Ethereum Rallies Above $3,300 Despite 62% Fee Decline and Record Binance Inflows

Ethereum has gone up more than 6.2% in the last 24 hours, reaching a price of more over $3,300. This is because of worse US job data and

Quick overview

- Ethereum's price has surged over 6.2% in the last 24 hours, reaching above $3,300 due to negative US job data and expectations of looser monetary policy.

- Despite a drop in base layer activity, Ethereum's layer-2 networks are thriving, with significant increases in transaction activity on platforms like Polygon.

- Recent large inflows to exchanges raise concerns about potential selling pressure, as traders monitor order book dynamics closely.

- Ethereum is currently facing resistance between $3,400 and $3,500, with critical support at $3,200 that could lead to further declines if broken.

Ethereum ETH/USD has gone up more than 6.2% in the last 24 hours, reaching a price of more over $3,300. This is because of worse US job data and forecasts of looser monetary policy. The second-largest cryptocurrency by market cap just hit a three-week high of nearly $3,400, which was an 11.2% weekly increase that has brought back short-term bullish enthusiasm.

But there is a complicated story behind this price recovery: base layer activity is going down while layer-2 activity is growing strongly. Nansen’s research shows that Ethereum’s network fees dropped by 62% in November, which is a much bigger drop than the 22% drop recorded on other networks like Tron, Solana, and HyperEVM over the same time period.

Ethereum’s Layer-2 Ecosystem Drives Alternative Growth Narrative

Ethereum’s layer-2 networks are still strong, even though the base layer metrics have dropped a lot. Base saw a 108% rise in transaction activity, and Polygon saw an 81% increase, which suggests that more and more users are moving to cheaper scaling alternatives. The Fusaka improvement on December 3 was meant to make rollup operations more efficient. It may have sped up this change by making layer-2 activities even more appealing.

Over the course of seven days, the amount of decentralized exchanges on Ethereum’s foundation layer dropped from $23.6 billion to $13.4 billion. During the same time, sales from decentralized applications also fell to a five-month low of $12.3 million. Over the course of two months, the total value locked on Ethereum’s foundation layer dropped from $100 billion to $76 billion.

This was due to a dramatic drop in TVL for popular DApps including Pendle, Athena, Morpho, and Spark.

Even with these cuts, Ethereum still has a huge 68% share of the DeFi market. Solana, on the other hand, has less than 10%. Bulls say that Ethereum’s focus on layer-2 scalability makes it a better long-term model than monolithic blockchain systems, which need more processing power and centralized coordination.

ETH Derivatives Markets Signal Cautious Optimism

Perpetual futures funding rates for ETH stayed at 9% annually, which means that buyers and sellers had around the same amount of leveraged positions. This is well within the average range of 6–12%, which takes into account capital costs. This means that there is not too much bullish or bearish posture in the derivatives markets.

After the US Bureau of Labor Statistics report showed 1.85 million layoffs in October, the biggest number since 2023, traders are still on the lookout. The Federal Reserve is expected to decrease interest rates by 0.25%, and investors are now paying close attention to Chair Jerome Powell’s forward guidance.

Record Exchange Inflows Raise Short-Term Concerns

On December 5, Ethereum had its biggest Binance netflow since May 2023, with 162,084 ETH deposited to the exchange at a price close to $3,021. This was a big deal. When there are large positive netflows, it usually means that holders are shifting their assets from self-custody to exchanges, which could mean they are getting ready to sell.

If a lot of these new orders make it to order books as market sells, this flood could cause short-term volatility. Traders are keeping a close eye on the order book depth and the netflow patterns that follow to see if this is just a one-time thing or the start of a larger dispersion.

ETH/USD Technical Structure Points to Critical Decision Zone

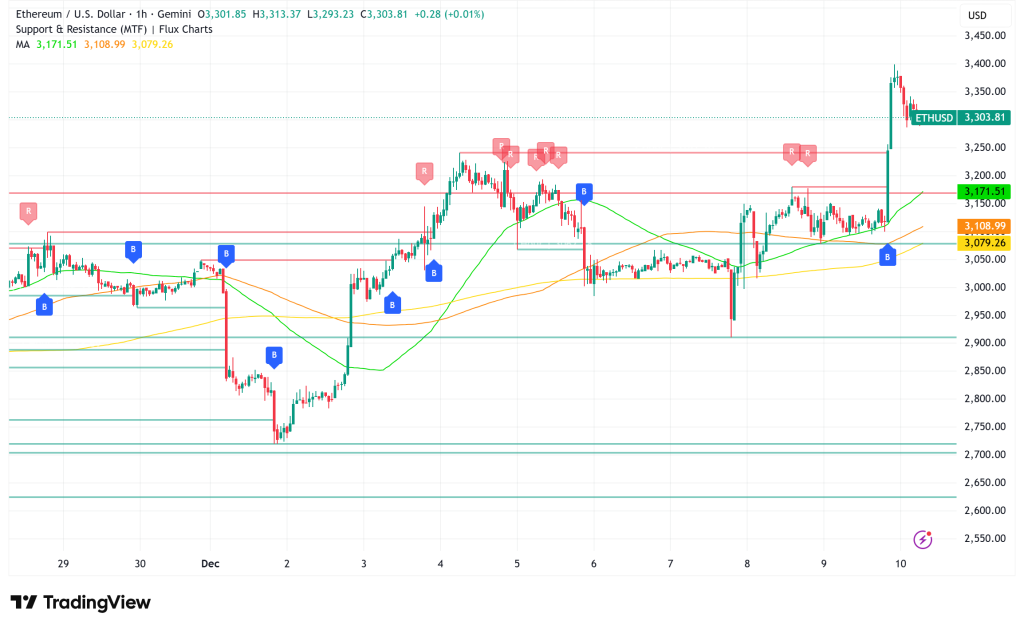

Ethereum’s daily chart shows that the market is trying to stabilize after falling below $2,800 in late November. The cryptocurrency has gotten back to the $3,100 area, but it is having a hard time breaking through structural barriers. The 50-day and 100-day moving averages constitute a resistance zone between $3,250 and $3,500. The 200-day MA is higher, which means that ETH is trading below its long-term trend structure.

Volume has dropped throughout the recent comeback, which suggests that buyers are hesitant at these levels. This recovery is still weak and could be hit by more downward pressure if the price doesn’t break clearly above the cluster of moving averages.

Ethereum Price Outlook: Cautiously Constructive With Key Tests Ahead

Even though there are problems in the short term, institutional catalysts are starting to show themselves. Paul Atkins, the head of the SEC, said that tokenization of US markets may happen in “a couple of years.” He pointed to the benefits of blockchain for making things more predictable and open. These kinds of changes could make Ethereum the main infrastructure layer for regulated digital assets.

Ethereum is having trouble right now between $3,400 and $3,500. If it stays above this level for a while, it could go up to the $3,800-$4,000 area. On the other hand, if the $3,200 support level breaks, the price could go back to the $2,800-$3,000 range.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM