SanDisk (SNDK) Sprints Toward $700: Has the AI Storage Supercycle Arrived?

With shares up 129% YTD as AI data centers eat up NAND storage, SanDisk's flash-memory pure-play, which spun off from Western Digital

Quick overview

- SanDisk's stock has surged 129% year-to-date, driven by increasing demand for NAND storage in AI data centers.

- The company reported a remarkable 61% revenue increase and a fivefold growth in adjusted earnings per share in its latest quarter.

- Analysts predict further growth, with Bernstein raising its price target for SanDisk from $580 to $1,000 due to strong pricing power.

- Despite recent volatility, the long-term outlook remains positive as NAND flash is essential for AI infrastructure amid a supply shortage.

With shares up 129% year-to-date as AI data centers eat up NAND storage, the flash-memory pure-play, which spun off from Western Digital a year ago, has emerged as one of 2026’s most exciting trades.

The Power of the Pure Play: Life After Western Digital

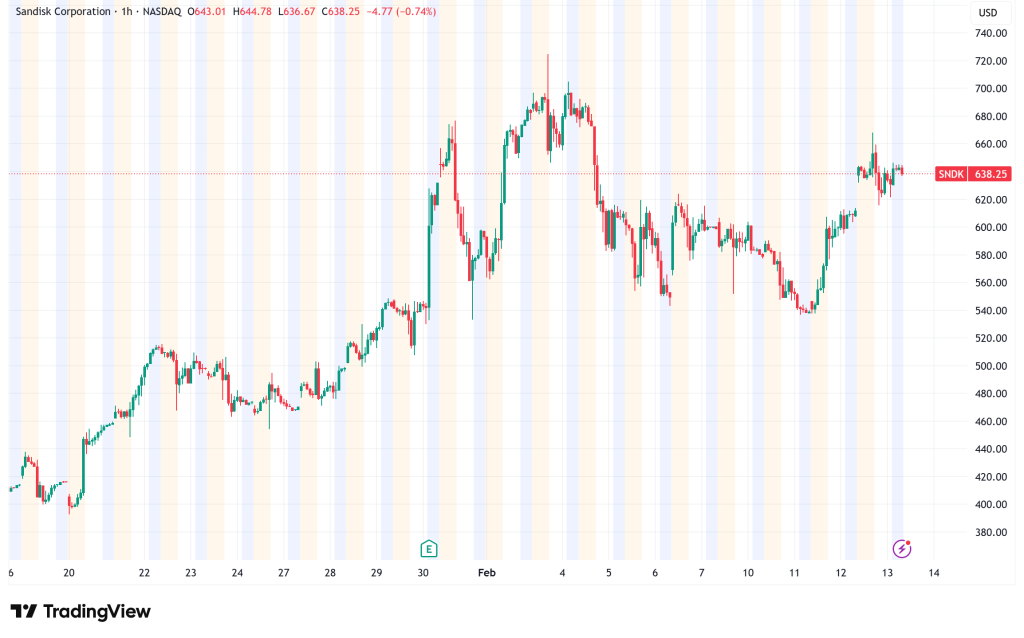

With good cause, SanDisk Corporation’s stock has emerged as one of Wall Street’s most followed names. After a week that saw a steep 7% decline, an incredible 11% recovery, and a year-to-date return of 129% that has outperformed broader market benchmarks, the flash-memory maker’s shares finished at $630.29 on Thursday, up more than 5% for the day.

In February 2025, Western Digital executed a spin-off of its flash-storage business, reviving the company as a separate public entity. It started off as the market’s clearest manifestation of a single premise, trading on the Nasdaq under the symbol SNDK: that supply cannot keep up with demand and that the AI revolution necessitates massive amounts of rapid, high-density NAND flash storage.

The earnings figures remarkably clearly demonstrate that argument. SanDisk reported a 61% increase in revenue and a growth in its gross margin from 32.3% to 50.9% in its most recent quarter. The increase in adjusted earnings per share was fivefold. The reason was simple: as AI data centers compete to obtain the high-performance solid-state drives required to store and transfer training data at scale, flash memory prices have been soaring.

Massive SanDisk (SNDK) Stock Guidance: Why $1,000 is No Longer a Meme

The company’s short-term momentum is enhanced by the structural background. The NAND market was in complete chaos a few years ago. Demand for electronics during the pandemic led to overbuilding, which caused prices to plummet so sharply that industry-wide gross margins became negative. In order to improve AI chip performance, memory manufacturers reduced manufacturing and shifted their focus to high-bandwidth memory, a specialized DRAM version. Just when AI infrastructure builders started to require it on a large scale, that change in direction led to a significant supply shortfall in NAND.

As a result, the pricing environment now resembles a structural shortage rather than a normal cyclical rebound. Investors and analysts have noticed. Mark Newman, a Bernstein analyst, increased his price objective for SNDK from $580 to $1,000, citing increased pricing power as the need for AI-driven storage keeps growing. Even with the strong year-to-date run, the company may be trading at a discount of around 69% to its intrinsic value, according to a discounted cash flow study from Simply Wall Street that projects free cash flow of almost $12 billion by 2028.

The valuation picture gives the transaction a surprising dimension for investors who are still on the sidelines. SNDK is trading at about 15 times fiscal year 2026 earnings predictions and just over 7.5 times fiscal year 2027 projections, which seems pedestrian for a firm reporting fivefold earnings growth at the epicenter of the AI infrastructure boom, even though it gained 129% in 2026.

Sandisk Stock Outlook

However, the erratic tape reminds us that momentum trades are not without risk. An 11% recovery after a 7% one-day drop indicates that the stock is driven as much by fundamental accumulation as by swift institutional positioning. The stock might be swiftly knocked off its perch by any easing of NAND pricing trends, a cautious data point on hyperscaler storage orders, or a selloff in the entire technology sector. Both sides of the issue are exacerbated by the trade’s congested character.

The longer-term scenario, however, seems to be unaffected. NAND flash plays an indispensable role in the data center stack, especially as AI infrastructure spending is accelerating and alternative memory technologies are still developing. SanDisk, the only pure-play vehicle for that exposure available on the market, is situated at the nexus of an unquenchable demand wave and a dearth of supply. The length of time that imbalance lasts may determine whether the stock is a sprint or a marathon, but for the time being, the path of least resistance is still pointing higher.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM