10 Best Ethereum Trading Brokers

We have listed the 10 Best Ethereum Trading Brokers offering secure and efficient platforms for buying, selling, and trading Ethereum. These brokers provide competitive spreads, strong regulation, and advanced trading tools, ensuring both beginners and experienced traders can trade Ethereum confidently and effectively.

10 Best Ethereum Trading Brokers (2026)

- MultiBank Group – Overall, The Best Ethereum Trading Broker

- eToro – Automatically copy the trades of successful investors

- Plus500 – Robust risk management tools

- FP Markets – Wide selection of trading platforms

- Pepperstone – Tight spreads and fast execution

- XM – Vast selection of over 1,400 tradable assets

- Interactive Brokers – Low costs including competitive margin rates

- IG – Robust and user-friendly trading platforms

- AvaTrade – AvaSocial platform for copying other traders

- HFM – Accounts offering zero commission

Top 10 Forex Brokers (Globally)

1. MultiBank Group

Multibank Group is a legit Ethereum trading broker offering secure, regulated access to cryptocurrency markets. Traders can buy and sell Ethereum with tight spreads, advanced trading platforms, and robust risk management tools suitable for all experience levels.

Frequently Asked Questions

Is MultiBank Group authorized to offer Ethereum trading?

Yes, MultiBank Group, through its subsidiary MultiBank.io, is authorized to offer Ethereum trading. MultiBank.io is regulated as a Virtual Assets Service Provider (VASP) by the UAE’s Virtual Assets Regulatory Authority (VARA).

What platforms does MultiBank Group offer for Ethereum trading?

MultiBank Group offers Ethereum trading primarily through its dedicated cryptocurrency exchange, MultiBank.io, which is available via a dedicated app and likely a web platform. Additionally, they offer crypto CFDs via the traditional platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), and their proprietary MultiBank-Plus platform.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated | Limited crypto asset selection beyond major coins |

| Tight spreads and low trading costs on Ethereum | Higher minimum deposits than some competitors |

| Supports MetaTrader 4 and 5 platforms | Inactivity fees may apply |

| Offers excellent customer support and education | Limited regional access in certain countries |

| Provides fast and secure transaction processing | No proprietary mobile trading app |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

MultiBank Group is an authorized and trusted Ethereum trading broker offering regulated access, competitive spreads, and powerful trading tools. It’s an excellent choice for traders seeking secure, efficient, and professional crypto trading conditions.

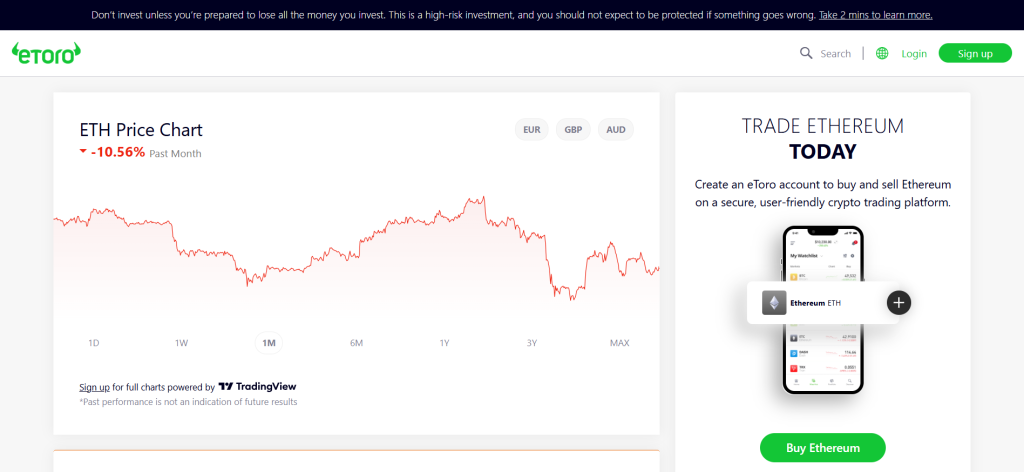

2. eToro

eToro is an authorized Ethereum trading broker known for its user-friendly platform and social trading features. It allows traders to buy, sell, and hold Ethereum securely while benefiting from real-time market data and strong regulatory oversight.

Frequently Asked Questions

Can I trade Ethereum on eToro with small amounts?

Yes, absolutely. eToro allows you to trade Ethereum with a very small investment. The minimum trade size for cryptocurrencies, including Ethereum, is only $10 USD on their platform.

Does eToro offer a crypto wallet for Ethereum?

Yes, eToro offers the eToro Money crypto wallet as a separate app. This secure, multi-crypto wallet fully supports Ethereum (ETH), allowing you to transfer, store, send, and receive your coins.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and regulated | Higher spreads compared to some crypto exchanges |

| Easy-to-use platform with social trading features | Limited control over private keys |

| Allows fractional Ethereum trading | Withdrawal fees may apply |

| Offers a secure built-in crypto wallet | Customer support can be slow at peak times |

| Transparent pricing and real-time market data | Not available in all countries |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐☆☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

eToro is a legit Ethereum trading broker offering a secure, beginner-friendly platform with social trading features. It’s ideal for traders who want regulated Ethereum access, reliable tools, and transparent trading conditions.

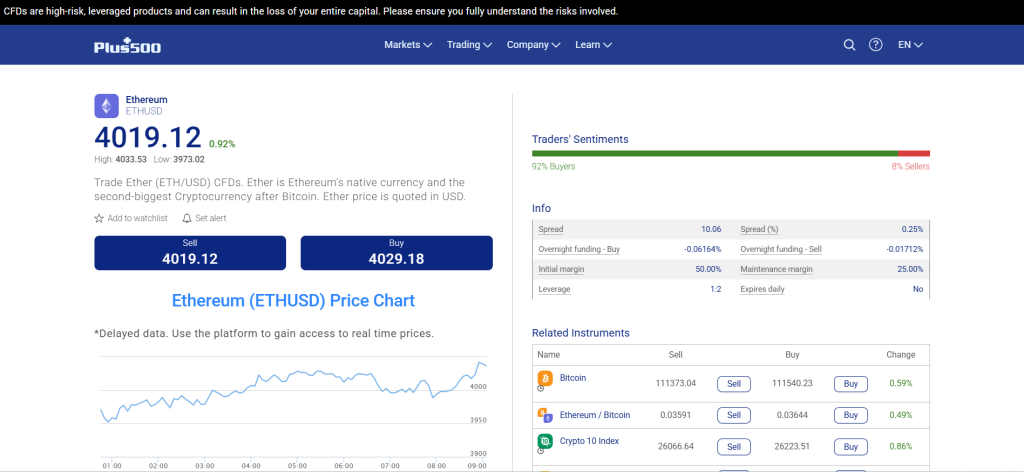

3. Plus500

Plus500 is a legit Ethereum trading broker offering a regulated and user-friendly platform for trading Ethereum CFDs. Traders can speculate on Ethereum price movements with competitive spreads, risk management tools, and real-time market data.

Frequently Asked Questions

Is Plus500 a legal Ethereum trading broker?

Yes, Plus500 is a highly regulated broker. It offers Ethereum trading via Contracts for Difference (CFDs) in many regions, operating legally under licenses from top-tier regulators like the FCA and CySEC.

Does Plus500 provide risk management tools for Ethereum trading?

Yes, Plus500 offers multiple risk management tools for Ethereum CFDs, including Stop Loss and Take Profit orders. Crucially, they also provide a Guaranteed Stop to eliminate slippage risk for a small fee, along with a Trailing Stop.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and regulated | Ethereum trading available only via CFDs |

| User-friendly and intuitive trading platform | Limited educational resources for beginners |

| Competitive spreads on Ethereum CFDs | No social or copy trading features |

| Advanced risk management tools | Withdrawal fees may apply |

| Fast trade execution and real-time quotes | Inactivity fees after prolonged non-use |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐☆☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐☆☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐☆☆☆ |

Our Insights

Plus500 is a legal Ethereum trading broker providing regulated CFD trading with competitive spreads and powerful risk tools. It’s ideal for traders seeking a secure, straightforward platform to speculate on Ethereum price movements confidently.

Top 3 Ethereum Trading Brokers – MultiBank Group vs eToro vs Plus500

4. FP Markets

FP Markets is a legal Ethereum trading broker offering Ethereum CFDs alongside a wide range of cryptocurrency CFDs. Traders enjoy regulated access, tight spreads (from around 0.0 pips), and advanced platforms like MT4, MT5, and cTrader.

Frequently Asked Questions

Can I trade real Ethereum with FP Markets?

FP Markets primarily offers Ethereum CFDs (Contracts for Difference). With CFDs, you speculate on the price movement without owning the actual Ethereum token, so no crypto wallet is required.

Which platforms does FP Markets support for Ethereum trading?

FP Markets supports trading Ethereum CFDs on multiple platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and the charting platform TradingView. These are available on desktop and mobile.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated | Ethereum trading only available via CFDs |

| Tight spreads and low trading costs | Limited cryptocurrency selection |

| Access to MT4, MT5, and cTrader platforms | Inactivity fees may apply |

| Fast trade execution and deep liquidity | Some advanced features suit experienced traders only |

| Excellent customer support and educational resources | Not available in all regions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

FP Markets is an approved Ethereum trading broker offering regulated CFD trading with tight spreads and advanced platforms. It’s ideal for traders seeking fast execution, secure trading environments, and professional-grade trading tools.

5. Pepperstone

Pepperstone is a regulated Ethereum trading broker offering Ethereum CFD trading via platforms like MT4, MT5, and cTrader. Traders benefit from tight spreads, fast execution, and oversight by major authorities such as ASIC, FCA, CySEC, and DFSA.

Frequently Asked Questions

Is Pepperstone a registered Ethereum trading broker?

Yes, Pepperstone is a multi-regulated broker offering Ethereum trading through CFDs (Contracts for Difference). They are licensed by top-tier financial authorities like ASIC, FCA, CySEC, and BaFin, which provides regulatory oversight for their services.

Can I buy real Ethereum through Pepperstone?

No, you cannot buy and own physical Ethereum through Pepperstone. They offer Cryptocurrency CFDs (Contracts for Difference), which allow you to speculate on Ethereum’s price movement without actually owning the underlying digital coin.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated | Ethereum trading only via CFDs |

| Tight spreads and low trading costs | No crypto wallet or direct ownership |

| Access to MT4, MT5, cTrader, and TradingView | Inactivity fees may apply |

| Fast execution with deep liquidity | Limited crypto asset range |

| Excellent customer service and support | Regional restrictions in some countries |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Pepperstone is a registered Ethereum trading broker offering regulated CFD trading with tight spreads and advanced platforms. It’s ideal for traders seeking professional tools, fast execution, and secure Ethereum market access worldwide.

6. XM

XM is a registered Ethereum trading broker offering Ethereum CFDs among its cryptocurrency CFD products. Traders can access ETH 24/7 with leverage (varies by region), through MT4 and MT5 platforms, and benefit from tight spreads and strong regulatory oversight.

Frequently Asked Questions

Is XM an authorized Ethereum trading broker?

Yes, XM is an authorized broker for trading Ethereum CFDs (Contracts for Difference), holding licenses from various global regulators like CySEC, ASIC, and the FSCA, depending on the client’s entity.

Which platforms does XM support for Ethereum trading?

XM supports Ethereum CFD trading primarily through the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These are available for desktop, WebTrader, and their proprietary XM Mobile App.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated | Ethereum trading only through CFDs |

| User-friendly MT4 and MT5 platforms | No crypto wallet or real asset ownership |

| Tight spreads and competitive trading conditions | Limited cryptocurrency selection |

| Negative balance protection | Regional trading restrictions |

| Strong educational resources and multilingual support | Inactivity fees may apply |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

XM is an authorized Ethereum trading broker offering regulated CFD trading through MT4 and MT5. It’s ideal for traders seeking a secure, user-friendly platform with competitive spreads and strong regulatory protection.

7. Interactive Brokers

Interactive Brokers is an authorized broker that offers Ethereum (ETH) trading alongside multiple crypto assets. Users can hold ETH in spot (non-derivative) form, trade 24/7 through its crypto account, and manage all assets – stocks, crypto, derivatives from a single unified interface.

Frequently Asked Questions

Can I buy real Ethereum with Interactive Brokers?

Yes, eligible Interactive Brokers clients can trade spot Ethereum. They partner with Paxos Trust Company or Zero Hash for execution and custody, and some jurisdictions allow crypto withdrawals.

Does Interactive Brokers offer Ethereum trading 24/7?

Yes, Interactive Brokers generally offers Ethereum trading 24/7 through its crypto providers (like Paxos or Zero Hash). This allows clients to trade continuously, though funding the dedicated account may have normal US banking hour restrictions.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and globally regulated | Platform can be complex for beginners |

| Real Ethereum ownership, not CFDs | Minimum deposit may be high for some users |

| 24/7 crypto trading availability | Limited educational content for crypto |

| Low commissions and tight spreads | No social or copy trading features |

| Unified account for stocks, crypto, and other assets | Fees vary by region and account type |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

Interactive Brokers is a legit Ethereum trading broker offering real ETH trading under strict regulation. It’s ideal for traders seeking professional tools, low fees, and seamless integration of crypto with traditional assets.

IG

IG is an authorized Ethereum trading broker offering Ethereum CFDs and, more recently, direct spot crypto trading in certain regions. Traders can go long or short on ETH, trade 24/7 through apps or MT4, and benefit from regulatory oversight and transparent pricing.

Frequently Asked Questions

Is IG a legal Ethereum trading broker?

Yes, IG is a fully regulated broker overseen by top-tier authorities like the FCA and ASIC. They offer Ethereum trading as a CFD in many regions, and in the UK, they also offer spot crypto trading through a registered entity.

What platforms does IG provide for Ethereum trading?

IG offers Ethereum trading on their proprietary IG Trading platform (web and mobile app), and through popular third-party platforms like MetaTrader 4 (MT4) and ProRealTime.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and regulated | Ethereum ownership limited to certain regions |

| Offers Ethereum CFDs with 24/7 market access | Higher minimum deposits in some countries |

| Advanced and intuitive trading platforms | Inactivity and overnight funding fees |

| Transparent fees and competitive spreads | CFD trading involves higher risk |

| Strong research tools and educational support | Limited cryptocurrency range compared to exchanges |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

IG is a legal Ethereum trading broker providing regulated CFD trading with transparent pricing and advanced tools. It’s ideal for traders seeking reliable platforms, 24/7 market access, and strong financial oversight.

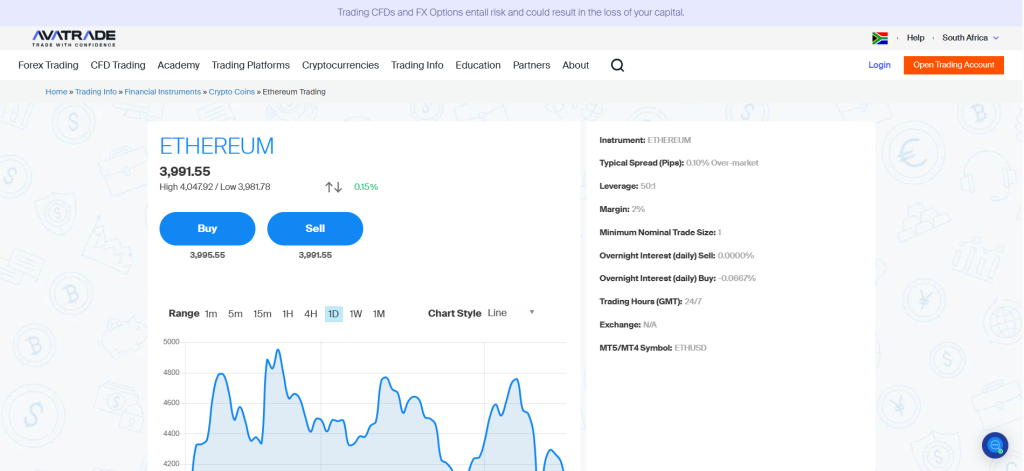

9. AvaTrade

AvaTrade is a legal Ethereum trading broker offering Ethereum CFDs among 1,250+ instruments. Traders benefit from robust regulation, tight spreads, multiple platforms (MT4, MT5, WebTrader, AvaTradeGO), and strong risk-management tools like negative balance protection.

Frequently Asked Questions

Can I buy real Ethereum with AvaTrade?

No, AvaTrade primarily offers Ethereum trading via Contracts for Difference (CFDs), where you speculate on the price movement without actually owning the underlying cryptocurrency. You do not purchase and hold real Ether coins or require a crypto wallet.

Which platforms does AvaTrade support for Ethereum trading?

AvaTrade supports Ethereum CFD trading on its platforms, which include the AvaTrade App, WebTrader, MetaTrader 4 (MT4), MetaTrader 5 (MT5), and their social/copy trading platform, AvaSocial.

Pros and Cons

| ✓ Pros ( | ✕ Cons |

| Approved and regulated | Ethereum trading only via CFDs |

| Wide range of trading platforms including MT4, MT5, and mobile apps | No direct crypto ownership or wallet service |

| Tight spreads and competitive trading conditions | Limited selection of other cryptocurrencies |

| Strong risk management tools, including negative balance protection | Some features better suited for experienced traders |

| Supports multiple account types suitable for beginners and pros | Regional restrictions may apply |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

AvaTrade is an approved Ethereum trading broker offering regulated CFD trading with tight spreads, multiple platforms, and strong risk management. It’s ideal for traders seeking secure and professional Ethereum trading conditions.

10. HFM

HFM is a registered Ethereum trading broker offering secure CFD trading on Ethereum. Traders can access Ethereum 24/7 through platforms like MT4, MT5, WebTrader, and the HFM App, benefiting from tight spreads, leverage, and strong regulatory oversight.

Frequently Asked Questions

Is HFM an authorized Ethereum trading broker?

HFM is a globally regulated broker that offers Ethereum trading through CFDs (Contracts for Difference), not by purchasing the actual Ethereum coins. They are authorized by multiple regulators for financial products including CFDs.

Can I trade real Ethereum with HFM?

HFM primarily offers trading on Cryptocurrency CFDs (Contracts for Difference), including Ethereum, rather than the actual underlying digital coin. This means you speculate on the price movement, but do not own the real Ethereum.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated | Ethereum ownership limited to CFDs |

| Ethereum CFD trading | No direct crypto wallet |

| Advanced trading platforms | Limited cryptocurrency selection |

| 24/7 crypto trading | Regional restrictions |

| Negative balance protection | Inactivity fees |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

HFM is an authorized Ethereum trading broker offering regulated CFD trading with leverage up to 1:50. It provides access to advanced platforms and 24/7 market availability, making it suitable for traders seeking secure and flexible trading options.

What is an Ethereum Trading Broker?

An Ethereum Trading Broker is a financial service provider that allows individuals or institutions to buy, sell, or trade Ethereum (ETH), either directly (owning the cryptocurrency) or indirectly (via CFDs or derivatives).

Here’s a clear breakdown:

-

Direct Trading – The broker allows you to buy and hold actual Ethereum in a secure wallet. You own the underlying asset and can transfer it, sell it, or store it.

-

CFD (Contract for Difference) Trading – The broker lets you speculate on Ethereum’s price movements without owning the cryptocurrency. You can profit from both rising and falling prices.

-

Platforms Provided – Most brokers offer trading via platforms like MetaTrader 4/5, WebTrader, proprietary apps, or web-based dashboards, often with tools for analysis and risk management.

-

Regulation & Safety – Reputable Ethereum brokers are regulated and authorized by financial authorities to ensure secure trading, fund protection, and legal compliance.

-

Other Features – Brokers may offer leverage, educational resources, research tools, and risk management features like stop-loss or negative balance protection.

An Ethereum trading broker acts as the middleman connecting you to the cryptocurrency market, allowing safe, convenient, and regulated access to trade ETH.

Criteria for Choosing an Ethereum Trading Broker

| Criteria | Description | Importance |

| Regulation & Authorization | Ensures the broker is licensed and overseen by recognized financial authorities, protecting traders from fraud and ensuring secure fund management. | ⭐⭐⭐⭐⭐ |

| Trading Fees & Spreads | Covers commissions, spreads, and other costs associated with trading Ethereum. Lower costs improve profitability. | ⭐⭐⭐⭐☆ |

| Trading Platforms | Availability of platforms like MT4, MT5, WebTrader, or proprietary apps with advanced charting, execution speed, and user-friendly interface. | ⭐⭐⭐⭐☆ |

| Security & Fund Protection | Measures such as segregated accounts, SSL encryption, and negative balance protection to safeguard trader funds and personal information. | ⭐⭐⭐⭐⭐ |

| Customer Support | Quality and responsiveness of support through live chat, email, or phone, especially important for urgent trading issues. | ⭐⭐⭐⭐☆ |

| Leverage & Margin Options | Availability of leverage to increase exposure with smaller capital, along with clear margin requirements. | ⭐⭐⭐⭐☆ |

| Cryptocurrency Options | Range of cryptocurrencies available beyond Ethereum; more options allow diversified trading strategies. | ⭐⭐⭐☆☆ |

| Educational Resources | Access to tutorials, webinars, and guides to help beginners and advanced traders improve skills. | ⭐⭐⭐☆☆ |

| Deposit & Withdrawal Methods | Variety and speed of funding options, including bank transfers, credit cards, and crypto wallets. | ⭐⭐⭐⭐☆ |

| User Reviews & Reputation | Feedback from other traders regarding reliability, platform performance, and transparency. | ⭐⭐⭐⭐☆ |

Top 10 Best Zero Spread Forex Brokers – A Direct Comparison

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From how to choose a broker to payment methods, we provide straightforward answers to help you understand Ethereum trading and choose the right broker confidently.

Q: How do I choose a reliable Ethereum trading broker? – David S.

A: Look for brokers regulated by top-tier authorities, offering transparent fees, secure trading platforms, and positive user reviews. Regulation ensures protection of your funds and fair trading conditions.

Q: Can I trade Ethereum with leverage on these brokers? – Mila R.

A: Yes, many brokers offer leveraged Ethereum trading through CFDs. However, leverage amplifies both potential gains and losses, so it’s important to understand the risks and use appropriate risk management.

Q: What payment methods can I use to fund my Ethereum trading account? – John L.

A: Payment methods generally include bank transfers, credit/debit cards, and electronic wallets like Neteller and Skrill. The specific options for funding your Ethereum trading account will depend on your broker and your location.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated Environment | No Asset Ownership |

| Leverage Options | Leverage Risks |

| Advanced Platforms | Fees & Spreads |

| CFD Flexibility | Regulatory Restrictions |

| 24/7 Market Access | Market Volatility |

You Might also Like:

- MultiBank Group Review

- eToro Review

- Plus500 Review

- FP Markets Review

- Pepperstone Review

- XM Review

- Interactive Brokers Review

- IG Review

- AvaTrade Review

- HFM Review

In Conclusion

Ethereum trading brokers provide a secure and convenient way to trade Ethereum through CFDs or direct markets. They offer advanced tools and regulation, but traders should be cautious of volatility, leverage risks, and trading fees.

Faq

It depends on the broker. Many brokers offer Ethereum as a Contract for Difference (CFD), meaning you speculate on the price without owning the actual coins. Some specialized platforms or brokers, however, do allow you to buy and hold the real asset.

Safety varies significantly. Regulated brokers or well-known exchanges are generally safer, offering investor protections. Unregulated platforms carry high risks of fraud, scams, or platform failure, so always choose a broker with proper financial oversight.

Most Ethereum brokers support MetaTrader 4 (MT4), MetaTrader 5 (MT5), WebTrader, or their own proprietary apps.

Yes, Ethereum brokers and exchanges typically operate 24 hours a day, seven days a week, because the cryptocurrency market is global and decentralized, unlike traditional stock markets.

It depends on how you trade. For buying and owning actual Ethereum (spot trading), a crypto wallet is necessary. However, if you trade Contracts for Difference (CFDs) with a broker, you are only speculating on the price and do not need a crypto wallet.

Yes, beginners can trade Ethereum with brokers, especially using platforms that offer Contracts for Difference (CFDs). Many brokers provide user-friendly interfaces, educational resources, demo accounts, and risk management tools suitable for new traders.

Yes, trading Ethereum through regulated brokers is legal in many countries, especially using instruments like CFDs or ETPs. However, legality and specific regulations vary significantly by jurisdiction. Always check local laws.

Yes, absolutely. Most major cryptocurrency exchanges and brokers offer feature-rich mobile apps for both iOS and Android, allowing you to buy, sell, and manage Ethereum on the go.

The minimum deposit varies greatly by platform, with some exchanges allowing cryptocurrency trading, including Ethereum, for as low as $0, while others may require $1 to $50 or more.