Nick Szabo Warns Bitcoin Faces Legal Risks as Node Disputes Intensify in 2025

Bitcoin's reputation as the unbreakable, censorship-resistant network came under scrutiny this week thanks to a wake-up call from American

Quick overview

- Nick Szabo challenges the notion that Bitcoin is completely immune to government interference, highlighting its inherent legal vulnerabilities.

- He warns that legal actions could impact not just exchanges, but also miners, node operators, and wallet providers.

- Szabo's comments have sparked debate within the community about Bitcoin's evolving use cases and the implications of increased network congestion.

- While some, like Chris Seedor, downplay Szabo's concerns, the discussion underscores the intersection of Bitcoin's security and regulatory pressures.

Bitcoin’s reputation as the unbreakable, censorship-resistant network came under scrutiny this week thanks to a wake-up call from American computer scientist Nick Szabo – a guy who knows a thing or two about secure blockchains – who said even the most secure smarts can’t fully escape the long arm of the law. Szabo argues that while Bitcoin is designed to minimize trust, it’s not entirely trustless – which means it can still be ganged up on by governments or big corporations who have the power and the will.

Szabo unloaded on X with a lengthy post that tore apart the idea that Bitcoin operates as a magical anarcho-capitalist Swiss army knife that’s impervious to state interference. He said his message is pretty straightforward: every blockchain that’s built from scratch has a built-in legal vulnerability, and assuming Bitcoin is somehow immune is just plain naive.

Szabo’s comments sent shockwaves because he’s a crypto legend, one of the first people to play around with the idea of smart contracts and the creator of Bit Gold (1988) – basically a blueprint for Bitcoin that he came up with ages before Satoshi Nakamoto made it all happen. Despite all the speculation over the years that he’s actually Satoshi, he’s repeatedly said no thanks.

Regulatory Pressure Ones and Fours

When asked about it online, Szabo laid out the risks in stark terms: legal action can affect more than just exchanges and custodians. In his view, miners, node operators, and wallet providers could all be on the receiving end if regulators decide any given data is in breach of national laws.

🚨BITCOIN ISN’T AS SAFE AS YOU THINK?

Crypto legend Nick Szabo warns that nation-state legal attacks could pose serious risks to #Bitcoin’s security, far beyond technical exploits. pic.twitter.com/AGmtlaoX4y

— Coin Bureau (@coinbureau) November 17, 2025

It’s a view thats pretty close in line with recent navel-gazing over whether Bitcoin should be used for things outside of money – you know, like storing data with ordinals, runes and BRC-20 activity etc. and this has got people talking because it’s pretty clear that these new features have made the network more congested – which is part of the reason why some people are getting all worked up about where Bitcoin is headed

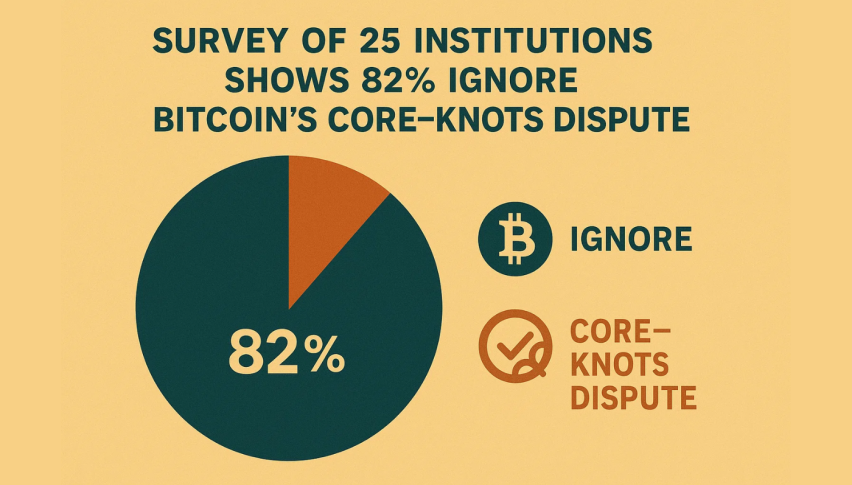

recently, there’s been a big increase in the use of Bitcoin Knots by node operators – mainly because some users are unhappy with Bitcoin Core’s decision to allow higher volumes of stuff they think is spam. The OP_RETURN function, which lets anyone store data on the chain, is at the centre of this debate

Some key points being raised include

- Can governments lean on nodes to delete or filter specific content?

- Can miners be made to exclude certain transactions?

- What happens if data gets stored on the chain for non-financial reasons?

Community Backlash and Bigger Implications

Not everyone agrees with Szabo’s take on things – Chris Seedor, the CEO of Bitseed (a firm that sells seed storage solutions for Bitcoin), said Szabo is making a mountain out of a molehill. Seedor reckons Bitcoin’s core strength comes from reducing technical bottlenecks – not speculating on every possible legal scenario.

He also argued that if regulators really had this kind of sway, they would have shut down encryption tools like PGP and Tor by now.

Despite the pushback, Szabo’s comments make one thing clear: Bitcoin’s security might depend just as much on the law as on all the clever cryptography that makes it work.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account