Forex Signals Brief for July 15: Will the USD Continue to Tumble?

Jerome Powell and the USD were the main stories all last week and the Greenback ended sharply lower after the odds of a rate cut ramped righ

Jerome Powell and the USD were the main stories all last week and the Greenback ended sharply lower after the odds of a rate cut ramped right up.

This week all the attention will be on whether or not those falls will continue or whether the cuts are now fully priced in. At the same time, the SPX is at record highs and the bulls are certainly in control, but we will be watching equities closely as well.

The main event this week will be US retail sales. We have seen it spike the dollar in the past and it will be worth watching along with the US Philly Fed. We have a few other key releases for the other majors with NZD/USD CPI data and the RBA Minutes for the AUD/USD. Followed by UK wage data that will keep the GBP/USD busy. WTI will also be in focus as tropical storm Barry (which is now a depression), has helped lift the price of Crude.

Earlier today, Chinese industrial production data came out stronger than expected and that has seen a bit of a risk-on feel early in the week. Time will tell if that can translate into a strong session to start the week.

Expect volatility to be high this week as there is plenty going and with a falling USD, the majors will clearly be the ones to watch.

Forex Signal Update

The FX Leaders Team finished with 14 wins from 24 signals for a 58% winning percentage for the week.

EUR/USD – Pending Signal

The EUR/USD along with most of the majors have all been appreciating against the USD as Powell’s testimony sank the Greenback. As mentioned, we are very interested to see if those moves can hold as the ECB is equally as dovish as the FOMC. As a result, we are hunting a short signal here on Monday.

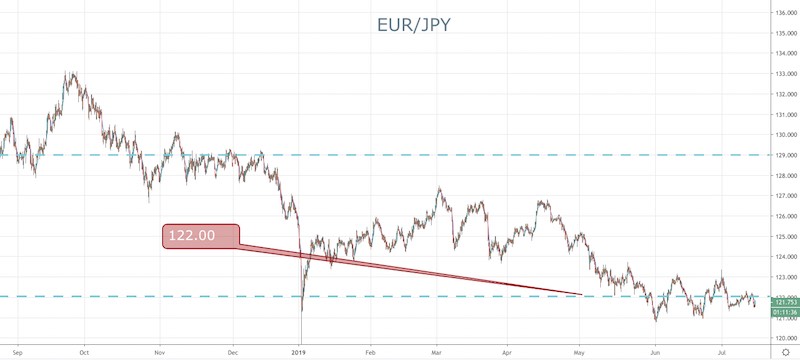

EUR/JPY – Pending Signal

The EUR/JPY is on a longer-term downtrend and has start consolidating below 122.00. This also looks like a flag type formation and as such we are looking for a short signal to ride out that higher time frame momentum.

Cryptocurrency Update

BTC has fallen sharply and is now testing the $10,000 level. Things started to go bad at the end of last week when US President Trump came out and slammed the cryptocurrency on Twitter.

Following on from that tweet, the big news is that the US Government is formally looking at ways to keep big tech companies away from the monetary system. This, of course, comes on the back of Facebook announcing its own version known as Libra.

Clearly, the US lawmakers are not happy with what is going on and that means and the wheels are in motion to kill it. This is a huge changing fundamentals moment for all cryptocurrencies so we will watch how this plays out this week with much interest. For now, I wouldn’t be looking to be long this pullback.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM