Windsor Brokers Review

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a Windsor Markets Account

- Safety and Security

- Trading Platforms and Tools

- Deposit and Withdrawal

- Copy Trading

- Bonus Offers and Promotions

- Partnership Options

- Customer Support

- Customer Reviews and Trust Scores

- Community Discussions and Forums

- Employee Overview: Working at Windsor Brokers

- Insights from Real Traders

- Pros and Cons

- In Conclusion

Windsor Brokers is regarded as a low-risk broker, earning a strong Trust Score of 88/100. It holds licenses from one Tier-1 regulator (highly trusted) and one Tier-2 regulator, along with three Tier-4 regulators. The broker offers three retail trading accounts: Zero, Prime, and VIP Zero.

★★★★ | Minimum Deposit: $50 Regulated by: FSC, CySEC, JSC, FSA, CMA Crypto: Yes |

Overview

Windsor Brokers has built a solid reputation since 1988 by prioritizing investor protection, regulatory compliance, and ethical trading. With a focus on fair and secure market access, it continues to expand globally while maintaining strong capital reserves and advanced trading tools for clients worldwide.

Frequently Asked Questions

What makes Windsor Brokers different from other brokers?

Windsor Brokers stands out due to its strong regulatory compliance, investor-first approach, and more than three decades of experience. It prioritizes security and ethical practices, offering advanced trading tools while maintaining substantial capital reserves for client protection and long-term stability.

Is Windsor Brokers suitable for beginners?

Yes, Windsor Brokers caters to beginners and experienced traders alike. It offers secure trading environments, regulated operations, and diverse account options. However, beginners should note that while the broker provides tools and support, its educational resources are relatively limited compared to competitors.

Our Insights

Windsor Brokers is a reliable choice for traders seeking security and transparency. With decades of experience, strong compliance, and multiple account options, it prioritizes client protection. Though it lacks some advanced features like crypto trading, its stability and ethical approach make it a trustworthy broker.

★★★★ | Minimum Deposit: $50 Regulated by: FSC, CySEC, JSC, FSA, CMA Crypto: Yes |

Fees, Spreads, and Commissions

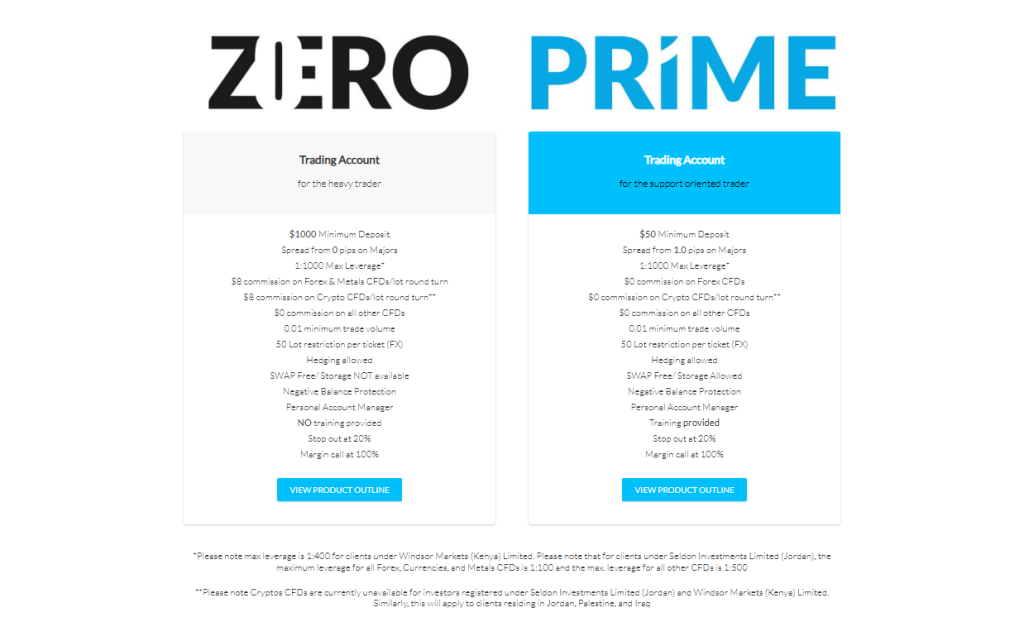

Windsor Brokers offers competitive spreads and clear commission policies. Spreads start from 0 pips for ZERO accounts, while Prime accounts begin at 1.0 pips. Commissions vary by asset class, with Forex and Metals at $8 per lot round turn for ZERO accounts, and zero commission for most CFDs.

Frequently Asked Questions

Does Windsor Brokers charge hidden fees?

No, Windsor Brokers maintains a transparent pricing structure. Commissions apply only to specific assets, such as Forex and Metals in ZERO accounts. Prime accounts operate with no commissions, making them attractive for traders who prefer simpler cost structures with fixed spreads.

Are there swap-free options available?

Yes, swap-free options are available for Prime accounts. However, ZERO accounts do not offer swap-free or storage-free conditions. This distinction allows traders to select an account type based on their trading style and preferences for overnight positions.

Our Insights

Windsor Brokers provides competitive pricing with clear transparency on spreads and commissions. ZERO accounts appeal to active traders with ultra-tight spreads, while Prime accounts suit traders seeking zero commissions. Although some regional restrictions apply, the cost structure remains highly competitive for most retail and professional clients.

★★★★ | Minimum Deposit: $50 Regulated by: FSC, CySEC, JSC, FSA, CMA Crypto: Yes |

Minimum Deposit and Account Types

Windsor Brokers offers two main retail accounts: ZERO and Prime. ZERO accounts require a $1000 minimum deposit, while Prime accounts start at just $50. Traders can enjoy features such as negative balance protection, personal account managers, and leverage up to 1:1000, tailored for different trading needs.

| Account Type | Open an Account | Minimum Deposit | Key Feature | Max Leverage |

| ZERO | 1000 USD | Spreads from 0 pips | 1:1000 | |

| Prime | 50 USD | Zero commissions on Forex | 1:1000 |

Frequently Asked Questions

What is the minimum deposit to start trading?

The minimum deposit depends on the account type. For the ZERO account, it is $1000, making it suitable for professional traders. The Prime account requires just $50, making it an affordable option for beginners and those testing strategies.

Does Windsor Brokers offer VIP accounts?

Yes, the VIP ZERO account is available exclusively to ZERO account holders. It offers perks such as a dedicated personal account manager, one-on-one analyst sessions, and lower commissions. This makes it ideal for high-net-worth individuals or heavy traders seeking premium benefits.

Our Insights

Windsor Brokers’ account options cater to both new and experienced traders. The Prime account offers easy entry with low costs, while ZERO accounts target advanced traders seeking tighter spreads and VIP perks. Despite higher requirements for premium accounts, flexibility makes Windsor suitable for diverse trading needs.

★★★★ | Minimum Deposit: $50 Regulated by: FSC, CySEC, JSC, FSA, CMA Crypto: Yes |

How to Open a Windsor Markets Account

To begin trading with Windsor Brokers, first create your online account and fully verify your identity to access all features, including deposits, trading, and withdrawals.

1. Step 1: Start Registration

Visit the Windsor Markets website and click Open Account. Then select New to Portal and complete the registration form with your name, email, phone, password, and country.

2. Step 2: Confirm Email

Check your inbox and follow the email verification link sent by Windsor to activate your new account.

3. Step 3: Log into Client Portal

Use the credentials you created to log into the client portal and proceed to the Complete Profile or Verify Account section.

4. Step 4: Fill Out Personal Details

Enter your personal information, including residential address, date of birth, and citizenship.

5. Step 5: Complete Investor Profile

Provide your occupation, income, trading experience, intended account type (Prime or Zero), base currency, and desired leverage.

6. Step 6: Accept Terms and Conditions

Read and agree to all client agreements and disclosures before continuing.

7. Step 7: Upload Documents

Submit proof of identity (ID card, passport, or driver’s license) and proof of address (utility bill, bank statement, or residency permit).

Once your documents are approved, your account will be verified. You can then fund your account and begin trading.

★★★★ | Minimum Deposit: $50 Regulated by: FSC, CySEC, JSC, FSA, CMA Crypto: Yes |

Safety and Security

Windsor Brokers demonstrates strong regulatory compliance under multiple jurisdictions, including 🇸🇨 Seychelles (FSA) and 🇯🇴 Jordan (JSC). The firm prioritizes client satisfaction through a transparent complaint-handling process. It ensures timely responses, confidentiality, and regulatory escalation when necessary, reinforcing trust and accountability in its global operations.

| Entity | Country | Regulator | License Type |

| Windsor Brokers International Ltd | 🇸🇨 Seychelles | Financial Services Authority (FSA) | Global Services |

| Seldon Investments Ltd | 🇯🇴 Jordan | JSC | Local Entity |

| Windsor Markets Ltd | 🇰🇪 Kenya | CMA | Local Entity |

| Windsor Global Markets Ltd | 🇻🇬 British Virgin Islands | FSC | International |

Frequently Asked Questions

How does Windsor Brokers handle client complaints?

Windsor Brokers manages complaints through a transparent process. Clients can submit complaints via email, phone, or letter. An acknowledgment with a unique reference number is issued within two working days, and the complaint is investigated thoroughly to achieve a timely and fair resolution.

What happens if Windsor Brokers cannot resolve a complaint?

If Windsor Brokers cannot resolve a complaint or the client disagrees with the outcome, the company provides details of the relevant Regulatory Authority for further escalation. This ensures compliance and offers clients an external review mechanism for unresolved disputes.

Our Insights

Windsor Brokers combines global regulatory supervision with a robust complaint management policy to ensure fairness and transparency. Its structured approach and willingness to escalate unresolved issues to regulators demonstrate integrity, making it a reliable choice for traders who value security and accountability in their broker.

★★★★ | Minimum Deposit: $50 Regulated by: FSC, CySEC, JSC, FSA, CMA Crypto: Yes |

Trading Platforms and Tools

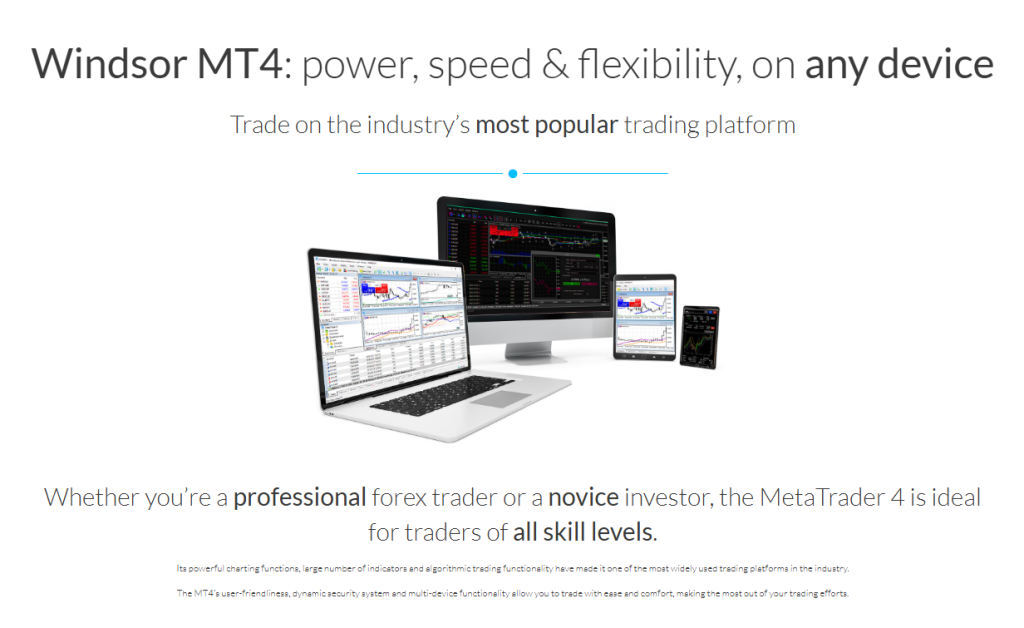

Windsor Brokers delivers MetaTrader 4 (MT4), the world’s most popular trading platform, optimized for desktops, mobile devices, and web browsers. It combines powerful charting tools, algorithmic trading, and real-time execution. Its accessibility across multiple devices ensures traders enjoy seamless trading experiences with speed, security, and comprehensive functionality.

| MT4 Version | Key Features | Device Compatibility | Accessibility |

| MT4 for PC | 50 indicators Expert Advisors 1-click | Windows Desktop | Download |

| MT4 WebTrader | No download 9 timeframes advanced charts | Any OS browser | Web Access |

| MT4 Mobile | 30 indicators full account functionality | Android iOS | App Store/Play |

| MT4 MultiTerminal | Manage 100+ accounts multiple orders | Windows Desktop | Download |

Frequently Asked Questions

Why choose MT4 with Windsor Brokers?

Windsor Brokers offers MT4 for traders who seek reliability and speed. The platform includes 50 technical indicators, advanced charting, one-click trading, and algorithmic capabilities, making it ideal for both beginners and professionals. It also supports multi-device access for maximum convenience and flexibility.

Does Windsor Brokers MT4 support multi-account management?

Yes, Windsor Brokers provides MT4 MultiTerminal for traders managing multiple accounts. It supports over 100 accounts simultaneously, allows one-click execution, offers multiple order types, and ensures real-time management. This feature is particularly useful for fund managers and advanced traders handling multiple portfolios.

Our Insights

Windsor Brokers’ MT4 platform excels in versatility, combining speed, advanced tools, and multi-device compatibility. With features like one-click trading, Expert Advisors, and comprehensive mobile apps, it provides a robust solution for traders of all experience levels seeking efficiency and security in their trading journey.

★★★★ | Minimum Deposit: $50 Regulated by: FSC, CySEC, JSC, FSA, CMA Crypto: Yes |

Deposit and Withdrawal

Windsor Brokers stands as a reputable broker with over three decades of experience, strong regulatory oversight, and a Trust Score of 88/100. It offers diverse account types, competitive spreads, and robust security, making it a preferred choice for traders seeking stability, transparency, and reliable execution worldwide.

| Feature | Details | Regulatory Strength | Account Options |

| Trust Score | 88/100 (Low-Risk) | Tier-1 Tier-2 Tier-4 | Zero Prime VIP Zero |

| Founded | 1988 | 🇸🇨 Seychelles 🇯🇴 Jordan | Multiple Global Offices |

| Platforms | MetaTrader 4 (MT4) | Multi-Jurisdiction | Desktop Mobile Web |

| Minimum Deposit | $50 (Prime) $1000 (ZERO) | Strong Compliance | Swap-Free Available |

Frequently Asked Questions

What makes Windsor Brokers a trusted choice for traders?

Windsor Brokers has operated since 1988, emphasizing regulatory compliance and ethical trading. It holds multiple licenses, including Tier-1 and Tier-2 regulators, ensuring client protection. Its strong capital reserves, secure trading environment, and clear pricing policies further enhance its credibility in global financial markets.

Are Windsor Brokers’ accounts beginner-friendly?

Yes, Windsor Brokers caters to all levels of traders. The Prime account requires only $50, making it ideal for beginners, while advanced traders benefit from ZERO and VIP ZERO accounts with tighter spreads and premium features. However, educational content is less extensive compared to some competitors.

Our Insights

Windsor Brokers offers a well-balanced mix of trust, competitive pricing, and global accessibility. With low-risk ratings, flexible account types, and strong regulatory compliance, it suits both beginners and professionals. While advanced features like crypto trading are absent, its security and ethical practices make it highly reliable.

Copy Trading

Windsor Brokers’ Copy Trading platform bridges the gap between beginners and experts by allowing investors to automatically replicate top traders’ strategies in real time. It’s a streamlined solution for those seeking market exposure without the learning curve, offering flexibility for both strategy providers and followers globally.

| Feature | Details |

| Role Options | Provider Follower |

| Fee Structure | Performance-based up to 50% |

| Control for Followers | Adjustable risk investment |

| Transparency | Public profiles performance data |

| Fee Calculation | High Water Mark (HWM) model |

Frequently Asked Questions

What is WB Copy Trading?

WB Copy Trading is a feature that lets investors (Followers) copy trades from experienced traders (Providers) automatically. Followers benefit from professional strategies without deep market knowledge, while Providers earn fees by sharing successful strategies and helping others trade more effectively.

How are performance fees calculated?

Providers charge Followers a performance fee—up to 50%—based on net profits generated from copied trades. The High Water Mark (HWM) model ensures fees are only charged when profits surpass the previous maximum profit level, aligning Provider incentives with Follower success.

Our Insights

Windsor Brokers’ Copy Trading platform empowers both novice and professional traders. Beginners gain instant access to expert strategies, while Providers can monetize their skills. With flexible controls, real-time execution, and performance-based fees, it offers a transparent and rewarding ecosystem for all types of traders.

★★★★ | Minimum Deposit: $50 Regulated by: FSC, CySEC, JSC, FSA, CMA Crypto: Yes |

Bonus Offers and Promotions

Windsor Brokers offers traders access to global markets with advanced tools, copy trading features, and lucrative reward programs. The broker provides opportunities to earn through trading competitions, loyalty benefits, and promotional bonuses. Traders can start easily and maximize potential gains with innovative programs designed for both beginners and professionals.

| Feature | Details | Conditions | Rewards |

| Copy Trading | Provider Follower roles | Flexible risk settings | Earn or replicate profitable trades |

| Global Championship | $420,000 Prize Pool | Based on ROI in tier | Cash/trading credits monthly |

| Loyalty Program | 4 Tiers Silver to Diamond | Trade to earn points | Up to 2% interest + cash rewards |

| Promotions | $30 Free Account | New clients only | Deposit bonus up to $10,000 |

Frequently Asked Questions

What is Windsor Brokers’ Copy Trading feature?

Copy Trading allows traders to replicate the strategies of top-performing investors in real time. Followers can choose providers, set risk preferences, and copy trades automatically. Providers earn performance fees only on profitable trades, making it a fair and transparent system for both parties.

How does the Global Trading Championship work?

The Global Trading Championship rewards top traders in each loyalty tier and region based on return on investment. Participants trade actively, meet minimum requirements, and compete for monthly prizes from a $60,000 pool. Rewards include a 50-50 split of cash and trading credit.

Our Insights

Windsor Brokers combines competitive trading conditions with innovative features like copy trading, global competitions, and loyalty rewards. These programs add value for traders at all levels, though they require active participation and understanding of the rules to maximize benefits.

★★★★ | Minimum Deposit: $50 Regulated by: FSC, CySEC, JSC, FSA, CMA Crypto: Yes |

Partnership Options

Windsor Brokers offers a powerful partnership program for Affiliates, Introducing Brokers, and White Label partners. With competitive commissions, advanced tools, and transparent payouts, partners can build long-term income streams while promoting a trusted broker with over 35 years of market expertise.

| Program | Key Features | Earnings | Extras |

| Introducing Broker | Custom rebate schemes, personal manager | Up to 60% spread rebates | Weekly payouts, marketing funnels |

| Web Affiliate | CPA/commission plans, affiliate manager | Unlimited potential | High-converting campaigns |

| White Label | Branded platforms, deep liquidity | Revenue sharing | Full API/CRM integrations |

| Refer & Earn | Invite traders partners | Flexible rewards | Real-time tracking, fast withdrawals |

Frequently Asked Questions

What are the benefits of becoming an Introducing Broker with Windsor Brokers?

Introducing Brokers enjoy lucrative lifetime rebate commissions, flexible payout options, and personalized support. They also gain access to marketing resources, advanced analytics, and the WB Partners Portal for performance tracking, making it easy to scale their business effectively.

How does the White Label solution work?

The White Label Program allows individuals or firms to start their brokerage under their brand within three months. Partners receive branded platforms, deep liquidity access, CRM tools, and a complete back-office system for seamless operations.

Our Insights

Windsor Brokers’ partnership programs cater to various business models, offering transparency, flexibility, and strong support. Whether you aim to monetize traffic, leverage a trading network, or launch your brokerage, WB provides the tools and rewards to help partners succeed globally.

★★★★ | Minimum Deposit: $50 Regulated by: FSC, CySEC, JSC, FSA, CMA Crypto: Yes |

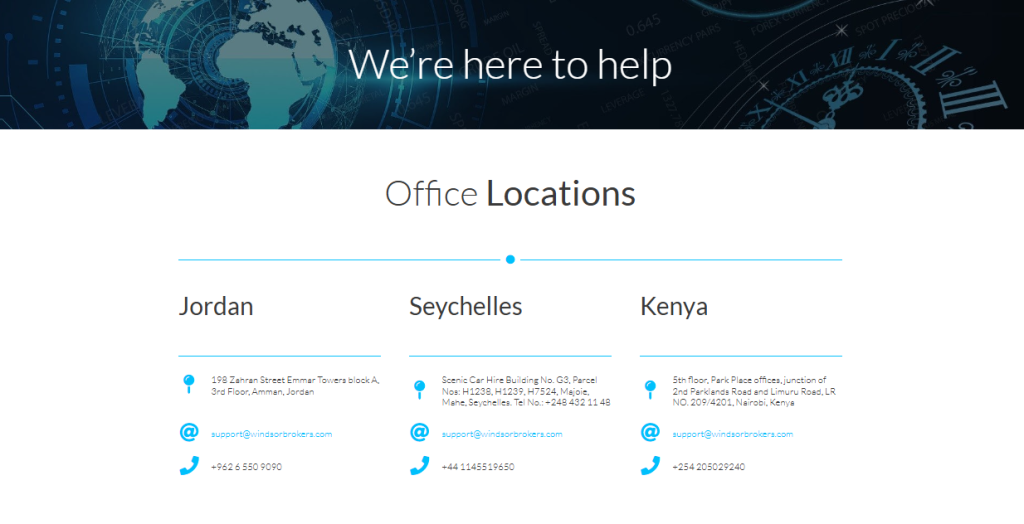

Customer Support

Windsor Brokers ensures global accessibility with offices in Jordan 🇯🇴, Seychelles 🇸🇨, and Kenya 🇰🇪. Clients benefit from multilingual support, multiple communication channels, and a dedicated team committed to assisting traders worldwide.

Frequently Asked Questions

How can I contact Windsor Brokers for support?

You can reach Windsor Brokers by email at [email protected] or call one of the regional office numbers. Additionally, clients can stay connected through the company’s official social media channels for updates and support information.

Does Windsor Brokers have local offices for in-person assistance?

Yes, Windsor Brokers maintains offices in Jordan, Seychelles, and Kenya, providing regional support and easy access for clients who prefer face-to-face assistance with account-related or technical queries.

Our Insights

Windsor Brokers’ global presence and accessible support channels make it easy for traders to connect with the team. With multilingual assistance and physical offices in strategic locations, they ensure a personalized approach for client satisfaction.

★★★★ | Minimum Deposit: $50 Regulated by: FSC, CySEC, JSC, FSA, CMA Crypto: Yes |

Customer Reviews and Trust Scores

Windsor Brokers maintains a respectable reputation, with clients highlighting helpful support and overall reliability. Trust ratings reflect a mix of positive feedback and some concerns regarding withdrawals and bonuses.

| Metric | Value |

| Trustpilot Score | 3.8/5 (98 reviews) |

| Verified Positive | 52% five-star |

| Verified Negative | 38% one-star |

| Company Response Rate | 46% of negative reviews |

| Common Praise | Fast support, helpful staff |

| Frequent Criticism | Withdrawal delays, bonus issues |

Overall, most customers express satisfaction, particularly regarding service quality and platform reliability.

★★★★ | Minimum Deposit: $50 Regulated by: FSC, CySEC, JSC, FSA, CMA Crypto: Yes |

Community Discussions and Forums

Trader forums reflect mixed opinions about Windsor Brokers. Some traders commend the broker for transparent execution and regulated operations, while others note occasional slippage and withdrawal delays.

| Forum/Platform | Key Feedback Summary |

| Forex Peace Army | Discussions on transparency and dispute resolution |

| Wikibit/Forex Wikibit | Reports of reliable MT4 execution with rare issues |

| Digital Cash Palace | Active threads with broker participation and user Q&A |

Overall, community sentiment suggests Windsor Brokers is trusted but requires due diligence from traders.

★★★★ | Minimum Deposit: $50 Regulated by: FSC, CySEC, JSC, FSA, CMA Crypto: Yes |

Employee Overview: Working at Windsor Brokers

Employee reviews highlight a generally positive workplace culture with learning opportunities, though some note challenges in compensation and career advancement.

| Category | Rating (5) | Feedback Highlights |

| Work–Life Balance | 3.0 | Supportive but occasionally demanding |

| Pay/Benefits | 2.6 | Compensation could be improved |

| Job Security/ Advancement | 2.9 | Stable but limited growth opportunities |

| Management | 2.9 | Leadership receives mixed feedback |

| Workplace Culture | 3.2 | Friendly and collaborative environment |

The company fosters stability and a positive work culture, though salary and advancement remain key areas for improvement.

★★★★ | Minimum Deposit: $50 Regulated by: FSC, CySEC, JSC, FSA, CMA Crypto: Yes |

Insights from Real Traders

🥇 Excellent Support and Service!

I’ve been trading with Windsor Brokers for over two years, and the support team has always been quick to respond. My account manager helped me understand advanced tools, and the trading experience feels safe and professional. – Sarah

⭐⭐⭐⭐

🥈 Reliable and Transparent Broker!

After trying multiple brokers, I chose Windsor Brokers for their regulated environment and consistent execution. Deposits and withdrawals have been smooth for me. They prioritize client security and transparency, which gives me confidence. – JR

⭐⭐⭐⭐⭐

🥉 Best for Beginners.

As a beginner, I appreciate Windsor Brokers’ simple account setup and helpful customer service. They explained everything patiently and provided the tools I needed to start trading responsibly. Highly recommended for anyone new to forex. – John

⭐⭐⭐⭐

Pros and Cons

| ✓ Pros | ✕ Cons |

| 30+ years of experience | No cryptocurrency trading |

| Strong regulatory compliance | Limited Tier-1 regulation |

| Multiple account types | No fixed spread accounts |

| Advanced trading tools | Limited educational resources |

| High capital reserves | Regional restrictions apply |

References:

In Conclusion

They have established regional offices to provide dedicated, localised service and support to clients across key markets.

- 🇯🇴 Jordan

- 🇸🇨 Seychelles

- 🇰🇪 Kenya

- 🇧🇿 Belize (headquarters)

These strategic locations ensure that investors benefit from tailored assistance, where local regulations and languages are understood. Let me know if you’d like contact details or operating hours for any of these offices!

Faq

Windsor Brokers is a globally regulated financial services company offering trading in Forex, CFDs on indices, commodities, shares, and other instruments.

Yes, Windsor Brokers operates under multiple regulations including FSC (Seychelles) 🇸🇨, CySEC 🇨🇾, and other local authorities. These licenses ensure compliance with strict financial standards and security for client funds.

The broker primarily offers the MetaTrader 4 (MT4) platform, which is known for its reliability, advanced charting tools, and support for automated trading strategies (Expert Advisors).

Windsor Brokers provides several account types, including Prime, Zero, and VIP accounts, catering to different levels of experience and trading strategies. Each account has specific spreads, commissions, and leverage options.

Yes. Through WB Copy Trading, traders can automatically copy strategies from top-performing providers. Users can participate as Followers or Providers, benefiting from flexible risk management and performance-based fee structures.

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a Windsor Markets Account

- Safety and Security

- Trading Platforms and Tools

- Deposit and Withdrawal

- Copy Trading

- Bonus Offers and Promotions

- Partnership Options

- Customer Support

- Customer Reviews and Trust Scores

- Community Discussions and Forums

- Employee Overview: Working at Windsor Brokers

- Insights from Real Traders

- Pros and Cons

- In Conclusion