City Index Review

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a City Index Account

- Safety and Security

- Trading Platforms and Tools

- Markets available for Trade

- Education and Resources

- Customer Support

- Insights from Real Traders

- City Index vs AvaTrade vs Pepperstone - a Comparison

- Employee Overview of Working for City Index

- Discussions and Forums about City Index

- Customer Reviews and Trust Scores

- Pros and Cons

- In Conclusion

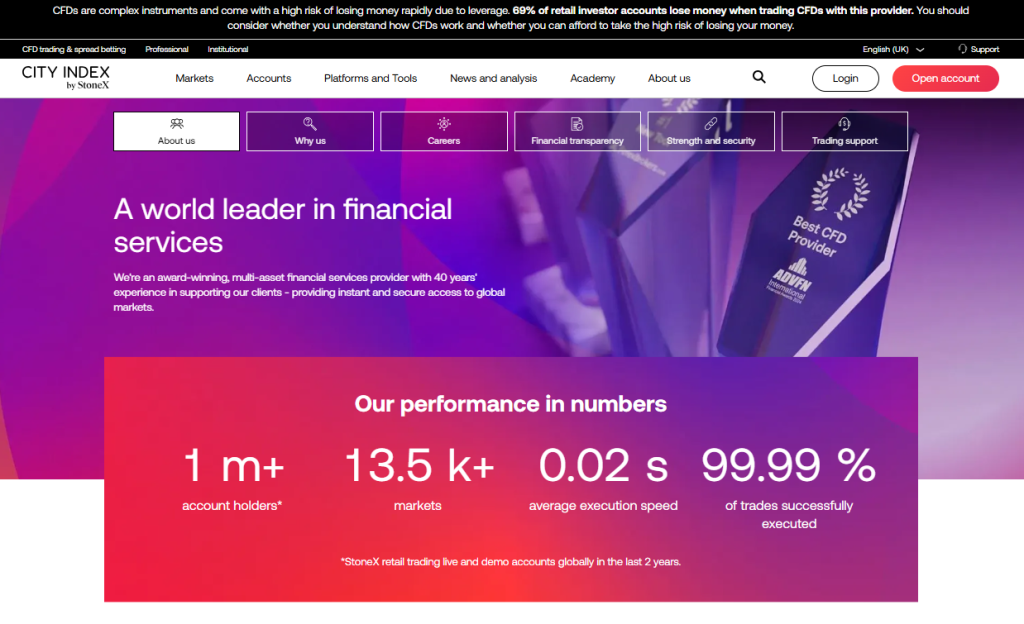

City Index is a well-established multi-asset brokerage with operations across the globe. City Index offers access to modern trading platforms and reasonable pricing with a trust score of 98 out of 99.

★★★★ | Minimum Deposit: $150 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, SFC, FSA, MAS, ASIC Crypto: No |

Overview

City Index is a global leader in multi-asset trading with a 40-year legacy. Backed by 🇺🇸 NASDAQ-listed StoneX Group, the broker provides secure, instant access to 13,500+ markets. Its industry-leading execution speed of 0.02s and a 99.99% trade success rate make it a preferred choice among over 1 million account holders.

Frequently Asked Questions

How old is City Index?

City Index was founded in 1983 in 🇬🇧 London. With over 40 years of experience in the financial markets, it has grown into a trusted trading partner for over one million traders globally, offering award-winning platforms and services across multiple regions.

How many countries does City Index operate in?

City Index maintains a global presence, operating in countries such as 🇬🇧 United Kingdom and 🇦🇺 Australia, with additional international reach through its parent company 🇺🇸 StoneX Group. Its platforms and services are accessible to clients in numerous regulated markets around the world.

Our Insights

City Index delivers a reliable and powerful trading environment backed by decades of expertise. With award-winning tools, lightning-fast execution, and strong financial backing from 🇺🇸 StoneX, it caters to traders seeking performance, stability, and global access in one platform.

★★★★ | Minimum Deposit: $150 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, SFC, FSA, MAS, ASIC Crypto: No |

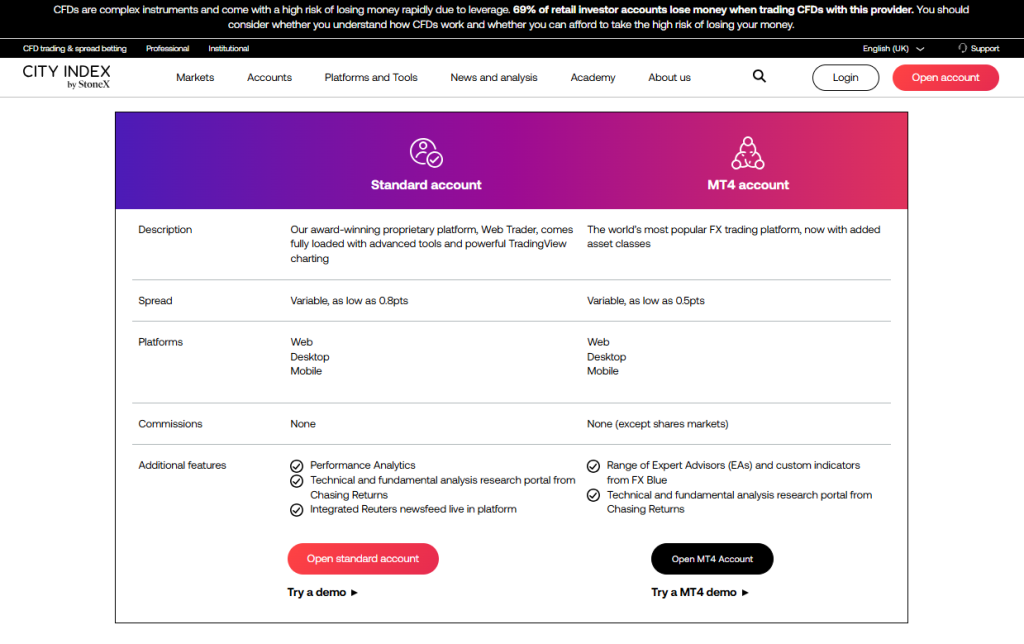

Fees, Spreads, and Commissions

City Index offers a competitive fee structure with tight spreads and minimal commissions. Traders benefit from variable spreads starting as low as 0.5 points and enjoy commission-free trading on most assets. Although some share markets do carry charges, overall pricing remains transparent and cost-efficient for most strategies.

| Account Type | Spread From | Commissions | Platform Access |

| Standard Account | 0.8 pts (variable) | None | Web, Desktop, Mobile |

| MT4 Account | 0.5 pts (variable) | None (except shares) | Web, Desktop, Mobile |

Frequently Asked Questions

Are there any commissions when trading with City Index?

City Index does not charge commissions on most asset classes. However, traders using the MT4 account may encounter commissions when trading shares. This makes it important to understand instrument-specific pricing before executing trades.

What spreads can traders expect on City Index platforms?

City Index offers variable spreads. The standard account features spreads from 0.8 points, while the MT4 account starts as low as 0.5 points. Spreads vary by asset type and market conditions, supporting both active and long-term trading approaches.

Our Insights

City Index provides an appealing fee structure with ultra-low spreads and minimal commissions. The pricing model supports both beginner and advanced traders by combining affordability with full transparency across asset classes.

★★★★ | Minimum Deposit: $150 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, SFC, FSA, MAS, ASIC Crypto: No |

★★★★ | Minimum Deposit: $150 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, SFC, FSA, MAS, ASIC Crypto: No |

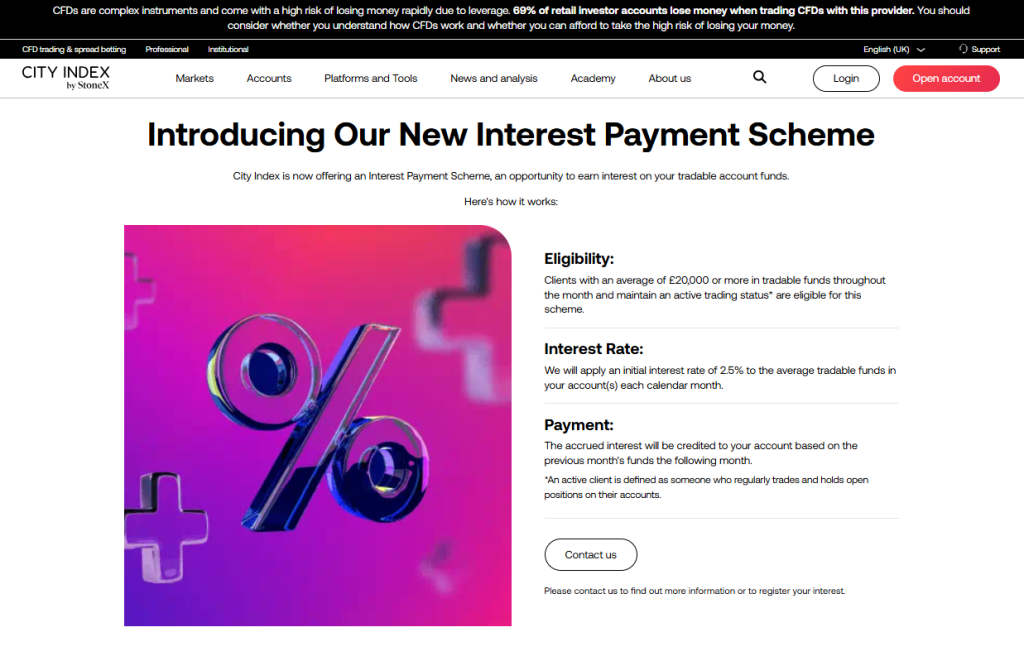

Minimum Deposit and Account Types

City Index offers two main account types: the Standard and MT4 accounts. Each is tailored to different traders’ needs, with no minimum deposit requirement publicly stated. The platform supports both advanced tools and ease of access, allowing users to explore options with full-featured demos before committing real capital.

| Account Type | Key Features | Platforms | Interest Eligibility* |

| Standard Account | Proprietary platform, analytics tools | Web Desktop Mobile | 🇬🇧 clients £20,000+ |

| MT4 Account | Expert Advisors, custom indicators | Web Desktop Mobile | 🇬🇧 clients £20,000+ |

*Interest scheme applies to active traders with average balances above £20,000.

Frequently Asked Questions

What is the minimum deposit required to start trading?

City Index does not specify a fixed minimum deposit. This makes it flexible for new traders to start with what they are comfortable with, while experienced clients can deposit higher amounts to meet eligibility for features like the interest payment scheme.

What account types does City Index offer?

City Index offers two main account types. The Standard Account gives access to its proprietary platform, while the MT4 Account provides the widely used MetaTrader 4. Both include analytics, research tools, and mobile compatibility.

Our Insights

City Index accounts are flexible and packed with tools, offering something for every trader. Whether using the sleek Standard platform or the familiar MT4 interface, users enjoy full market access, customizable features, and the option to earn interest on large balances.

★★★★ | Minimum Deposit: $150 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, SFC, FSA, MAS, ASIC Crypto: No |

How to Open a City Index Account

Opening a City Index account is straightforward, fully digital, and typically completed within one business day. Traders are guided through a secure registration and verification process, followed by platform selection and funding. No minimum deposit is required, making it accessible for all experience levels.

1. Step 1: Registration

Go to the City Index website and click “Open Account.” Fill in your details such as full name, email address, country of residence, contact number, and date of birth.

2. Step 2: Verification

Upload a valid government-issued photo ID (like a passport or driver’s license) along with a recent proof of address document (such as a utility bill or bank statement dated within the last three months).

3. Step 3: Complete Your Trading Profile

Answer a short questionnaire covering your financial background, trading experience, and investment knowledge. Then select your preferred account type, Standard or MT4, and choose your base currency.

4. Step 4: Approval Process

City Index will review the information and documents you’ve submitted. If everything is in order, your account will be approved and activated within one working day.

5. Step 5: Fund Your Account

Once approved, you can deposit funds via debit card, credit card, bank transfer, or supported e-wallets. There is no official minimum deposit, but a starting amount of around £100 or equivalent is generally recommended.

Once funded, you can start trading immediately using City Index’s Web Trader platform, the MetaTrader 4 platform, or the mobile trading app. Let me know if you’d like this formatted for download or added to your broader review.

★★★★ | Minimum Deposit: $150 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, SFC, FSA, MAS, ASIC Crypto: No |

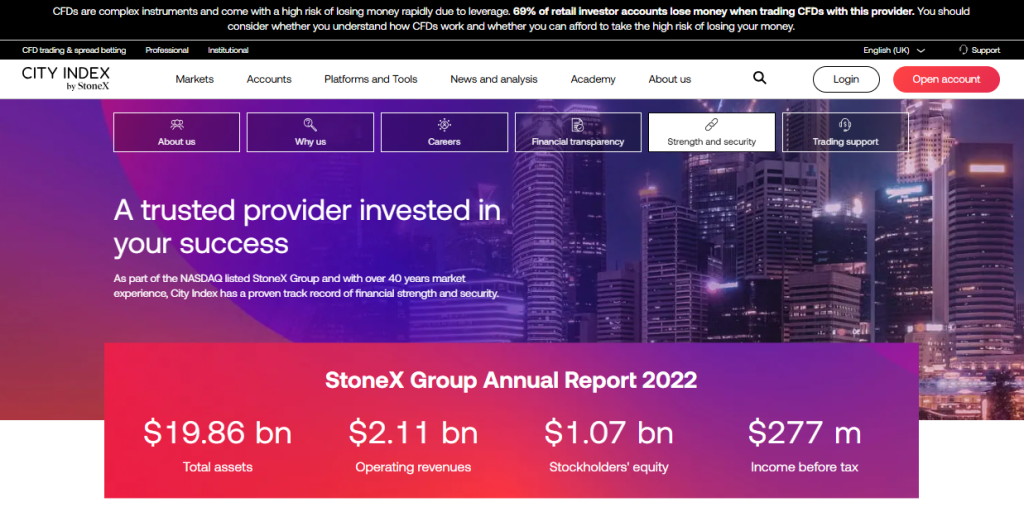

Safety and Security

City Index, part of the 🇺🇸 NASDAQ-listed StoneX Group, brings over 40 years of trading excellence backed by robust financials and full global regulation. With licensed oversight in regions like 🇬🇧 UK (FCA), 🇺🇸 USA (CFTC and NFA), 🇨🇾 Cyprus (CySEC), 🇨🇦 Canada (CIRO), and 🇦🇺 Australia (ASIC), it ensures strong security for client funds and operations.

| Region | Regulator |

| 🇨🇦 Canada | Canadian Investment Regulatory Organization (CIRO) |

| 🇨🇾 Cyprus | Cyprus Securities and Exchange Commission (CySEC) |

| 🇺🇸 USA | National Futures Association (NFA), CFTC |

| 🇰🇾 Cayman Islands | Cayman Islands Monetary Authority (CIMA) |

| 🇬🇧 United Kingdom | Financial Conduct Authority (FCA) |

| 🇭🇰 Hong Kong | Securities and Futures Commission (SFC) |

| 🇯🇵 Japan | Financial Services Agency (FSA) |

| 🇸🇬 Singapore | Monetary Authority of Singapore (MAS) |

| 🇦🇺 Australia | Australian Securities and Investments Commission (ASIC) |

Frequently Asked Questions

Is my money safe with City Index?

Yes. City Index holds client funds in segregated accounts, complies with 🇬🇧 FCA client money rules, and is a member of the FSCS. If the broker fails, clients are eligible for compensation of up to £85,000 under this UK scheme.

What risk management measures does City Index implement?

City Index uses automatic margin monitoring and position closure to help prevent account losses. In addition, it supports strong internal controls, regular audits, and compliance with all regional regulatory standards like 🇬🇧 FCA and 🇺🇸 CFTC requirements.

Our Insights

City Index offers a stable, transparent trading environment backed by nearly a century of institutional knowledge through 🇺🇸 StoneX. With extensive global regulation and client-first fund protection practices, it stands as a strong, secure choice for serious traders worldwide.

★★★★ | Minimum Deposit: $150 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, SFC, FSA, MAS, ASIC Crypto: No |

Trading Platforms and Tools

City Index offers three powerful platforms, Web Trader, TradingView, and MT4, each designed for different trading strategies and preferences. Whether you are a beginner or an experienced trader, you can access rich analytical tools, powerful automation, and an intuitive trading experience tailored to your needs.

| Platform | Markets Covered | Best For | Key Features |

| Web Trader | Indices Shares FX Metals Commodities | Performance Analytics Advanced Charting | Performance Analytics, Reuters News, Trading Central |

| TradingView | Indices Shares FX Metals Commodities | Social Visual Traders | 100K+ community indicators, Pine Script, Custom Tools |

| MetaTrader 4 | Indices FX Metals Commodities | EA Users Automated Strategies | EA Hosting, FX Blue Apps, 30+ Indicators |

Frequently Asked Questions

Which City Index platform is best for new traders?

Web Trader is ideal for new traders due to its intuitive interface, built-in Reuters news, and Performance Analytics. It includes essential tools such as technical indicators and custom watchlists, while remaining easy to navigate on both desktop and mobile.

Can I use automated trading on City Index?

Yes, the MT4 platform supports automated trading via Expert Advisors (EAs). You can also use FX Blue’s suite of tools and download from the MetaTrader Market, making it suitable for advanced strategies and hands-free trading.

Our Verdict

City Index provides a compelling mix of platforms, allowing users to match their trading strategy with the right tools. Whether you’re a visual trader, a data analyst, or a code-savvy EA user, City Index delivers functionality, flexibility, and strong integrated research to support smarter trading.

★★★★ | Minimum Deposit: $150 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, SFC, FSA, MAS, ASIC Crypto: No |

Markets available for Trade

City Index empowers traders with access to over 13,500 global markets, including forex, shares, indices, commodities, bonds, and options. Backed by competitive pricing, lightning-fast execution, and intelligent trading tools, this platform offers a seamless experience across web and mobile, catering to both beginners and experienced investors.

| Feature | Description |

| Markets Offered | 13,500+ Forex Shares Indices, etc. |

| Spread From | 0.5 pts (Forex) 0.4 pts (Indices) |

| Market Data Fees | None |

| Execution Speed | 0.02s avg with 99.99% success rate |

Frequently Asked Questions

What types of markets can I trade on City Index?

City Index offers a diverse range of over 13,500 markets. These include 84+ forex pairs, 4,700+ global shares, 40+ indices, popular commodities, and even government bonds and options—all accessible through spread betting or CFD trading.

Does City Index charge fees for market data?

No, City Index does not charge any market data fees, regardless of the instrument you trade. This feature, along with their price improvement guarantee, ensures competitive pricing and improved value for active and professional traders alike.

Our Insights

City Index is a comprehensive platform with global reach, extensive asset coverage, and advanced trading tools. It’s zero data fees, competitive spreads, and real-time analytics make it ideal for both new and seasoned traders looking to trade with confidence and insight.

★★★★ | Minimum Deposit: $150 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, SFC, FSA, MAS, ASIC Crypto: No |

Education and Resources

City Index provides a comprehensive trading education suite designed for all experience levels. From beginner to advanced traders, you can explore expertly structured lessons, webinars, and glossaries to sharpen your market knowledge. Learn, practice with a demo, and confidently transition to real-market trading.

| Feature | Description |

|---|---|

| Course Levels | Beginner to Advanced |

| Demo Account | £10,000 virtual funds included |

| Popular Topics | Leverage Strategies Market Basics |

| Additional Tools | Glossary Webinars Real-time Lessons |

Frequently Asked Questions

What can I learn from City Index’s trading education platform?

City Index offers a variety of courses—from foundational lessons about financial markets and leverage, to advanced strategies involving patterns and indicators. The structured content helps traders progress naturally from beginner to expert, with useful guides and practical tools to apply concepts in real trading.

Is City Index’s education free, and can I practise risk-free?

Yes, all educational content is available for free. Additionally, City Index provides a risk-free demo account where users can apply what they’ve learned using £10,000 in virtual funds, offering a safe space to practise and test strategies before going live.

Our Insights

City Index combines high-quality educational content with interactive tools to help traders improve confidently. With step-by-step courses, a rich glossary, and a risk-free demo environment, it’s an ideal resource hub for traders looking to enhance their skills at their own pace.

★★★★ | Minimum Deposit: $150 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, SFC, FSA, MAS, ASIC Crypto: No |

Customer Support

Whether you’re new to City Index or an existing client needing assistance, the support team is available 24/5 to help you with all account-related queries. From live chat to email or phone support, City Index ensures you’re never left without answers.

Frequently Asked Questions

What is the fastest way to get help from City Index?

The quickest method is to use the live chat function, available directly through the platform. It connects you instantly with a member of the Client Services team who can answer questions about your account, platform issues, or trading queries.

Is customer service available around the clock?

City Index provides support 24 hours a day, five days a week. You can reach them via phone, email, or chat. Most requests submitted via form are answered within one business day, and common questions are also covered in a detailed FAQ section.

Our Insights

City Index offers strong, multi-tiered support with convenient access through live chat, phone, and email. The 24/5 availability and wide FAQ coverage ensure you’ll receive timely, clear guidance – whether you’re troubleshooting a platform issue or managing your account.

★★★★ | Minimum Deposit: $150 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, SFC, FSA, MAS, ASIC Crypto: No |

Insights from Real Traders

🥇Exceptional Trading Tools and Fast Execution!

I’ve been trading with City Index for over a year, and their platform speed is fantastic. Orders execute almost instantly, and the charting tools are advanced yet easy to use. I also appreciate the seamless mobile app integration when I’m on the go. – James T., United Kingdom

⭐⭐⭐⭐

🥈Reliable and Regulated – Peace of Mind!

Knowing that City Index is regulated by 🇦🇺 ASIC and part of the StoneX Group gives me full confidence. My funds are safe, and customer service is quick and knowledgeable. It’s one of the most secure brokers I’ve worked with. – Sophia M., Australia

⭐⭐⭐⭐⭐

🥉Great Support and Educational Resources.

As someone new to trading, City Index’s academy and tutorials have helped me build a solid foundation. The support team is friendly and responds promptly whenever I have questions. It’s been a smooth and supportive experience all around. – Daniel K., Singapore

⭐⭐⭐⭐

★★★★ | Minimum Deposit: $150 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, SFC, FSA, MAS, ASIC Crypto: No |

City Index vs AvaTrade vs Pepperstone – a Comparison

★★★★ | Minimum Deposit: $150 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, SFC, FSA, MAS, ASIC Crypto: No |

Employee Overview of Working for City Index

Employee reviews show modest satisfaction. Many appreciate a friendly culture and supportive colleagues. However, some highlight limited career progression and frequent shifts in management focus, which may challenge long‑term growth prospects.

| Metric | Score/Comment |

| Overall rating | ~2.7 out of 5 |

| Work‑life balance | Moderate few positives |

| Career development | Limited opportunity reported |

| Culture and colleagues | Generally supportive |

Employees often praise peer collaboration, though long‑term growth and leadership consistency pose concerns.

★★★★ | Minimum Deposit: $150 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, SFC, FSA, MAS, ASIC Crypto: No |

Discussions and Forums about City Index

Online forums reveal a varied trader experience. Some users report chart mismatches and execution quirks compared with other providers. Others commend deposit safety and customer support. The tone is honest and unfiltered, highlighting real‑user tradeoffs.

| Forum Topic | Key Insight |

| Chart accuracy | Some report candles differ from other data |

| Platform reliability | Complaints about outages or slow fills |

| Trust and safety | Many trust deposit and withdrawal safety |

Forum commentary paints a real‑world view of City Index beyond marketing claims.

★★★★ | Minimum Deposit: $150 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, SFC, FSA, MAS, ASIC Crypto: No |

Customer Reviews and Trust Scores

City Index receives mixed customer feedback. Many reviews praise its responsive support and fast payouts, though others identify platform instability and occasional login or withdrawal issues. Trust scores hover around average, suggesting a well‑known broker with both strengths and areas to improve.

| Aspect | Summary |

| Trustpilot rating | ~4.0 out of 5 |

| Common praise | Responsive support, smooth payouts |

| Common complaints | Platform instability, slow login |

Customer reviews reflect both satisfaction with service and occasional frustration over technical reliability.

★★★★ | Minimum Deposit: $150 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, SFC, FSA, MAS, ASIC Crypto: No |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Responsive customer support | Platform instability reported |

| Long industry track record | Login and access frustrations |

| Regulated across major jurisdictions | Career development limited internally |

| Deposit and withdrawal safety | Platform quirks noted by traders |

| Strong charting tools available | Chart accuracy sometimes questioned |

References:

In Conclusion

City Index has established physical offices and support operations in several countries where it holds regulatory licenses and serves clients directly. These include the United Kingdom, Australia, Singapore, and the United Arab Emirates. Additionally, it has regional offices in Shanghai to cover markets in Asia-Pacific. Countries with local offices and support:

- 🇬🇧 United Kingdom

- 🇦🇺 Australia

- 🇸🇬 Singapore

- 🇦🇪 United Arab Emirates

These four are where City Index maintains local presence – including registered offices and regulated entities – with dedicated customer support available. Some regional representation in China (e.g., Shanghai) exists but is not typically counted as a primary country‑level support hub.

Faq

City Index was founded in 1983 and has over 40 years of experience in the financial markets.

You can access over 13,500 global markets, including forex, shares, indices, commodities, bonds, and options.

No fixed minimum deposit is required, making it flexible for traders of all experience levels to get started.

Yes, City Index is regulated in multiple jurisdictions including the UK (FCA), Australia (ASIC), and USA (CFTC). Client funds are held in segregated accounts for added security.

City Index offers three main platforms: Web Trader, TradingView, and MetaTrader 4 (MT4), catering to both beginners and advanced traders.

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a City Index Account

- Safety and Security

- Trading Platforms and Tools

- Markets available for Trade

- Education and Resources

- Customer Support

- Insights from Real Traders

- City Index vs AvaTrade vs Pepperstone - a Comparison

- Employee Overview of Working for City Index

- Discussions and Forums about City Index

- Customer Reviews and Trust Scores

- Pros and Cons

- In Conclusion