10 Best Litecoin Trading Brokers

We have listed the 10 Best Litecoin Trading Brokers for buying, selling, and investing in Litecoin with ease. These brokers offer low spreads, strong regulation, and advanced trading platforms, allowing both beginners and experienced traders to trade Litecoin securely and efficiently.

10 Best Litecoin Trading Brokers (2026)

- MultiBank Group – Overall, The Best Litecoin Trading Broker

- Swissquote – Massive range of over 3 million tradable assets

- Interactive Brokers – Powerful and customizable trading platforms

- OANDA – Transparent, commission-free pricing options

- Plus500 – Robust global regulation and security measures

- eToro – Social trading network and the CopyTrader function

- FP Markets – Low-cost trading through tight spreads and commissions

- Pepperstone – Robust multi-jurisdictional regulation

- AvaTrade – Unique risk management tool AvaProtect™

- Tickmill – Highly competitive pricing

Top 10 Forex Brokers (Globally)

1. MultiBank Group

MultiBank Group offers Litecoin (LTC) trading with competitive spreads, high liquidity, and fast execution on advanced platforms like MetaTrader 4 and 5. Regulated in multiple jurisdictions, it provides a secure environment for trading Litecoin against major currencies with leverage options and reliable customer support.

Frequently Asked Questions

Is MultiBank Group authorized to offer Litecoin trading?

Yes, MultiBank Group is authorized to offer Litecoin trading. They offer Litecoin as a CFD (Contract for Difference) through their primary brokerage platform and also offer spot crypto trading, including Litecoin, through their regulated cryptocurrency arm, MultiBank.io.

What platforms does MultiBank Group provide for Litecoin trading?

MultiBank Group offers Litecoin trading on their platforms, which include the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5). They also provide their proprietary platforms: MultiBank-Plus and the regulated crypto exchange MultiBank.io.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated | Limited cryptocurrency selection beyond major coins |

| Competitive spreads and low trading costs | Inactivity fees may apply to dormant accounts |

| Access to MT4 and MT5 platforms with fast execution | Minimum deposit requirements may be higher for some traders |

| Strong security and fund protection measures | Not available to residents of certain countries |

| 24/7 multilingual customer support | Educational materials could be more extensive for crypto traders |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

MultiBank Group is an authorized and well-regulated broker offering secure, efficient Litecoin trading. With tight spreads, advanced platforms, and strong support, it provides an excellent choice for both beginner and experienced cryptocurrency traders worldwide.

2. Swissquote

Swissquote is an authorized and regulated online broker offering Litecoin (LTC) trading through its secure and user-friendly platforms. Traders can buy, sell, and hold Litecoin with competitive spreads, transparent pricing, and advanced analytical tools, all under strong Swiss financial regulation.

Frequently Asked Questions

What platforms does Swissquote offer for Litecoin trading?

Swissquote offers Litecoin trading through its Swissquote App (a multi-asset platform) and its in-house crypto-exchange, SQX. They also offer CFDs, which can be traded on platforms like MetaTrader 5 (MT5).

Can I store my Litecoin safely with Swissquote?

Yes, you can. Swissquote provides a secure crypto wallet integrated into your account to store and manage your real Litecoin. It is backed by the institutional-grade security and reliability of a regulated Swiss bank.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and regulated Swiss financial institution | Higher trading fees compared to some brokers |

| Transparent pricing with no hidden fees | Limited leverage options for crypto trading |

| Secure crypto custody and cold storage | Account verification may take longer |

| Easy-to-use web and mobile trading platforms | Fewer cryptocurrency pairs available |

| Strong reputation for reliability and trust | Customer support not available 24/7 |

Final Score

| # | Criteria | Score |

| 1. | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2. | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3. | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4. | Research and Education | ⭐⭐⭐⭐☆ |

| 5. | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6. | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7. | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8. | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9. | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10. | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Swissquote is a legit and trusted broker for Litecoin trading, offering strong security, transparent pricing, and user-friendly platforms. Its regulation and reliability make it ideal for traders seeking a secure and professional trading environment.

3. Interactive Brokers

Interactive Brokers is a legit and authorized broker that offers Litecoin (LTC) trading through its advanced trading platforms. Traders can access Litecoin with competitive spreads, robust security, and professional-grade tools, all under strong regulatory oversight.

Frequently Asked Questions

Can beginners trade Litecoin safely with Interactive Brokers?

Interactive Brokers is highly secure due to top-tier regulation (SEC, FINRA) and uses custodians like Paxos for crypto. While the platform is advanced, the firm’s security makes it a very safe choice for beginners to trade Litecoin.

Is Interactive Brokers legal for Litecoin trading?

Yes, it is legal for eligible clients. Interactive Brokers is a regulated global broker that offers spot Litecoin trading through regulated custodians like Paxos, integrating it alongside traditional assets on their platform.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and regulated | Crypto trading may have higher fees compared to specialized brokers |

| Competitive spreads and transparent pricing | Limited cryptocurrency options compared to dedicated crypto platforms |

| Advanced trading tools and charting features | Account setup and verification can take time |

| Strong account security and fund protection | Mobile platform may be complex for beginners |

| Access to multiple asset classes beyond crypto | Customer support may not be 24/7 for crypto inquiries |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

Interactive Brokers is a legal and regulated broker providing secure Litecoin trading with advanced platforms and transparent pricing. Its robust tools and professional environment make it a strong choice for both beginner and experienced traders.

Top 3 Litecoin Trading Brokers – MultiBank Group vs Swissquote vs Interactive Brokers

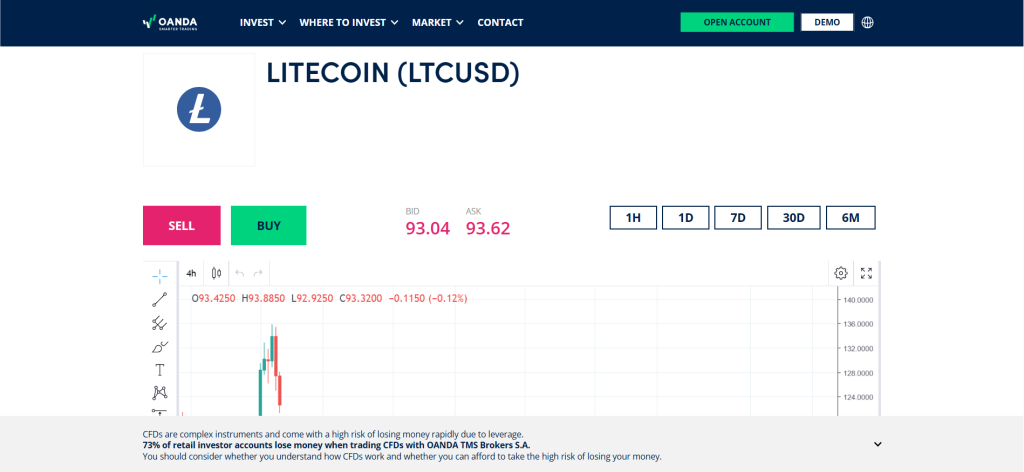

4. OANDA

OANDA is a legit and authorized broker offering Litecoin (LTC) trading with competitive spreads and reliable execution. Traders can access Litecoin through OANDA’s user-friendly web and mobile platforms, all under strong regulatory oversight.

Frequently Asked Questions

Is OANDA an approved broker for Litecoin trading?

Yes, OANDA offers Litecoin trading to eligible clients. In the US, they offer spot crypto trading, including Litecoin, through a partnership with the regulated custodian Paxos Trust Company. Other jurisdictions may offer Litecoin via CFDs.

Which platforms can I use to trade Litecoin with OANDA?

You can trade Litecoin using OANDA’s own proprietary mobile app and OANDA Web platform. Additionally, it is available on TradingView and, in some regions, on MetaTrader (either MT4 or MT5) for CFD trading.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated broker with strong oversight | Limited cryptocurrency selection beyond major coins |

| Competitive spreads and transparent fees | Lower leverage options for crypto trading |

| User-friendly web and mobile platforms | Account verification may take time |

| Secure trading environment with fund protection | Customer support not 24/7 for crypto specific queries |

| Demo accounts and educational resources for beginners | Advanced features may be less suited for professional crypto traders |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐☆☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

OANDA is an approved and reliable broker for Litecoin trading, offering secure platforms, competitive spreads, and educational resources. Its regulation and user-friendly environment make it ideal for both beginner and experienced traders.

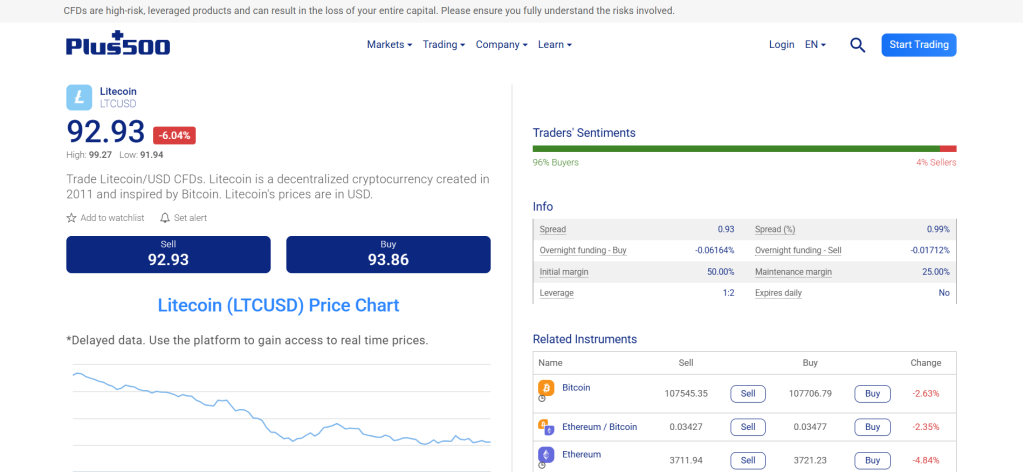

5. Plus500

Plus500 is a regulated broker offering Litecoin (LTC) trading as CFDs (Contracts for Difference). This means you can speculate on Litecoin’s price changes, going long or short, without actually owning the cryptocurrency. You trade using their proprietary web and mobile platforms.

Frequently Asked Questions

Which platforms can I use to trade Litecoin with Plus500?

You can trade Litecoin CFDs on Plus500 using their proprietary WebTrader platform accessible via your web browser, or through the highly-rated Plus500 mobile app for iOS and Android devices.

Can beginners trade Litecoin safely with Plus500?

CFD trading is inherently risky due to leverage. Plus500 is regulated and offers a free demo account for practice, plus risk management tools like Stop Loss orders, which are essential for beginners.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated | Limited to CFD trading, no ownership of actual Litecoin |

| User-friendly web and mobile trading platforms | Limited cryptocurrency selection beyond major coins |

| Access to Litecoin CFDs with transparent pricing | Fees may apply for overnight positions |

| Free demo account for practice trading | Leverage options are restricted in some regions |

| Quick account setup and responsive support | Advanced traders may find tools less comprehensive |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐☆☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐☆☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐☆☆☆ |

Our Insights

Plus500 is a registered and reliable broker for Litecoin CFD trading, known for its user-friendly and secure platforms. The broker’s strong regulation and transparent pricing, combined with beginner-friendly features, make it an excellent choice for both new and experienced crypto traders.

6. eToro

eToro’s user-friendly, multi-asset platform allows traders to buy, sell, or hold Litecoin (LTC). It features transparent pricing, access to over 100 crypto assets, and includes built-in wallet support for eligible users.

Frequently Asked Questions

How can I trade Litecoin on eToro?

To trade Litecoin (LTC) on eToro, first create an account and deposit funds. Then, use the search function to find Litecoin, click “Trade” (or “Invest”), and enter the amount you wish to buy or sell. You can also use CopyTrader to follow expert crypto investors.

Can I store Litecoin safely on eToro?

Yes, you can. eToro provides a secure environment to hold Litecoin directly on its platform. For users who wish to transfer their coins, eToro also offers the separate eToro Money crypto wallet, which provides additional security and control.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated | Higher spreads compared to some crypto exchanges |

| Ability to buy real Litecoin, not just CFDs | Limited advanced charting tools for technical traders |

| User-friendly platform with social trading features | Withdrawal fees apply for some transactions |

| Built-in crypto wallet for secure storage | Customer support not always available 24/7 |

| Transparent pricing and no hidden fees | Social trading may not suit all investor types |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐☆☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

eToro is an authorized and trusted broker for Litecoin trading, offering real crypto ownership, a secure wallet, and social trading tools. Its regulation and easy-to-use platform make it ideal for both beginners and active traders.

7. FP Markets

FP Markets offers Litecoin (LTC) trading through its CFD platform, allowing traders to access this digital asset alongside other cryptocurrencies, forex pairs and commodities. The broker is regulated globally and provides advanced platforms like MetaTrader 4 and 5.

Frequently Asked Questions

Is FP Markets a legit broker for Litecoin trading?

Yes, FP Markets is a legit, multi-regulated broker that offers Litecoin (LTC) trading in the form of Cryptocurrency CFDs. It is overseen by top-tier authorities like ASIC (Australia) and CySEC (Europe), ensuring a safe and transparent trading environment.

What platforms does FP Markets offer for trading Litecoin?

FP Markets offers Litecoin CFD trading on MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView. These platforms are available across desktop, web, and mobile, providing comprehensive tools and flexibility for traders.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and regulated across multiple jurisdictions | Primarily a CFD broker |

| Access to advanced platforms (MT4/MT5/cTrader) and many trading instruments | Demo account limitations |

| Competitive pricing and execution speeds. | Crypto coverage and tools might be less extensive |

| Low minimum deposit levels and wide payment method support | Some user complaints regarding withdrawal issues |

| Strong reputation and positive user reviews for support and service | Some account tiers or regional limitations apply |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

FP Markets is a legit and regulated broker offering Litecoin trading via advanced platforms and broad asset access. While it may lack some crypto-specific features of dedicated exchanges, its strong infrastructure and multi-asset support make it a solid choice for diversified traders.

8. Pepperstone

Pepperstone allows trading of Litecoin (LTC) through cryptocurrency CFDs, enabling speculation on its price without ownership. The broker, regulated across multiple jurisdictions, offers the LTC/USD pair and others on platforms including MetaTrader 4/5 and cTrader.

Frequently Asked Questions

Can I trade actual Litecoin (LTC) on Pepperstone or just CFDs?

Pepperstone only offers Litecoin (LTC) as a Contract for Difference (CFD), not the underlying coin itself. This allows you to speculate on price movement with leverage, without needing a crypto wallet or taking ownership of the actual asset.

What platforms does Pepperstone support for Litecoin trading?

Pepperstone supports Litecoin CFD trading on its own proprietary Pepperstone Platform (web/mobile app), along with third-party software including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and regulated | Only CFD trading of Litecoin is offered |

| Competitive pricing and tight spreads | Some regions have regulatory limitations |

| Multiple trading platforms | Interface issues or platform bugs in specific cases |

| Strong reputation | Withdrawal or deposit methods may attract fees or delays |

| Offers access to a wide range of markets | Leverage and margin conditions vary by region |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Pepperstone is a legal and regulated broker that facilitates Litecoin CFD trading with strong platforms and competitive pricing. While you won’t own the actual Litecoin asset, its infrastructure and reputation make it a solid choice for CFD‑focused traders.

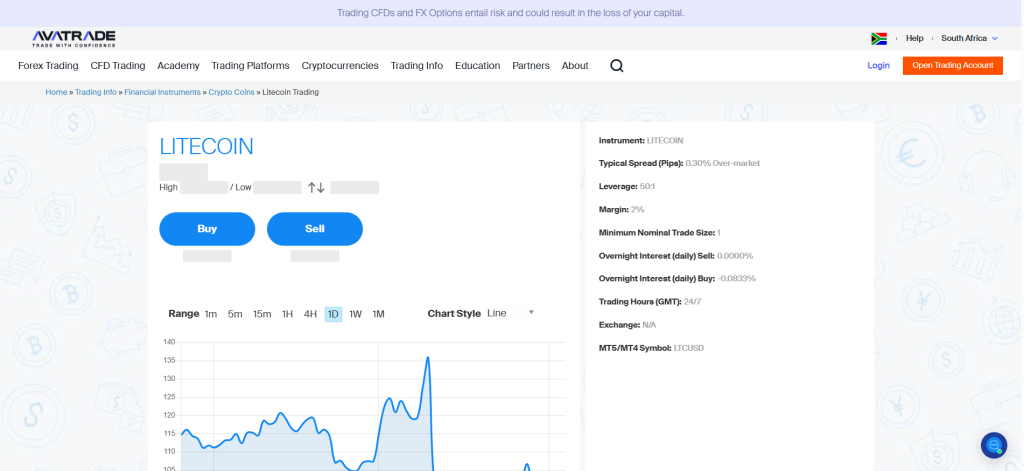

9. AvaTrade

AvaTrade allows trading of Litecoin (LTC) via CFDs, giving traders the ability to speculate on price moves by going both long and short. It offers competitive spreads, regulated account protection, and access via MetaTrader 4/5 and mobile trading apps.

Frequently Asked Questions

Which platforms can I use to trade Litecoin with AvaTrade?

AvaTrade supports Litecoin CFD trading on MetaTrader 4 (MT4), MetaTrader 5 (MT5), and their proprietary platforms, AvaTradeGO (mobile app) and AvaOptions. This provides flexibility for both manual and automated trading.

Can beginners trade Litecoin safely with AvaTrade?

Litecoin CFD trading is risky due to leverage. AvaTrade, as a highly regulated broker, offers essential safety features like Negative Balance Protection, a free demo account, and risk management tools, making it a secure choice for beginners to practice.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated | Only CFD trading is available |

| Competitive spreads and transparent pricing | Limited cryptocurrency selection |

| Multiple platforms including MT4, MT5, and AvaTradeGo | Withdrawal fees may apply in some regions |

| Secure trading environment and fund protection | Customer support may not be 24/7 globally |

| Demo accounts and educational tools for beginners | Advanced traders may find charting tools less comprehensive |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

AvaTrade is an approved and reliable broker for Litecoin CFD trading, offering secure platforms, competitive spreads, and educational resources. Its regulation and beginner-friendly environment make it a solid choice for both new and experienced traders.

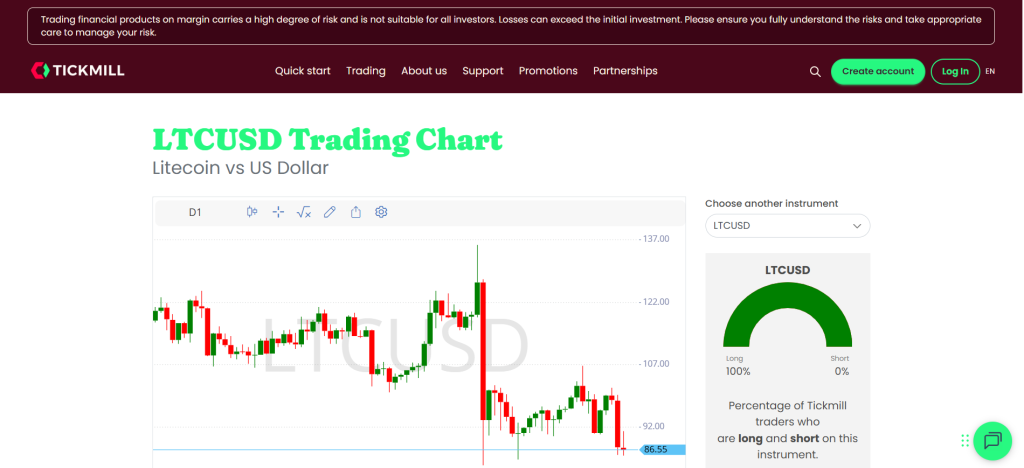

10. Tickmill

Tickmill, a regulated broker, facilitates 24/7 Litecoin (LTC/USD) CFD trading on its MT4/MT5 platforms. It features low spreads (starting around $0.04) and offers leverage up to 1:200 to eligible traders.

Frequently Asked Questions

Can I trade Litecoin with Tickmill?

Yes, you can trade Litecoin (LTC) with Tickmill, but only in the form of a Cryptocurrency CFD (Contract for Difference). This allows you to speculate on its price movements using platforms like MT4 and MT5.

What kind of account support and regulation applies when trading Litecoin with Tickmill?

Tickmill offers Classic and Raw accounts for Litecoin CFDs, which are accessible to retail and professional clients. It is regulated by multiple authorities, including the FCA (UK), CySEC (Cyprus), and FSCA (South Africa).

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated | Trading is via CFDs only |

| Access to Litecoin CFD trading | Not all jurisdictions may allow crypto |

| Competitive cost structure | The minimum deposit may be higher than very low‑budget brokers |

| Strong client fund protection policies | Customer support and crypto‑specific tools may be less tailored |

| Global access | High leverage and volatility mean higher risk |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐⭐ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Tickmill is a registered and well‑regulated broker offering Litecoin CFD trading with strong safety features, competitive costs, and access via MT4/MT5. While you’ll trade derivatives rather than owning Litecoin outright, its regulatory credentials make it a credible choice.

What is a Litecoin Trading Broker?

A Litecoin trading broker facilitates buying, selling, or speculating on the LTC cryptocurrency. They grant access to the crypto market via platforms like MetaTrader 4/5, cTrader, or mobile/web apps, allowing traders to execute trades and manage risk without necessarily owning the physical coin.

Litecoin brokers typically offer:

-

CFD trading: Traders speculate on Litecoin’s price movements without owning the actual coin.

-

Leverage: Allows traders to control larger positions with a smaller amount of capital.

-

Security & Regulation: Legit brokers are regulated by authorities, ensuring client fund protection.

-

Trading tools: Charts, technical indicators, and risk management features.

-

Payment options: Deposits and withdrawals in fiat currencies or sometimes crypto.

Overall, a Litecoin trading broker acts as the middleman between the trader and the cryptocurrency market, providing a secure and regulated environment for trading Litecoin efficiently.

Criteria for Choosing a Litecoin Trading Broker

| Criteria | Description | Importance |

| Regulation & Authorization | Ensure the broker is regulated and authorized by reputable financial authorities to protect your funds. | ⭐⭐⭐⭐⭐ |

| Trading Platform | Look for user-friendly, stable, and feature-rich platforms (e.g., MT4, MT5, cTrader, or proprietary apps). | ⭐⭐⭐⭐☆ |

| Spreads & Fees | Competitive spreads and transparent fees reduce trading costs, enhancing profitability. | ⭐⭐⭐⭐☆ |

| Security | Strong security measures like two factor authentication, encryption, and segregated accounts. | ⭐⭐⭐⭐⭐ |

| Leverage Options | Check if the broker offers suitable leverage while balancing risk and compliance with local regulations. | ⭐⭐⭐☆☆ |

| Customer Support | Reliable and accessible support, ideally 24/7, for fast resolution of trading issues. | ⭐⭐⭐⭐☆ |

| Cryptocurrency Selection | Availability of Litecoin and other crypto assets for diversification. | ⭐⭐⭐☆☆ |

| Deposit & Withdrawal Methods | Variety of payment options with fast processing times and minimal fees. | ⭐⭐⭐⭐☆ |

| Educational Resources | Tutorials, webinars, and demo accounts to help beginners and advanced traders improve skills. | ⭐⭐⭐☆☆ |

| Reputation & Reviews | Positive feedback from other traders and industry recognition indicate reliability. | ⭐⭐⭐⭐☆ |

Top 10 Best Litecoin Trading Brokers – A Direct Comparison

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From how Litecoin trading works to the risks, we provide straightforward answers to help you understand Litecoin and choose the right broker confidently.

Q: Do I need a broker to trade Litecoin? – James M.

A: A cryptocurrency exchange or a broker is typically required to trade Litecoin. Brokers offer access to buy, sell, or speculate on its price using either spot crypto or CFDs. Trading via CFDs allows leverage and speculation on price movements without owning the actual coin, though this involves risk.

Q: What are the main risks of trading Litecoin? – David T.

A: The main risks of trading Litecoin are extreme market volatility leading to rapid price swings and potential for large losses. Other risks include regulatory uncertainty, security risks from hacks, and, if trading CFDs, the magnified risk of leverage.

Q: How does trading Litecoin CFDs work on brokers’ platforms? – Emily R.

A: Litecoin CFDs let you speculate on LTC’s price movement (up or down) without buying the actual coin. You open a position with a small deposit (leverage) and profit/lose based on the difference between the opening and closing price.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Easy Market Access | Leverage Risks |

| Regulated Platforms | Limited Crypto Ownership |

| Leverage Opportunities | Regulatory Restrictions |

| Advanced Trading Tools | Overnight Fees |

| Diverse Asset Options | Volatility Exposure |

You Might also Like:

- MultiBank Group Review

- Swissquote Review

- Interactive Brokers Review

- OANDA Review

- Plus500 Review

- eToro Review

- FP Markets Review

- Pepperstone Review

- AvaTrade Review

- Tickmill Review

In Conclusion

Litecoin trading brokers offer a secure, regulated, and convenient way to trade LTC without owning the coin. While they provide strong tools and leverage, traders must manage volatility and risk carefully to succeed.

Faq

Yes, you can trade Litecoin (LTC) without owning the asset by using Contracts for Difference (CFDs) offered by many forex brokers. CFDs allow you to speculate on the price movement without the need for a crypto wallet.

Yes, the most reliable Litecoin trading brokers are well-regulated by top-tier authorities (FCA, ASIC, CySEC). They offer Litecoin as a CFD (Contract for Difference), which is a regulated financial product, ensuring client fund safety and operational standards.

Litecoin trading is legal in most major jurisdictions, including the US, UK, EU, and Australia. While the specific regulations, licensing, and tax treatment vary significantly by country, outright bans are rare, but some nations do restrict or prohibit it.

The main benefits of using a broker include leverage (for CFDs), regulated security, access to sophisticated platforms (MT4/5), and easy access to other asset classes alongside Litecoin, all from one account.

Yes, brokers charge fees for Litecoin trading. The main fees are the spread (built into the price) and overnight/swap charges for holding leveraged CFD positions past the daily market close. Some brokers also charge a commission per trade.

The minimum deposit for Litecoin trading varies significantly by broker. Many top-tier CFD brokers, offer no minimum deposit. However, some brokers require $10 to $50, while others may set it higher at $250 or more for certain accounts.

Yes, you can use leverage when trading Litecoin (LTC), particularly through CFDs (Contracts for Difference) offered by brokers. Regulatory limits often cap retail crypto leverage low, typically at 2:1, but this still allows you to control a larger position with a smaller deposit.

Yes, you absolutely can! Most major CFD brokers (like OANDA, and AvaTrade) and cryptocurrency exchanges offer dedicated mobile apps. These apps give you full trading functionality, including charts, order execution, and account management, for Litecoin on your smartphone or tablet.

Yes, many Litecoin CFD brokers are very beginner-friendly. They offer intuitive platforms (like proprietary mobile apps), free demo accounts for practice, and strong educational resources. However, beginners must be cautious of the magnified risk that comes with CFD leverage.

Yes, withdrawing profits is usually easy with regulated brokers. They offer quick methods like e-wallets (often instant) or bank transfers (1-5 business days). Ensure your account is fully verified (KYC), as this is the main factor that can cause delays.