Michael Burry Closes His Fund

urry’s announcement coincided with another notable move: a bearish push against two of the biggest symbols of the AI boom.

Quick overview

- Michael Burry announced the liquidation of Scion Asset Management and the return of all client capital, citing a disconnect with market values.

- He expressed concerns about a new financial bubble and disclosed short positions in Nvidia and Palantir, two major players in the AI sector.

- Burry's farewell letter included apologies and gratitude, while advising clients to contact his partner for future matters.

- Despite deregistering from the SEC, Burry may continue to manage his personal investments through the firm.

The legendary U.S. investor apologized for being “out of sync,” sharing the news in a letter posted on social media.

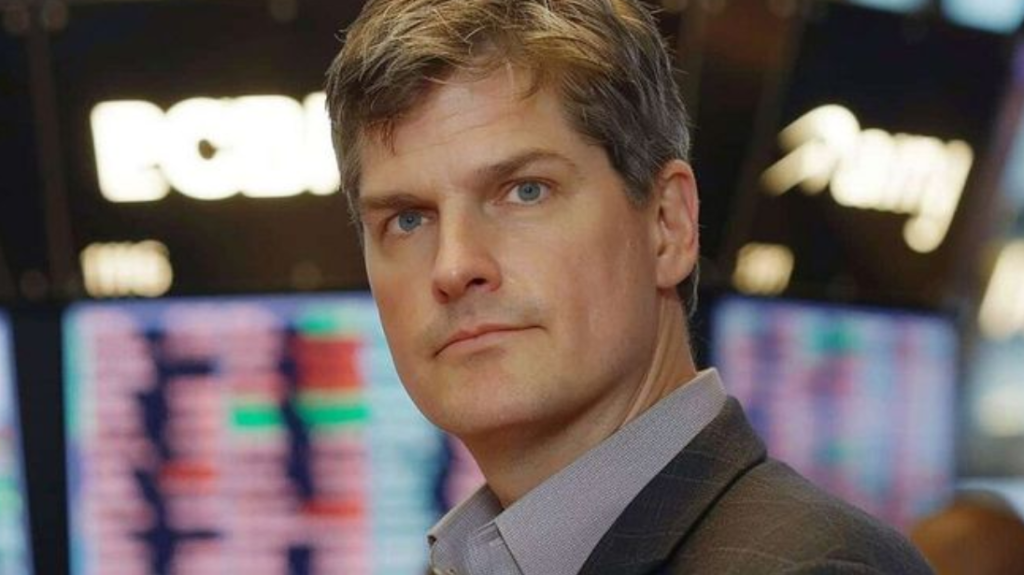

Michael Burry—the famed investor who foresaw the U.S. subprime collapse and was portrayed by Christian Bale in The Big Short—announced the liquidation of Scion Asset Management and the return of all client capital. In a letter circulated on social media, Burry apologized for being “out of sync” with the market and confirmed that he had formally withdrawn the firm’s registration with U.S. regulators.

The decision followed Burry’s warnings about what he considers a new financial bubble, as well as disclosures showing a high-risk bet against the artificial intelligence sector, including short positions in Palantir and Nvidia.

Although Burry has stepped away from the spotlight before due to market pressure, his latest move has revived speculation that he may simply be trying to operate off the radar while managing his own money.

Burry’s path

At the onset of the Global Financial Crisis, as U.S. mortgages began to implode, Burry couldn’t yet see the damage reflected in his books. The credit default swaps he had purchased—designed to surge in value as mortgage loans deteriorated—remained stagnant, and Scion Capital was losing millions each month.

Facing mounting losses, Burry invoked legal provisions to block redemptions and prevent investors from pulling their money. He justified the move by pointing to signs of market manipulation.

After weeks of complaints and threats of lawsuits from his own clients, the CDS positions eventually caught up with the unfolding mortgage collapse and generated extraordinary gains.

Exhausted by the ordeal, Burry shut down Scion Capital and returned the now-multiplied capital to investors. He later returned to the industry and relaunched his firm under the name Scion Asset Management—the vehicle he has now decided to close once again.

His farewell letter to investors

In the letter dated October 27, which circulated widely in recent weeks, Burry announced his decision in blunt terms:

“With a heavy heart, I will be winding down the funds and returning capital before year-end.”

He added that his “assessment of value in assets is not in sync with markets,” a disconnect he said had persisted for a long period. He closed with gratitude, an apology, and a final recommendation:

“With heartfelt thanks, and also with my apologies, I wish you all well in your future investments,” advising clients to reach out to his partner Phil Clifton for any future matters.

Betting against artificial intelligence

Burry’s announcement coincided with another notable move: a bearish push against two of the biggest symbols of the AI boom. Earlier this month, Scion disclosed short positions in Nvidia and Palantir Technologies—two companies at the center of the market’s excitement over a potential profit surge driven by artificial intelligence.

Burry amplified his stance with cryptic social-media posts, including “sometimes we see bubbles,” alongside an image of Christian Bale portraying him in the film. He also shared a still from one of the movie’s most intense scenes, captioned: “Me then, me now. Well, things worked out. Things will work out.”

Scion AM’s deregistration from the SEC does not necessarily mean Burry has dissolved his operating structure or abandoned his bearish strategy against the tech giants. So far, there is no evidence that the company itself is being wound down, suggesting he could continue managing his personal capital through it.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM