Buterin Pushes On-Chain Gas Futures to Stabilize Ethereum Transaction Costs

Vitalik Buterin, the co-founder of Ethereum, has proposed a trustless, onchain futures market for gas to improve the predictability...

Quick overview

- Vitalik Buterin has proposed a trustless, onchain futures market for gas to enhance the predictability of Ethereum transaction prices.

- The proposed market would allow users to lock in gas prices for future dates, helping to mitigate uncertainty and volatility in fees.

- This futures market aims to provide clear signals for future gas expenses, enabling users to hedge against price fluctuations.

- Implementing such a market could be particularly beneficial for high-traffic network users, offering them greater certainty in operational costs.

Vitalik Buterin, the co-founder of Ethereum, has proposed a trustless, onchain futures market for gas to improve the predictability of Ethereum transaction prices.

In a post on X on Saturday, Buterin stated that the market need a “good trustless onchain gas futures market,” as users have questioned his ability to guarantee low gas prices through current price reduction mechanisms in Ethereum’s roadmap

Buterin stated that one approach to solve the uncertainty would be to let users to essentially lock in pricing for specific times in the future, as he described one potential market for Ethereum Base fees, which are a critical factor in overall gas fees.

We need a good trustless onchain gas futures market.

(Like, a prediction market on the BASEFEE)

I've heard people ask: "today fees are low, but what about in 2 years? You say they'll stay low because of increasing gaslimit from BAL + ePBS + later ZK-EVM, but do I believe you?"…

— vitalik.eth (@VitalikButerin) December 6, 2025

The idea behind it is similar to conventional futures markets, including those for commodities, in which buyers and sellers agree on a set price for a future date in order to hedge risk or trade on price swings.

When implemented on Ethereum, it could enable users to prepay for a certain amount of gas over a set time period, shielding them from unexpected fee increases.

People would receive a clear warning of future gas fees and could even hedge against them, stated Buterin.

As such, a well-established and dependable futures market would be an important yardstick for the ecosystem to speculate, plan, or expand on.

An on-chain gas futures market could help fix this. People would receive a clear signal of their expectations for future gas expenses, and they would hedge against future gas prices, essentially prepaying for any specified amount of gas in a specific time interval, he stated.

A practical prediction market like this would be an invaluable service for network users with high traffic, such as dealers, builders, applications, and institutions, who demand a level of certainty when predicting operational costs.

Ethereum Fees Drop but Volatility Persists Amid Buterin’s Proposal

Meanwhile, gas costs have decreased this year, with basic Ethereum transfers averaging around 0.474 gwei, or roughly one cent, according to Etherscan.

More sophisticated activities, like as token swaps ($0.16), NFT transactions ($0.27), and cross-chain bridging ($0.05), continue to be more expensive.

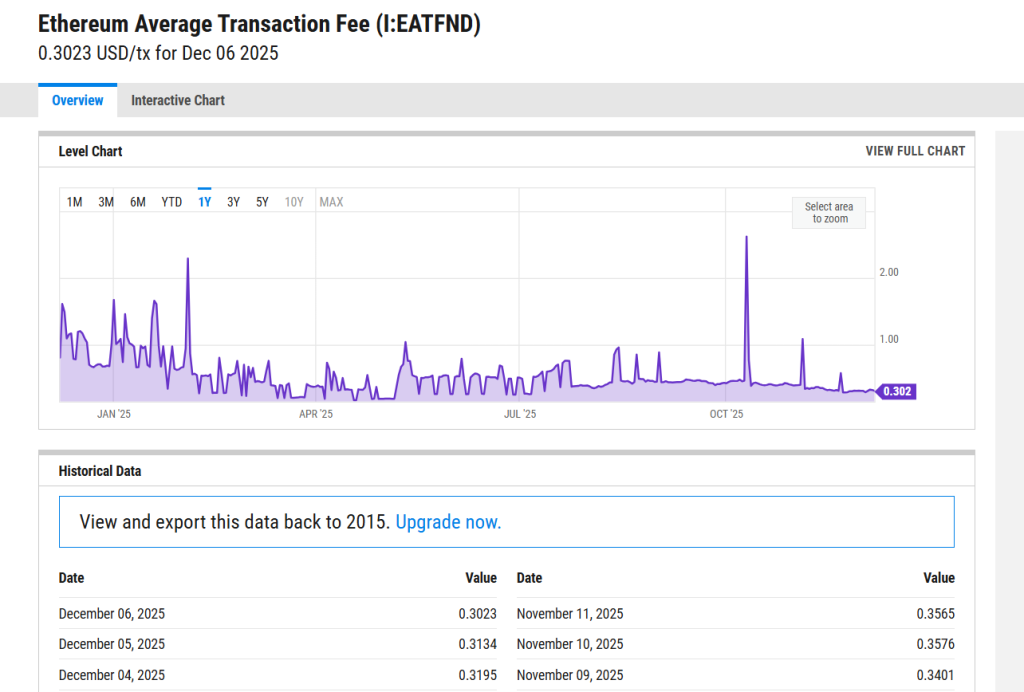

Despite the overall drop, fee volatility remains an issue. According to YCharts data, average Ethereum costs began 2025 near $1 and fell to $0.30, with swings that reached as much as $2.60 and as lower as $0.18.

Buterin’s idea seeks to mitigate these variations by providing consumers with a tool for anticipating and managing expenses, particularly ahead of peak demand periods.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM