We’ve selected the 5 Best Forex Brokers accepting M-Pesa that allow Kenyan traders to fund and withdraw trading accounts easily using mobile money while benefiting from strong regulation and reliable trading conditions. Forex trading in Kenya is legal and regulated by the 🇰🇪 Capital Markets Authority (CMA), ensuring transparency and investor protection. Many brokers support Kenyan Shilling (KES) funding via M-Pesa, helping traders reduce conversion costs and access global forex markets with low entry requirements, competitive spreads, fast execution, and secure multi-asset trading platforms.

5 Best Forex Brokers accepting M-Pesa in Kenya (2026)

- Exness – Overall, the Best Forex Broker accepting M-Pesa in Kenya.

- XM – Accepts M-Pesa deposits for Kenyan clients via local payment partners.

- HFM – Multiple account types suited to different experience levels.

- Pepperstone – Institutional-grade execution with deep liquidity.

- FBS – Very low minimum deposit, accessible to entry-level traders.

10 Best Forex Brokers – Globally

Pros and Cons of Forex Brokers Accepting M-Pesa in Kenya – Immediate Advantages and Disadvantages

Forex brokers accepting M-Pesa make trading more accessible for Kenyan traders by combining mobile money convenience, low entry barriers, and access to global forex markets. When paired with proper regulation and secure platforms, M-Pesa-enabled brokers offer a practical and beginner-friendly trading solution, featuring efficient funding and reduced friction.

1. Exness

Exness operates as a 🇰🇪 CMA-regulated forex broker that actively serves Kenyan traders through a locally authorised entity. The broker combines strong regulatory oversight, instant M-Pesa funding, and competitive trading conditions, giving Kenyan traders secure access to global forex markets with low entry requirements and fast execution.

| Minimum Deposit: $1 Regulated by: CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA Crypto: Yes | |

Frequently Asked Questions

Is Exness regulated and authorised to operate in Kenya?

Yes. Exness holds official authorisation from the 🇰🇪 Capital Markets Authority through its Kenyan entity. This approval allows Exness to legally offer forex trading services to Kenyan residents under local regulatory supervision, transparency standards, and investor protection rules.

Does Exness accept Kenyan traders and support M-Pesa funding?

Yes. Exness actively accepts traders from 🇰🇪 Kenya and supports M-Pesa deposits and withdrawals. Kenyan traders can fund accounts locally, reduce transaction friction, and access live forex markets quickly without relying on international bank transfers.

| Minimum Deposit: $1 Regulated by: CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA Crypto: Yes | |

Pros and Cons

Our Insights

Exness stands out as one of the strongest forex brokers for Kenyan traders due to its 🇰🇪 CMA regulation, instant M-Pesa funding, and very low minimum deposit requirements. Its blend of local authorisation and global trading infrastructure makes it a reliable and accessible choice for all experience levels.

2. XM

XM accepts forex traders from 🇰🇪 Kenya under its global regulatory licences but does not hold direct authorisation from the 🇰🇪 Capital Markets Authority (CMA). Kenyan clients trade under XM’s international entities with strong oversight from respected regulators and benefit from M-Pesa funding support for deposits and withdrawals.

| Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). | |

Frequently Asked Questions

Is XM regulated or authorised in Kenya?

No. XM is not directly regulated or authorised by the 🇰🇪 Capital Markets Authority. Kenyan traders access XM under its international licences, typically through XM Global Limited, regulated by the Financial Services Commission of Belize and other international regulators.

Can Kenyan traders use XM and fund accounts with M-Pesa?

Yes. Kenyan traders can open accounts with XM and use M-Pesa for deposits and withdrawals via supported local payment methods. This provides easy local funding and quicker access to trading capital for the Forex and CFD markets.

| Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). | |

Pros and Cons

Our Insights

XM serves Kenyan forex traders with a globally regulated offering and convenient M-Pesa funding options, but does not carry local 🇰🇪 CMA authorisation. Its international oversight, low minimum deposits, and solid execution make it accessible, while traders should remain aware of the regulatory distinction.

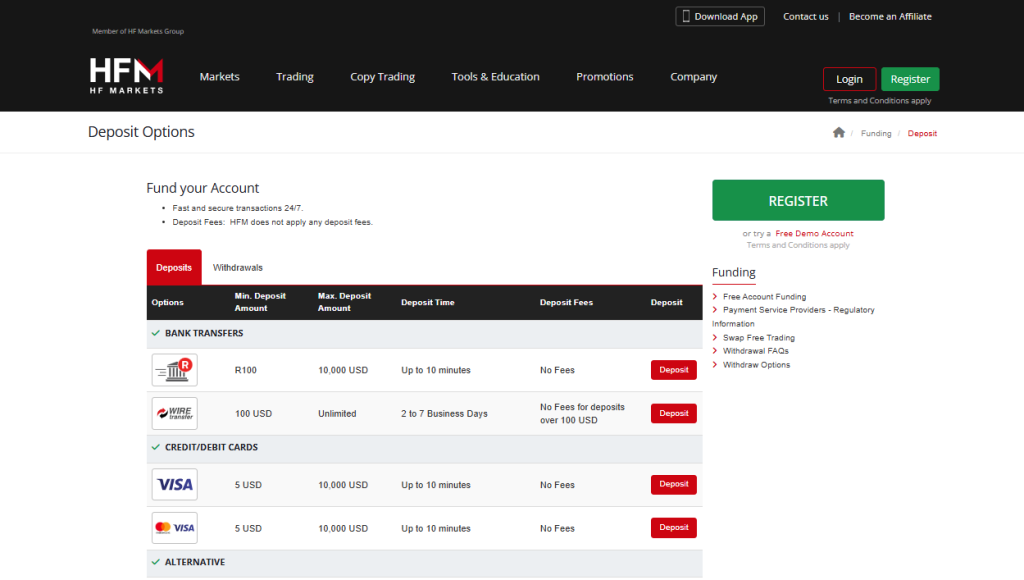

3. HFM

HFM operates as a regulated forex broker that accepts traders from 🇰🇪 Kenya and holds authorisation from multiple respected regulators, including the 🇰🇪 Capital Markets Authority. The broker supports M‑Pesa funding, offers varied account types, and delivers competitive spreads and flexible leverage for Kenyan traders.

| Minimum Deposit: $0 Regulated by: FSCA, FSA, FCA, FSC, CMA Crypto: Yes | |

Frequently Asked Questions

Is HFM regulated or authorised to operate in Kenya?

Yes. HFM holds a regulation from the 🇰🇪 Capital Markets Authority, allowing it to legally offer forex services to Kenyan traders. It also maintains licences from other respected authorities, which reinforces compliance standards and investor protection for Kenyan clients.

Can Kenyan traders use HFM and fund accounts with M‑Pesa?

Yes. Kenyan traders can open accounts with HFM and use M‑Pesa for deposits and withdrawals. This local mobile funding option provides fast transactions and easier access to live trading capital without relying solely on bank transfers.

| Minimum Deposit: $0 Regulated by: FSCA, FSA, FCA, FSC, CMA Crypto: Yes | |

Pros and Cons

Our Insights

HFM stands out for Kenyan traders thanks to its 🇰🇪 CMA regulation, broad instrument range, and M‑Pesa funding support. Its strong compliance, flexible leverage, and varied account options make it a solid choice for beginner and experienced forex traders in Kenya.

Top 3 Forex Brokers accepting M-Pesa – Head to Head Comparison

4. Pepperstone

Pepperstone accepts forex traders from 🇰🇪 Kenya and operates with multiple global licences, including local authorisation from the 🇰🇪 Capital Markets Authority (CMA). Kenyan clients trade under Pepperstone Markets Kenya Limited with access to competitive platforms and M-Pesa funding, where supported by local payment channels.

| Minimum Deposit: $200 Regulated by: ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB Crypto: Yes | |

Frequently Asked Questions

Is Pepperstone regulated or authorised in Kenya?

Yes. Pepperstone is authorised by the 🇰🇪 Capital Markets Authority as Pepperstone Markets Kenya Limited, giving Kenyan traders access to local regulation. The broker also holds licences from other respected authorities, adding layers of oversight and compliance.

Can Kenyan traders use Pepperstone and fund accounts with M-Pesa?

Yes. Kenyan traders can open accounts with Pepperstone and use M-Pesa for deposits and withdrawals, where the local payment integration is available. This provides fast and convenient local funding alongside global transfer methods.

| Minimum Deposit: $200 Regulated by: ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB Crypto: Yes | |

Pros and Cons

Our Insights

Pepperstone serves Kenyan traders with both local (🇰🇪 CMA) and global regulation, making it a legally approved broker in Kenya. Combined with M-Pesa funding options and strong execution conditions, Pepperstone offers a secure and accessible environment for forex and CFD trading.

5. FBS

FBS accepts forex traders from 🇰🇪 Kenya but does not hold direct authorisation from the 🇰🇪 Capital Markets Authority (CMA). It operates under reputable international regulators and supports M-Pesa deposits and withdrawals, giving Kenyan traders convenient local funding and access to global forex markets.

| Minimum Deposit: $5 Regulated by: FSC, CySEC, ASIC Crypto: Yes | |

Frequently Asked Questions

Is FBS regulated or authorised in Kenya?

No. FBS does not hold a licence from the 🇰🇪 CMA. Instead, it serves Kenyan traders under international regulatory frameworks, including licences from bodies like the International Financial Services Commission (IFSC) and the Cyprus Securities and Exchange Commission (CySEC).

Can Kenyan traders use FBS and fund accounts with M-Pesa?

Yes. Kenyan traders can open live trading accounts with FBS and use M-Pesa for deposits and withdrawals. This local mobile money funding makes it faster and more convenient to move capital into trading accounts.

| Minimum Deposit: $5 Regulated by: FSC, CySEC, ASIC Crypto: Yes | |

Pros and Cons

Our Insights

FBS provides Kenyan traders with low entry requirements, high leverage, and M-Pesa support, but it lacks direct 🇰🇪 CMA regulation. Its international licences ensure basic oversight, yet traders should understand the regulatory differences and exercise proper risk management.

5 Best Forex Brokers accepting M-Pesa – Leaders Face Off

The Best Forex Brokers Accepting M-Pesa in Kenya – Quick Overview

Kenyan traders can access global forex markets with brokers that accept M-Pesa funding, allowing fast, convenient deposits and withdrawals in local currency. The top brokers offer competitive spreads, low minimum deposits, multiple platforms, and strong international or 🇰🇪 CMA regulation. P

Popular choices include Exness, XM, HFM, Pepperstone, and FBS, each providing beginner-friendly options and secure trading environments.

Pros and Cons of Trading with Forex Brokers Accepting M-Pesa

You might also like:

In Conclusion

M-Pesa-enabled brokers simplify funding for Kenyan traders, reducing friction and currency conversion costs. These brokers combine regulatory oversight, accessible account types, and reliable platforms, making forex trading practical and low-risk for both beginners and experienced traders in Kenya.