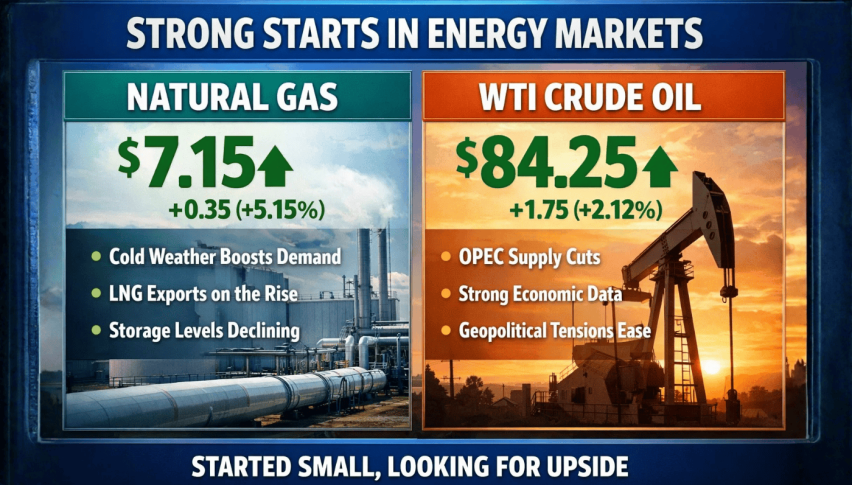

Natural gas and WTI are sharp but readable with good news flow. Started small there.

The US Senate Agriculture Committee has announced a last-minute markup of its eagerly anticipated crypto market structure bill...

Quick overview

- The US Senate Agriculture Committee is moving forward with a crypto market structure bill aimed at defining federal oversight of digital assets.

- Key provisions include raising investor protection standards and clarifying agency roles, while also addressing stablecoin yield limits that could impact traditional banking.

- Bipartisan support faces challenges from Senate Democrats demanding ethics regulations for public officials involved in crypto ventures.

- Concerns over decentralized finance compliance obligations have emerged, but supporters believe compromise is possible as the January 27th markup approaches.

The US Senate Agriculture Committee has announced a last-minute markup of its eagerly anticipated crypto market structure bill, effectively moving ahead with long-overdue efforts to define federal oversight of digital assets. Chairman John Boozman has confirmed the legislative text will be out by the 21st, January, leaving lawmakers barely a week to digest the complex provisions that could ultimately reshape the US Crypto Regulation landscape.

This sudden urgency mirrors the frenetic activity of the Senate banking committee, where over 137 amendments were filed to the CLARITY Act ahead of their own markup. Boozman claims the fast-track was all about promoting transparency and bringing badly needed regulatory certainty to markets that have been lacking clear rules for so long. This legislation aims to clarify which agencies have the upper hand, raise investor protection standards, and ensure that trading platforms and any intermediaries play by the same rules.

Stablecoin Yield Limits Spark Banking Favour

One of the most contentious bits that emerged from the Banking committee’s draft of the thing is going to target yield on stablecoins. The text effectively bans firms from just paying interest for sitting on stablecoin balances – a concession that traditional banks have been banging on about as a way to stop deposit outflows.

Here are some of the key elements

- No more paying interest just for holding onto stablecoin balances.

- It’s now fine to pay interest if people are actually doing something – like making transactions or providing liquidity, for example.

- Banking groups have managed to rig the restrictions so that theyre really looking after their own interests.

JPMorgan CFO Jeremy Barnum reckons that stablecoins that pay out interest are blurring the lines with uninsured deposits and that this kind of parallel system is “plain crazy.

But the other side is saying that banks are just in it to keep protecting their own margins rather than actually looking out for the consumer – and that looks like a pretty dodgy move. Coinbase is being cautious but is supportive of the bill’s language (so far, at least).

Ethics Squabbles and DeFi Concerns Intensify

Bipartisan support is now facing some pushback from Senate Democrats, who are demanding ethics guardrails around crypto ventures that would ban public officials from profiting from the sector. Senator Adam Schiff reckons these rules need to apply to everyone – and Senator Ruben Gallego has even gone so far as to say they’d be a “red line” that needs to be crossed if the bill is going to pass. And then, to add further complexity, three Democrats have requested a full hearing and are also complaining that the text arrived too late.

Around the same time, the Banking Committee added a new section on decentralized finance, leaving the industry scratching its head. While the bill explicitly protects developers and lets people keep their digital assets in their own hands, compliance obligations for web-based interfaces have raised major concerns.

Despite the divisions still simmering, supporters claim compromise is still on the table. Senator Cynthia Lummis says there has been strong bipartisan cooperation across the board and that this bill will be essential to the US remaining a leader in financial innovation as the 27th January markup looms.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM