Natural Gas Held Back by Storage Reports

The price of natural gas is changing little as high export levels contrast with lower than expected withdrawals.

Quick overview

- Bearish storage data has kept U.S. natural gas futures from gaining ground, with a recent report showing 249 billion cubic feet withdrawn from storage.

- Natural gas futures rose slightly to $3.23 per MMBtu, but the market remains sluggish due to warm weather forecasts reducing winter demand.

- High LNG export demand is a potential factor that could stabilize gas futures despite mild temperatures and increased withdrawals compared to last year.

- The Energy Information Administration projects natural gas production to reach all-time highs in 2026, which could lead to lower market prices.

Bearish storage data kept United States natural gas futures from gaining ground on Friday as the latest report came in under expectations.

Natural gas is already a bearish market, but the most recent storage report showing 249 billion cubic feet of gas withdrawn from storage is only making things worse. Gas futures ticked up 0.08% on Friday to $3.23 per MMBtu, back to October 2025 prices.

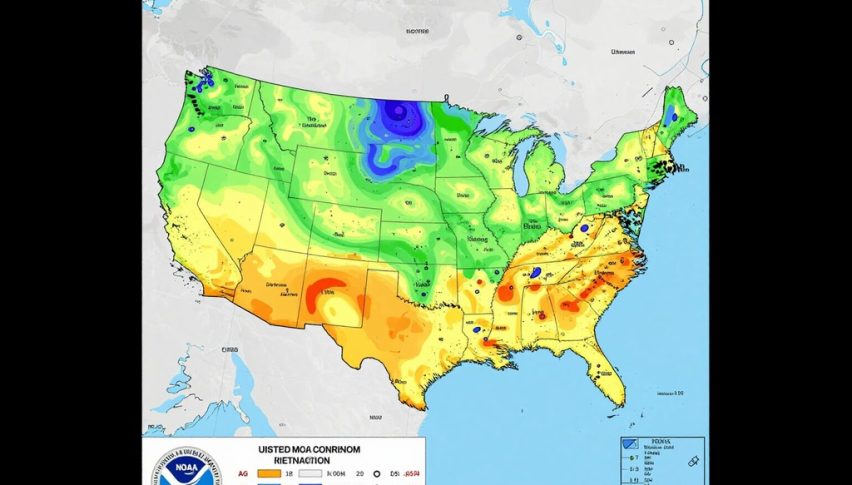

The sluggish market can be blamed on warm weather forecasts that have cut the winter season short for much of the United States. Natural gas futures are expected to remain low so long as weather forecasts call for relatively mild temperatures.

LNG Export Demand Could Shift Market Upward

There is one factor that could push back against mild weather and low withdrawals, and that is the exceptional export demand that U.S gas traders are experiencing. LNG export demand is high right now as trade partners around the world need heating for their cold winter weather. As long as that demand remains high, the gas futures will not dip much lower.

Warm weather is expected to continue all the way through the end of February with forecasts pointing to unusually mild temperatures for this time of year. However, withdrawals are higher this year than they were the previous year, coming in at 249 billion cubic feet compared to 111 from the same time last year. The withdrawal numbers are also much higher than the five year average 146 bcf.

That is promising for the market that has struggled with high reserve levels for a while. All throughout 2025, the natural gas supply was unusually high, and injections continued to occur to an already elevated supply level. For now, the reserve levels are going back down and are correcting, but that could change later on this year. Several production facilities are expected to open in the region, and several facilities are expected to increase their production output this year as well.

The Energy Information Administration expects natural gas production to reach all-time highs in 2026. The production levels could move as high as 120.8 billion cubic feet per day, which would mean an increase of about 2%. Much of the growth should come from the Appalachian region, but production in Texas is expected to ramp up as well this year. If production levels really do increase, then overall market prices will likely fall in response.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM