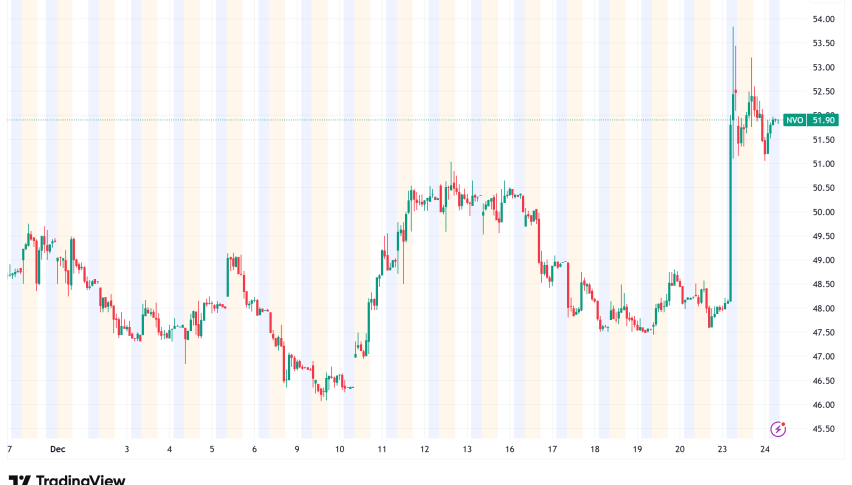

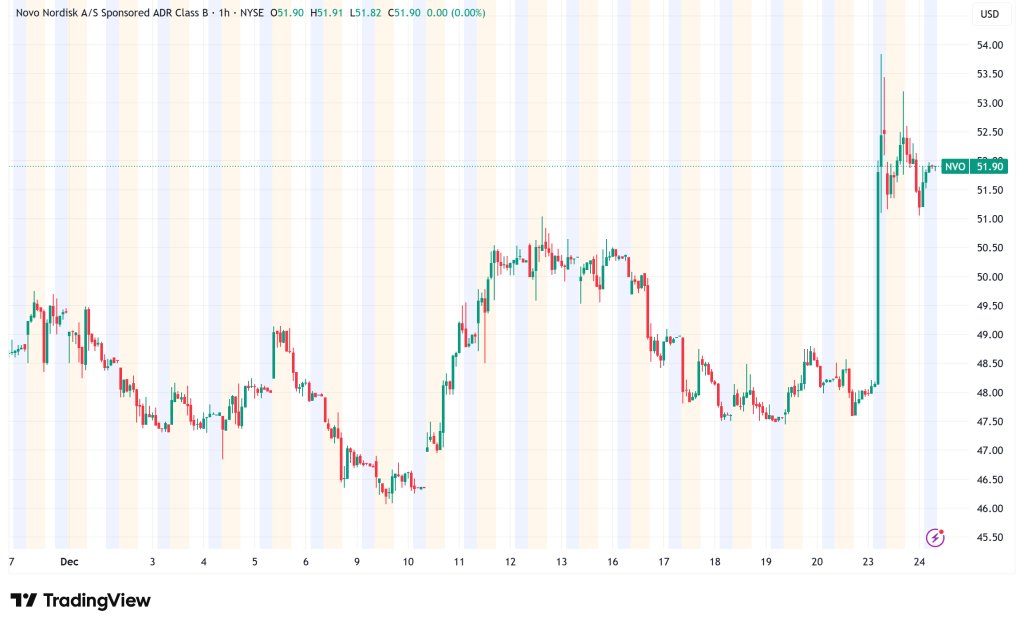

Novo Nordisk Surges 7.3% as FDA Approves First Oral Weight-Loss GLP-1 Drug

Novo Nordisk's stock price shot up over 10% on December 23 after the FDA approved their oral Wegovy formulation. This was the first pill

Quick overview

- Novo Nordisk's stock surged over 10% following FDA approval of the oral Wegovy formulation, the first pill-based GLP-1 medication for weight management in the US.

- The approval grants Novo Nordisk temporary market exclusivity, positioning it ahead of competitors like Eli Lilly, whose similar product won't be available until 2026.

- The oral formulation expands accessibility for patients hesitant about injections, potentially increasing the patient base significantly.

- Analysts predict that the oral Wegovy could achieve peak annual sales of over DKK 24 billion, highlighting its importance in Novo Nordisk's growth strategy amid a competitive landscape.

Novo Nordisk’s stock price shot up over 10% on December 23 after the FDA approved their oral Wegovy formulation. This was the first pill-based GLP-1 medication approved in the US for weight management. The regulatory triumph eases investors’ worries about the company’s competitive position and proves that its obesity franchise is a long-term growth engine.

The approval gives Novo Nordisk temporary market exclusivity in oral obesity therapies, putting it ahead of Eli Lilly, whose orforglipron small-molecule medicine isn’t anticipated to be available until 2026. Shares rose to 335.60 Danish crowns, the biggest one-day rise since August 2023. This added tens of billions to the company’s market value.

Technical Catalyst Driving the Rally

The market’s strong reaction is due to three important concerns that the approval immediately addresses. First, it shows that Novo Nordisk can handle complicated GLP-1 manufacturing problems and the supply problems that made the launch of the injectable Wegovy in 2021 so difficult. Mike Doustdar, the CEO, said that the company is “better prepared this time” since it has enough pills on hand for the launch.

Second, the oral formulation greatly increases the number of people who can use it, going beyond just people who are comfortable with self-injection. Paul Major, a portfolio manager at Bellevue Asset Management, says that more than 10% of adults are hesitant to have injections. This means that there is a large group of patients who have not yet been treated. Oral formulations aren’t as effective as injectables; for example, it takes 25mg of semaglutide to match the 2.4mg injectable dose. However, the convenience element makes it easier for people who couldn’t get it before to get it.

Third, the clearance puts Novo Nordisk back in the running after Lilly’s Zepbound injectable took market share in 2025 and led U.S. prescription volumes for much of the year. BMO Capital’s Evan Seigerman and other analysts say that this advantage may not last long, but being the first to market gives you important revenue visibility through at least 2026.

Financial Impact and Growth Trajectory

Novo Nordisk’s main source of growth is now the obesity care segment. In 2023, revenues reached DKK 41.6 billion (increasing 147–154% year-over-year) and sped up to DKK 65.1 billion in 2024. The DKK 18.4 billion in revenue from obesity care in the first quarter of 2025 predicts an annually run rate of more than DKK 70 billion, or about $10–11 billion.

This part of the corporation today makes up a large part of the DKK 215.1 billion diabetes and obesity care division, which brings in more over 90% of all sales. Management always says that demand is still higher than supply, which means that revenue is still limited by capacity rather than demand.

According to Sydbank analyst Soren Lontoft Hansen, the oral Wegovy formulation might reach peak annual sales of over DKK 24 billion ($3.79 billion) worldwide. The timing of the introduction is very important because Novo Nordisk will encounter problems in 2026, such as expected price drops for its current GLP-1 medications Ozempic and injectable Wegovy.

Novo Nordisk’s Wegovy Pricing Strategy and Market Access

Novo Nordisk agreed in November to charge Medicare, Medicaid, and uninsured cash-paying patients $149 a month for starter dosages, which is the same price as the introductory rate for general cash-pay consumers. Patients with insurance can get all dose levels for as little as $25 a month. This is better than the new prices for injectable Wegovy, which are $199 at first and $349 after two months for patients who pay for their own care.

Novo Nordisk bought Emisphere for $1.3 billion in 2020, and the oral formulation uses SNAC (sodium N-[8-(2-hydroxybenzoyl)amino]caprylate) technology from that company. This excipient generates a pH buffer zone that keeps stomach enzymes from breaking down peptides and makes them easier to absorb. This is the same technology used in the company’s diabetes medication Rybelsus.

Competitive Landscape

Novo Nordisk has a short-term monopoly on the oral obesity treatment market, however this industry is changing quickly. Lilly’s orforglipron may have certain benefits over Wegovy, such as not having to be taken at specific times of the day, like Wegovy does. Roche, AstraZeneca, Viking Therapeutics, and Structure Therapeutics are all working on oral weight-loss prospects.

For investors, the rise is a sign that they have regained faith in the long-term growth of the market, not just short-term gains. The main question has changed from whether Novo Nordisk’s growth will continue with obesity treatments to how well the business can scale up manufacturing to meet rising worldwide demand in a market that is becoming more competitive.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM