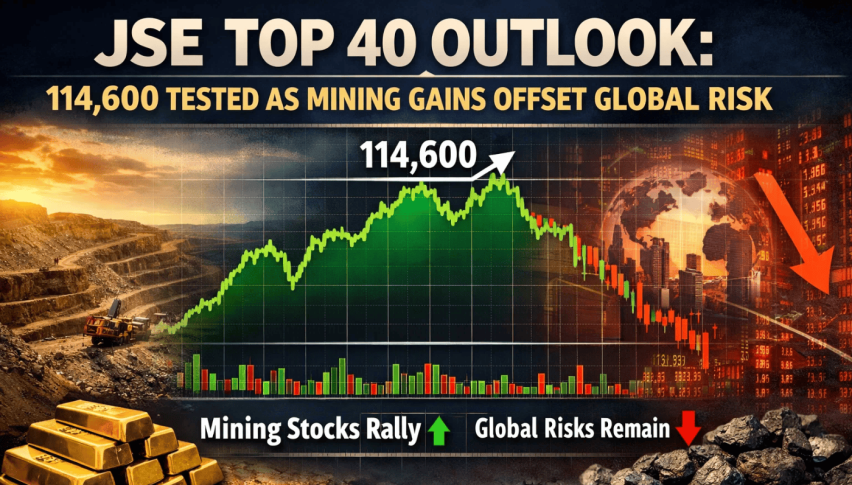

JSE Top 40 Outlook: 114,600 Tested as Mining Gains Offset Global Risk

South Africa’s equity market opened the week on firmer footing, with the JSE FTSE All Share Index rising 336 points to 120,452 ZAR...

Quick overview

- South Africa's equity market showed resilience with the JSE FTSE All Share Index rising 336 points, driven by cautious investor confidence and support from commodity-linked sectors.

- The South African rand weakened amid global risk-off sentiment, influenced by US trade tensions and geopolitical uncertainties, impacting emerging-market currencies.

- Upcoming mining production data is anticipated to provide stability, with October output exceeding expectations and economists predicting a moderate increase for November.

- The JSE Top 40 index is in a consolidation phase, with key support and resistance levels identified, suggesting a potential for upward movement if resistance is broken.

South Africa’s equity market opened the week on firmer footing, with the JSE FTSE All Share Index rising 336 points to 120,452 ZAR, reflecting cautious but improving investor confidence. While global markets remain unsettled by geopolitical risks and shifting US trade policy, local equities have found support from commodity-linked sectors. Mining-heavy stocks led the advance, helped by stronger precious metal prices and expectations that domestic production data will remain resilient.

The broader tone is not one of exuberance but of stability. Investors appear selective, favoring companies with exposure to hard assets and cash flows that can weather currency swings. This measured optimism has kept the benchmark index positive even as external risks continue to dominate headlines.

Rand Pressure and Global Risk Appetite

Currency dynamics remain a key variable. The South African rand softened as global markets leaned into a risk-off posture, driven by renewed tariff rhetoric from the US and ongoing geopolitical uncertainty. Historically, the rand has acted as a barometer of global sentiment, weakening when investors rotate toward safe havens.

That shift has been visible across asset classes:

- Gold surged above $4,700 per ounce, reinforcing demand for defensive assets

- Silver hovered near record levels, tracking broader precious-metal strength

- Emerging-market currencies, including the rand, faced renewed pressure

These moves matter for equities. A weaker rand can inflate input costs but also boosts earnings for exporters and mining firms, helping explain the sector’s relative strength.

Mining Data and Bond Yields in Focus

Domestic fundamentals could help cushion external shocks. Markets are watching upcoming mining production figures after October output jumped 5.8% year-on-year, beating expectations. Economists see a more moderate 3.9% increase for November, still consistent with steady production and supportive commodity pricing.

Bond markets offer another signal. The 2035 government bond yield edged up to 8.45%, suggesting investors are demanding a modest risk premium but not pricing in acute stress. Together, mining output and yield stability provide a constructive backdrop for equities, even as global volatility persists.

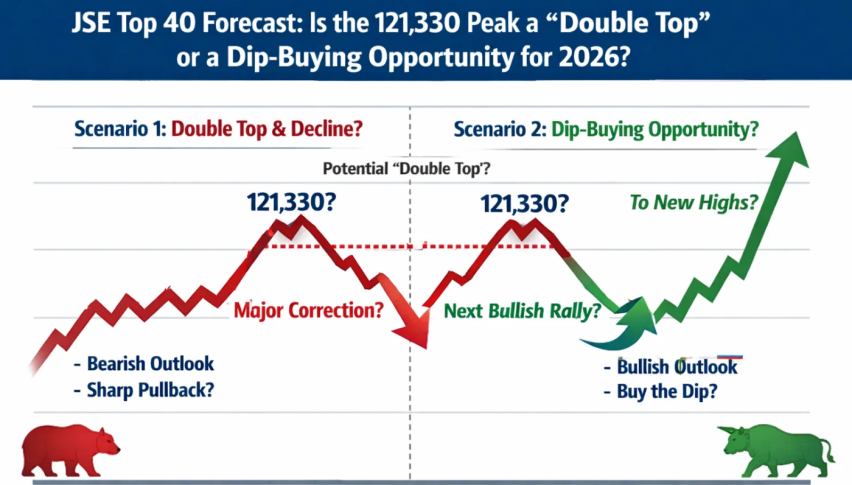

JSE Top 40 Technical Outlook

From a technical perspective, the JSE Top 40 has entered a consolidation phase after stalling near 114,600. Price continues to respect a rising trendline from early January, indicating the pullback is corrective rather than structural. On shorter time frames, the index holds above the 50-period EMA near 112,500, while the 200-EMA around 110,600 underpins the medium-term trend.

Key levels to watch include:

- Support: 111,800, then 111,300

- Resistance: 112,700, followed by 113,850 and 114,600

A sustained break above resistance could reopen the path toward 116,000, while a loss of trend support would shift focus back to the 110,000 zone. For now, the bias favors buying pullbacks rather than chasing strength, with consolidation likely setting the stage for the next directional move.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM