10 Best Forex Brokers for Professional Traders

We have listed the 10 Best Forex Brokers for professional traders who demand advanced tools, ultra-tight spreads, and lightning-fast execution. These brokers offer robust platforms, top-tier regulation, and premium trading conditions, enabling experienced traders to manage large volumes and complex strategies with confidence.

10 Best Forex Brokers for Professional Traders (2026)

- MultiBank Group – Overall, The Best Forex Broker for Professional Traders

- FP Markets – Competitive spreads from 0 pips on raw accounts

- IC Markets – Ultra-fast execution with low latency

- Pepperstone – Powerful trading platforms like MT 4, MT 5, and cTrader

- FOREX.com – Wide range of trading products beyond forex

- IG – Robust risk management tools like negative balance protection

- AvaTrade – Comprehensive educational resources through the AVA Academy

- Saxo Bank – High level of security with a banking license and deposit protection

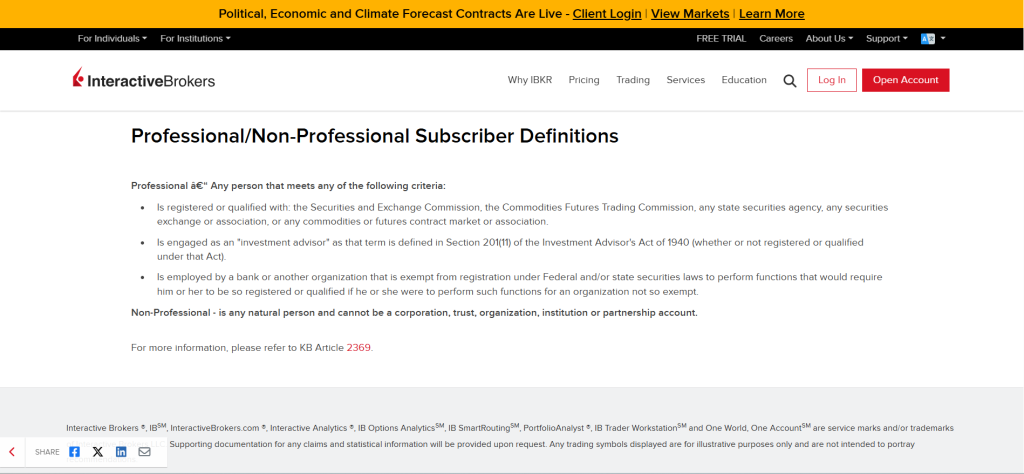

- Interactive Brokers – Competitive rates with IBKR Pro

- PrimeXBT – High leverage trading options

Top 10 Forex Brokers (Globally)

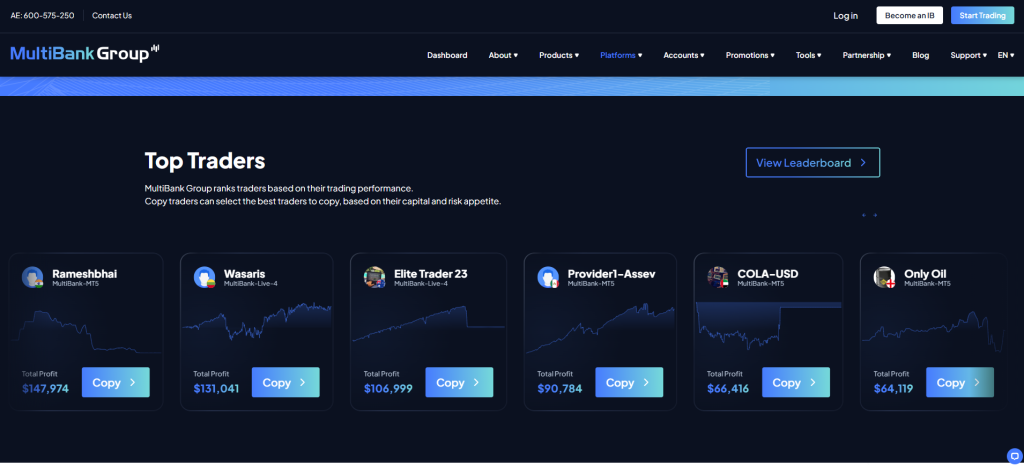

1. MultiBank Group

MultiBank Group is one of the best Forex brokers for professional traders, offering institutional-grade liquidity, ultra-low spreads starting from 0.0 pips, and advanced platforms like MetaTrader 4 and 5. Regulated by multiple authorities worldwide, MultiBank Group provides fast execution, high leverage options, and secure trading conditions, making it a top choice for experienced traders seeking premium performance and reliability.

Frequently Asked Questions

Why is MultiBank Group suitable for professional traders?

MultiBank Group is suitable due to its ECN account offering raw spreads from 0.0 pips, high leverage up to 500:1, deep liquidity, and strong global regulation

What trading platforms does MultiBank Group provide?

MultiBank Group offers professional traders the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5), along with their own proprietary platform, MultiBank-Plus. They also provide FIX API for advanced algorithmic trading.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated | High minimum deposit for some accounts |

| Ultra-tight spreads starting from 0.0 pips | Limited educational resources for beginners |

| Advanced trading platforms (MT4 & MT5) | Not available to traders in certain regions |

| Fast and reliable execution | Complex account options may confuse new users |

| Strong fund security and client protection | Customer support response can vary by region |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

MultiBank Group is an authorized and trusted Forex broker known for its professional-grade trading conditions, advanced tools, and robust regulation. It’s ideal for experienced traders seeking premium performance, low spreads, and secure trading environments.

2. FP Markets

FP Markets is an authorized Forex and CFD broker recognized as one of the best choices for professional traders. It offers ECN pricing with spreads from 0.0 pips, lightning-fast execution, and advanced platforms like MetaTrader 4, MetaTrader 5, and cTrader.

Fully authorized and regulated by ASIC and CySEC, FP Markets provides deep liquidity, flexible leverage, and top-tier trading tools, making it ideal for professionals who demand precision, transparency, and reliability.

Frequently Asked Questions

Is FP Markets a legit Forex broker?

Yes, FP Markets is considered a legitimate and trustworthy broker. It is multi-regulated by top-tier authorities like ASIC (Australia) and CySEC (Cyprus), and has a strong 20-year track record, offering segregated client funds.

Why is FP Markets suitable for professional traders?

FP Markets suits professional traders with Raw ECN accounts offering spreads from 0.0 pips and ultra-fast execution from deep liquidity pools, supported by advanced platforms (MT4/5, cTrader) and higher leverage on Pro Accounts.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and regulated | Inactivity fees may apply |

| ECN pricing with low spreads from 0.0 pips | Limited educational resources for beginners |

| Multiple trading platforms (MT4, MT5, cTrader) | No U.S. clients accepted |

| Fast order execution and deep liquidity | VPS service may require minimum trading volume |

| Strong reputation and client fund protection | Complex account options for new traders |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

FP Markets is a legit Forex broker offering professional-grade ECN trading, advanced platforms, and deep liquidity. Ideal for experienced traders seeking transparency, low costs, and precision execution in a regulated and secure trading environment.

3. IC Markets

IC Markets is a legit and authorized Forex broker widely regarded as one of the best for professional traders. It offers institutional-grade liquidity, ultra-low spreads from 0.0 pips, and lightning-fast execution speeds. Regulated by ASIC, CySEC, and FSA, IC Markets provides advanced platforms like MetaTrader 4, MetaTrader 5, and cTrader, making it ideal for professionals who demand precision, reliability, and seamless trading performance in a secure environment.

Frequently Asked Questions

What trading instruments does IC Markets provide?

IC Markets provides CFDs on Forex, Indices, Commodities (including metals and energy), Stocks, Bonds, Futures, and Digital Currency (Cryptocurrency).

Why is IC Markets popular among professional traders?

IC Markets is popular for its Raw Spread account, offering extremely tight spreads from 0.0 pips and fast execution via its Equinix NY4 server, which benefits high-volume traders and those using automated strategies.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and regulated | No bonus or promotional offers |

| Ultra-tight spreads from 0.0 pips | Customer support can be slow during peak hours |

| Lightning-fast trade execution | Not available for U.S. clients |

| Supports MT4, MT5, and cTrader platforms | Limited educational tools for beginners |

| Excellent conditions for scalpers and algorithmic traders | High leverage may increase trading risk |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

IC Markets is a legal and trusted Forex broker offering professional-grade trading conditions, advanced platforms, and deep liquidity. It’s perfect for experienced traders seeking speed, transparency, and reliability under strict international regulation.

Top 3 Forex Brokers for Professional Traders – MultiBank Group vs FP Markets vs IC Markets

4. Pepperstone

Pepperstone is a preferred broker for professional traders because it delivers razor-sharp spreads (from 0.0 pips), ultra-fast execution, and deep liquidity. It supports popular platforms like MT4, MT5, and cTrader.

Frequently Asked Questions

Why is Pepperstone ideal for professional traders?

Pepperstone is ideal for professionals due to its Razor account offering raw spreads from 0.0 pips, fast execution, and support for advanced platforms like MT4/MT5 and cTrader, which suits high-volume and algorithmic traders.

What trading platforms does Pepperstone offer?

Pepperstone offers a robust selection of trading platforms including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and integration with TradingView. It also provides its own native Pepperstone platform and mobile app.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated | No fixed-spread accounts available |

| Spreads from 0.0 pips on Razor accounts | Limited product range compared to larger brokers |

| Excellent execution speed and reliability | No proprietary trading platform |

| Supports MT4, MT5, cTrader, and TradingView | Inactivity fees may apply after long periods |

| Ideal for scalping, hedging, and automated trading | Customer support not 24/7 in all regions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Pepperstone is a trusted, regulated Forex broker that delivers the speed and precision experienced traders demand. It provides deep liquidity and a suite of advanced trading platforms for transparent, professional-grade trading.

5. FOREX.com

FOREX.com is a strong choice for professional traders, offering access to over 5,500 markets, multiple premium platforms including MT4, MT5 and its proprietary Advanced Trading platform, as well as flexible pricing structures tailored for high-volume trading.

Frequently Asked Questions

Is FOREX.com a registered Forex broker?

Yes, FOREX.com is a registered and globally regulated broker. It holds licenses from multiple top-tier authorities, including the FCA (UK), CFTC/NFA (US), ASIC (Australia), and others.

Why is FOREX.com suitable for professional traders?

FOREX.com suits professionals with its Active Trader program offering cash rebates, higher leverage (on Pro accounts), dedicated support, and advanced platforms. It provides tight spreads and fast, reliable execution crucial for high-volume trading.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated | Limited leverage in some jurisdictions |

| Wide market access with 5,500+ tradable instruments | No cTrader or TradingView platform support |

| Advanced proprietary and MetaTrader platforms | High minimum deposit for DMA accounts |

| Competitive spreads and pricing for professionals | Limited bonus or promotional offers |

| Reliable execution with deep liquidity | Education mainly focused on beginners |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FOREX.com is a registered and trusted broker offering advanced tools, deep liquidity, and competitive pricing. It’s best suited for professional traders seeking powerful platforms and regulated, transparent trading conditions across global markets.

6. IG

IG is a premier professional trading choice due to its massive offering of over 17,000 instruments, backed by multiple advanced platforms like MT4, TradingView, and DMA L2. It provides enhanced features for high-volume traders.

Frequently Asked Questions

Is IG an authorized Forex broker?

Yes, IG is an authorized and highly regulated global forex broker. It is overseen by multiple top-tier financial bodies, including the FCA (UK), CFTC/NFA (US), ASIC (Australia), and BaFin (Germany).

What platforms does IG support?

IG supports its proprietary Online Trading Platform and Mobile App, along with major third-party platforms. These include MetaTrader 4 (MT4), ProRealTime, TradingView (via integration), and the L2 Dealer platform for Direct Market Access (DMA).

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated | Higher minimum balance required for professional accounts |

| Over 17,000 tradable markets across multiple asset classes | Limited leverage for retail clients |

| Advanced trading tools and professional account options | No MetaTrader 5 or cTrader support |

| Excellent research, analytics, and charting features | Inactivity fees may apply |

| Robust proprietary platform and DMA access | Customer support not 24/7 in all regions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

IG is an authorized and highly reputable broker offering professional traders access to advanced tools, deep market liquidity, and extensive asset choices. It’s ideal for experienced traders seeking powerful platforms and top-tier regulatory protection.

7. AvaTrade

AvaTrade is a globally regulated broker that caters to professionals, offering institutional-style conditions. This includes high leverage (up to 400:1) and a choice of advanced platforms, such as MT4, MT5, and AvaTrade’s own proprietary solutions.

Frequently Asked Questions

Why is AvaTrade suitable for professional traders?

AvaTrade suits professional traders by offering institutional-style conditions, including high leverage up to 400:1 through their Professional Accounts. They provide a broad asset selection and support advanced platforms like MT4, MT5, and their own proprietary solutions, empowering experienced traders with flexible control.

What platforms does AvaTrade provide?

AvaTrade provides the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5). They also offer their proprietary WebTrader and the AvaTradeGO App. Specialized platforms include AvaOptions for vanilla options and AvaSocial for copy trading.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and regulated | Inactivity fees apply after 3 months |

| Wide range of platforms (MT4, MT5, AvaTradeGO, AvaOptions) | No direct market access (DMA) accounts |

| High leverage for professional traders | Limited advanced tools for institutional trading |

| Strong fund security and negative balance protection | Slower withdrawal times compared to ECN brokers |

| Competitive spreads and commissions | Customer service not available 24/7 |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

AvaTrade is a legitimate, well-regulated Forex broker perfect for professional traders seeking reliability. It offers high-leverage professional accounts and advanced trading platforms while operating securely under strict international oversight.

8. Saxo Bank

Saxo Bank is an authorized multi-asset broker ideal for professional traders. It features access to over 70,000 instruments from one account and offers platforms like SaxoTraderPRO and SaxoTraderGO. Experienced traders can gain elective professional client status for benefits like higher leverage.

Frequently Asked Questions

Is Saxo Bank a legal Forex broker?

Yes, Saxo Bank is a fully legal and trusted Forex broker. It operates as a licensed Danish bank and is subject to strict regulation by top-tier financial authorities in multiple global jurisdictions, ensuring high client security.

Why is Saxo Bank ideal for professional traders?

Saxo Bank is ideal for professional traders due to higher leverage, lower margin rates, and reduced regulatory constraints through its Elective Professional Client status, combined with the advanced SaxoTraderPRO platform and access to 70,000+ instruments.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and regulated | High minimum deposit requirements |

| Access to 70,000+ global instruments | Spreads can be higher for smaller accounts |

| Professional-grade trading platforms (SaxoTraderPRO & GO) | Complex platform for beginners |

| Deep liquidity and advanced market access | Limited customer support hours |

| Strong reputation for transparency and stability | No MetaTrader or cTrader platform support |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

Saxo Bank is a legal and reputable broker offering professional traders access to extensive markets, advanced platforms, and deep liquidity. It’s best suited for experienced traders seeking institutional-grade tools and global market exposure.

9. Interactive Brokers

Interactive Brokers is a legal, globally regulated broker specializing in professional traders. It offers access to over 160 markets with institutional-grade technology and ultra-low margin rates, perfect for high-volume trading.

Frequently Asked Questions

Why is Interactive Brokers ideal for professional traders?

Interactive Brokers is favored for professionals due to its institutional-grade technology, ultra-low margin rates, vast global access (160+ markets), and powerful Trader Workstation (TWS) platform, ideal for high-volume trading.

What platforms does Interactive Brokers offer?

Interactive Brokers offers its flagship Trader Workstation (TWS) for advanced traders, the user-friendly IBKR Desktop, the web-based Client Portal, and mobile apps like IBKR Mobile and GlobalTrader.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated | Complex interface for beginners |

| Access to 160+ markets across 36 countries | High minimum deposit for some accounts |

| Institutional-grade platforms and tools | Limited customer support on weekends |

| Low trading costs and margin rates | Platform learning curve for casual traders |

| Exceptional reliability and market depth | Inactivity fees for low balance accounts |

Our Insights

Interactive Brokers is an approved, world-class broker ideal for professional traders. It offers global market access, advanced technology, and ultra-low costs, backed by institutional-level tools, deep liquidity, and trusted regulation.

10. PrimeXBT

PrimeXBT is tailored for professional traders, providing institutional-level execution and tools across 100+ global markets. It features advanced platforms like MetaTrader 5 and PXTrader, with ultra-high leverage up to 1000:1 on select assets.

Frequently Asked Questions

Is PrimeXBT a registered broker?

Yes, PrimeXBT is a multi-regulated broker. It is registered with the FSCA (South Africa) for financial services, the FSA (Seychelles), the FSC (Mauritius), and holds crypto licenses in El Salvador and South Africa.

Why is PrimeXBT suitable for professional traders?

PrimeXBT suits professional traders due to its ultra-fast execution speed, high leverage up to 1:2000 on some assets, competitive low fees, and an advanced platform with extensive charting tools and multi-asset access (Forex, Crypto, Indices, Commodities).

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and licensed in multiple jurisdictions | Limited educational resources for beginners |

| High leverage options up to 1:1000 | No traditional investor protection in some regions |

| Low spreads with zero commissions on many CFDs | Platform interface may be complex for new users |

| Advanced proprietary and MT5 trading platforms | No direct integration with TradingView |

| Negative balance protection and segregated accounts | Crypto deposits only; no fiat funding options |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

PrimeXBT is a registered and trusted multi-asset broker offering high leverage, low-cost trading, and advanced platforms. It’s best suited for professional traders seeking flexibility, performance, and security across global CFD and crypto markets.

How to tell if a Forex Broker is suitable for Professional Traders?

| Criteria | What to Look For | Why It Matters |

| Regulation and Licensing | The broker should be authorized or registered with top tier regulators (like FCA, ASIC, CySEC, or NFA). | Ensures the broker operates legally and follows strict financial standards. |

| Trading Conditions | Look for tight spreads, low commissions, and fast execution speeds. | Professional Traders need efficiency and minimal trading costs to maintain profitability. |

| Leverage Options | Brokers offering flexible or high leverage (within legal limits). | Allows professionals to manage large positions and complex strategies effectively. |

| Advanced Platforms | Access to MetaTrader 4/5, cTrader, or proprietary platforms with analytical tools. | Enables precise analysis, automation, and strategy testing. |

| Liquidity and Execution | Institutional-grade or ECN/STP execution with deep liquidity. | Reduces slippage and ensures fast trade fills during high-volume trading. |

| Risk Management Features | Availability of negative balance protection and segregated client accounts. | Protects traders from losing more than their deposits and ensures fund safety. |

| Professional Account Options | Offers Pro Accounts with tailored benefits like higher leverage or reduced restrictions. | Designed specifically for experienced traders who meet prfessional criteria. |

| Reputation and Transparency | Proven track record, clear fee structure, and positive user reviews. | Shows trustworthiness and consistent service quality. |

Criteria for Choosing a Professional Forex Broker

| Criteria | Description | Importance |

| Regulation & Licensing | Broker must be authorized/registere with top-tier regulators like FCA, ASIC, or CySEC. | ⭐⭐⭐⭐⭐ |

| Trading Conditions | Tight spreads, low commissions, and fast execution speeds. | ⭐⭐⭐⭐⭐ |

| Leverage Options | Flexible or high leverage suitable for professional trading strategies. | ⭐⭐⭐⭐☆ |

| Trading Platforms | Access to advanced platforms such as MT4, MT5, cTrader, or proprietary platforms with automation tools. | ⭐⭐⭐⭐⭐ |

| Liquidity & Execution | ECN/STP execution with deep liquidity to reduce slippage. | ⭐⭐⭐⭐⭐ |

| Risk Management Features | Negative balance protection and segregated client accounts for fund safety. | ⭐⭐⭐⭐☆ |

| Professional Account Options | Accounts tailored for professionals with higher leverage or reduced restrictions. | ⭐⭐⭐⭐☆ |

| Reputation & Transparency | Proven track record, clear fee structure, and positive independent reviews. | ⭐⭐⭐⭐☆ |

| Range of Instruments | Access to Forex, indices, commodities, cryptocurrencies, and other global assets. | ⭐⭐⭐⭐☆ |

| Customer Support | Responsive and knowledgeable support, ideally 24/7 for professional needs. | ⭐⭐⭐☆☆ |

Top 10 Best Forex Brokers for Professional Traders – A Direct Comparison

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From where to find if a broker is regulated to specific account types, we provide straightforward answers to help you understand forex brokers suited for professional traders.

Q: How do I choose a broker with the best trading conditions for high-volume scalping? – Alex W.

A: Choose a broker with ECN/Raw Spreads (near zero pips) and low, fixed commissions. Essential conditions are ultra-fast execution (low latency) and no scalping restrictions to minimize costs and slippage.

Q: How do I verify if a forex broker is truly regulated? – David W.

A: Locate the broker’s license number and official regulator name on their website. Then, cross-reference this information directly on the regulator’s official online public register or database to confirm their authorization status.

Q: Are there specific account types suitable for professional traders? – Jessica P.

A: Yes, ECN (Electronic Communication Network) and RAW Spread accounts are best. They offer ultra-tight, near-zero spreads and low commissions, providing the cost efficiency and fast execution professional, high-volume traders require.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Tight Spreads & Low Commissions | High Minimum Deposits |

| High Leverage Options | Complex Platforms |

| Advanced Trading Platforms | Limited Retail Benefits |

| Institutional-Grade Liquidity | Restricted Leverage by Region |

| Tailored Professional Accounts | Customer Support Limitations |

| Strong Regulation | Potential Higher Fees |

You Might also Like:

- MultiBank Group Review

- FP Markets Review

- IC Markets Review

- Pepperstone Review

- FOREX.com Review

- IG Review

- AvaTrade Review

- Saxo Bank Review

- Interactive Brokers Review

- PrimeXBT Review

In Conclusion

Forex brokers for professional traders offer advanced platforms, tight spreads, high leverage, and institutional-grade liquidity. They are ideal for experienced traders seeking efficiency, flexibility, and secure trading conditions, though they may require higher capital and expertise.

Faq

A suitable Forex broker offers low latency, fast execution, and deep liquidity for minimal slippage. They also provide competitive pricing (low spreads/commissions), advanced trading platforms, and robust regulation.

Professional traders frequently use platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) due to their reliability and extensive support for automated trading (Expert Advisors). Other strong preferences include cTrader for its advanced charting and transparency, and proprietary platforms from established brokers like Interactive Brokers and IG.

Yes, professional traders often receive lower spreads and commissions through special active/professional accounts or volume-based rebates from brokers, granting them superior pricing compared to retail traders.

Yes, professional and institutional traders can access more sophisticated instruments, including swaps, forwards, and IPOs, often unavailable to retail clients due to regulatory requirements and high volume trading.

No, fund protection is often weaker for professional traders. They are considered more knowledgeable, so they waive regulatory protections like the Investor Compensation Scheme eligibility and Negative Balance Protection afforded to retail traders.

Yes, professional clients often receive priority customer support and dedicated relationship managers from brokers. This preferential service recognizes their high-volume trading and the significant value they bring to the brokerage firm.

Yes, professional accounts are highly suitable for algorithmic and automated trading. They often provide lower fees, greater leverage, direct market access (DMA), and advanced APIs essential for high-speed automated strategies.

Yes, professional traders generally pay swap or rollover fees when holding leveraged positions, such as in forex or CFDs, overnight. This is essentially an interest charge reflecting the cost of funding the trade.

Yes, professional traders absolutely can and routinely do hedge positions to manage risk. Hedging is a fundamental strategy for protecting capital from adverse market movements.

You typically must meet at least two of these three criteria: sufficient trading activity, a financial instrument portfolio over EUR 500,000, or at least one year of relevant financial sector work experience.2