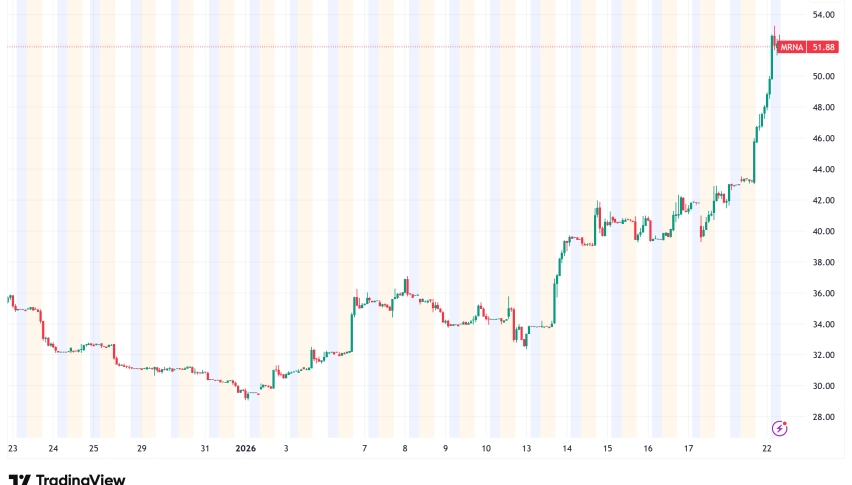

Intel Stock Soars 12% to Four-Year High as Earnings Optimism Builds

Intel's amazing comeback continued on Wednesday, as shares rose 11.7% to close at $54.25. This was the highest level for the chipmaker since

Quick overview

- Intel's shares surged 11.7% to $54.25, marking the highest level since early 2022 and a 140% increase over the past year.

- Strong demand for Intel's server CPUs, particularly for AI workloads, is boosting investor confidence ahead of the quarterly earnings report.

- Analysts expect Intel to report lower earnings compared to last year, but optimism remains about future growth, especially with new products like the Panther Lake processors.

- The U.S. government and Nvidia have made significant investments in Intel, highlighting the company's importance in the chip industry and its potential for growth.

Intel’s amazing comeback continued on Wednesday, as shares rose 11.7% to close at $54.25. This was the highest level for the chipmaker since early 2022. The stock has gone up more than 140% in the past year, and Wall Street is getting more and more excited about the company’s quarterly earnings report, which will come out on Thursday after the market closes.

The semiconductor giant’s amazing rebound shows that people are becoming more confident in CEO Lip-Bu Tan’s plan to turn things around and that demand for Intel’s newest chips is growing. FactSet projections say that analysts expect the company to make eight cents per share in adjusted earnings on $13.42 billion in sales in the fourth quarter of 2025. Those numbers are lower than they were a year ago, but investors seem to be more interested in indications that point to better times ahead.

Strong demand for Intel’s server CPUs, which power AI workloads in data centers, is a big part of the confidence. John Vinh, an analyst at KeyBanc, said that Intel’s Granite Rapids server CPUs are selling well as clients replace their systems. Supply is almost gone through 2026. FactSet thinks that Intel’s sales of data centers and AI could go up by around 29% from last year to $4.4 billion.

The “Panther Lake” Catalyst and 18A Yields

Investors are excited to hear more about Intel’s new Panther Lake processors and how well they are doing in the market, in addition to the quarterly data. These chips show off Intel’s advanced 18A manufacturing process, which the company hopes will prove its foundry capabilities and bring in outside customers. This is an important part of Tan’s plan to make Intel a big contract chipmaker.

Intel’s foundry division is both its largest problem and its best chance to grow. The division is still losing billions of dollars every quarter, but recent events have given people optimism. Several experts have noted that more people are interested in the product, and there is still talk that Apple might become an anchor client for Intel’s 18A and 14A manufacturing processes.

Paul Meeks, head of technology analysis at Freedom Capital Markets, said, “The only thing I think could be a real fundamental surprise would be confirmation of Apple, or confirmation of other partners—not rumors, but actual partners—for their latest manufacturing technology.”

Intel’s change has drawn strong support. After investing $8.9 billion last year, the U.S. government became the company’s biggest shareholder, seeing Intel as key to the U.S. chip industry’s independence. Nvidia, the leader in AI chips, put up $5 billion and committed to work with Intel to combine its CPUs with its AI systems. Both stakes have gone up a lot as Intel’s stock price went up.

Intel (INTC) Stock Price Prediction: The Path to $65?

Wall Street has taken note; HSBC, KeyBanc, and Seaport Research have all lately raised their ratings on the stock. KeyBanc established a price objective of $60, which shows that they believe in Intel’s data center growth. However, analysts are still being careful. Of the eight current ratings tracked by Visible Alpha, only one suggests buying shares, six are neutral, and one suggests selling.

Even though Intel’s stock rose by almost 50% in January, most analysts say that the company needs to show that it can keep up the good work before it can be called a success. The earnings call on Thursday will provide us important information about whether the chipmaker’s amazing rise is based on good fundamentals or too much hope too soon.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account