GO Markets Review

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a GO Markets Account

- Safety and Security

- Trading Platforms

- Markets available for Trade

- Deposit and Withdrawal

- Deposits and Withdrawals

- Education Hub

- Partnership Program

- Customer Support

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Discussions and Forums About GO Markets

- Employee Overview of Working for GO Markets

- Pros and Cons

- In Conclusion

GO Markets is a trustworthy and highly regulated Forex Broker with a presence in major cities, including Hong Kong and Taipei. GO Markets offers access to competitive spreads and has a trust score of 98 out of 99.

★★★★ | Minimum Deposit: $200 Regulated by: ASIC, FSA, FSC, CySEC Crypto: Yes |

Overview

GO Markets delivers a high-performance trading experience backed by regulation, tight spreads, powerful platforms, and award-winning support. With accounts tailored to both beginners and professionals, the broker offers fast execution, transparent pricing, and access to a diverse range of instruments across Forex, indices, commodities, shares, metals, and cryptocurrencies.

Frequently Asked Questions

What platforms does GO Markets support?

GO Markets supports MetaTrader 4, MetaTrader 5, cTrader, and TradingView. These platforms offer advanced charting, strategy automation, and intuitive interfaces, making them suitable for all types of traders. Additionally, features like cTrader Copy and MetaTrader Genesis enhance trading efficiency.

Is GO Markets regulated and secure?

🇦🇺 Yes, GO Markets is a regulated broker with strict compliance policies. Client funds are held in segregated accounts, offering an additional layer of protection. This ensures transparency and builds confidence among traders worldwide, especially those seeking a reliable and secure trading environment.

Our Insights

GO Markets is an excellent choice for traders seeking tight spreads, strong regulation, and platform flexibility. Whether you are a beginner or a seasoned trader, the broker provides powerful tools, competitive pricing, and top-tier support to help you succeed in the fast-paced CFD market.

★★★★ | Minimum Deposit: $200 Regulated by: ASIC, FSA, FSC, CySEC Crypto: Yes |

Fees, Spreads, and Commissions

GO Markets offers competitive fee structures designed for all trader types. With spreads starting from 0.0 pips and a choice between commission-free and low-commission accounts, traders benefit from flexibility, transparency, and efficient execution. This ensures cost-effective access to global CFD markets.

| Account Type | Spreads (from) | Commission | Leverage |

| GO Plus+ | 0.0 pips | $2.50 per side | Up to 500:1 |

| Standard | 0.8 pips | $0.00 | Up to 500:1 |

Frequently Asked Questions

What is the commission on a GO Plus+ account?

The GO Plus+ account charges a $2.50 commission per side on a standard FX lot. It offers ultra-low spreads from 0.0 pips, making it ideal for high-volume or algorithmic traders seeking precise pricing with minimal slippage.

Are there any hidden fees with GO Markets?

No, GO Markets maintains a transparent pricing model. There are no deposit fees, and all trading costs are clearly outlined based on your chosen account type. However, traders should always check the live spread data for real-time pricing accuracy.

Our Insights

GO Markets provides excellent pricing flexibility through its low-spread Plus+ account and zero-commission Standard account. This clear structure allows traders to control their costs, which is especially valuable for those using expert advisors or placing frequent trades.

★★★★ | Minimum Deposit: $200 Regulated by: ASIC, FSA, FSC, CySEC Crypto: Yes |

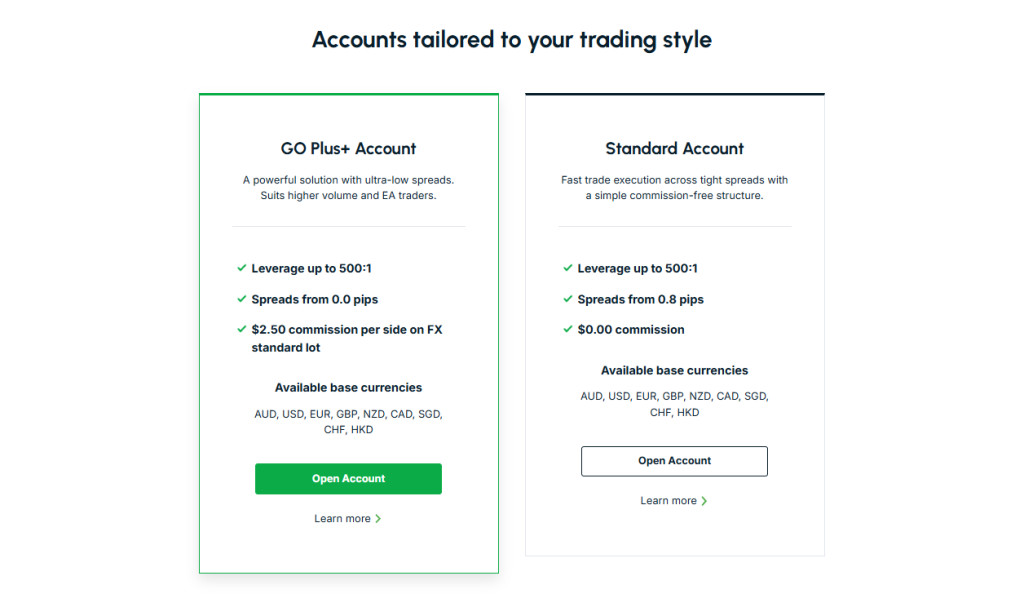

Minimum Deposit and Account Types

GO Markets offers two main account types tailored to different trader profiles. Whether you prefer a commission-free structure or ultra-low spreads with a commission model, both accounts come with strong support, advanced tools, and leverage up to 500:1 across various instruments.

| Account | GO Plus+ Account | Standard Account |

| Spreads | From 0.0 pips | From 0.8 pips |

| Commission | $2.50 per side | $0.00 |

| Leverage | Up to 500:1 | Up to 500:1 |

| Open an Account |

Frequently Asked Questions

What is the minimum deposit for GO Markets accounts?

GO Markets does not enforce a fixed minimum deposit. However, traders are encouraged to fund their accounts based on their trading goals and risk appetite. The absence of a high entry barrier makes it accessible for both new and experienced traders.

Which GO Markets account is better for beginners?

The Standard Account is more suitable for beginners. It offers spreads from 0.8 pips with zero commission, along with easy setup and fast execution. This makes it ideal for traders learning the market while keeping trading costs predictable.

Our Insights

With flexible account choices and no rigid deposit requirement, GO Markets provides accessibility without compromising on quality. Both accounts support advanced tools, allowing traders to grow with their platform as their strategies evolve.

★★★★ | Minimum Deposit: $200 Regulated by: ASIC, FSA, FSC, CySEC Crypto: Yes |

How to Open a GO Markets Account

Follow these steps to open your GO Markets trading account quickly and securely.

1. Step 1: Register Online

Complete the online application form with your country of residence, full name, email, phone, password, and date of birth.

2. Step 2: Provide Personal Details

Enter your residential address, nationality, employment status, and select your preferred trading platform, account type, and base currency.

3. Step 3: Confirm Your Identity

Upload proof of identity (such as a passport or driver’s licence) and proof of address issued within the last few months.

4. Step 4: Complete Financial Questionnaire

Answer questions about your trading experience, income source, and agree to terms and conditions such as the privacy policy and disclosure statement.

5. Step 5: Verify Account

GO Markets usually processes verification within one business day. More complex cases may take longer.

6. Step 6: Fund Your Account

Once verified, deposit via bank transfer, credit or debit card, Skrill, Neteller, or other available methods. There is no fixed minimum deposit, but a recommended starting amount of around AUD 200 may support effective trading.

7. Step 7: Begin Trading

After funding, log into your preferred platform (MT4, MT5, cTrader, or TradingView) and start placing trades.

Note: The entire account opening process is fully digital and typically takes just a few minutes to complete. Most clients receive full platform access within one business day once documents are approved.

★★★★ | Minimum Deposit: $200 Regulated by: ASIC, FSA, FSC, CySEC Crypto: Yes |

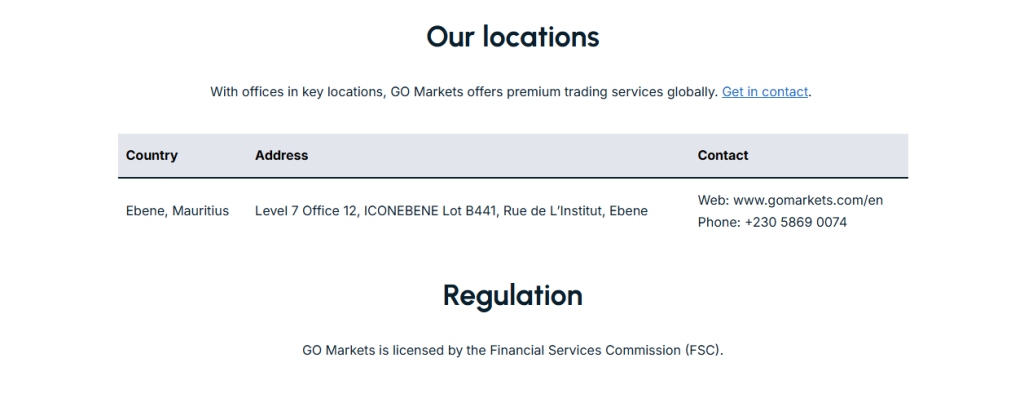

Safety and Security

GO Markets, founded in 🇦🇺 Australia in 2006, has built a solid reputation as a secure, transparent, and regulated CFD broker. With regulation from the 🇲🇺 Financial Services Commission of Mauritius and a values-driven approach, it offers traders confidence through strong compliance, client fund protection, and award-winning reliability.

| Category | Details |

| Founded | 2006 in 🇦🇺 Australia |

| Regulator | 🇲🇺 FSC Mauritius |

| Platforms Supported | MT4 MT5 cTrader TradingView |

| Client Fund Safety | Segregated Accounts |

Frequently Asked Questions

Is GO Markets a regulated broker?

Yes, GO Markets is fully licensed by the 🇲🇺 Financial Services Commission of Mauritius as an Investment Dealer. This ensures that the company operates under strict regulatory guidelines, providing traders with a secure, transparent, and compliant trading environment.

How does GO Markets protect client funds?

GO Markets maintains segregated accounts to ensure that client funds are kept separate from company operating capital. This structure adds an extra layer of safety, giving traders peace of mind while managing their positions across global markets.

Our Insights

GO Markets is a trustworthy and transparent broker for traders who value safety, compliance, and global support. Its long-standing presence, strong regulation, and client-first approach make it a top choice for those prioritizing account security and regulatory oversight.

★★★★ | Minimum Deposit: $200 Regulated by: ASIC, FSA, FSC, CySEC Crypto: Yes |

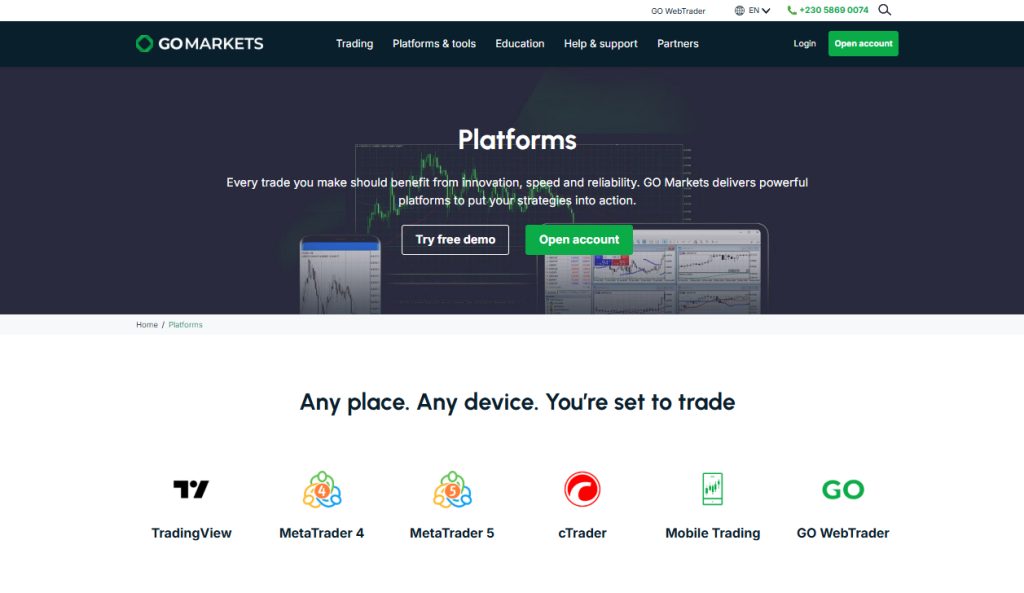

Trading Platforms

GO Markets empowers traders with a suite of industry-leading platforms like MetaTrader 4, MetaTrader 5, TradingView, and cTrader. These tools provide speed, flexibility, and automation for every level of trader. Whether on desktop or mobile, GO Markets delivers reliability and powerful charting across global financial markets.

| Platform | Key Feature | Ideal For | Accessibility |

| MetaTrader 4 | Fast execution EAs | Beginners and experts | Desktop Mobile Web |

| MetaTrader 5 | Algorithmic trading multi-asset | Advanced traders | Desktop Mobile Web |

| TradingView | Live alerts 100+ indicators | Technical analysts | Desktop Browser |

| cTrader | Custom order control | Strategy-based traders | Desktop Mobile |

Frequently Asked Questions

What platforms does GO Markets offer for trading?

GO Markets offers a wide selection of trading platforms, including MetaTrader 4, MetaTrader 5, TradingView, cTrader, GO WebTrader, and mobile apps. Each platform provides unique features like advanced analytics, automation tools, and seamless cross-device trading.

Can I trade on GO Markets using my phone?

Yes, GO Markets provides full-featured mobile trading for both Android and iOS. Traders can access MetaTrader 4 and MetaTrader 5 with real-time charting, fast execution, and all the tools available on desktop for trading CFDs anytime, anywhere.

Our Insights

GO Markets stands out with its range of powerful platforms designed to meet the needs of all traders. With real-time data, automation, and mobility, users can trade efficiently and confidently. This multi-platform approach makes GO Markets a strong contender in today’s competitive brokerage landscape.

★★★★ | Minimum Deposit: $200 Regulated by: ASIC, FSA, FSC, CySEC Crypto: Yes |

Markets available for Trade

GO Markets offers traders access to a wide range of CFDs, including Forex, shares, indices, metals, commodities, and cryptocurrencies. With tight spreads, low pricing, and high leverage, the broker delivers an efficient trading experience supported by advanced tools and trusted platforms for global market exposure.

| Asset Class | Leverage | Available Instruments | Key Benefit |

| Forex | Up to 500:1 | Major Minor Exotic Pairs | 24-hour trading and deep liquidity |

| Shares CFDs | Up to 20:1 | 🇦🇺 ASX 🇺🇸 US 🇭🇰 HKEX Shares | Trade rising and falling markets |

| Cryptocurrency CFDs | Up to 20:1 | Popular crypto pairs | 24/7 access with no crypto wallets |

| Index CFDs | Up to 500:1 | US 500 FTSE 100 CAC 40 ASX 200 | Full market exposure from one trade |

Frequently Asked Questions

What types of trading products does GO Markets offer?

GO Markets provides access to a broad selection of CFDs, including Forex, share CFDs, indices, cryptocurrencies, commodities, metals, ETFs, and treasuries. These instruments allow traders to speculate on price movements without owning the underlying asset, offering flexibility and portfolio diversification.

Can I trade cryptocurrencies with GO Markets?

Yes, GO Markets offers cryptocurrency CFDs, enabling traders to speculate on popular digital assets without needing to own them. With 24/7 access and leverage up to 20:1, you can trade crypto markets with competitive conditions and reliable execution.

Our Insights

GO Markets stands out by offering thousands of CFD products across multiple asset classes, all accessible from one account. Whether you’re trading Forex, indices, or crypto, the platform’s tight spreads and high leverage create opportunity. It’s a strong option for traders seeking diversified exposure.

★★★★ | Minimum Deposit: $200 Regulated by: ASIC, FSA, FSC, CySEC Crypto: Yes |

Deposit and Withdrawal

GO Markets provides fast, secure, and flexible deposit and withdrawal options in multiple currencies. Traders benefit from 0% internal fees, quick processing times, and a streamlined client portal experience. While external bank fees may apply, GO Markets ensures user-friendly account management with top-tier funding convenience.

| Method Availability | Currencies Accepted | Processing Time | Internal Fees |

| Most Payment Methods | AUD, USD, GBP, EUR, AED, SGD, CAD, CHF, HKD, NZD | 1–2 hours (up to 2 days) | None |

| Withdrawals | Same as deposit currency and method | 1–2 business days | None |

Frequently Asked Questions

How fast are deposits processed at GO Markets?

Deposit processing times vary depending on the method, typically taking from one hour up to two business days. Most major currencies, including 🇦🇺 AUD, 🇺🇸 USD, 🇬🇧 GBP, and 🇪🇺 EUR, are accepted, with real-time updates available through the secure Client Portal.

Are there fees for deposits and withdrawals with GO Markets?

GO Markets does not charge internal fees for deposits or withdrawals. However, traders may incur fees from international banks or payment service providers, including intermediary and conversion fees. These external charges are the client’s responsibility and vary by payment method.

Our Insights

GO Markets makes account funding and withdrawals simple and transparent. With no internal fees, multiple currency options, and secure portal access, the process is efficient. While external bank or PSP charges may apply, the overall experience remains smooth, making fund management stress-free for traders.

★★★★ | Minimum Deposit: $200 Regulated by: ASIC, FSA, FSC, CySEC Crypto: Yes |

Deposits and Withdrawals

GO Markets offers a streamlined funding and withdrawal process that prioritises speed and security. Through the Client Portal, traders can deposit and withdraw funds quickly, with most transactions processed within one to two business days. The platform ensures compliance and clarity, with zero internal withdrawal fees.

| Feature | Details | Timeframe | Fees |

| Deposit Methods | Varies by country | Usually 1–2 hours | No internal fees |

| Withdrawal Processing | Back to original funding source | 1–2 business days | External bank fees may apply |

| Currency Compatibility | Multiple global currencies supported | Based on method | Varies by institution |

| Portal Access | Client Portal for secure transactions | 24/7 access | Free to use |

Frequently Asked Questions

How do I deposit or withdraw funds from GO Markets?

Simply log into the secure Client Portal, choose your preferred deposit or withdrawal method, enter the amount, and confirm. Most withdrawals are processed within 1–2 business days. However, availability of payment options varies by country, so check directly within the portal.

Are there any fees involved when withdrawing funds?

GO Markets does not charge internal fees for withdrawals. However, international transfers may incur intermediary or receiving bank charges. Some PSPs or credit card providers may also apply transaction or cash advance fees. These external fees are the trader’s responsibility.

Our Insights

GO Markets delivers a reliable and secure funding system with fast turnaround and transparent rules. The Client Portal makes managing deposits and withdrawals simple, while strict third-party restrictions enhance account safety. Although external fees may apply, the internal process remains cost-free and efficient.

★★★★ | Minimum Deposit: $200 Regulated by: ASIC, FSA, FSC, CySEC Crypto: Yes |

Education Hub

GO Markets delivers a rich and structured education hub, packed with free resources for all experience levels. From Forex basics to advanced trading psychology and platform tutorials, traders gain practical insights. Weekly webinars, strategy guides, and expert analysis help users make smarter decisions in live markets.

| Resource Type | Focus Area | Ideal For | Access Format |

| Courses | Forex Shares Strategy | Beginners to Intermediate | On-demand enrollment |

| Webinars (Inner Circle) | Weekly coaching market analysis | All traders | Live sessions |

| Video Tutorials | MT4 TradingView walkthroughs | Platform users | Video on demand |

| News and Analysis | Market updates trade ideas | Active traders | Written articles |

Frequently Asked Questions

What kind of educational resources does GO Markets offer?

GO Markets provides free access to structured learning through courses, webinars, expert analysis, video tutorials, and podcasts. Topics range from beginner Forex basics to advanced share CFD trading, making it ideal for both new and seasoned traders.

Are the GO Markets courses suitable for beginners?

Yes, courses like “First Steps in Forex” and “Introduction to Forex” are specifically designed for beginners. They offer clear explanations and practical steps to build trading knowledge from the ground up, including strategy, psychology, and platform navigation.

Our Insights

GO Markets excels in trader education by offering a complete suite of free, high-quality learning tools. Whether through live webinars, platform tutorials, or in-depth courses, the broker supports informed trading decisions. This focus on accessible education creates long-term value for traders at every level.

★★★★ | Minimum Deposit: $200 Regulated by: ASIC, FSA, FSC, CySEC Crypto: Yes |

Partnership Program

GO Markets offers a rewarding Referral Program designed for signal providers, educators, and trading service professionals. With a respected global brand, partners enjoy flexible commission terms, real-time payments, and marketing support. The program focuses on new client acquisition while GO Markets handles ongoing client servicing.

| Feature | Details | Benefit | Ideal For |

| Commission Structure | Up to $5 per lot | Scalable earnings | Signal and content providers |

| Dashboard Access | Real-time referral tracking | Full transparency | Active partners |

| Marketing Materials | Banners, tracking cookies | Easy client conversion | Website or blog owners |

| Support | Dedicated account managers | Personalised partnership support | All partners |

Frequently Asked Questions

Who can join the GO Markets Referral Program?

Anyone with a trading audience – such as signal providers, educators, or community leaders—can apply. Whether you manage a website, trading group, or forum, you can earn commissions by referring clients to GO Markets after accepting the Client Referral Agreement and Guidelines.

What are the key benefits of GO Markets’ Referral Program?

Referrers earn up to $5 per lot, benefit from real-time payments, and receive dedicated support. The program includes cookie tracking for accurate commission crediting, marketing banners, and a referral dashboard to monitor activity—all supported by GO Markets’ reputation and long-term industry experience.

Our Insights

GO Markets makes it easy for partners to earn while referring new traders. With multi-level commissions, real-time tracking, and robust support, the program offers value for individuals and businesses alike. It’s a strong option for anyone looking to monetise their trading network with a trusted broker.

★★★★ | Minimum Deposit: $200 Regulated by: ASIC, FSA, FSC, CySEC Crypto: Yes |

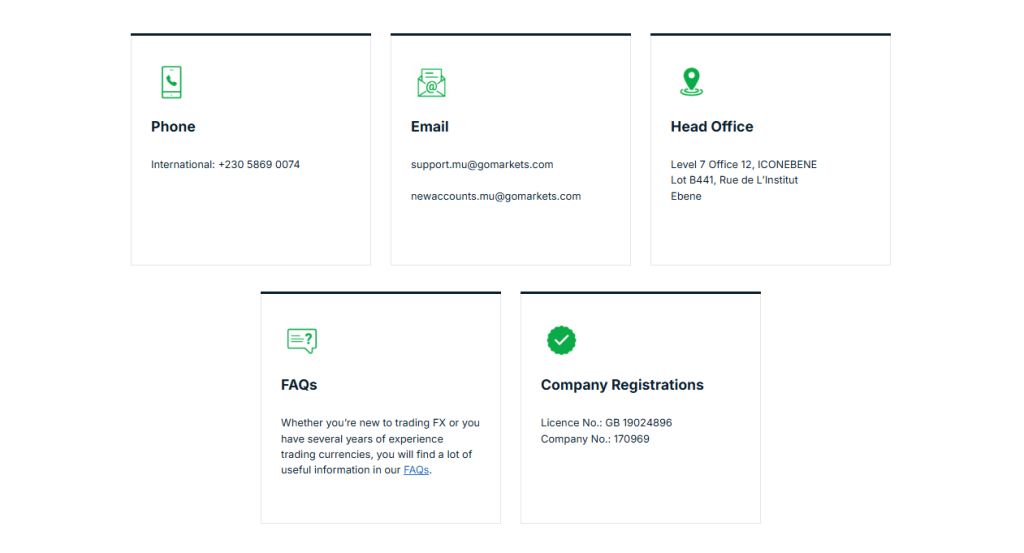

Customer Support

GO Markets provides around-the-clock customer support through a multilingual team based in 🇲🇺 Mauritius. Whether you need help with funding, accounts, platforms, or trading hours, assistance is available via phone or email. The broker’s commitment to responsive, global service enhances the overall trading experience.

Frequently Asked Questions

How can I contact GO Markets support?

You can reach GO Markets by phone at +230 5869 0074 or email at [email protected] for general support and [email protected] for new account queries. Their team is available 24/7 and offers multilingual assistance for clients worldwide.

Where is GO Markets headquartered?

GO Markets is headquartered in 🇲🇺 Mauritius, located at Level 7 Office 12, ICONEBENE, Lot B441, Rue de L’Institut, Ebene. The firm is licensed under Licence No. GB 19024896 operates with a strong regulatory and professional foundation.

Our Insights

GO Markets offers responsive and multilingual customer support that is accessible around the clock. From account setup to platform issues, traders can rely on fast assistance by phone or email. This hands-on support structure makes GO Markets a dependable broker for global clients.

★★★★ | Minimum Deposit: $200 Regulated by: ASIC, FSA, FSC, CySEC Crypto: Yes |

Insights from Real Traders

🥇Seamless Experience and Fast Withdrawals!

I’ve been trading with GO Markets for over a year, and the platform never disappoints. Deposits and withdrawals are fast and reliable, and I love that there are no internal fees. Everything feels professional, and the Client Portal is incredibly easy to use. – Jason

⭐⭐⭐⭐

🥈Powerful Platforms for All Strategies!

GO Markets gives me access to all the platforms I need – MT5, TradingView, and cTrader. Execution is quick, and the spreads are tight. Whether I’m on desktop or mobile, it’s smooth trading all the way. Highly recommended for serious traders who want flexibility. – Priya

⭐⭐⭐⭐⭐

🥉Wide Product Range with Great Support.

What impressed me most is how many products I can trade from just one account – Forex, indices, crypto, metals, and more. The support team is knowledgeable and always available when I have a question. GO Markets is a trustworthy broker that delivers what it promises. – David

⭐⭐⭐⭐

★★★★ | Minimum Deposit: $200 Regulated by: ASIC, FSA, FSC, CySEC Crypto: Yes |

Customer Reviews and Trust Scores

GO Markets receives a mix of feedback, with many praising its tight spreads, support quality, and ease of onboarding. Yet complaints about withdrawal delays and inconsistent experiences also appear, making its overall trust rating nuanced.

| Source | Key Sentiment | Common Themes |

| Trustpilot | Mostly 5-star reviews | Low spreads fast support smooth setup |

| Negative cases | Occasional 1-star reports | Withdrawal delays support response issues |

GO Markets seems reliable for many, though isolated cases highlight areas for improvement.

★★★★ | Minimum Deposit: $200 Regulated by: ASIC, FSA, FSC, CySEC Crypto: Yes |

Discussions and Forums About GO Markets

Online forums and comments express general satisfaction with conditions like spreads and platform choice. However, broader views on review sites urge caution, as some platforms may not reflect the full trustworthiness of ratings.

| Discussion Platform | Tone of Discussion | Key Observations |

| Trustpilot feedback | Mainly positive, occasional critical posts | Users praise service quality |

| Reddit commentary | Skeptical of review credibility | Review manipulation concerns |

Viewers are encouraged to consider multiple information sources before forming a judgment.

★★★★ | Minimum Deposit: $200 Regulated by: ASIC, FSA, FSC, CySEC Crypto: Yes |

Employee Overview of Working for GO Markets

Glassdoor reviews report a mixed employee experience. Some employees highlight excellent pay structures and supportive mentorship. Others warn of inconsistent management, strategic uncertainty, and limited career growth.

| Reviewer Role | Positive Remarks | Negative Remarks |

| Account managers | High commission potential, strong mentorship | No work from home, unclear direction |

| Managers and staff | Good camaraderie and cultural cohesion | Toxic culture, poor communication, limited progression |

There are benefits at GO Markets, although the workplace culture and structure may not suit everyone.

★★★★ | Minimum Deposit: $200 Regulated by: ASIC, FSA, FSC, CySEC Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Tight spreads from 0.0 pips | Commission on GO Plus+ account |

| Regulated in multiple regions | Limited crypto options |

| Fast trade execution | No fixed spread accounts |

| Supports MT4, MT5, cTrader | No Islamic account options |

| Segregated client funds | Limited proprietary tools |

Reference:

In Conclusion

GO Markets operates a global customer support and office network, including corporate and support desks in multiple countries to cater to different regions and compliance jurisdictions.

- 🇦🇺 Australia

- 🇨🇾 Cyprus

- 🇲🇺 Mauritius

- 🇬🇧 United Kingdom

- 🇻🇨 St. Vincent and the Grenadines

These locations offer regional customer support as well as official office presence. GO Markets maintains multilingual service accessible 24/5 via phone, email, and remote support across these hubs.

Faq

They provide a variety of payment alternatives, including bank wire, credit/debit cards, e-wallets, and cryptocurrency wallets. Deposits are normally free, but withdrawal costs vary.

Withdrawals from GO Markets normally take 1 to 3 business days, depending on the client’s withdrawal method.

GO Markets charges typical trading fees like spreads, commissions, and overnight fees. Furthermore, while GO Markets does not charge deposit or withdrawal fees, payment providers might.

The lowest amount necessary to start a trading account with GO Markets is $200, making it affordable to most traders.

Yes, GO Markets provides an unlimited demo account for risk-free trading before investing real money.

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a GO Markets Account

- Safety and Security

- Trading Platforms

- Markets available for Trade

- Deposit and Withdrawal

- Deposits and Withdrawals

- Education Hub

- Partnership Program

- Customer Support

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Discussions and Forums About GO Markets

- Employee Overview of Working for GO Markets

- Pros and Cons

- In Conclusion