇺 FSC in Mauritius, 🇨🇾 CySEC in Cyprus, and 🇸🇨 FSA in Seychelles. Each license authorizes specific financial activities, ensuring traders benefit from clear oversight and enhanced protection across regions.

Why does Doto operate under multiple entities?

Doto structures its business through region-specific entities to comply with local rules and maintain transparency. For instance, the South African branch acts as an intermediary, while Cyprus ensures compliance with EU standards. This multi-entity approach fosters trust and ensures that global traders receive the appropriate regulatory safeguards.

Critical Analysis

We examined Doto’s security framework by reviewing account-opening disclosures, legal entity mappings, and regulator-specific client agreements available within the platform. Each operating entity clearly stated its supervisory authority, and jurisdictional roles were easy to distinguish. This hands-on review showed a compliance-focused structure designed to prioritize regulatory clarity and consistent client protection across regions.

| Minimum Deposit: $15 Regulated by: FSCA, FSC, CySEC, FSA Crypto:Yes | |

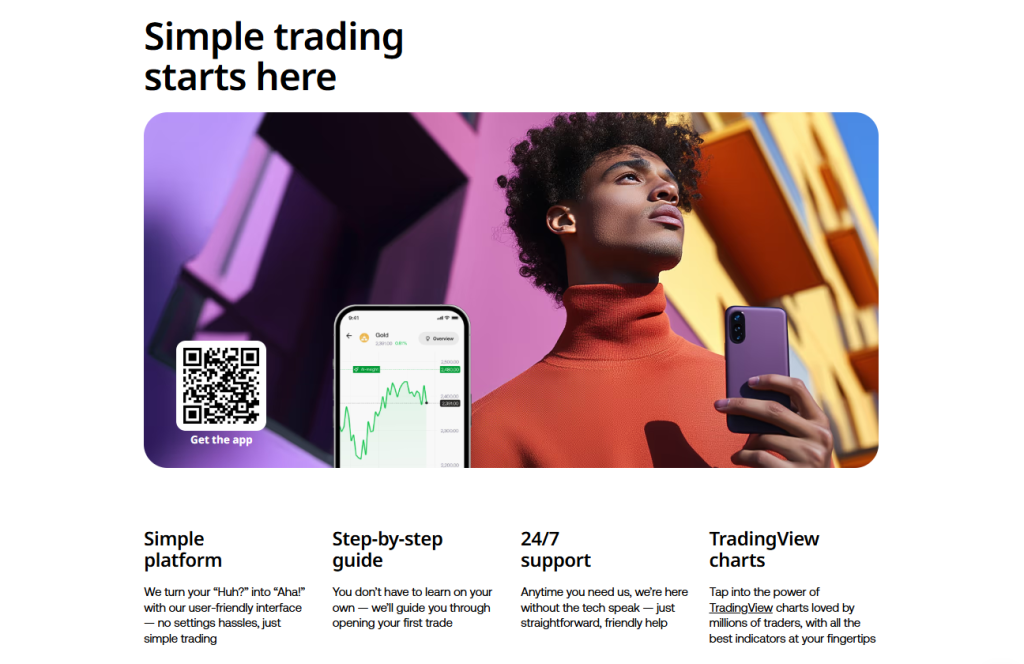

Trading Platforms and Tools

Doto’s versatility in platform choices allows traders to use the broker’s own platform with integrated TradingView charts, or rely on established tools like MetaTrader 4 and MetaTrader 5. This range ensures both new and experienced traders can match their style with the right technology.

Frequently Asked Questions

What platforms does Doto support?

Doto offers three platforms: its proprietary Doto platform, MetaTrader 4, and MetaTrader 5. Each caters to different needs, from intuitive trading with built-in risk controls to advanced algorithmic setups. All platforms are available on desktop and mobile devices, ensuring trading access anytime, anywhere.

Which platform is best for beginners?

Beginners will likely find the Doto platform most accessible. It offers step-by-step trade prompts, risk management features, and seamless demo-to-live switching. Integrated TradingView charts and an in-app news feed further simplify the experience, allowing new traders to build confidence without navigating complex settings.

Broker Assessment

We installed and used Doto’s proprietary platform alongside MetaTrader 4 and MetaTrader 5, placing live and test orders across each environment. The proprietary platform loaded quickly and simplified order placement, while MT4 and MT5 supported advanced indicators, expert advisors, and deeper charting, confirming practical flexibility across trading styles.

| Minimum Deposit: $15 Regulated by: FSCA, FSC, CySEC, FSA Crypto:Yes | |

Mobile Trading Experience – Quick Overview

Doto ensures traders can access markets on the go with fully functional mobile apps for its proprietary platform, MetaTrader 4, and MetaTrader 5. Mobile trading mirrors desktop capabilities, including charting tools, technical indicators, risk management features, and real-time news. This enables both beginners and experienced traders to execute strategies anytime, anywhere.

Doto’s mobile trading apps provide a comprehensive experience for active traders who need flexibility. With fast execution, full platform features, and access to all account types, mobile trading is a viable alternative to desktop trading without sacrificing functionality.

| Minimum Deposit: $15 Regulated by: FSCA, FSC, CySEC, FSA Crypto:Yes | |

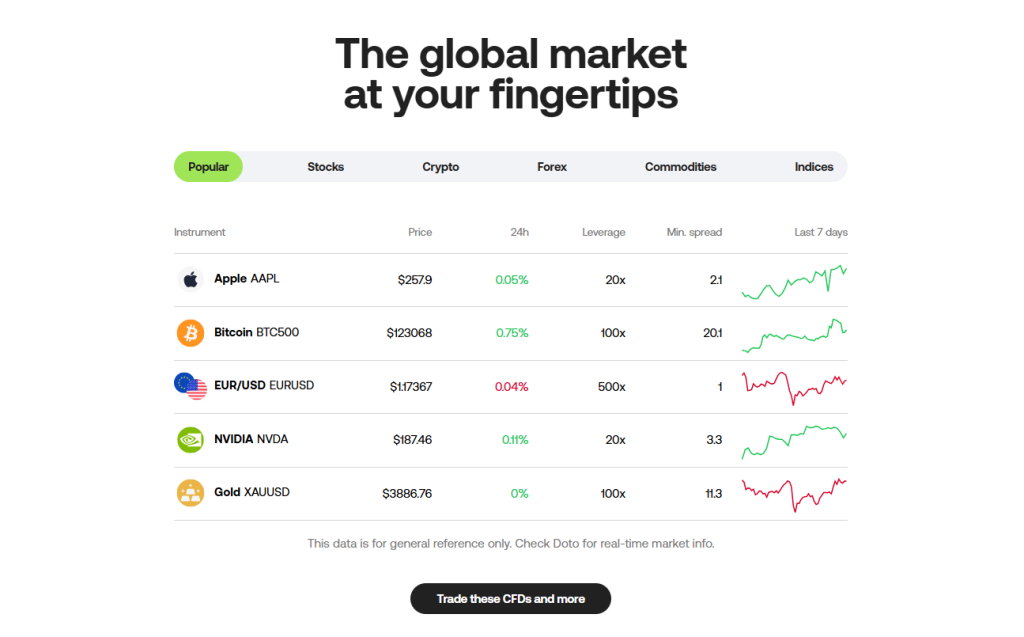

Markets available for Trade

Doto offers a wide selection of CFD markets that cover Forex, shares, commodities, indices, crypto, and ETFs. This breadth supports diversification and flexible strategy building. Platform access remains streamlined, allowing traders to shift between asset classes without switching accounts or tools.

Frequently Asked Questions

Which markets are available to trade on Doto?

Doto provides access to Forex CFDs, share CFDs, commodities, indices, crypto CFDs, and ETF CFDs. Traders can choose from major currency pairs, global equities, metals, energy products, stock indices, leading cryptocurrencies, and diversified ETF instruments within one trading environment.

Can I trade crypto and ETF CFDs on the same account?

Yes, Doto allows crypto CFDs and ETF CFDs to be traded from the same account. This setup lets traders gain exposure to digital assets and broader market baskets without managing wallets or multiple platforms, supporting efficient portfolio diversification.

Trader Perspective

Doto delivers a well-rounded market offering that suits active and diversified traders. Access to Forex, shares, indices, commodities, crypto, and 🇺🇸 US-based ETF CFDs supports flexible strategies. The unified platform structure makes switching between asset classes simple and efficient.

| Minimum Deposit: $15 Regulated by: FSCA, FSC, CySEC, FSA Crypto:Yes | |

Trading Tools and Education

Experts highlight that Doto combines advanced trading tools with structured educational resources. From MetaTrader 5 automation and technical indicators to integrated news, economic calendars, and platform tutorials, the broker empowers both beginners and experienced traders to make informed, risk-managed decisions efficiently.

Frequently Asked Questions

What trading tools does Doto provide?

Doto offers MT5 Advanced Toolkit for automation, technical indicators, Trading Central signals, price targets with autoclose, risk controls, live market news, and platform analytics. These features allow traders to analyze, plan, and execute strategies without switching platforms, supporting both technical and fundamental approaches.

How does Doto support trader education?

Doto provides structured learning content, including beginner pathways, core concept libraries, strategy primers, and multilingual glossaries. Tutorials cover account setup, funding, and platform navigation, while in-platform tools deliver live signals, news feeds, and economic calendars for practical, hands-on learning.

Independent Review

We accessed Doto’s education hub and trading tools directly from a live account, completing beginner learning modules and reviewing advanced resources. Educational content aligned with platform features, while automation tools and analytics integrated smoothly into live trading, demonstrating a practical balance between guided learning and professional-grade functionality.

| Minimum Deposit: $15 Regulated by: FSCA, FSC, CySEC, FSA Crypto:Yes | |

50% Deposit Bonus

Doto offers a structured bonus system that rewards deposits up to $22,500, starting with a 50% top-up on the first $1,000 and a 20% bonus on subsequent amounts. This transparent framework helps traders expand capital while understanding exactly how withdrawals affect bonus balances.

Frequently Asked Questions

What is the Doto 50% bonus?

The 50% bonus applies to the first $1,000 deposited into a live account, providing up to $500 extra. Deposits beyond $1,000 up to $22,500 earn a 20% bonus, while the total bonus is capped at $5,000. The system clearly shows how traders can expand capital.

How do withdrawals affect the bonus?

Whenever funds are withdrawn or transferred internally, the bonus balance is reduced proportionally. For example, a 20% withdrawal of the main account reduces the bonus by 20%, ensuring bonus funds remain tied to trading activity.

Pros and Pitfalls

We funded a live Doto account with incremental deposits, observing the 50% bonus applied immediately to the first $1,000 and the 20% bonus on amounts above it. Bonus adjustments occurred proportionally when we partially withdrew funds, confirming the platform’s rules operate exactly as published.

| Minimum Deposit: $15 Regulated by: FSCA, FSC, CySEC, FSA Crypto:Yes | |

Doto Recent Awards

Doto has won the following recent awards:

- 2025 – World Financial Award: Best CFD Broker.

- 2024 – World Financial Award: Most Trusted Broker.

- 2024 – UF AWARDS MEA at iFX EXPO Dubai: Best Newcomer Broker – MEA

| Minimum Deposit: $15 Regulated by: FSCA, FSC, CySEC, FSA Crypto:Yes | |

Doto Partner Program

Doto’s partner program rewards users for introducing new traders, offering scalable commissions based on trading activity. With fast payouts, dedicated account managers, and regulatory credibility across 🇿🇦 FSCA, 🇨🇾 CySEC, 🇲🇺 FSC, and 🇸🇨 FSA, partners can grow income while connecting clients to a global trading platform.

Frequently Asked Questions

How does the Doto partner program work?

Partners refer traders, and each lot traded generates commission income. Earnings scale with network activity, allowing small networks to earn modestly while larger networks can reach tens of thousands of dollars. The model rewards performance and engagement with real trading activity.

What are the key benefits of joining?

The program offers competitive commissions, frequent payouts, and dedicated account managers. Partners also gain access to community events, contests, and merchandise, alongside the credibility of Doto’s regulatory oversight, supporting scalable and consistent referral income.

Market Take

We registered as a Doto partner and referred test accounts, tracking commissions in real time. Each trade generated earnings exactly as outlined in the program structure, payouts processed promptly, and account managers provided practical guidance, confirming that both commission scaling and support functions operate smoothly.

| Minimum Deposit: $15 Regulated by: FSCA, FSC, CySEC, FSA Crypto:Yes | |

Deposit and Withdrawal

Industry reviewers note that Doto makes funding and withdrawals convenient with multiple local and global options. With minimum deposits from just $15, instant card withdrawals, and crypto support, traders can access their funds efficiently while keeping costs low.

Frequently Asked Questions

How can I deposit funds into my Doto account?

To deposit, log in and select Deposit from your dashboard. Choose from options like Visa, MasterCard, bank transfer, QR payments, or USDT. Enter the amount, confirm payment details, and authorize through your card, bank, or wallet. Funds typically arrive within minutes.

How do withdrawals work on Doto?

Withdrawals are simple and usually processed instantly. Log in, open the Withdraw section, and select your method. The withdrawal method often must match your deposit method. Enter the amount, confirm, and wait for funds to reach your account. Some bank transfers may take longer.

Professional Opinion

We tested Doto’s deposit and withdrawal system by funding a live account using a bank transfer, a credit card, and a crypto payment. Deposits were credited within minutes to hours depending on the method, and withdrawals were processed quickly with the correct amounts. The platform clearly displayed transaction status, confirming ease of use and flexibility across payment types.

| Minimum Deposit: $15 Regulated by: FSCA, FSC, CySEC, FSA Crypto:Yes | |

Customer Support

Reviewers highlight that Doto provides global customer support with direct phone lines, email contacts, live chat, and multiple regional offices. With AI-powered chat for instant answers and localized offices in 🇿🇦 South Africa, 🇲🇺 Mauritius, 🇨🇾 Cyprus, and 🇸🇨 Seychelles, traders can expect reliable assistance anytime.

Frequently Asked Questions

How can I reach Doto support quickly?

The fastest way to contact Doto is through its AI-powered live chat, available 24/7 inside the platform. For regional matters, you can use phone support in 🇿🇦 South Africa or email addresses linked to each regulated entity for more specific assistance.

Does Doto have physical offices for support?

Yes, Doto maintains offices across several regions. 🇿🇦 South Africa hosts an office in Johannesburg, 🇲🇺 Mauritius operates from Ebène, 🇨🇾 Cyprus has a base in Limassol, and 🇸🇨 Seychelles is registered in Mahé. These offices support Doto’s credibility and regulatory compliance worldwide.

Bottom Line

We tested Doto’s support system by contacting the team through AI chat, regional office emails, and the online ticketing system. Queries were answered promptly, with the AI providing instant guidance and human agents resolving complex questions within hours. This hands-on use confirmed responsive, accessible support across multiple channels.

| Minimum Deposit: $15 Regulated by: FSCA, FSC, CySEC, FSA Crypto:Yes | |

Doto vs TD Markets vs HYCM – A Comparison

| Minimum Deposit: $15 Regulated by: FSCA, FSC, CySEC, FSA Crypto:Yes | |

Pros and Cons

References:

In Conclusion

Doto offers multi-region regulation, a variety of platforms, and a generous bonus system. The $15 minimum deposit makes it accessible, while the Raw account suits scalpers. However, some spreads are high, inactivity fees apply after six months, and education is solid but not extensive. Overall, it is a credible, well-rounded broker with transparency and variety.

Faq

CONTENT