We’ve selected the 5 Best Low Minimum Deposit Forex Brokers in Kenya that allow traders to start with minimal capital while still benefiting from strong regulation and reliable trading conditions. Forex trading in Kenya is legal and regulated by the 🇰🇪 Capital Markets Authority (CMA), ensuring transparency and investor protection. Many brokers support the Kenyan Shilling (KES), enabling traders to fund accounts locally, reduce conversion costs, and access global forex markets with low entry requirements, competitive spreads, fast execution, and secure multi-asset platforms.

5 Best Low Minimum Deposit Forex Brokers in Kenya (2026)

- FBS – Overall, the Best Low Minimum Deposit Forex Broker (Kenya).

- JustMarkets – Low minimum deposit from 10 USD/KES 1,500.

- XM – Accepts M-Pesa payments in Kenya.

- HFM – 🇰🇪 CMA-regulated, offering local oversight.

- FXTM – Strong educational resources focused on Kenyan Traders.

10 Best Forex Brokers – Globally

Pros and Cons of Low Minimum Deposit Forex Brokers in Kenya – Immediate Advantages and Disadvantages

Low minimum deposit forex brokers lower the entry barrier for Kenyan traders by allowing participation in global markets with minimal capital. When combined with regulation and secure platforms, these brokers offer a practical, beginner-friendly way to trade forex while managing risk and gaining real-market experience.

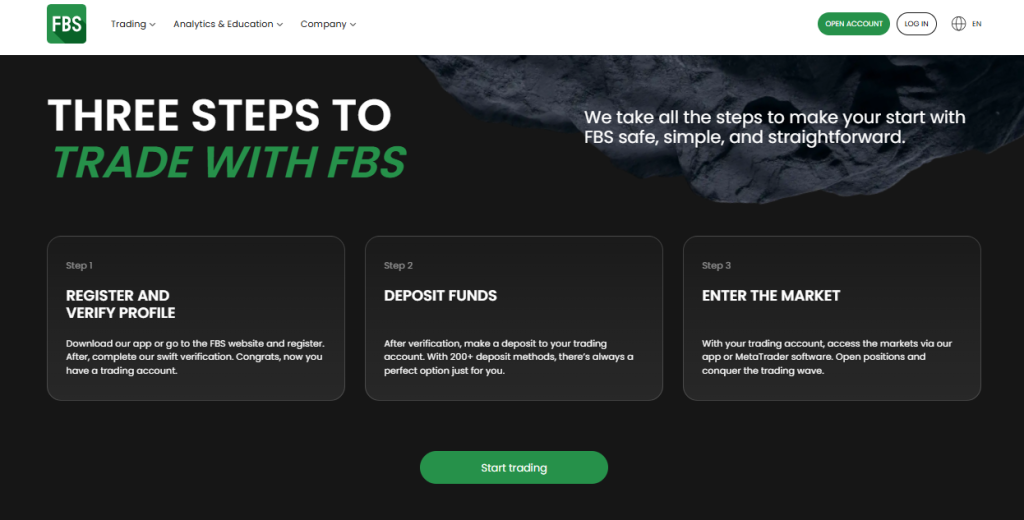

1. FBS

FBS is not regulated by the 🇰🇪 Capital Markets Authority (CMA), but it accepts traders from Kenya under international regulation. It operates legally through reputable global authorities and provides Kenyan traders access to forex markets with low minimum deposits and local funding options.

| Minimum Deposit: $5 Regulated by: FSC, CySEC, ASIC Crypto: Yes | |

Frequently Asked Questions

Is FBS legally accessible to traders in Kenya?

Yes. FBS allows Kenyan traders to open live trading accounts under its international regulation, even though it does not hold a local 🇰🇪 CMA licence. Kenyan users can trade safely under these global frameworks.

Can Kenyan traders fund accounts easily with FBS?

Yes. FBS supports funding methods popular in Kenya, including M-Pesa, making deposits and withdrawals convenient for local users.

| Minimum Deposit: $5 Regulated by: FSC, CySEC, ASIC Crypto: Yes | |

Pros and Cons

Our Insights

FBS is a viable choice for Kenyan traders who want low entry costs and access to global markets. It offers reliable platforms and local payment support, though it lacks direct 🇰🇪 CMA regulation, which means local dispute resolution is not provided.

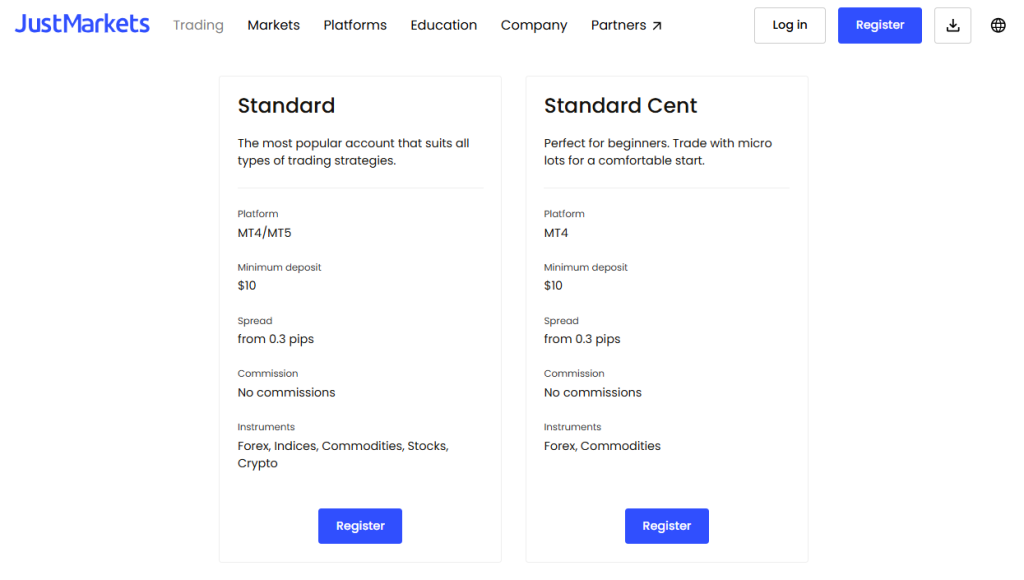

2. JustMarkets

JustMarkets welcomes traders from Kenya even though it does not hold a 🇰🇪 Capital Markets Authority (CMA) licence. It operates under well-known international regulations and offers Kenyan users access to forex and CFD markets with competitive conditions and a low minimum deposit.

| Minimum Deposit: $10 Regulated by: FSA, CySEC, FSCA, FSC Crypto: Yes | |

Frequently Asked Questions

Is JustMarkets legally accessible to traders in Kenya?

Yes. JustMarkets accepts Kenyan traders and provides regulated access through its international licences, even though it does not hold a local 🇰🇪 CMA licence. Kenyan users can legally open and manage trading accounts under this global framework.

Can Kenyan traders fund and trade easily with JustMarkets?

Yes. JustMarkets supports local payment methods, including M-Pesa, making deposits and withdrawals straightforward for Kenyan users, with low minimum funding requirements and easy account setup.

| Minimum Deposit: $10 Regulated by: FSA, CySEC, FSCA, FSC Crypto: Yes | |

Pros and Cons

Our Insights

JustMarkets offers a practical option for Kenyan traders seeking a reliable broker with a low minimum deposit and reputable international regulation. It delivers competitive trading tools and local payment support, though it lacks direct 🇰🇪 CMA oversight.

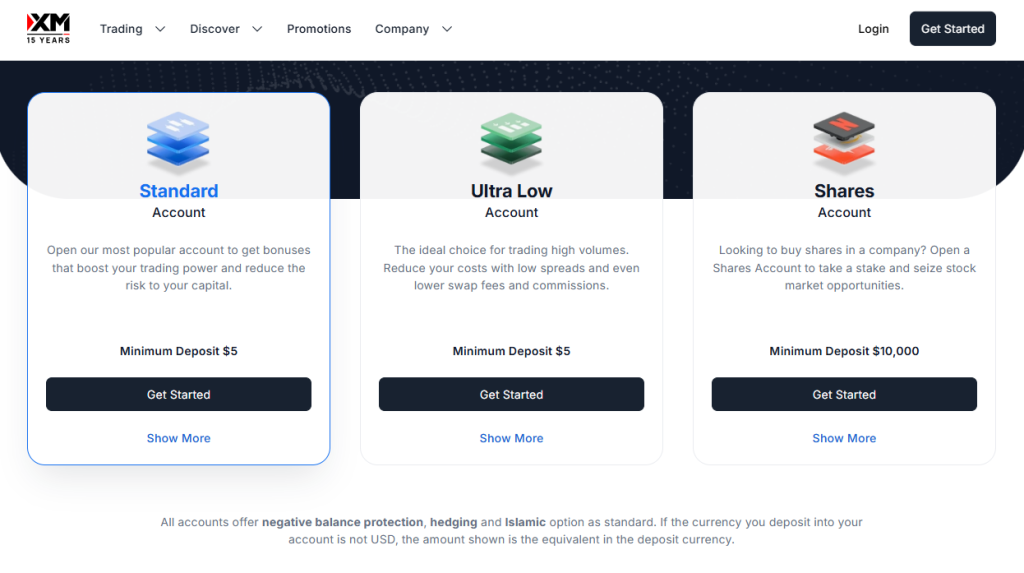

3. XM

XM welcomes Kenyan forex traders under its international regulatory licences. While XM lacks direct 🇰🇪 CMA oversight, strong regulation from respected authorities provides support for safe trading. Kenyan users benefit from low minimum deposits, diverse tradable instruments, and reliable platform execution.

| Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). | |

Frequently Asked Questions

Is XM legally accessible to forex traders in Kenya?

Yes. XM accepts Kenyan forex traders under its international regulatory framework. Although it is not regulated by 🇰🇪 CMA, XM provides legal access and secure trading under reputable foreign regulators.

Can Kenyan traders fund and trade with XM easily?

Yes. XM offers easy account opening and supports local payment methods commonly used in Kenya, enabling straightforward deposits and trading with low minimum amounts.

| Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). | |

Pros and Cons

Our Insights

XM offers Kenyan traders a reliable and accessible forex trading option with a low minimum deposit and strong international regulation. It provides a broad range of markets and solid trading tools, though it does not operate under direct 🇰🇪 CMA oversight.

Top 3 Low Minimum Deposit Forex Brokers in Kenya – Head-to-Head Comparison

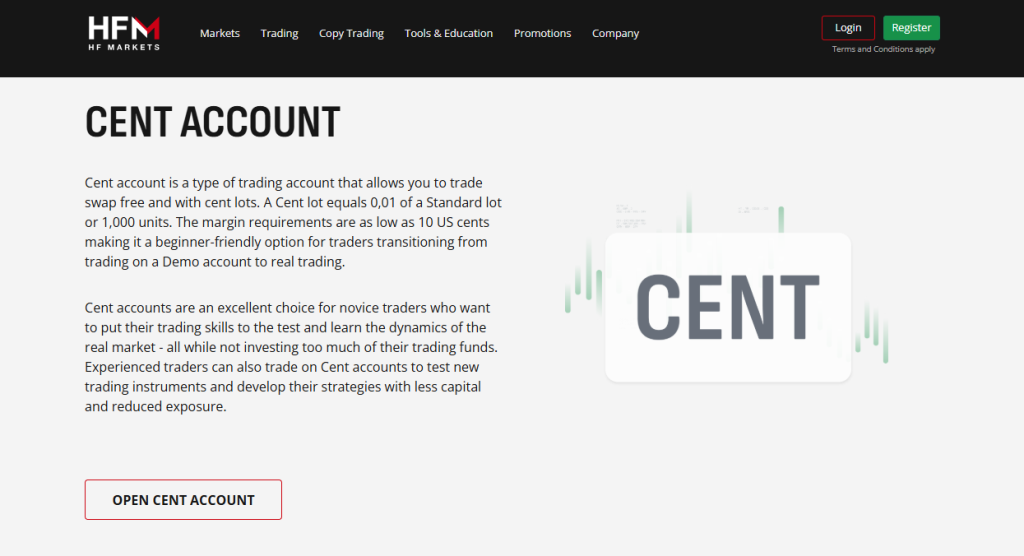

4. HFM

HFM provides Kenyan traders with legally approved forex trading under direct 🇰🇪 CMA supervision. The broker combines local regulatory protection with low minimum deposits, secure client fund handling, and global market access, making it a trusted choice for both beginner and experienced traders in Kenya.

| Minimum Deposit: $0 Regulated by: FSCA, FSA, FCA, FSC, CMA Crypto: Yes | |

Frequently Asked Questions

Is HFM legally authorized to offer forex trading in Kenya?

Yes. HFM holds 🇰🇪 CMA Licence No. 155 as a non-dealing online forex broker. This authorization allows HFM to operate legally in Kenya while meeting strict regulatory standards that protect traders through transparency, compliance, and ongoing regulatory supervision.

What protections does CMA regulation provide Kenyan traders using HFM?

CMA regulation ensures HFM follows strict operational rules, including client fund segregation, fair trading practices, and regulatory oversight. Kenyan traders benefit from local dispute resolution mechanisms and enhanced investor protection enforced by Kenya’s primary financial regulator.

| Minimum Deposit: $0 Regulated by: FSCA, FSA, FCA, FSC, CMA Crypto: Yes | |

Pros and Cons

Our Insights

HFM stands out as a top-tier forex broker for Kenyan traders due to its direct 🇰🇪 CMA regulation, low minimum deposit, and secure trading environment. It delivers legal market access, strong investor protection, and flexible account options, making it one of the safest choices in Kenya.

5. FXTM

FXTM provides Kenyan traders with legally approved forex trading under 🇰🇪 CMA oversight. The broker combines local authorization with global operational standards, low minimum deposits, and accessible funding options, creating a secure and transparent trading environment for Kenyan retail traders.

| Minimum Deposit: $200 Regulated by: FCA, CMA, FSC, SCA Crypto: Yes | |

Frequently Asked Questions

Is FXTM legally authorized to offer forex trading in Kenya?

Yes. FXTM operates in Kenya under Exinity Capital East Africa Ltd and holds 🇰🇪 CMA Licence No. 135. This authorization confirms that FXTM meets Kenyan regulatory requirements and operates legally while offering forex and CFD trading services to local clients.

Can Kenyan traders open and fund FXTM accounts easily?

Yes. FXTM allows Kenyan traders to open accounts quickly and supports local funding methods such as M-Pesa. The broker also maintains a low minimum deposit, making it accessible to both beginner and experienced traders across Kenya.

| Minimum Deposit: $200 Regulated by: FCA, CMA, FSC, SCA Crypto: Yes | |

Pros and Cons

Our Insights

FXTM stands out as a trusted forex broker in Kenya due to its direct 🇰🇪 CMA regulation, strong investor protection, and low minimum deposit. It offers legal market access, reliable platforms, and local payment support, making it a solid choice for regulated forex trading in Kenya.

5 Best Low Minimum Deposit Forex Brokers in Kenya – Broker Scorecard

The Best Low Minimum Deposit Forex Brokers in Kenya – A Quick Overview

Low minimum deposit forex brokers in Kenya allow traders to enter the global markets with as little as 5 USD (≈ KES 750). These brokers reduce entry barriers, support local funding methods like M-Pesa, and provide access to forex and CFDs through secure, regulated trading platforms.

Many low-deposit brokers operating in Kenya offer beginner-friendly accounts, competitive spreads, and modern platforms such as MT4 and MT5. This makes them suitable for new traders testing strategies as well as experienced traders managing risk with smaller capital allocations.

Pros and Cons of Forex Trading With a Low Minimum Deposit in Kenya

You might also like:

In Conclusion

Low minimum deposit forex brokers offer Kenyan traders an affordable and practical way to access global markets. They lower financial risk, support local payment methods, and make forex trading more accessible. When combined with proper regulation and risk management, these brokers provide a strong starting point for Kenyan traders.