Crypto.com Crypto Exchange

Crypto.com Crypto Exchange is a premier crypto platform known for its wide range of cryptocurrencies. They are a leader in regulatory compliance, serving more than 80 million users worldwide. They are a trusted partner in cryptocurrency trading.

Minimum Deposit: $0 Regulated by: FDIC, FCA, CySEC, ACPR, De Nederlandsche Bank Crypto: Yes |

Overview

Crypto.com positions itself as a trusted global exchange, offering over 400 digital assets, equities, and exchange-traded funds. It emphasizes regulatory compliance across multiple jurisdictions and provides users with a secure, liquid, and versatile trading environment. Its Visa card, deep liquidity exchange, and mobile app deliver broad financial accessibility.

Frequently Asked Questions

What makes Crypto.com different from other exchanges?

Crypto.com differentiates itself with an all-in-one ecosystem that combines cryptocurrency trading, equities, and exchange-traded funds. Additionally, it integrates a Visa card, ensuring seamless spending and rewards. Strong security infrastructure and deep liquidity further strengthen its position as a reliable, globally recognized trading platform.

Is Crypto.com regulated internationally?

Yes, Crypto.com operates under regulatory compliance in several countries, ensuring legal and transparent operations. This global oversight adds trust for traders, while its licenses across different jurisdictions reflect a commitment to safety. Therefore, users can engage with confidence knowing the platform aligns with recognized financial authorities.

Our Insights

Crypto.com demonstrates why it remains one of the most recognized names in digital finance. With regulatory compliance, global access, and a wide asset offering, it appeals to traders seeking both flexibility and reliability. Its Visa card and mobile-first experience create an engaging and secure way to manage investments.

Minimum Deposit: $0 Regulated by: FDIC, FCA, CySEC, ACPR, De Nederlandsche Bank Crypto: Yes |

How to Open a Crypto.com Account

Opening a Crypto.com account is mostly online and straightforward. You register via web or mobile, verify your identity, and then once approved, you can fund your account and begin using their services.

1. Step 1: Go to registration

Download the Crypto.com app or visit the Crypto.com web sign-up page, then select “Create New Account” or “Sign Up.”

2. Step 2: Enter email address

Provide your email address. You may also have the option to enter a referral code or opt in for offers.

3. Step 3: Confirm email

Check your email inbox and click the verification link sent by Crypto.com to confirm your email before proceeding.

4. Step 4: Verify phone number

Provide your country code, phone number, and input the one-time verification code (OTP) sent by SMS.

5. Step 5: Set password/passcode

Create a strong password and, if required, a transaction passcode or app passcode.

6. Step 6: Identity verification (KYC)

Upload required identity documents, such as a government-issued ID, proof of residence, and take a selfie. Wait for verification to complete.

After verification is approved, your account becomes active. You can then fund the account and use the web or mobile app to trade, buy crypto, or use other features.

Minimum Deposit: $0 Regulated by: FDIC, FCA, CySEC, ACPR, De Nederlandsche Bank Crypto: Yes |

Security and Trust

Crypto.com strengthens its reputation by prioritizing security, trust, and compliance. With regulation under major authorities such as 🇺🇸 FINRA and 🇬🇧 FCA, the platform ensures oversight in key markets. Combined with advanced fraud prevention tools and certified data protection, it provides a secure trading environment for global users.

| Feature | Details |

| Regulatory Oversight | 🇺🇸 FINRA 🇬🇧 FCA 100+ jurisdictions |

| Security Certifications | SOC 2 Type 2 PCI DSS 4.0 ISO 27001 |

| Fraud Prevention | Real-time monitoring, blacklist updates, scam detection |

| Security Partners | Kudelski Security and other top firms |

Frequently Asked Questions

How does Crypto.com protect user funds and data?

Crypto.com secures funds and data through advanced measures like SOC 2 Type 2, PCI DSS 4.0, and ISO 27001 certifications. Additionally, it applies real-time monitoring, blacklist updates, and fraud detection algorithms, ensuring threats are addressed quickly while providing users with multi-layered protection.

What fraud prevention strategies does Crypto.com use?

Fraud prevention includes anti-phishing passcodes, scam detection, wallet trust verification pop-ups, and withdrawal holds for elderly users. Moreover, the platform partners with top-tier security firms for audits and stress testing, adding another layer of trust to its overall security framework.

Our Insights

Crypto.com delivers a strong balance of security, regulation, and fraud prevention. By working with established regulators and adopting advanced monitoring systems, it maintains user confidence. Its multi-layered protection, coupled with ongoing audits and global oversight, ensures it remains one of the most trusted platforms available today.

Minimum Deposit: $0 Regulated by: FDIC, FCA, CySEC, ACPR, De Nederlandsche Bank Crypto: Yes |

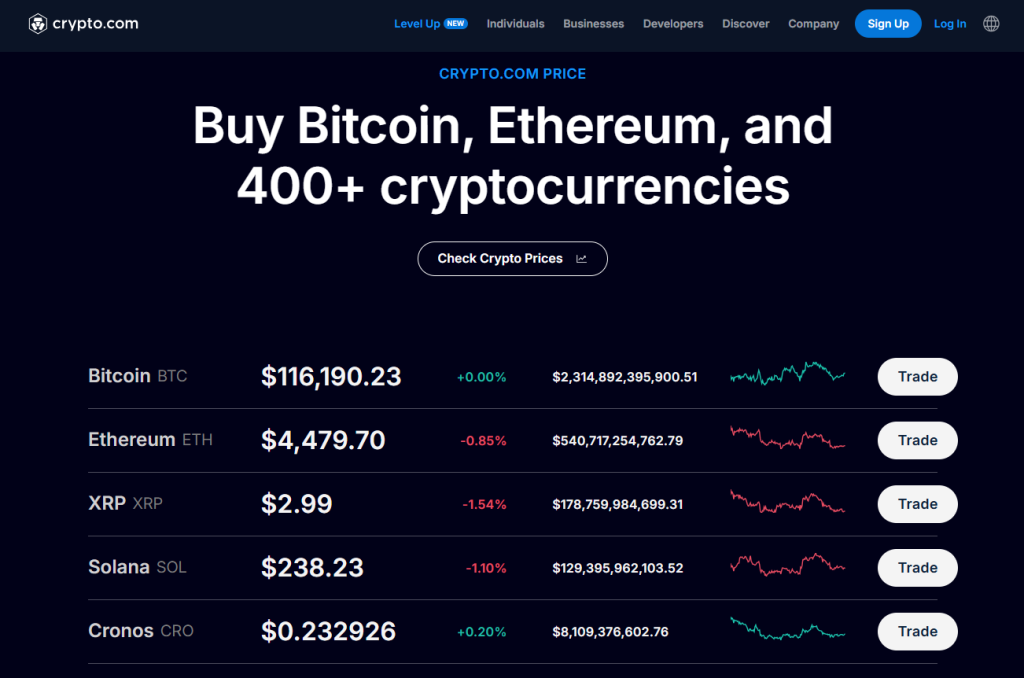

Asset Diversity

Crypto.com stands out with over 400 digital assets and equities, offering investors a mix of crypto and fintech opportunities. While it does not cover forex or commodities, it expands access with stocks, ETFs, and advanced exchange features like margin and derivatives trading for global users.

| Asset Type | Availability |

| Cryptocurrencies | 400+ |

| Equities (U.S. users) | Yes |

| ETFs (U.S. users) | Yes |

| Forex / Commodities | None |

Frequently Asked Questions

What assets can I trade on Crypto.com?

Crypto.com allows trading in over 400 cryptocurrencies, U.S. equities, and ETFs. The platform also supports spot, margin, and futures trading, offering both retail and institutional traders diverse investment opportunities. However, it does not provide forex or commodity trading.

Does Crypto.com offer services for institutional traders?

Yes, institutional clients benefit from deep liquidity, derivatives, and OTC trading for high-volume transactions. This makes the platform attractive for large-scale investors seeking efficient execution and broader investment opportunities beyond retail-focused trading.

Our Insights

Crypto.com delivers broad asset diversity, making it attractive for retail and institutional investors. Its inclusion of U.S. equities and ETFs alongside crypto creates a hybrid platform. Despite the absence of forex and commodities, its liquidity, futures, and OTC options offer strong appeal to serious traders.

Minimum Deposit: $0 Regulated by: FDIC, FCA, CySEC, ACPR, De Nederlandsche Bank Crypto: Yes |

Crypto.com Account Types

Crypto.com provides flexible account options designed for both retail and institutional users. From demo and Islamic accounts to advanced institutional tools, the platform ensures accessibility for beginners while offering high-liquidity features for professionals. With no minimum deposit, starting your trading journey is simple and inclusive.

| Account Type | Availability | Open an Account |

| Demo Account | Yes | |

| Islamic Account | Yes | |

| Segregated Account | Yes | |

| Managed Account | None |

Frequently Asked Questions

Does Crypto.com offer demo accounts for practice?

Yes, Crypto.com offers demo accounts that allow traders to practice strategies and explore the platform without risking real funds. This makes it an excellent entry point for beginners who want hands-on experience before committing money.

Are there Islamic accounts on Crypto.com?

Yes, Crypto.com provides Islamic accounts that comply with Sharia law. These accounts enable Muslim traders to participate in crypto trading while adhering to their financial and religious principles, ensuring inclusivity in the platform’s global offerings.

Our Insights

Crypto.com accommodates a wide range of users, from beginners to institutional clients. With demo, Islamic, and segregated accounts available, the platform balances inclusivity with professionalism. The absence of managed accounts is notable, yet its no-minimum deposit policy ensures accessibility for all types of traders.

Minimum Deposit: $0 Regulated by: FDIC, FCA, CySEC, ACPR, De Nederlandsche Bank Crypto: Yes |

Commission and Fees

Crypto.com maintains a transparent fee structure that supports both new and experienced traders. With no minimum deposit, free deposits, and no inactivity fees, the platform offers cost-effective trading. However, users should review the detailed schedule for trading, withdrawal, and special order-related fees.

| Fee Type | Policy |

| Minimum Deposit | None |

| Deposit Fee | Free |

| Inactivity Fee | None |

| Withdrawal Fee | Varies by asset |

Frequently Asked Questions

Does Crypto.com charge for deposits and inactivity?

No, Crypto.com does not charge deposit or inactivity fees. This makes it convenient for traders who prefer to hold funds or take breaks without worrying about unexpected costs reducing their balances over time.

What trading fees can I expect with Crypto.com?

Crypto.com applies maker fees and guaranteed stop order fees but does not charge taker fees, making it appealing for high-volume traders. Withdrawal fees vary depending on the asset, so checking the updated schedule before transactions is recommended.

Our Insights

Crypto.com delivers a cost-effective structure with no minimum deposits, free deposits, and no inactivity or overnight funding fees. Although some maker and withdrawal fees apply, the absence of taker fees strengthens its appeal, especially for active and institutional traders seeking transparent and fair pricing.

Minimum Deposit: $0 Regulated by: FDIC, FCA, CySEC, ACPR, De Nederlandsche Bank Crypto: Yes |

Trading Platforms

Crypto.com delivers a versatile trading experience through mobile, web, and desktop platforms. From casual traders using mobile apps to professionals seeking advanced desktop tools, the platform ensures seamless access to crypto, equities, and ETFs with high-speed execution and deep liquidity.

| Platform Type | Availability |

| Desktop Windows | Yes |

| Desktop Mac | Yes |

| Web Platform | Yes |

| Mobile (iOS and Android) | Yes |

Frequently Asked Questions

Does Crypto.com have a mobile trading app?

Yes, Crypto.com offers a mobile app for iOS and Android. It allows users to trade over 400 cryptocurrencies, manage accounts, and access advanced trading features, making it suitable for both retail and institutional clients.

Can I trade on Crypto.com using desktop platforms?

Yes, Crypto.com provides desktop platforms for Windows and macOS. These platforms include professional-grade charting tools, fast execution, and deep liquidity, making them ideal for advanced traders who prefer a more robust trading setup.

Our Verdict

Crypto.com ensures accessibility for all traders through mobile, web, and desktop platforms. Whether trading on the go or using advanced charting features at a desk, the platform combines flexibility with speed. This multi-platform approach caters effectively to both beginners and seasoned professionals.

Minimum Deposit: $0 Regulated by: FDIC, FCA, CySEC, ACPR, De Nederlandsche Bank Crypto: Yes |

Research and Education

Crypto.com strengthens its offering with a robust educational hub designed to support both beginners and experienced traders. From tutorials and guides to real-time data and market analysis, the platform empowers users to stay informed, trade confidently, and adopt best practices in security and strategy.

| Resource Type | Availability |

| Tutorials and Guides | Yes |

| Security Awareness Training | Yes |

| Real-Time Market Data | Yes |

| Technical Analysis Tools | Yes |

Frequently Asked Questions

Does Crypto.com provide educational resources for beginners?

Yes, Crypto.com University offers tutorials, guides, and beginner-friendly resources. These materials simplify cryptocurrency concepts, helping new traders understand digital assets while building confidence in trading strategies and safe practices.

Are there research tools for advanced traders on Crypto.com?

Yes, advanced users benefit from real-time market data, technical analysis tools, and security-focused insights. These features allow experienced traders to make data-driven decisions while keeping pace with evolving market conditions and regulatory changes.

Our Verdict

Crypto.com combines education with trading tools, offering resources for users at every level. By providing structured learning, fraud prevention guidance, and real-time data, the platform enhances user confidence. This dual approach strengthens both security awareness and market readiness for its global trading community.

Minimum Deposit: $0 Regulated by: FDIC, FCA, CySEC, ACPR, De Nederlandsche Bank Crypto: Yes |

Customer Support

Crypto.com ensures reliable, round-the-clock customer support with multiple digital channels. Users can access live web chat, the mobile app, or the Help Center for troubleshooting. Combined with real-time status updates and an extensive knowledge base, the platform empowers traders with timely solutions and clear guidance.

| Support Type | Availability |

| Live Web Chat | Yes |

| Mobile App Support | Yes |

| Help Center | Yes |

| Phone Support | None |

Frequently Asked Questions

How can I contact Crypto.com support?

Users can reach Crypto.com support through live web chat on the official website, via the mobile app, or by using the Help Center. These digital channels ensure 24/7 access to assistance without requiring direct phone contact.

Does Crypto.com provide educational support?

Yes, Crypto.com University offers detailed guides to help users navigate platform features and adopt secure trading practices. This educational support complements real-time status updates and troubleshooting resources, creating a well-rounded support system for traders.

Minimum Deposit: $0 Regulated by: FDIC, FCA, CySEC, ACPR, De Nederlandsche Bank Crypto: Yes |

Customer Reviews and Trust Scores

Crypto.com has gotten very mixed to negative feedback from customers on many review platforms. While its features and security efforts are often praised by analysts, users frequently complain about customer service, withdrawal issues, and high fees. Trust and transparency are two of the biggest recurring concerns.

| Platform/Metric | Score/Rating | What People Say Mostly |

| BitCompare security audits | Strong on security certifications, bug bounty, audits | Good marks for security infrastructure, but customer support & UX are weak points |

| Scam Detector | “Medium trust” – score ~ 58.4 / 100 | Some red flags: phishing risk, spamming, domain issues flagged |

| Sitejabber | ~ 1.1 / 5 stars | Many users report account restrictions, verification delays, poor communication |

| TradersUnion | 7.84 / 10 | More positive; acknowledges many satisfied users, features, regulation, security |

| Trustpilot | ~ 1.5 / 5 stars (≈ 70-75% 1-star reviews) | Negative: withdrawal delays, support unhelpful, hidden fees |

Overall, the trust scores show a tension: strong technical/regulatory/security backing, but a lot of dissatisfaction around service and user experience.

Minimum Deposit: $0 Regulated by: FDIC, FCA, CySEC, ACPR, De Nederlandsche Bank Crypto: Yes |

Discussions and Forums about Crypto.com

On Reddit and other forums, many users share detailed experiences — both positive and negative. Common threads include hidden or confusing fees, withdrawal problems, issues with verification (KYC), and frustrations with being unable to reach live or helpful support. Some users also point out distinguishing between Crypto.com’s “app” vs its “exchange” or “wallet” offerings, saying the experience differs significantly.

Examples:

- In /r/CryptoMarkets, one user complained about very high spreads (3.64%) and a lack of clarity around cost of trades.

- On /r/Crypto_com, users debate whether many Trustpilot 1-star reviews are genuine or part of coordinated negative campaigns.

- Long threads about “numbers in the app being misleading” — e.g. unrealised gains/losses misrepresented, and how what’s shown isn’t always what you get when withdrawing or selling.

These discussions suggest that while many features are useful, user trust is often undermined by a lack of clarity in pricing, delays, and support responsiveness.

Minimum Deposit: $0 Regulated by: FDIC, FCA, CySEC, ACPR, De Nederlandsche Bank Crypto: Yes |

Employee Overview: Working for Crypto.com

From platforms like Glassdoor, Indeed, and employee forums, here’s what people report about working at Crypto.com. The picture is mixed – many like the pace, pay, and colleagues, but others find problems with management, clarity, and work pressure.

| Aspect | Rating/Feedback |

| Overall Rating (Glassdoor) | ~ 3.3 / 5 from ~ 600+ reviews |

| Work-Life Balance | Around average to slightly above average; many say long hours but also flexibility in many roles |

| Pay Benefits | Generally viewed as good; compensation is competitive in many locations |

| Management Leadership | More critical: issues with communication, clarity of company vision, transparency in decisions |

| Culture Colleagues | Many positive remarks: fast-paced, dynamic, good teams. Some negative comments on stress, turnover, and frequent change |

For many, working at Crypto.com is exciting and offers good opportunities – but it can come with high expectations, rapid change, and not always clear internal processes.

Minimum Deposit: $0 Regulated by: FDIC, FCA, CySEC, ACPR, De Nederlandsche Bank Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Wide selection of cryptocurrencies and products | Withdrawal delays & verification issues |

| Strong security measures & audits | High fees, spreads, and hidden costs |

| Regulatory presence in multiple jurisdictions | Poor or slow customer support |

| Competitive pay / benefits (for employees) | Management & leadership transparency concerns |

| Active community & market presence | Confusing UX / misleading app metrics |

References:

In Conclusion

Crypto.com has established a strong global footprint, with offices and local presence in multiple regions, to enhance customer support and ensure regulatory compliance. These locations highlight its commitment to operating within major financial hubs worldwide.

- 🇸🇬 Singapore

- 🇺🇸 United States

- 🇫🇷 France

- 🇬🇧 United Kingdom

- 🇭🇰 Hong Kong

- 🇲🇹 Malta

- 🇮🇪 Ireland

- 🇰🇷 South Korea

- 🇦🇺 Australia

- 🇮🇹 Italy

- 🇬🇷 Greece

- 🇨🇾 Cyprus

- 🇦🇪 United Arab Emirates

This international spread ensures that Crypto.com can provide localized support while maintaining compliance with diverse regulatory frameworks, strengthening its global credibility and customer trust.

Faq

No, Crypto.com does not set a minimum deposit. This makes the platform highly accessible, allowing both beginners and experienced traders to open an account and start trading without a large upfront commitment.

Crypto.com provides access to more than 400 cryptocurrencies, along with stocks and ETFs for 🇺🇸 U.S. users. This broad selection allows traders to diversify across digital assets and traditional financial instruments within one platform.

Yes, Crypto.com applies trading fees in line with its transparent, publicly available fee schedule. Users can review current rates directly on the platform to better understand costs before making trades.

Yes, Crypto.com offers demo accounts, allowing traders to practice strategies and get familiar with the platform’s features without risking real money. This makes it especially useful for beginners who want hands-on experience before moving to live trading.