Bitmine Stakes 2.01M ETH, Eyes $164M Annual Yield at 2.81% Rate

Bitmine Immersion Technologies expanded its Ethereum holdings by 40,302 ETH last week, bringing its total to 4,243,338 ETH...

Quick overview

- Bitmine Immersion Technologies increased its Ethereum holdings by 40,302 ETH, totaling 4,243,338 ETH, solidifying its status as the largest publicly traded Ether treasury.

- The company also raised its staked Ether balance by 171,264 ETH, bringing total staked holdings to 2,009,267 ETH, which could generate approximately $164 million in annual staking revenue.

- Chairman Tom Lee indicated that staking the entire Ether balance could yield around $374 million annually, prompting plans to internalize staking operations by 2026.

- Bitmine's Ether holdings now account for 3.52% of Ethereum's circulating supply, with a long-term goal of acquiring 5% of the total ETH supply.

Bitmine Immersion Technologies expanded its Ethereum holdings by 40,302 ETH last week, bringing its total to 4,243,338 ETH and maintaining its position as the largest publicly traded Ether treasury.

During the same period, Bitmine increased its staked Ether balance by 171,264 ETH, lifting total staked holdings to 2,009,267 ETH. With nearly half of its Ether now staked, the company is converting idle assets into protocol-generated income.

At the 2.81% Composite Ethereum Staking Rate (CESR) cited by Bitmine, the current staked position would generate about $164 million in annualized staking revenue, based on Ether’s current price.

Staking Revenue Increases With Deployment

Chairman Tom Lee said staking the company’s full Ether balance would significantly increase revenue. If all 4.24 million ETH were staked at the same 2.81% CESR, Bitmine would generate approximately $374 million annually, or more than $1 million per day.

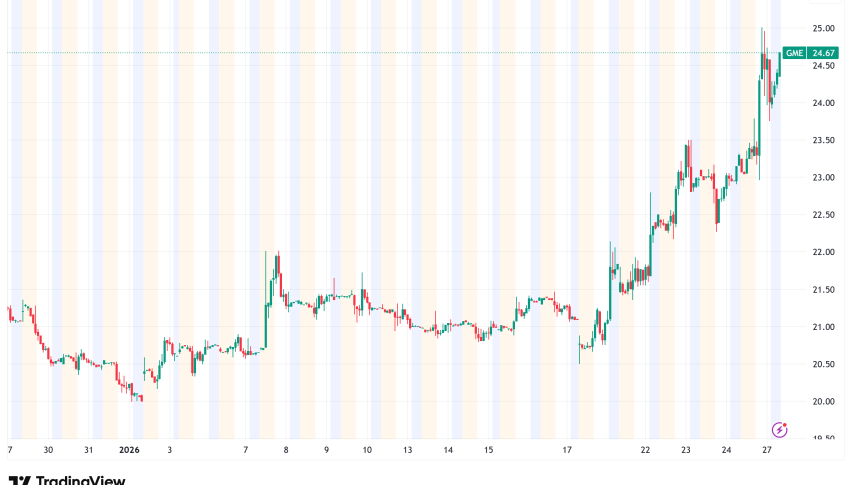

🔥UPDATE: Tom Lee–backed Bitmine purchased another 20,000 $ETH worth $58.22M and staked 184,960 $ETH ($538M).

Total staked $ETH now stands at 2.13M tokens, valued at $6.22B. pic.twitter.com/IBa9N15aMv

— The Crypto Times (@CryptoTimes_io) January 27, 2026

Bitmine currently partners with several external staking providers but plans to internalize operations. The company aims to launch US-based validator infrastructure in 2026, enabling direct management of validators and internal capture of staking economics.

In addition to Ether, Bitmine disclosed the following balance sheet assets:

- $682 million in cash

- 193 Bitcoin

- Minority equity investments

Bitmine’s total crypto and cash holdings amount to $12.8 billion, underscoring its scale as a digital asset treasury.

ETH Treasuries Increase Staking Demand

Bitmine’s Ether holdings now represent 3.52% of Ethereum’s circulating supply, based on an estimated 120.7 million ETH outstanding. The company has publicly stated a long-term target of acquiring 5% of total ETH supply.

Other firms are adopting similar strategies. SharpLink Gaming, the second-largest Ether treasury, reported generating 10,657 ETH in staking rewards over the past seven months, worth roughly $33 million. SharpLink currently holds 864,840 ETH, according to CoinGecko.

Additional examples include:

- Bit Digital, which in June began winding down Bitcoin mining; it now holds 153,546 ETH and only six BTC

- Ether Machine, launched a month later, now holding 496,712 ETH, making it the third-largest Ether treasury

Rising institutional participation is visible onchain. On Jan. 17, Ethereum’s staking exit queue dropped to zero, while more than 2.6 million ETH waited to enter staking—the largest entry backlog since mid-2023—highlighting accelerating demand for Ether staking yield.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM