10 Best Forex Brokers with ZAR Accounts

We have listed the 10 Best Forex Brokers offering ZAR trading accounts, ideal for South African traders. These brokers provide low spreads, trusted regulation, and secure platforms, allowing both beginners and professionals to trade efficiently in their local currency with confidence.

10 Best Forex Brokers with ZAR Accounts (2026)

- IFX Brokers – Overall, The Best Forex Broker with a ZAR Account

- iUX – Ultra-low latency execution

- HFM – Negative balance protection

- Exness – Ultra-low spreads and unlimited leverage

- Tickmill – Competitive commissions

- XM – Wide range of account types

- JustMarkets – Support for the popular MT4 and MT5 platforms

- FxPro – Strong multi-jurisdictional regulation

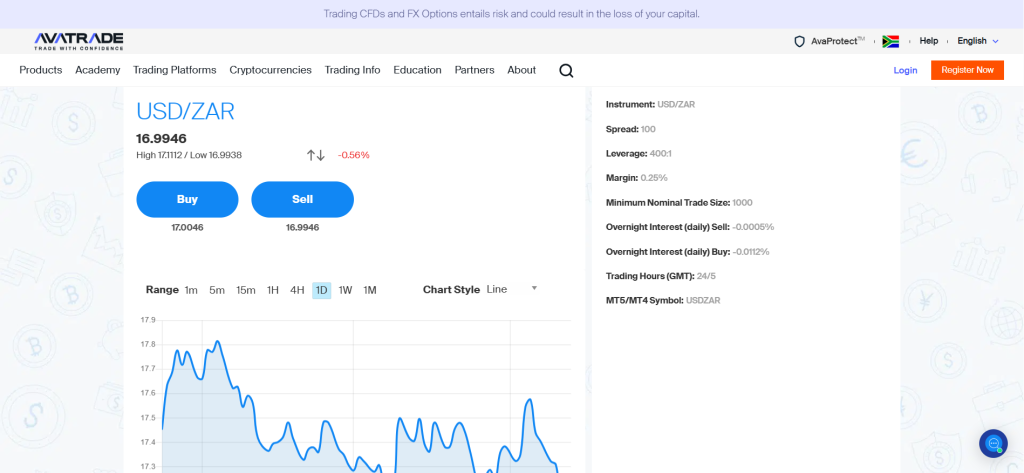

- AvaTrade – Unique risk management tool AvaProtect

- FP Markets – Competitive low spreads and fees

Top 10 Forex Brokers (Globally)

1. IFX Brokers

IFX Brokers offers ZAR trading accounts tailored for South African traders, allowing deposits and withdrawals in local currency. The broker provides competitive spreads, fast execution, FSCA regulation, and access to major trading platforms like MetaTrader 4 and 5.

Frequently Asked Questions

Is IFX Brokers authorized to operate in South Africa?

Yes, IFX Brokers is fully authorized to operate in South Africa. It is regulated by the Financial Sector Conduct Authority (FSCA) as an Authorized Financial Services Provider (FSP number 48021). This local license ensures the broker complies with South African financial sector laws.

Can I trade using a ZAR account with IFX Brokers?

Yes, IFX Brokers caters directly to South African traders by offering the South African Rand (ZAR) as an Account Base Currency option for all their account types (Standard, Premium, Cent, etc.). This allows you to fund, trade, and withdraw without currency conversion fees.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated by the FSCA | Swap fees apply on overnight trades |

| Supports ZAR accounts for local traders | Limited global regulation outside South Africa |

| Low minimum deposit requirement | No fixed spread account option |

| Competitive spreads and leverage up to 1:500 | Limited educational materials for beginners |

| Offers both MT4 and MT5 platforms | Customer support not available 24/7 |

Final Score

| # | Criteria | IFX Brokers |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

IFX Brokers is an FSCA-authorized South African broker offering ZAR trading accounts, low spreads, and powerful platforms. It’s ideal for local traders seeking reliable regulation, fast execution, and seamless trading in their local currency.

2. iUX

iUX offers ZAR trading accounts for South African traders, allowing deposits and withdrawals in local currency. The broker is authorized by the FSA, provides competitive spreads, high leverage, and supports MetaTrader 4 and 5 platforms.

Frequently Asked Questions

Does iUX offer ZAR trading accounts?

Yes, iUX offers ZAR-denominated accounts, enabling South African clients to trade, deposit, and withdraw funds in their local currency conveniently.

What trading platforms does iUX provide?

IUX provides the widely-used MetaTrader 5 (MT5) platform for its traders, confirming the integration of the MT5 Gateway. While MT4 is common, their primary advanced offering is the MT5 desktop, web, and mobile suite, which supports advanced tools and multi-asset trading.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and authorized by the FSA | Limited variety of account types |

| Supports ZAR accounts for South African traders | Limited educational content for beginners |

| Competitive spreads and fast trade execution | No fixed spread accounts |

| Leverage up to 1:500 | Customer support not available 24/7 |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐☆☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐☆☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐☆☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐☆☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐☆☆☆ |

Our Insights

iUX is a legit FSA-authorized broker offering ZAR accounts, competitive spreads, and powerful trading platforms. It’s a solid choice for South African traders seeking local currency trading with global market access.

3. HFM

HFM caters to South African clients by offering ZAR-denominated accounts, which allows them to deposit and withdraw funds in rand without conversion fees. This local service is supported by its FSCA-authorized regulation and access to the industry’s preferred platforms, MetaTrader 4 and MetaTrader 5.

Frequently Asked Questions

Does HFM offer ZAR trading accounts?

Yes, HFM offers ZAR-denominated trading accounts. This is specifically tailored for South African clients, allowing you to deposit, trade, and withdraw funds using the South African Rand as the base currency, eliminating conversion costs.

Which platforms does HFM support?

HFM supports the popular industry-standard platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Additionally, they offer their own HFM Platform, available as a WebTrader and a highly-rated HFM Mobile App with integrated Copy Trading features.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Fully legal and FSCA regulated in South Africa | Swap fees apply on overnight positions |

| Supports ZAR accounts for local convenience | Inactivity fees may apply |

| Competitive spreads and fast execution | Limited fixed spread options |

| Multiple account types for all trader levels | No crypto funding methods |

| Excellent educational resources and tools | Some features unavailable to non FSCA clients |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

HFM is a legal, FSCA-regulated broker that is ideal for South African traders. It offers ZAR accounts for smooth local transactions, tight spreads, and advanced trading tools, ensuring a trusted regulatory environment and reliable local currency trading.

Top 3 Forex Brokers with ZAR Accounts – IFX Brokers vs iUX vs HFM

4. Exness

Exness supports ZAR-denominated trading accounts for South African users, enabling deposits and withdrawals in rand, low entry minimums, and access to platforms like MT4, MT5 and Exness Terminal under FSCA licensing.

Frequently Asked Questions

Is Exness an approved forex broker in South Africa?

Yes, Exness is an approved and legal forex broker in South Africa. It is regulated by the Financial Sector Conduct Authority (FSCA) under FSP number $text{51024}$. This local authorization ensures the broker complies with South African financial laws, providing protection for local traders.

Does Exness offer ZAR trading accounts?

Yes, Exness offers ZAR-denominated trading accounts, which is a great benefit for South African clients. This allows you to deposit, trade, and withdraw funds using the South African Rand as the base currency, eliminating currency conversion fees.

Pros and Cons

| ✓ Pros | ✕ Cons |

| FSCA-approved and globally regulated broker | Swap fees apply to overnight positions |

| Supports ZAR accounts for South African traders | Limited range of educational materials |

| Tight spreads and fast execution speeds | Some features vary by region |

| No minimum deposit requirement | No fixed spread account option |

| 24/7 multilingual customer support | Customer service may experience high demand during peak hours |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐☆☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Exness is an FSCA-approved forex broker that is a trusted choice for South African traders. It offers ZAR accounts for local currency efficiency, competitive spreads, and powerful trading platforms, delivering a regulated, low-cost, and reliable trading environment.

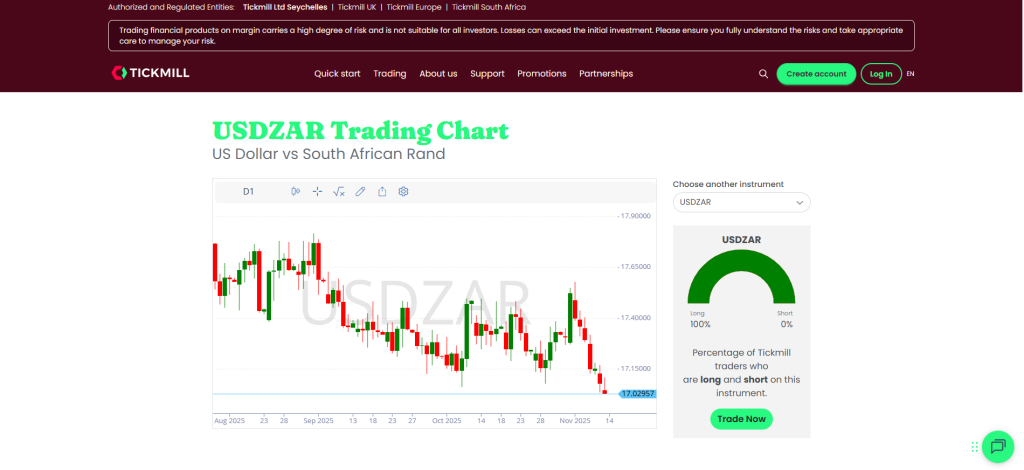

5. Tickmill

Tickmill, which is FSCA-regulated (FSP 49464), offers ZAR-denominated trading accounts. This allows South African clients to deposit and withdraw funds in rand via local bank transfers, and trade using the preferred MetaTrader 4 and MetaTrader 5 platforms.

Frequently Asked Questions

Does Tickmill offer ZAR trading accounts?

Tickmill, under its FSCA regulation (FSP 49464), offers ZAR-denominated trading accounts. This allows South African clients to deposit and withdraw funds in South African Rand, eliminating the need for currency conversion and associated fees.

Which trading platforms does Tickmill support?

Tickmill supports the essential industry platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5), available for desktop, web, and mobile. They also offer their proprietary Tickmill Trader app and integration with the popular charting platform, TradingView, for advanced analysis.

Pros and Cons

| ✓ Pros | ✕ Cons |

| FSCA-registered and globally regulated broker | Swap fees apply on overnight trades |

| Supports ZAR accounts with local bank funding | No proprietary trading platform |

| Low spreads from 0.0 pips | Limited crypto trading options |

| Fast execution and reliable platforms | Educational materials could be more extensive |

| No deposit or withdrawal fees via local methods | No 24/7 customer support |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Options | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Tickmill is an FSCA-regulated broker that offers ZAR accounts, making it an excellent, secure choice for South African traders. It provides low spreads and reliable access to the MetaTrader 4/5 platforms for cost-effective, local currency trading.

6. XM

XM provides trading accounts denominated in ZAR specifically for South African clients, enabling seamless deposits and withdrawals directly in rand. These ZAR accounts are available across multiple types including Micro, Standard, and Ultra-Low, making it easier to trade using local currency without conversion complexities.

Frequently Asked Questions

Is XM an authorized forex broker in South Africa?

Yes, XM is an authorized Financial Service Provider (FSP) in South Africa. The local entity, XM ZA (Pty) Ltd, is regulated by the FSCA with authorization number $text{49976}$. However, client trading accounts are typically opened with its offshore entities (FSC Belize or FSA Seychelles).

Which platforms does XM support?

XM supports the industry-standard platforms: MetaTrader 4 (MT4) and the multi-asset MetaTrader 5 (MT5), both available for PC, Mac, WebTrader, and mobile devices. They also offer the XM App for seamless account management and trading on the go.

Pros and Cons

| ✓ Pros | ✕ Cons |

| FSCA-authorized and well-regulated globally | Swap fees apply on overnight positions |

| Supports ZAR accounts for South African clients | Limited leverage under some regulations |

| Low minimum deposit of $5 | No cryptocurrency funding options |

| Tight spreads and zero hidden fees | Some bonuses unavailable under FSCA entity |

| Excellent educational and analytical resources | No fixed spread accounts |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

XM is an authorized FSCA-regulated broker offering ZAR accounts, low-cost trading, and advanced platforms. It’s a top choice for South African traders seeking a trusted, transparent, and user-friendly local trading experience.

7. JustMarkets

JustMarkets caters to South African traders by allowing ZAR base currency accounts for easy deposits/withdrawals in rand. They offer flexible trading conditions with low spreads (starting at 0.3 pips) and high leverage (up to 1:3000) across Standard, Pro, and Raw Spread accounts on the MT4 and MT5 platforms.

Frequently Asked Questions

Is JustMarkets a legit forex broker?

Yes, JustMarkets is a legit, multi-regulated broker. It holds licenses from the CySEC (Cyprus), FSCA (South Africa) (FSP 51114), FSC (Mauritius), and FSA (Seychelles). This multi-jurisdictional oversight ensures client fund segregation and compliance with financial standards.

Does JustMarkets offer ZAR trading accounts?

Yes, JustMarkets offers ZAR-denominated trading accounts for South African traders on most of their account types (Standard, Pro, Raw Spread). This allows local clients to deposit and withdraw funds using the South African Rand, avoiding unnecessary currency conversion fees.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit broker with global regulation | Not FSCA-regulated in South Africa |

| Supports ZAR accounts for South African traders | Swap fees apply on overnight positions |

| High leverage up to 1:3000 | Limited educational content |

| Tight spreads starting from 0.3 pips | No proprietary trading platform |

| User-friendly MT4 and MT5 platforms | Promotions vary by region |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

JustMarkets is a legit globally regulated broker offering ZAR accounts, competitive spreads, and powerful trading tools. It’s a great choice for South African traders seeking flexible, low-cost, and secure forex trading options.

8. FxPro

XM allows South African traders to open accounts denominated in ZAR, enabling deposits and withdrawals in rand without conversion fees. The broker is authorized for SA clients and supports MetaTrader 4 and MetaTrader 5 platforms for seamless trading.

Frequently Asked Questions

Does FxPro offer ZAR trading accounts?

Yes, FxPro does offer the South African Rand (ZAR) as one of the base currencies for its trading accounts. This allows South African clients to deposit, trade, and withdraw in ZAR, helping them avoid currency conversion fees on local transactions.

What trading platforms does FxPro support?

FxPro offers a strong selection of platforms: the industry-leading MetaTrader 4 (MT4) and MetaTrader 5 (MT5), the advanced ECN-style cTrader, and their proprietary FxPro Edge platform. These are all available on desktop, web, and mobile, with integration for TradingView charts.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Fully legal and FSCA regulated in South Africa | Swap fees apply on overnight positions |

| Offers ZAR accounts for local traders | Higher minimum deposit than some brokers |

| Multiple advanced trading platforms | Limited bonus promotions |

| Fast execution and deep liquidity | No crypto trading under FSCA entity |

| Transparent pricing with no dealing desk | Educational content could be more extensive |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FxPro is an officially authorized broker regulated by the Financial Sector Conduct Authority (FSCA) in South Africa 🇿🇦, providing ZAR-denominated accounts. It features competitive spreads and advanced trading platforms, making it a reliable and secure option for South African traders who want to trade efficiently with their local currency.

9. AvaTrade

AvaTrade allows South African traders to open trading accounts in ZAR, facilitating deposits and withdrawals directly in rand to avoid currency conversion charges. This broker is authorized and regulated by the Financial Sector Conduct Authority (FSP 45984) and supports widely used platforms including MetaTrader 4, MetaTrader 5, and AvaTradeGO for versatile trading options.

Frequently Asked Questions

Is AvaTrade an approved forex broker in South Africa?

Yes, AvaTrade is an approved forex broker in South Africa. Its local entity, Ava Capital Markets Pty Ltd, is regulated by the Financial Sector Conduct Authority (FSCA) under FSP number 45984, ensuring compliance with local financial protection standards.

Which trading platforms does AvaTrade support?

AvaTrade supports a diverse suite of platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5). They also offer their proprietary AvaTrade WebTrader, the mobile-focused AvaTradeGO App, and specialized platforms like AvaOptions and AvaSocial for copy trading.

Pros and Cons

| ✓ Pros | ✕ Cons |

| FSCA-approved and globally regulated broker | Swap fees apply on overnight trades |

| Supports ZAR accounts for South African traders | Limited crypto trading options under SA entity |

| Multiple trading platforms including MT4, MT5, and AvaTradeGO | Some bonuses and promotions unavailable locally |

| Tight spreads and competitive trading conditions | No fixed spread accounts |

| Strong customer support and educational resources | Customer support not 24/7 in all regions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

AvaTrade is an FSCA-approved broker that is an excellent choice for South African traders. It offers ZAR accounts for local currency convenience, competitive spreads, and multiple platforms, ensuring a regulated, secure, and reliable trading experience.

10. FP Markets

FP Markets supports South African traders by allowing ZAR deposits and withdrawals, utilizing local payment methods. Clients can trade on the popular MT4 and MT5 platforms, benefiting from competitive spreads specifically tailored to the local market needs.

Frequently Asked Questions

Is FP Markets a registered forex broker in South Africa?

Yes, FP Markets is a registered Financial Services Provider (FSP) in South Africa. The local entity, FP Markets (Pty) Ltd, is authorised and regulated by the FSCA (Financial Sector Conduct Authority) under FSP Number 50926, ensuring local compliance and protection.

What trading platforms does FP Markets support?

FP Markets supports a wide array of platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader for advanced order management. They also offer their proprietary WebTrader and Mobile App, along with direct trading integration via TradingView charts.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated broker in South Africa | Swap fees apply for overnight positions |

| Supports ZAR accounts with local deposit/withdrawal options | Minimum deposit can be higher than some brokers |

| Tight spreads and low trading costs | Limited promotions for SA clients |

| Multiple platforms including MT4, MT5, and IRESS | Customer support not 24/7 in all regions |

| Access to Forex, CFDs, Commodities, Indices, and Cryptos | No fixed spread accounts for all account types |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

FP Markets is an FSCA-authorized broker in South Africa, providing ZAR-based accounts alongside competitive spreads and a variety of trading platforms. This makes it a strong choice for South African traders looking for safe, cost-effective, and seamless trading in their native currency.

What is a ZAR Account in Forex Trading?

A ZAR Account in Forex Trading is a trading account where the base currency is the South African Rand (ZAR). This means all deposits, withdrawals, and account balances are held in rand instead of foreign currencies like USD or EUR.

ZAR accounts are especially beneficial for South African traders, as they:

- Avoid currency conversion fees when funding or withdrawing.

- Can trade directly in their local currency.

- Enjoy faster local bank transactions.

- Reduce the impact of exchange rate fluctuations on profits or losses.

Overall, a ZAR account makes forex trading more cost-effective, convenient, and localized for traders based in South Africa.

Criteria for Choosing a Forex Broker with ZAR Accounts

| Criteria | Description | Importance |

| Regulation & Licensing | Ensure the broker is regulated by the FSCA or other top-tier authorities to guarantee fund safety and fair trading practices. | ⭐⭐⭐⭐⭐ |

| ZAR Account Availability | Choose a broker that offers ZAR denominated accounts to avoid currency conversion fees and simplify local transactions. | ⭐⭐⭐⭐⭐ |

| Deposit & Withdrawal Methods | Look for brokers supporting local payment options and South African banks for faster and cheaper transfers. | ⭐⭐⭐⭐☆ |

| Trading Platforms | Verify the broker provides reliable platforms such as MetaTrader 4, MetaTrader 5, or proprietary apps for smooth trading. | ⭐⭐⭐⭐☆ |

| Spreads & Commissions | Compare brokers with low spreads and transparent commission structures to minimize trading costs. | ⭐⭐⭐⭐⭐ |

| Leverage Options | Select brokers offering reasonable leverage to match your trading style without excessive risk exposure. | ⭐⭐⭐⭐☆ |

| Customer Support | Reliable brokers provide responsive, local, and multilingual support, preferably available 24/5 or 24/7. | ⭐⭐⭐⭐☆ |

| Reputation & Reviews | Research the broker’s track record, user feedback, and transparency before opening an account. | ⭐⭐⭐⭐⭐ |

| Educational Resources | Access to training materials, webinars, and market analysis helps beginners grow trading skills effectively. | ⭐⭐⭐☆☆ |

| Negative Balance Protection | Protects traders from losing more than their account balance during volatile market conditions. | ⭐⭐⭐⭐⭐ |

Top 10 Best Forex Brokers with ZAR Accounts – A Direct Comparison

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From trading platforms to minimum deposit, we provide straightforward answers to help you understand ZAR accounts and choose the right broker confidently.

Q: Can I deposit and withdraw directly in ZAR to avoid conversion fees? – Sipho M.

A: Yes, brokers offering ZAR accounts allow deposits and withdrawals directly in South African Rand, eliminating currency conversion fees and simplifying your trading experience.

Q: Which trading platforms support ZAR accounts at local brokers? – Thandi N.

A: Popular platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and proprietary apps like AvaTradeGO support ZAR account trading for South African traders.

Q: What is the typical minimum deposit required for ZAR accounts with reputable brokers? – Johan K.

A: Minimum deposits vary but start as low as R500 (~USD 20) with brokers like JustMarkets, making forex trading accessible even for beginners.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Avoid currency conversion costs | Limited broker options |

| Eliminated exchange rate risk on deposits/withdrawals | Currency pair limitations |

| Simplified funding/withdrawals | Volatility of the Rand |

| Better alignment with local currency familiarity | Potentially higher spreads / trading costs |

| Local regulatory and banking advantages | Liquidity and infrastructure constraints |

You Might also Like:

- IFX Brokers Review

- iUX Review

- HFM Review

- Exness Review

- Tickmill Review

- XM Review

- JustMarkets Review

- FxPro Review

- AvaTrade Review

- FP Markets Review

In Conclusion

Choosing a broker with a ZAR account offers South African traders clear advantages like avoiding conversion fees and simplifying local deposits. However, be aware of possible trade-off in terms of fewer broker choices, higher spreads, and Rand-volatility risks.

Faq

A ZAR trading account is a forex account where the base currency is the South African Rand (ZAR). This allows traders to deposit, trade, and withdraw funds in rand, avoiding the conversion fees and exchange rate fluctuations associated with USD or EUR accounts.

Choosing a Forex broker with a ZAR account eliminates currency conversion fees on deposits and withdrawals, saving you money. It also simplifies profit/loss calculations since your trading balance is natively in the South African Rand.

Yes, ZAR trading accounts offered by brokers that are FSCA-regulated (Financial Sector Conduct Authority) in South Africa are regulated. The FSCA oversees these brokers to ensure they comply with local laws for fund segregation and financial conduct, protecting your ZAR capital.

Yes, many international brokers offer ZAR-denominated accounts to specifically serve South African traders. By either being FSCA-regulated or having a local presence, they allow clients to deposit and trade in Rand, which helps avoid currency conversion fees and simplifies profit calculations.

Yes, ZAR trading accounts directly help avoid conversion fees. Since your account’s base currency is the South African Rand, you can deposit and withdraw funds via local banks without paying the intermediary bank or broker fees typically charged for converting ZAR to USD or EUR.

Yes, you can use ZAR accounts on MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Many brokers regulated by the FSCA in South Africa, such as IFX Brokers, Exness, and Tickmill, fully support ZAR as the base currency on both popular platforms.

Yes, ZAR accounts are highly suitable for beginners in South Africa. They simplify trading by allowing you to deposit, calculate profits/losses, and withdraw funds without worrying about complex currency conversions or unexpected fees from using USD or EUR.

There are few drawbacks: you may face fewer broker options compared to USD/EUR, and some brokers might offer a slightly limited range of tradable instruments on ZAR accounts. However, the benefit of avoiding conversion fees usually outweighs these minor limitations.

Yes, ZAR accounts offered by FSCA-regulated brokers are specifically designed to support local bank transfers (EFTs). This facilitates quick, direct funding and withdrawal in South African Rand from your local bank account, avoiding international wire fees and delays.

Yes, you can trade all major currency pairs (like EUR/USD, GBP/USD, USD/JPY) with a ZAR account. While your base currency is ZAR, the platform simply quotes and calculates all profits/losses on these major pairs in ZAR. Your trading options remain comprehensive.