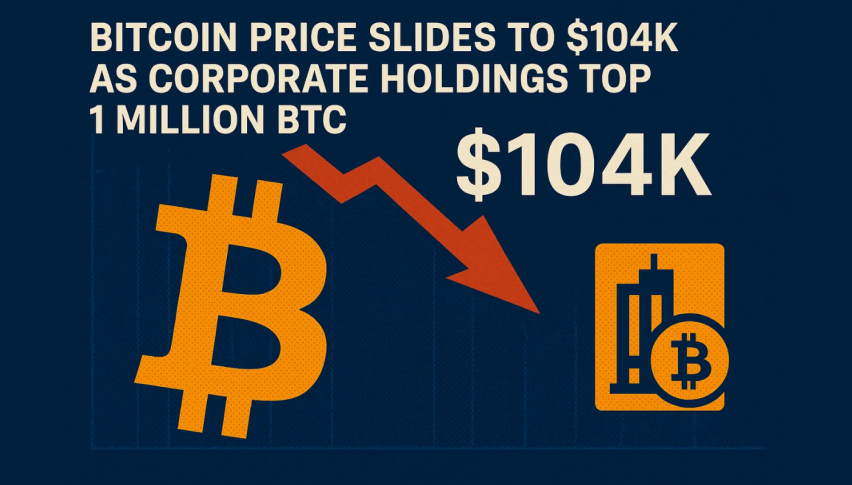

Bitcoin Price Slides to $104K as Corporate Holdings Top 1 Million BTC

Bitcoin’s price slipped to $104,655, down 6.17% in 24 hours and nearly 14% over the week, even as institutional demand...

Quick overview

- Bitcoin's price fell to $104,655, down 6.17% in 24 hours and nearly 14% over the week, despite rising institutional demand.

- Public company holdings of Bitcoin exceeded 1.02 million BTC in Q3 2025, reflecting a 20.87% increase from the previous quarter.

- Nearly 40% more public firms now hold Bitcoin, indicating growing mainstream adoption as a strategic reserve asset.

- Corporate accumulation is reshaping Bitcoin's market dynamics, with companies using it for treasury diversification and financing operations.

Bitcoin’s price slipped to $104,655, down 6.17% in 24 hours and nearly 14% over the week, even as institutional demand for the cryptocurrency reached unprecedented levels.

In the third quarter of 2025, public company holdings of Bitcoin surpassed 1.02 million BTC, marking a 20.87% jump from the prior quarter. At an average acquisition price of $114,402, these holdings are valued at approximately $117 billion, signaling sustained corporate conviction in Bitcoin’s long-term potential despite short-term volatility.

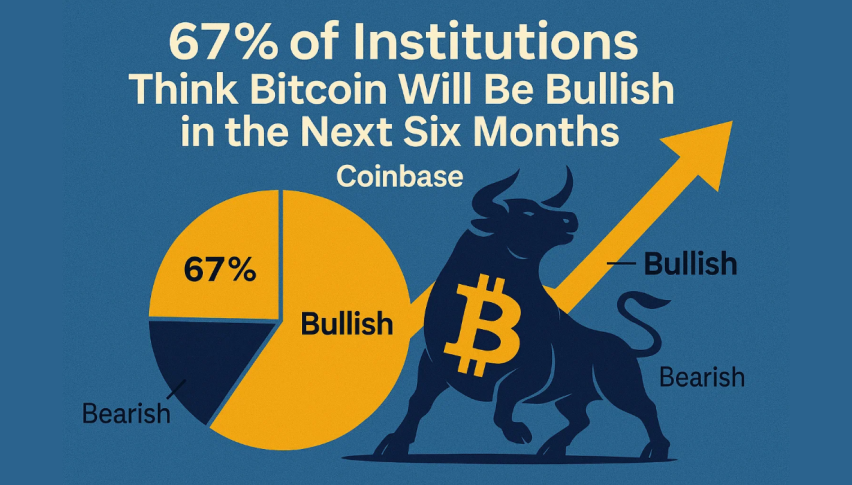

According to Bitwise Asset Management, nearly 40% more public firms now hold Bitcoin compared to three months ago — a sign of growing mainstream adoption among listed corporations using BTC as a strategic reserve asset.

Institutional Leaders Fuel Expansion

The surge in corporate Bitcoin ownership was driven by 172 public companies, with several industry leaders expanding their holdings:

- Strategy Inc. – 640,031 BTC (+40,000 BTC this quarter)

- MARA Holdings – 52,850 BTC

- XXI Corp. – 43,514 BTC

- Metaplanet – 30,823 BTC (doubled reserves)

- Bitcoin Standard Treasury Co. – 30,021 BTC via $1.5B SPAC-backed PIPE

Major breakdown spotted on the BTC/USD 4H chart!

Price has closed below the key $110K support and is now trading near $104,640.

If Bitcoin sustains below $104K, more downside pressure is likely. Trend remains bearish unless price reclaims $110K.#Bitcoin #Crypto #BTCUSD… pic.twitter.com/5NPQRFnQyn— MarketMinds (@07hosa) October 17, 2025

Notable transactions included Bullish Holdings’ public listing with over 24,000 BTC and Strive’s acquisition of Semler Scientific, the first major Bitcoin-focused merger and acquisition deal.

These developments underscore how Bitcoin is becoming a cornerstone for corporate treasuries and strategic growth plays alike.

Institutional Demand Reshapes Market Structure

Corporate accumulation is now a defining force in Bitcoin’s price behavior. Companies are leveraging BTC for treasury diversification, balance sheet optimization, and even financing operations through:

- PIPE and SPAC-backed funding tied to Bitcoin reserves

- Preferred stock issuance linked to BTC holdings

- Strategic M&A aimed at consolidating corporate Bitcoin exposure

While skeptics warn that large-scale institutional ownership could amplify volatility, proponents see it as a legitimizing force — one that embeds Bitcoin deeper into corporate finance frameworks.

Despite the current correction to $104K, the Q3 surge in corporate holdings signals that institutional demand remains resilient. For many executives, Bitcoin has evolved from a speculative hedge to an integral asset for long-term capital preservation and liquidity strategy.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account