Ethereum Eyes $3,000 as Macro Liquidity Signal and Corporate Treasury Surge Flash 2021-Style Rally

Quick overview

- Ethereum is currently valued at over $2,900, having increased by more than 3.3% in the last 24 hours as it stabilizes after a recent drop.

- A three-stage pattern involving global liquidity and the Russell 2000 suggests that Ethereum could experience a significant price rise by March 2026.

- On-chain data indicates strong accumulation by long-term holders, with a critical support level around $2,720 that could act as a local bottom.

- However, declining institutional interest in the US, as indicated by the Ethereum Coinbase Premium Index, raises concerns about the sustainability of any price recovery.

Ethereum ETH/USD is worth over $2,900 and has gone up more than 3.3% in the last 24 hours. This is because it is trying to stabilize after dropping below $2,800 recently. It is the second-largest cryptocurrency. The short-term price action is still very erratic, but a rare convergence of macroeconomic factors implies that ETH could be getting ready for a big rise like the one it had in 2021.

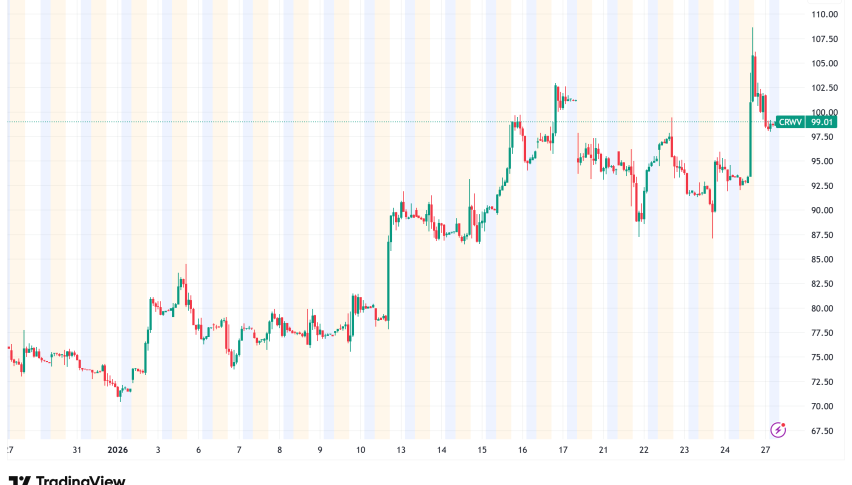

Ethereun’s Global Liquidity Pattern Points to March 2026 Breakout

Sykodelic, a crypto analyst, has found a three-stage pattern that keeps happening between the Russell 2000’s performance, the increase of global liquidity, and Ethereum’s price swings. The order of events—global liquidity breaking out first, then the small-cap Russell 2000 index, and finally Ethereum a few weeks later—has happened again for the first time since 2021.

The Russell 2000 and global liquidity have both already confirmed breakouts. Last Thursday, the Russell 2000 achieved a fresh all-time high of 2,738. Ethereum’s big rally started in 2021, just 119 days after the Russell verified its breakout. Between March and November of that year, Ethereum rose 226%. Analysts think that if the trend maintains, ETH might break out around March 2026.

Max, the CEO of BecauseBitcoin, agrees with this idea, saying that the Russell 2000 leadership has always come before Ethereum price discovery periods. The correlation shows that if people keep feeling good about taking risks, ETH might go up a lot in the next few weeks.

ETH’s Strong On-Chain Accumulation Provides Structural Support

Even though there has been a lot of volatility lately, on-chain data shows that long-term holders are still buying. CryptoQuant’s research shows that the realized price of ETH accumulation addresses is rising to about $2,720, a level that has traditionally offered strong support during market drops. Ethereum is presently trading at about $2,900. If it goes down to the $2,720 zone, it would only go down about 7%, which suggests that this could be a local bottom near this level.

Bitmine Immersion Technologies, the largest publicly traded Ether treasury, controls approximately 4.2 million ETH, which is 3.5% of the circulating supply. This is another reason to be bullish. The company is making over $164 million a year from staking, with more than 2 million ETH currently staked. This shows that institutions believe in Ethereum’s long-term value proposition.

US Institutional Demand Raises Red Flags

But not all of the signals point up. The Ethereum Coinbase Premium Index, which analyzes the price difference between Coinbase’s ETH/USD pair and Binance’s ETH/USDT pair, has dropped to -0.08 on its 30-day simple moving average. This is the lowest level since early 2023. This very low premium means that Ethereum is selling for less on Coinbase, which could mean that institutional purchasers in the US, who usually drive long-term price increases, are less interested.

Technical analysts say that recovery attempts could stay weak and open to more selling pressure if American institutions don’t back them up strongly. This is true even as global markets stabilize prices.

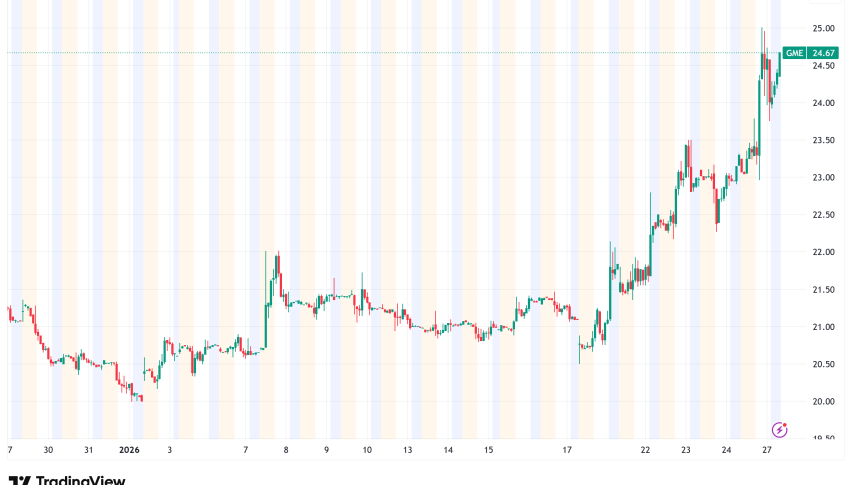

ETH/USD Technical Outlook: Bulls Must Reclaim $3,000

From a technical point of view, Ethereum is facing immediate resistance at $2,960. The important $3,000 level is the key to a longer-lasting recovery. To really change the tide in their favor, bulls need to surge beyond $3,020 and eventually get back to $3,065. The 50-period and 100-period moving averages are both above the current levels and rolling over. This shows that traders are selling into rallies.

On the downside, there is support at $2,840 and major support at $2,720, which is where the realized price of accumulation addresses is. If Ethereum falls below these levels, it might go down to $2,765 or below.

Ethereum Price Prediction

If the global liquidity scenario stays the same as it was in 2021 and institutional demand picks up, Ethereum might break out toward $3,150 in the near future, with the possibility of triple-digit percentage gains by the end of 2026. But if ETH doesn’t get back above $3,000 and US institutional flows keep getting weaker, it could test support between $2,720-$2,750 before any real recovery happens.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM