Daily Brief, October 02 – Gold Exhibits Sharp Price Action – Brace for NFP Figures!

Good morning traders, Prices for the precious metal, gold, closed at 1,905.96, after placing a high of 1,912.21, and a low of 1,883.99. Over

Prices for the precious metal, gold, closed at 1,905.96, after placing a high of 1,912.21, and a low of 1,883.99. Overall, the movement of the gold prices remained bullish throughout the day. Gold prices crossed the 1,900 level again on Thursday, on the back of the weakness of the broad-based US dollar, over the rising hopes that US Congress was set to approve a COVID-19 stimulus package, ahead of the November Presidential elections.On Thursday, the US Dollar Index (DXY) slipped by 0.2%, to the 93.75 level. The declining US dollar helped gold to post gains. These gains in the yellow metal could be attributed to the optimism that the US Congress will finally issue another round of the US Stimulus package.The renewed hopes came in as US House Speaker Nancy Pelosi held talks on a new coronavirus relief bill with US Treasury Secretary Steven Mnuchin. Although the differences between the Democrats and the Republicans were still there, the fact that the parties were trying to reach a deal and making an effort raised hopes in the market.

In the early trading session, Nancy Pelosi told reporters that she would provide the US Congress with a revised $ 2.2 Trillion coronavirus relief fund, where both parties could find common ground.

Pelosi has been trying hard to get President Donald Trump’s Republican Party to agree with the Health and Economic Recovery Omnibus Emergency Solution (HEROES) Act. The proposed Act was originally projected at $ 3 Trillion, and after that, it was reduced to 2.2 trillion dollars. The Democrats have also agreed to further revision regarding the HEROES Act in recent weeks.

The hopes for another round of stimulus aid from US Congress increased after Mnuchin confirmed on Wednesday that a deal might come soon, as the communications with Nancy Pelosi were very effective.

Apart from this, the gold prices were also supported by the weak US Manufacturing Activity in the market. At 18:45 GMT, the Final Manufacturing PMI figures were released – they remained flat at the expectations of 53.2. At the same time, the highlighted ISM Manufacturing PMI declined to 55.4, against the projected 56.0, weighing heavily on the US dollar, and adding upside momentum to the gold prices. The Personal Income from the United States declined to -2.7%, against the expected -2.0%, weighing on the US dollar and adding further support to the rising gold prices on Thursday.

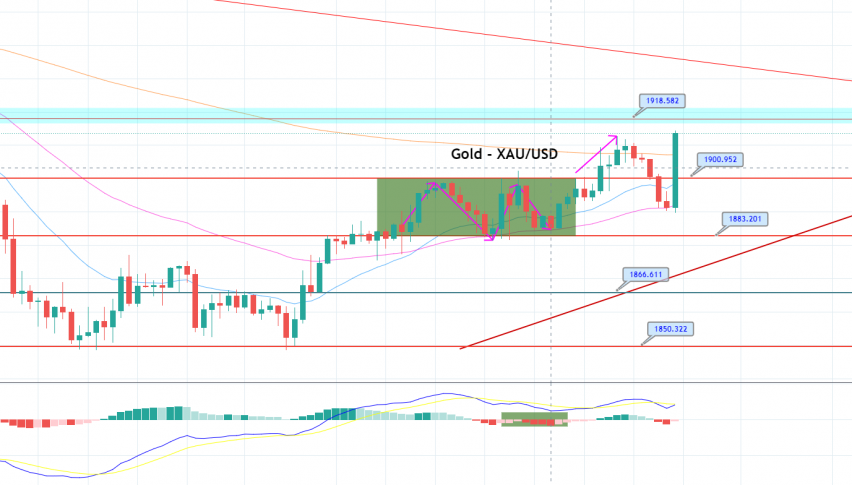

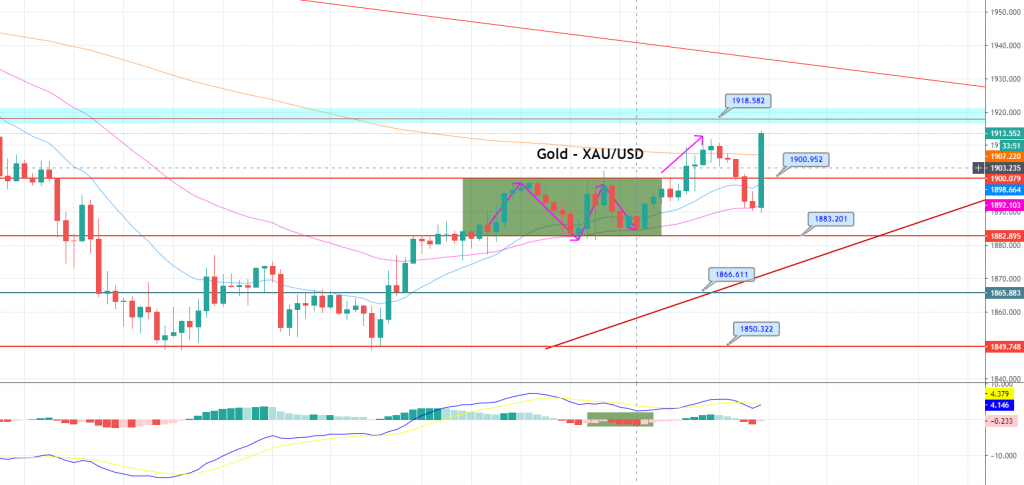

Daily Technical Levels

Support Resistance

1,893.91 1,921.51

1,878.23 1,933.43

1,866.31 1,949.11

Pivot Point: 1,905.83

Gold is exhibiting extreme volatility, as it fell sharply from 1,906 to 1,890, before reversing upward to trade at 1,906. It seems like the investors are bracing for the US Non-Farm Employment Change and Unemployment Rate figures from the US economic data. Economists are expecting mixed numbers; therefore, gold could trade sideways until the news comes out. On the higher side, gold may find resistance at 1,920, upon the breakout at the 1,911 level. At the same time, a bearish breakout at the 1,900 level could trigger selling until 1,892. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM