Daily Crypto Signals: Bitcoin Tumbles Below $93K, XRP Under $2 Amid Trade War Fears

The cryptocurrency market faced significant headwinds on Monday as Bitcoin fell nearly $3,500 and XRP dropped below the critical $2 level

Quick overview

- The cryptocurrency market experienced significant volatility on Monday, with Bitcoin dropping nearly $3,500 and XRP falling below $2 amid rising geopolitical tensions.

- President Trump's tariff threats against European nations contributed to a risk-off sentiment, leading to over $875 million in liquidations across leveraged positions.

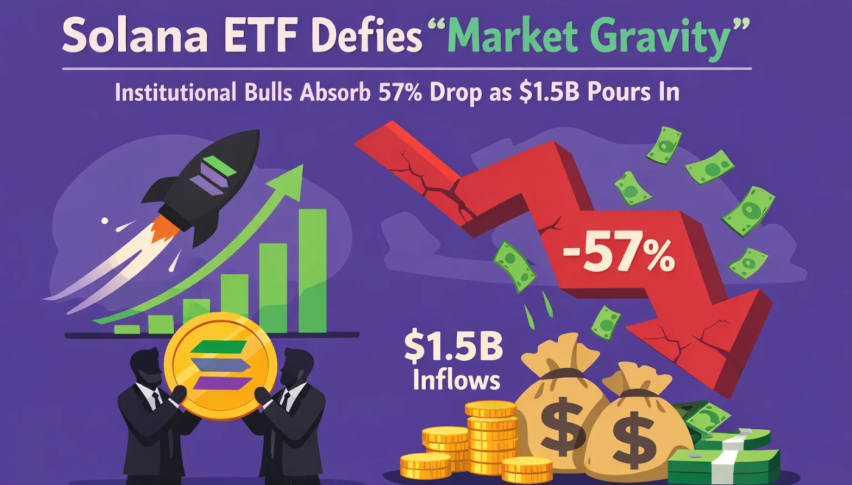

- Despite the price declines, institutional interest in digital assets remained strong, with crypto exchange-traded products attracting $2.17 billion last week.

- XRP's price continued to decline for the sixth consecutive day, but institutional investment in XRP products showed resilience, indicating ongoing interest from larger investors.

The cryptocurrency market faced significant headwinds on Monday as Bitcoin BTC/USD fell nearly $3,500 and XRP XRP/USD dropped below the critical $2 threshold amid escalating geopolitical tensions. President Trump’s weekend tariff threats targeting European nations over Greenland negotiations triggered a broad risk-off sentiment, with over $875 million in leveraged positions liquidated across the market.

Crypto Market Developments

As tensions rose in global commerce, the bitcoin market became quite unstable. President Donald Trump said that starting February 1, imports from Denmark, Sweden, France, Germany, the Netherlands, and Finland will be subject to 10% tariffs. If negotiations over Greenland don’t go anywhere, the rates could go up to 25% by June. The European Union got ready to fight back by putting off tariffs worth up to €93 billion and perhaps using its Anti-Coercion Instrument, also known as the “trade bazooka.”

About 250,000 traders were affected by the market instability, which caused about $788.9 million in long position liquidations. Gold prices rose beyond $4,650 for the first time as investors ran for shelter. The Euronext 100 Index fell 1.6%. The flight to traditional safe havens showed that cryptocurrencies still have a long way to go before they can be seen as alternative hedge assets.

Even if the prices were all over the place, institutional interest in digital assets stayed strong. Last week, crypto exchange-traded products brought up $2.17 billion, the most since October and more than any other week in 2026. But on Friday, things changed a lot, with $378 million leaving the market as worries about geopolitics grew.

In the meantime, 99.89% of the Injective network community voted to make big changes to the tokenomics. The governance proposal cuts down on the number of native tokens issued while keeping the network’s buyback-and-burn scheme, which the project says will make INJ “one of the most deflationary assets over time.” Burns have already taken almost 6.85 million INJ tokens out of circulation on the network.

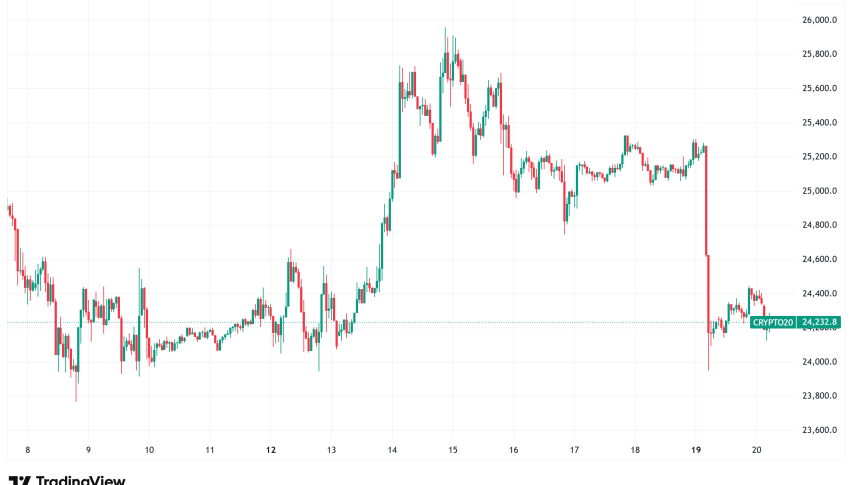

Bitcoin Sees Sharp Volatility Under $93,000

On Monday, Bitcoin’s price dropped quickly, going from $95,450 to just around $92,000 on Coinbase in the first few hours of trade. This was a 3.6% drop in just a few hours. Because US markets were closed for a national holiday, the crypto markets were more open to changes throughout the world. In just four hours, around $750 million in long bets were closed, with Bitcoin making up $224 million of the total. By Monday afternoon, the asset had only slightly rebounded to $92,580, but technical indicators showed that it was still weak.

The Bitcoin futures annualized premium was close to the neutral-to-bearish 5% level, which meant that demand for leveraged bullish bets stayed modest after the failed attempt to go back to $98,000 on Wednesday. Bitcoin spot ETFs had $395 million in net withdrawals on Friday, which is bad news for bulls because institutional investors switched to precious metals. The options market showed that traders were becoming more cautious. The BTC options delta skew at Deribit jumped to 8%, which is significantly above the neutral -6% to +6% range. This meant that traders were paying extra for downside protection.

Aside from price measurements, basic blockchain activity exhibited worrying signs. Nansen statistics shows that the number of daily active Bitcoin addresses dropped to 370,800, a 13% drop from two weeks ago. This drop in network activity made some worried about whether there would still be enough demand for mining operations, which depend on both block rewards and transaction fees. China’s economy grew at its slowest rate since 2022 in the last quarter of 2025, at 4.5% year-over-year, down from 4.8% the previous quarter. This made the negative mood even worse. Analysts said that measures that help consumers could be cut back, and a possible global trade war could hurt exporters, making it harder for risk assets like Bitcoin to grow.

XRP Under Pressure Despite Strong Fundamentals

XRP’s drop continued for a sixth day on Monday, breaching below the $2 mark, which is critical for the mind, even though the underlying fundamentals are strong. Long liquidations of $39.5 million for the altcoin were the most since November 22, 2025. This was because the market as a whole was selling off and putting pressure on all major cryptocurrencies. The demand for XRP derivatives dropped a lot, with open interest dropping from $4.55 billion on January 6, its yearly high, to $3.56 billion. This was a 21.7% drop that showed traders were losing faith.

The drop in price didn’t seem to have anything to do with how institutions felt, which stayed mostly positive. XRP spot ETFs based in the US added $1.12 million on Friday, increasing the overall amount of money that has come in to $1.28 billion and the total amount of assets to over $1.52 billion. The Franklin XRP ETF had the most money coming in on Friday, bringing its total assets to $287.75 million. XRP investment products brought in $69.5 million from throughout the world during the week ending Friday. This shows that institutions are still interested, even though retail opinion has gotten worse.

Onchain measurements also showed that prices were not showing the same positive picture. On Wednesday, the XRP Ledger had 2,575,561 transactions, the most since July 2025 and the most in six months. Despite the 18.5% drop in price from the eight-week high of $2.41 on January 6, this rise in network utilization signaled that it was becoming more useful in the real world.

Technical analysis showed that important support levels were coming up, and the cost basis distribution heatmap showed that more than 1.78 billion XRP were bought at the current $1.96 level. The next important support level is between $1.78 and $1.80, where buyers bought almost 1.84 billion XRP. This level has not been broken on a daily close since April 2025. If the price breaks below this level, it could lead to more selling down to $1.61 or potentially the 200-week exponential moving average at $1.41, which is the last significant support level for XRP bulls.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM