Figma (FIG) Surges 7% on 40% Growth Beat as AI Monetization Moves to Center Stage

Following a solid fourth-quarter earnings beat this week, shares of Figma Inc. (NYSE: FIG) surged up to 15% before closing the day about 7%

Quick overview

- Figma Inc. shares surged 7% following a strong fourth-quarter earnings report, but remain significantly below their IPO price.

- The company reported a 40% year-over-year revenue increase, surpassing analyst expectations with $303.8 million in revenue.

- Figma's net dollar retention rate improved to 136%, indicating strong growth among existing customers, particularly in large enterprises.

- The company plans to introduce paid AI tiers in March, enhancing its monetization strategy as it expands its AI capabilities.

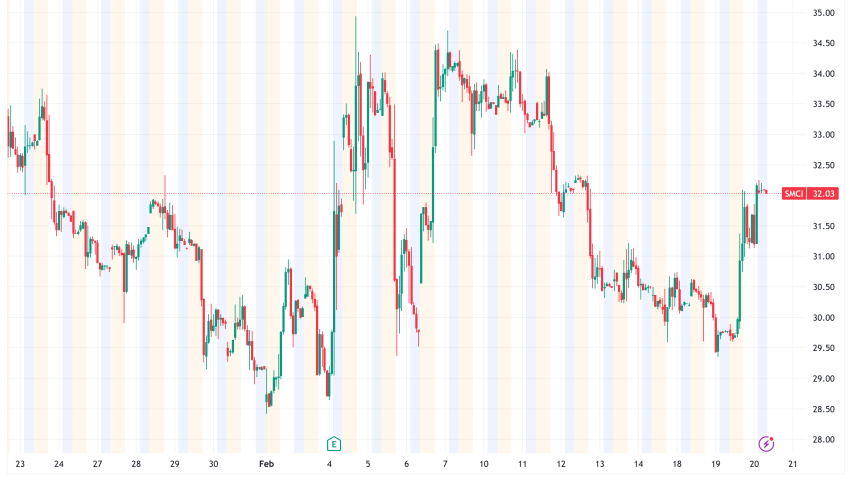

Following a solid fourth-quarter earnings beat this week, shares of Figma Inc. (NYSE: FIG) surged up to 15% before closing the day about 7% higher. Wall Street is split on the company’s true value because, despite the excitement, the stock is still trading between $25 and $26, around 80% below its post-IPO highs and below its $33 IPO price.

Figma’s Q4 Earnings: A “Beat and Raise” Validates AI Strategy

Revenue for the fourth quarter was $303.8 million, up 40% from the previous year and above the $293 million analyst consensus. Estimates of $0.06 to 0.07 were surpassed by adjusted EPS of $0.08. Non-GAAP operating income for the quarter was $44 million, while non-GAAP gross margins remained at an exceptional 86%.

A $975.7 million stock-based compensation charge associated with its initial public offering (IPO) significantly affected Figma’s reported full-year net loss of about $227 million on a GAAP basis. A more positive view of the underlying business was provided by the year’s adjusted free cash flow, which came to $242.7 million.

The true impetus came from management’s forward direction. Figma forecasted $315–317 million in revenue for the first quarter of 2026, which is a 38% increase and much over the $292 million experts had predicted. The $1.366–1.374 billion full-year 2026 projection reflects a 29–30% growth, which is significantly more than the 22–24% Wall Street had anticipated.

Enterprise Momentum

Deepening entrenchment in large enterprises is reflected in the customer KPIs. Net dollar retention, which gauges how much current clients increase their spending, increased to 136% from 131% in the previous quarter. The retention rate for gross revenue is roughly 97%. Consumers who spend more than $100,000 a year increased 46% from the previous year to 1,405 accounts, and those who spend more than $1 million increased from about 40 at the beginning of fiscal 2025 to 67. Approximately 95% of Fortune 500 companies are already Figma users, and the company is growing not just through new logos but also through more seats, more products, and more teams per customer.

AI as a Growth Driver for Figma

Figma’s move into AI monetization is arguably the most significant aspect of the financial story. Weekly active users of its Figma Make product, which turns natural language queries into UI mockups and code scaffolding, increased by more than 70% from quarter to quarter. Every week during the quarter, over half of clients who spend more than $100,000 annually utilize Make.

Figma will implement paid AI tiers across its Professional, Organization, and Enterprise plans beginning in March. This will add a usage-based monetization layer to the company’s current seat model and enforce monthly AI credit restrictions. Additionally, the business revealed a collaboration with Anthropic, whose “Code to Canvas” function transforms code produced by programs like Claude Code into fully editable Figma drawings.

The AI firm Weavy, now known as Figma Weave, was recently acquired by Figma, expanding the platform’s ability to generate images and videos. These days, the AI stack includes real-time collaboration, code alignment, layout, and content generation.

Figma (FIG) Stock Analyst Reaction

In general, Wall Street is cautious yet constructive. Citing economic uncertainties, RBC Capital reduced its target from $38 to $31 while keeping a Sector Perform rating. The aim for Piper Sandler’s Overweight is $35. Figma was characterized by Morgan Stanley as a robust AI player rather than a victim, while Bank of America recognized good performance but warned of larger market difficulties as a possible overhang.

Figma is currently trading at about 8.8–9 times forward enterprise value to sales, which is a significant premium to its slower-growing software competitors but a substantial discount to its own past. How soon the AI credit model converts into quantifiable revenue and whether the market as a whole starts rewarding growth will determine whether the gap between the stock and the company eventually narrows.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM